中高温热泵及高效换热器装备

Search documents

双良节能系统股份有限公司2025年度向特定对象发行股票预案

Zhong Guo Zheng Quan Bao - Zhong Zheng Wang· 2025-10-24 21:05

Core Viewpoint - The company plans to issue shares to specific investors to raise a total of up to RMB 1,291.99 million, which will be used for capital expenditures related to energy-saving and green hydrogen production projects, aligning with national policies on carbon neutrality and clean energy development [4][5][10]. Group 1: Issuance Details - The share issuance plan has been approved by the company's board and will require further approval from the shareholders' meeting and regulatory bodies [2][39]. - The issuance will target no more than 35 specific investors, including various financial institutions and qualified investors, who will subscribe in cash at the same price [2][26]. - The final issuance price will be set at no less than 80% of the average trading price over the 20 trading days prior to the pricing date [3][29]. Group 2: Fund Utilization - The total amount raised will be allocated entirely to capital expenditures for specific projects, with non-capital expenditures covered by the company’s own funds [5][33]. - The projects funded will focus on energy-saving and green hydrogen production technologies, which are crucial for achieving carbon neutrality goals [10][21]. - The company aims to enhance its production capacity in energy-saving equipment and green hydrogen technologies, which are expected to see significant market demand [21][22]. Group 3: Market Context and Policy Support - The global trend towards low-carbon energy solutions is reinforced by national policies aimed at achieving carbon neutrality, with significant investments in energy-saving and hydrogen technologies [9][11]. - The company is positioned to benefit from the growing market for energy-efficient technologies and green hydrogen production, supported by favorable government policies and increasing demand [14][15]. - The development of advanced technologies in energy-saving and hydrogen production is expected to lower costs and improve economic viability, enhancing the company's competitive edge [17][20].

双良节能拟不超12.9亿定增 连亏1年连3季近3年募61亿

Zhong Guo Jing Ji Wang· 2025-10-24 02:46

Core Viewpoint - The company, Shuangliang Energy (600481.SH), has announced a plan to issue shares to specific investors in 2025, aiming to raise up to 1.29199 billion yuan for various projects, including the construction of a zero-carbon intelligent manufacturing plant and the production of green hydrogen equipment [1][2]. Summary by Sections Share Issuance Details - The share issuance will target no more than 35 specific investors, including various financial institutions and qualified foreign investors, with all subscriptions to be made in cash at a price not lower than 80% of the average trading price over the previous 20 trading days [1][2]. - The shares will be domestic listed ordinary shares (A-shares) with a par value of 1.00 yuan each, and the total number of shares issued will not exceed 30% of the company's total share capital prior to the issuance [2]. Fundraising and Project Allocation - The total amount expected to be raised is up to 1.29199 billion yuan, which will be allocated to several projects, including: - Zero-carbon intelligent manufacturing plant construction: 499.339 million yuan - Production of 700 sets of green hydrogen equipment: 200 million yuan - R&D projects: 213.6 million yuan - Working capital: 385 million yuan [2][3]. Shareholder Structure and Control - The controlling shareholder is Shuangliang Group, with the actual controller, Miao Shuangda, holding a total of 45.93% of the shares as of September 30, 2025. Post-issuance, the total share capital will increase to approximately 2.4359 billion shares, with the actual controller's stake reducing to 35.33% [4]. Previous Issuance Termination - The company has decided to terminate its 2023 plan for issuing A-shares due to various external and internal factors, with the previous plan aimed at raising up to 2.56 billion yuan for different projects [5]. Financial Performance - For the third quarter of 2025, the company reported a revenue of 1.688 billion yuan, a decrease of 49.86% year-on-year, while the net profit attributable to shareholders was 53.18 million yuan, an increase of 164.75% year-on-year [8][9].

双良节能:拟定增募资不超过12.92亿元,募集资金将用于零碳智能化制造工厂建设等项目

Ge Long Hui A P P· 2025-10-23 12:56

Core Viewpoint - The company, Shuangliang Energy, announced a plan to raise up to RMB 1,291.99 million through a private placement of shares, with the specific amount to be determined by the board of directors upon authorization from the shareholders' meeting [1]. Fund Utilization - The raised funds will be allocated entirely to several projects after deducting issuance costs, including: - Construction of a zero-carbon intelligent manufacturing factory - Development of efficient air-cooled and liquid-cooled intelligent equipment systems - Production of medium and high-temperature heat pumps and efficient heat exchangers - Establishment of a facility for the annual production of 700 sets of green electricity intelligent hydrogen production equipment - Research and development projects - Establishment of a research center for intelligent hydrogen production equipment and materials - Research and development of efficient energy-saving and carbon-reduction equipment systems - Supplementing working capital [1].

双良节能:拟向特定对象增发募资不超过约12.92亿元

Mei Ri Jing Ji Xin Wen· 2025-10-23 12:55

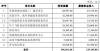

Core Viewpoint - The company, Shuangliang Energy, has announced a plan to issue shares to specific investors, aiming to raise up to approximately 1.292 billion yuan for various projects, including zero-carbon manufacturing and intelligent hydrogen production equipment [1] Group 1: Share Issuance Details - The share issuance plan was approved by the board on October 23, 2025, and will be submitted for shareholder approval [1] - The issuance will target no more than 35 specific investors, with the number of shares not exceeding 30% of the company's total shares prior to the issuance, equating to approximately 562 million shares [1] - The issuance price will be no less than 80% of the average trading price over the 20 trading days prior to the pricing date [1] Group 2: Fundraising Allocation - The total amount to be raised is approximately 1.292 billion yuan, allocated as follows: - Zero-carbon intelligent manufacturing factory project: total investment of approximately 690 million yuan, with about 493 million yuan from the raised funds [1] - Efficient air-cooling and liquid-cooling intelligent equipment system project: total investment of 423 million yuan, with about 300 million yuan from the raised funds [1] - Medium and high-temperature heat pump and efficient heat exchanger equipment project: total investment of 267 million yuan, with about 193 million yuan from the raised funds [1] - Annual production of 700 sets of green electricity intelligent hydrogen production equipment: total investment of 584 million yuan, with about 200 million yuan from the raised funds [1] - R&D projects: total investment of 245 million yuan, with about 214 million yuan from the raised funds [1] - Intelligent hydrogen equipment and materials R&D center project: total investment of 192 million yuan, with about 174 million yuan from the raised funds [1] - Efficient energy-saving and carbon-reduction equipment system R&D project: total investment of 52.6 million yuan, with about 40 million yuan from the raised funds [1] - Supplementing working capital: total investment of 385 million yuan, with the entire amount from the raised funds [1] Group 3: Revenue Composition - For the first half of 2025, the company's revenue composition is as follows: - Photovoltaic new energy: 68.99% - Energy-saving and water-saving: 31.13% - Inter-segment elimination: -0.12% [2] Group 4: Market Capitalization - As of the latest report, the company's market capitalization stands at 12.2 billion yuan [3]