绿电智能制氢装备

Search documents

双良节能2025年业绩大幅减亏 多维创新与政策红利打开增长新空间

Xin Hua Cai Jing· 2026-01-27 08:16

Core Viewpoint - The company, Shuangliang Energy, forecasts a net loss of 780 million to 1.06 billion yuan for 2025, indicating a significant reduction in losses compared to 2024, attributed to the seasonal characteristics of the photovoltaic industry [2] Group 1: Financial Performance - Shuangliang Energy's projected losses are relatively smaller compared to leading companies in the photovoltaic sector, which are expected to incur losses ranging from 4 billion to 10 billion yuan [2] - The company has made provisions for fixed asset impairment, which may also contribute to the losses in the fourth quarter [3] Group 2: Growth Drivers - The company has made breakthroughs in zero-carbon parks, core equipment, and emerging sectors, which inject growth momentum and enhance market confidence [3] - Shuangliang Energy's zero-carbon park solutions have gained industry recognition, with significant projects underway, including a 24 MW rooftop photovoltaic green electricity project and a 600 MW wind-solar-storage project expected to be operational by 2026 [3] Group 3: Technological Advancements - Continuous breakthroughs in core equipment technology are crucial for supporting performance, with the energy service industry in China projected to exceed 1.2 trillion yuan by 2025, growing at a compound annual growth rate of over 18% [4] - The company has achieved significant advancements in its natural ventilation direct air cooling system, which has been successfully applied in extreme conditions, filling a gap in the market [4] Group 4: Market Opportunities - The synergy between the photovoltaic sector and emerging markets strengthens the growth foundation, with the company adopting a customer-centric strategy to ensure stable supply and delivery [6] - The space photovoltaic sector is expected to open a trillion-yuan market, with Shuangliang Energy positioned to benefit from its technological capabilities in photovoltaic silicon materials and smart energy management [6] - The green hydrogen production business is emerging as a new growth driver, with the company’s alkaline water electrolysis equipment setting global benchmarks and aligning with low-carbon transition demands [6] Group 5: International Recognition - Shuangliang Energy is a core equipment supplier for the largest polysilicon project in the Middle East, showcasing its international recognition and capability to provide solutions for the photovoltaic industry [7] - The company’s diverse business layout and technological accumulation enable it to maintain stable development amid industry fluctuations, supported by national energy-saving and carbon reduction policies [7]

双良节能(600481):Q3业绩扭亏,定增聚焦于制氢、热泵装备

Changjiang Securities· 2025-11-11 02:14

Investment Rating - The investment rating for the company is "Buy" and is maintained [6]. Core Insights - The company reported a revenue of 6.076 billion yuan for the first three quarters of 2025, a year-on-year decrease of 41.27%. The net profit attributable to shareholders was -544 million yuan. In Q3 2025, the revenue was 1.688 billion yuan, down 49.86% year-on-year and 26.89% quarter-on-quarter, while the net profit was 53 million yuan, indicating a turnaround from losses [3][4]. - The company plans to raise no more than 1.292 billion yuan through a private placement, with funds allocated for the construction of a zero-carbon intelligent manufacturing plant, the production of 700 sets of green electricity intelligent hydrogen production equipment, R&D projects, and to supplement working capital [3][4]. - The company announced a 119 million USD order for air-cooled systems, with a delivery period of 39 months [4]. Financial Performance - In Q3 2025, the company achieved a net profit turnaround primarily due to an increase in silicon wafer prices since August, alongside ongoing improvements in lean management and cost reductions in photovoltaic products [9]. - The company’s inventory impairment losses decreased to 18 million yuan, benefiting from a recovery in industry prices. The debt ratio decreased by 2.44 percentage points to 81.91% due to the repayment of some payables [9]. - The company’s financial outlook indicates stable growth in energy-saving and water-saving businesses, with new overseas orders reflecting product strength. The hydrogen production segment is expected to gradually contribute to profits, while photovoltaic profitability is anticipated to recover with rising silicon wafer prices [9].

募资方案半夜生变,双良节能悄然“改行”

Sou Hu Cai Jing· 2025-10-25 07:17

Core Viewpoint - The company has significantly revised its financing plan, reducing the scale from 25.6 billion to 12.92 billion yuan, and shifting focus away from photovoltaic projects to zero-carbon intelligent manufacturing and green hydrogen equipment [2][3]. Financing Changes - The new financing plan reflects a nearly 50% reduction in scale, with the absence of the previously planned "38GW large-size monocrystalline silicon pulling project" [3]. - The company cites external market conditions and its strategic direction as reasons for the termination of the original plan [3]. Business Performance - In 2024, the company's revenue from energy-saving and water-saving equipment, new energy equipment, and photovoltaic products is projected to be 30.02 billion, 9.46 billion, and 88.62 billion yuan, respectively, with significant declines in the photovoltaic segment [3]. - The gross margin for photovoltaic products is expected to be -16.63%, a drop of 24.86 percentage points year-on-year [3]. Financial Pressure and Strategic Shift - The company is facing increased financial pressure, with the asset-liability ratio rising from 68.49% at the end of 2022 to 81.91% by September 2025 [6]. - The new fundraising plan allocates 3.85 billion yuan, nearly 30% of the total, to replenish working capital [6]. - The company aims to enhance profitability by focusing on energy-saving and hydrogen equipment, aligning with national policies [5]. Recent Performance - In Q3 2025, the company reported a net profit of 0.53 billion yuan, marking a 164.75% increase year-on-year, despite a 49.86% decline in revenue to 16.88 billion yuan [7]. - The revenue drop is attributed to reduced sales of photovoltaic products, while profit recovery is linked to improved management and cost reductions [7].

双良节能系统股份有限公司2025年度向特定对象发行股票预案

Zhong Guo Zheng Quan Bao - Zhong Zheng Wang· 2025-10-24 21:05

Core Viewpoint - The company plans to issue shares to specific investors to raise a total of up to RMB 1,291.99 million, which will be used for capital expenditures related to energy-saving and green hydrogen production projects, aligning with national policies on carbon neutrality and clean energy development [4][5][10]. Group 1: Issuance Details - The share issuance plan has been approved by the company's board and will require further approval from the shareholders' meeting and regulatory bodies [2][39]. - The issuance will target no more than 35 specific investors, including various financial institutions and qualified investors, who will subscribe in cash at the same price [2][26]. - The final issuance price will be set at no less than 80% of the average trading price over the 20 trading days prior to the pricing date [3][29]. Group 2: Fund Utilization - The total amount raised will be allocated entirely to capital expenditures for specific projects, with non-capital expenditures covered by the company’s own funds [5][33]. - The projects funded will focus on energy-saving and green hydrogen production technologies, which are crucial for achieving carbon neutrality goals [10][21]. - The company aims to enhance its production capacity in energy-saving equipment and green hydrogen technologies, which are expected to see significant market demand [21][22]. Group 3: Market Context and Policy Support - The global trend towards low-carbon energy solutions is reinforced by national policies aimed at achieving carbon neutrality, with significant investments in energy-saving and hydrogen technologies [9][11]. - The company is positioned to benefit from the growing market for energy-efficient technologies and green hydrogen production, supported by favorable government policies and increasing demand [14][15]. - The development of advanced technologies in energy-saving and hydrogen production is expected to lower costs and improve economic viability, enhancing the company's competitive edge [17][20].

账面资金高达43亿 却要募集13亿 这家老牌企业差不差钱?

Guo Ji Jin Rong Bao· 2025-10-24 14:33

Core Viewpoint - The company, Shuangliang Energy, is raising up to 1.292 billion yuan through a private placement to fund projects in zero-carbon manufacturing, green hydrogen equipment, R&D, and to supplement working capital [2][4]. Financial Performance - As of Q3 2025, the company reported a revenue of 6.076 billion yuan, a year-on-year decrease of 41.27%, and a net loss of 544 million yuan [4]. - Despite a quarterly profit of 53.18 million yuan, the overall performance remains low due to reduced sales in photovoltaic products [4]. - The company has cash reserves of 4.335 billion yuan but still seeks to raise additional funds [4]. Debt and Financing Strategy - The company's debt ratio has increased from 68.49% at the end of 2022 to 81.91% by September 2025, indicating rising financial pressure [5]. - The planned fundraising will be allocated to four key areas: 493 million yuan for zero-carbon manufacturing, 200 million yuan for green hydrogen equipment, 214 million yuan for R&D, and 385 million yuan for working capital [5][6]. Hydrogen Energy Focus - Shuangliang Energy has been involved in the hydrogen energy sector since 2018 and officially entered the market in 2022 [6]. - The company has developed the world's largest alkaline water electrolysis unit with a hydrogen production capacity of 5000 Nm³/h [6]. - Since 2025, the hydrogen business has seen explosive growth, with order amounts exceeding 800 million yuan, a 300% year-on-year increase [6].

双良节能:拟定增募资近13亿元近三成用于补流 前次募投项目未达预期

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 02:55

Core Viewpoint - The company, Shuangliang Energy (600481.SH), plans to raise up to 1.292 billion yuan through a private placement to specific investors, primarily for the construction of a zero-carbon intelligent manufacturing plant and other projects, despite facing challenges with previous fundraising efforts and project profitability [1] Fundraising Plan - The company intends to raise funds from no more than 35 specific investors, with a total amount not exceeding 1.292 billion yuan [1] - The allocation of the raised funds includes 493 million yuan for the zero-carbon intelligent manufacturing plant, 200 million yuan for the annual production of 700 sets of green electricity intelligent hydrogen production equipment, 213 million yuan for R&D projects, and 385 million yuan for working capital, which constitutes 29.8% of the total raised amount [1] Financial Health - The company's asset-liability ratio has increased since 2022, with ratios of 68.49% in 2022, 76.45% in 2023, 82.77% in 2024, and 81.91% as of September 30, 2025 [1] Previous Fundraising Performance - A previous fundraising effort through convertible bonds for the "40GW Monocrystalline Silicon Phase II Project (20GW)" reached its intended usable state by March 2023, but as of September 30, 2025, the project has not met profitability expectations, incurring a loss of 154 million yuan from January to September 2025 [1] - The company attributes the underperformance to fluctuations in the supply and demand dynamics of the photovoltaic industry, particularly the decline in prices of silicon materials and wafers since the end of 2022, which has compressed project revenue and profit margins [1]

双良节能拟不超12.9亿定增 连亏1年连3季近3年募61亿

Zhong Guo Jing Ji Wang· 2025-10-24 02:46

Core Viewpoint - The company, Shuangliang Energy (600481.SH), has announced a plan to issue shares to specific investors in 2025, aiming to raise up to 1.29199 billion yuan for various projects, including the construction of a zero-carbon intelligent manufacturing plant and the production of green hydrogen equipment [1][2]. Summary by Sections Share Issuance Details - The share issuance will target no more than 35 specific investors, including various financial institutions and qualified foreign investors, with all subscriptions to be made in cash at a price not lower than 80% of the average trading price over the previous 20 trading days [1][2]. - The shares will be domestic listed ordinary shares (A-shares) with a par value of 1.00 yuan each, and the total number of shares issued will not exceed 30% of the company's total share capital prior to the issuance [2]. Fundraising and Project Allocation - The total amount expected to be raised is up to 1.29199 billion yuan, which will be allocated to several projects, including: - Zero-carbon intelligent manufacturing plant construction: 499.339 million yuan - Production of 700 sets of green hydrogen equipment: 200 million yuan - R&D projects: 213.6 million yuan - Working capital: 385 million yuan [2][3]. Shareholder Structure and Control - The controlling shareholder is Shuangliang Group, with the actual controller, Miao Shuangda, holding a total of 45.93% of the shares as of September 30, 2025. Post-issuance, the total share capital will increase to approximately 2.4359 billion shares, with the actual controller's stake reducing to 35.33% [4]. Previous Issuance Termination - The company has decided to terminate its 2023 plan for issuing A-shares due to various external and internal factors, with the previous plan aimed at raising up to 2.56 billion yuan for different projects [5]. Financial Performance - For the third quarter of 2025, the company reported a revenue of 1.688 billion yuan, a decrease of 49.86% year-on-year, while the net profit attributable to shareholders was 53.18 million yuan, an increase of 164.75% year-on-year [8][9].

双良节能(600481.SH):拟定增募资不超12.92亿元

Ge Long Hui A P P· 2025-10-23 14:35

Core Viewpoint - Shuangliang Energy (600481.SH) announced a plan to issue shares to specific targets in 2025, aiming to raise up to 1.292 billion yuan for various projects [1] Group 1: Fundraising Details - The total amount of funds to be raised is expected to not exceed 1.292 billion yuan, including the principal [1] - After deducting issuance costs, all funds will be allocated to specific projects [1] Group 2: Project Allocation - Funds will be used for the construction of a zero-carbon intelligent manufacturing factory [1] - The establishment of a production line for 700 sets of green electricity intelligent hydrogen production equipment [1] - Investment in research and development projects [1] - Supplementing working capital [1]

双良节能:拟定增募资不超过12.92亿元,募集资金将用于零碳智能化制造工厂建设等项目

Ge Long Hui A P P· 2025-10-23 12:56

Core Viewpoint - The company, Shuangliang Energy, announced a plan to raise up to RMB 1,291.99 million through a private placement of shares, with the specific amount to be determined by the board of directors upon authorization from the shareholders' meeting [1]. Fund Utilization - The raised funds will be allocated entirely to several projects after deducting issuance costs, including: - Construction of a zero-carbon intelligent manufacturing factory - Development of efficient air-cooled and liquid-cooled intelligent equipment systems - Production of medium and high-temperature heat pumps and efficient heat exchangers - Establishment of a facility for the annual production of 700 sets of green electricity intelligent hydrogen production equipment - Research and development projects - Establishment of a research center for intelligent hydrogen production equipment and materials - Research and development of efficient energy-saving and carbon-reduction equipment systems - Supplementing working capital [1].

双良节能:拟向特定对象增发募资不超过约12.92亿元

Mei Ri Jing Ji Xin Wen· 2025-10-23 12:55

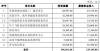

Core Viewpoint - The company, Shuangliang Energy, has announced a plan to issue shares to specific investors, aiming to raise up to approximately 1.292 billion yuan for various projects, including zero-carbon manufacturing and intelligent hydrogen production equipment [1] Group 1: Share Issuance Details - The share issuance plan was approved by the board on October 23, 2025, and will be submitted for shareholder approval [1] - The issuance will target no more than 35 specific investors, with the number of shares not exceeding 30% of the company's total shares prior to the issuance, equating to approximately 562 million shares [1] - The issuance price will be no less than 80% of the average trading price over the 20 trading days prior to the pricing date [1] Group 2: Fundraising Allocation - The total amount to be raised is approximately 1.292 billion yuan, allocated as follows: - Zero-carbon intelligent manufacturing factory project: total investment of approximately 690 million yuan, with about 493 million yuan from the raised funds [1] - Efficient air-cooling and liquid-cooling intelligent equipment system project: total investment of 423 million yuan, with about 300 million yuan from the raised funds [1] - Medium and high-temperature heat pump and efficient heat exchanger equipment project: total investment of 267 million yuan, with about 193 million yuan from the raised funds [1] - Annual production of 700 sets of green electricity intelligent hydrogen production equipment: total investment of 584 million yuan, with about 200 million yuan from the raised funds [1] - R&D projects: total investment of 245 million yuan, with about 214 million yuan from the raised funds [1] - Intelligent hydrogen equipment and materials R&D center project: total investment of 192 million yuan, with about 174 million yuan from the raised funds [1] - Efficient energy-saving and carbon-reduction equipment system R&D project: total investment of 52.6 million yuan, with about 40 million yuan from the raised funds [1] - Supplementing working capital: total investment of 385 million yuan, with the entire amount from the raised funds [1] Group 3: Revenue Composition - For the first half of 2025, the company's revenue composition is as follows: - Photovoltaic new energy: 68.99% - Energy-saving and water-saving: 31.13% - Inter-segment elimination: -0.12% [2] Group 4: Market Capitalization - As of the latest report, the company's market capitalization stands at 12.2 billion yuan [3]