零碳智能化制造

Search documents

双良节能一边亏损,一边“伸手要钱”

Shen Zhen Shang Bao· 2025-10-24 04:26

Core Viewpoint - The company, Shuangliang Energy, reported significant financial losses in the third quarter of 2025, with a revenue decline of 41.27% year-on-year and a net loss of 5.44 billion yuan, while simultaneously seeking to raise funds through a stock issuance plan [1][2]. Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 6.076 billion yuan, down 41.27% year-on-year [1]. - In the third quarter alone, revenue was 1.688 billion yuan, reflecting a 49.86% decrease compared to the same period last year [2][3]. - The net profit for the third quarter was 53.18 million yuan, marking a turnaround from losses, with a total profit of 72.75 million yuan, a 166.08% increase year-on-year [2][3]. - The company reported a significant increase in cash flow from operating activities, which rose by 262.63% year-on-year to approximately 1.749 billion yuan [3]. Fundraising and Investment Plans - The company plans to raise up to 1.292 billion yuan through a targeted stock issuance, with funds allocated for projects including a zero-carbon intelligent manufacturing factory and the production of green hydrogen equipment [3][4]. - The investment breakdown includes approximately 493.39 million yuan for the zero-carbon factory, 200 million yuan for green hydrogen equipment, and 213.6 million yuan for R&D projects [4]. Debt and Financial Health - The company's asset-liability ratio has shown an upward trend, with figures of 68.49% at the end of 2022, 76.45% in 2023, 82.77% in 2024, and 81.91% as of September 30, 2025 [5]. - As of September 30, 2025, the company had cash and cash equivalents amounting to 4.335 billion yuan [6][7]. Shareholder Information - The controlling shareholder of the company is Shuangliang Group, with the actual controller, Miao Shuangda, holding a total of 45.93% of the shares as of September 30, 2025 [9]. Market Performance - As of October 24, the company's stock price decreased by 3.08%, trading at 6.30 yuan per share, with a total market capitalization of 11.805 billion yuan [11].

双良节能:拟定增募资近13亿元近三成用于补流 前次募投项目未达预期

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 02:55

Core Viewpoint - The company, Shuangliang Energy (600481.SH), plans to raise up to 1.292 billion yuan through a private placement to specific investors, primarily for the construction of a zero-carbon intelligent manufacturing plant and other projects, despite facing challenges with previous fundraising efforts and project profitability [1] Fundraising Plan - The company intends to raise funds from no more than 35 specific investors, with a total amount not exceeding 1.292 billion yuan [1] - The allocation of the raised funds includes 493 million yuan for the zero-carbon intelligent manufacturing plant, 200 million yuan for the annual production of 700 sets of green electricity intelligent hydrogen production equipment, 213 million yuan for R&D projects, and 385 million yuan for working capital, which constitutes 29.8% of the total raised amount [1] Financial Health - The company's asset-liability ratio has increased since 2022, with ratios of 68.49% in 2022, 76.45% in 2023, 82.77% in 2024, and 81.91% as of September 30, 2025 [1] Previous Fundraising Performance - A previous fundraising effort through convertible bonds for the "40GW Monocrystalline Silicon Phase II Project (20GW)" reached its intended usable state by March 2023, but as of September 30, 2025, the project has not met profitability expectations, incurring a loss of 154 million yuan from January to September 2025 [1] - The company attributes the underperformance to fluctuations in the supply and demand dynamics of the photovoltaic industry, particularly the decline in prices of silicon materials and wafers since the end of 2022, which has compressed project revenue and profit margins [1]

双良节能拟不超12.9亿定增 连亏1年连3季近3年募61亿

Zhong Guo Jing Ji Wang· 2025-10-24 02:46

Core Viewpoint - The company, Shuangliang Energy (600481.SH), has announced a plan to issue shares to specific investors in 2025, aiming to raise up to 1.29199 billion yuan for various projects, including the construction of a zero-carbon intelligent manufacturing plant and the production of green hydrogen equipment [1][2]. Summary by Sections Share Issuance Details - The share issuance will target no more than 35 specific investors, including various financial institutions and qualified foreign investors, with all subscriptions to be made in cash at a price not lower than 80% of the average trading price over the previous 20 trading days [1][2]. - The shares will be domestic listed ordinary shares (A-shares) with a par value of 1.00 yuan each, and the total number of shares issued will not exceed 30% of the company's total share capital prior to the issuance [2]. Fundraising and Project Allocation - The total amount expected to be raised is up to 1.29199 billion yuan, which will be allocated to several projects, including: - Zero-carbon intelligent manufacturing plant construction: 499.339 million yuan - Production of 700 sets of green hydrogen equipment: 200 million yuan - R&D projects: 213.6 million yuan - Working capital: 385 million yuan [2][3]. Shareholder Structure and Control - The controlling shareholder is Shuangliang Group, with the actual controller, Miao Shuangda, holding a total of 45.93% of the shares as of September 30, 2025. Post-issuance, the total share capital will increase to approximately 2.4359 billion shares, with the actual controller's stake reducing to 35.33% [4]. Previous Issuance Termination - The company has decided to terminate its 2023 plan for issuing A-shares due to various external and internal factors, with the previous plan aimed at raising up to 2.56 billion yuan for different projects [5]. Financial Performance - For the third quarter of 2025, the company reported a revenue of 1.688 billion yuan, a decrease of 49.86% year-on-year, while the net profit attributable to shareholders was 53.18 million yuan, an increase of 164.75% year-on-year [8][9].

双良节能(600481.SH):拟定增募资不超12.92亿元

Ge Long Hui A P P· 2025-10-23 14:35

Core Viewpoint - Shuangliang Energy (600481.SH) announced a plan to issue shares to specific targets in 2025, aiming to raise up to 1.292 billion yuan for various projects [1] Group 1: Fundraising Details - The total amount of funds to be raised is expected to not exceed 1.292 billion yuan, including the principal [1] - After deducting issuance costs, all funds will be allocated to specific projects [1] Group 2: Project Allocation - Funds will be used for the construction of a zero-carbon intelligent manufacturing factory [1] - The establishment of a production line for 700 sets of green electricity intelligent hydrogen production equipment [1] - Investment in research and development projects [1] - Supplementing working capital [1]

双良节能:拟向特定对象增发募资不超过约12.92亿元

Mei Ri Jing Ji Xin Wen· 2025-10-23 12:55

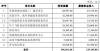

Core Viewpoint - The company, Shuangliang Energy, has announced a plan to issue shares to specific investors, aiming to raise up to approximately 1.292 billion yuan for various projects, including zero-carbon manufacturing and intelligent hydrogen production equipment [1] Group 1: Share Issuance Details - The share issuance plan was approved by the board on October 23, 2025, and will be submitted for shareholder approval [1] - The issuance will target no more than 35 specific investors, with the number of shares not exceeding 30% of the company's total shares prior to the issuance, equating to approximately 562 million shares [1] - The issuance price will be no less than 80% of the average trading price over the 20 trading days prior to the pricing date [1] Group 2: Fundraising Allocation - The total amount to be raised is approximately 1.292 billion yuan, allocated as follows: - Zero-carbon intelligent manufacturing factory project: total investment of approximately 690 million yuan, with about 493 million yuan from the raised funds [1] - Efficient air-cooling and liquid-cooling intelligent equipment system project: total investment of 423 million yuan, with about 300 million yuan from the raised funds [1] - Medium and high-temperature heat pump and efficient heat exchanger equipment project: total investment of 267 million yuan, with about 193 million yuan from the raised funds [1] - Annual production of 700 sets of green electricity intelligent hydrogen production equipment: total investment of 584 million yuan, with about 200 million yuan from the raised funds [1] - R&D projects: total investment of 245 million yuan, with about 214 million yuan from the raised funds [1] - Intelligent hydrogen equipment and materials R&D center project: total investment of 192 million yuan, with about 174 million yuan from the raised funds [1] - Efficient energy-saving and carbon-reduction equipment system R&D project: total investment of 52.6 million yuan, with about 40 million yuan from the raised funds [1] - Supplementing working capital: total investment of 385 million yuan, with the entire amount from the raised funds [1] Group 3: Revenue Composition - For the first half of 2025, the company's revenue composition is as follows: - Photovoltaic new energy: 68.99% - Energy-saving and water-saving: 31.13% - Inter-segment elimination: -0.12% [2] Group 4: Market Capitalization - As of the latest report, the company's market capitalization stands at 12.2 billion yuan [3]

双良节能:拟定增募资不超12.92亿元 用于零碳智能化制造工厂等项目

Zheng Quan Shi Bao Wang· 2025-10-23 12:40

Core Viewpoint - The company, Shuangliang Energy (600481), announced the termination of its plan to issue A-shares to specific investors for the year 2023, while also revealing a new plan to issue shares in 2025 to raise up to 1.292 billion yuan for various projects [1] Group 1 - The company has terminated the A-share issuance plan for 2023 [1] - A new share issuance plan for 2025 has been disclosed, aiming to raise no more than 1.292 billion yuan [1] - The funds raised will be allocated for the construction of a zero-carbon intelligent manufacturing factory, the establishment of a production line for 700 sets of green electricity intelligent hydrogen production equipment, research and development projects, and to supplement working capital [1]