绿电制氢

Search documents

双良节能2025年业绩大幅减亏 多维创新与政策红利打开增长新空间

Xin Hua Cai Jing· 2026-01-27 08:16

Core Viewpoint - The company, Shuangliang Energy, forecasts a net loss of 780 million to 1.06 billion yuan for 2025, indicating a significant reduction in losses compared to 2024, attributed to the seasonal characteristics of the photovoltaic industry [2] Group 1: Financial Performance - Shuangliang Energy's projected losses are relatively smaller compared to leading companies in the photovoltaic sector, which are expected to incur losses ranging from 4 billion to 10 billion yuan [2] - The company has made provisions for fixed asset impairment, which may also contribute to the losses in the fourth quarter [3] Group 2: Growth Drivers - The company has made breakthroughs in zero-carbon parks, core equipment, and emerging sectors, which inject growth momentum and enhance market confidence [3] - Shuangliang Energy's zero-carbon park solutions have gained industry recognition, with significant projects underway, including a 24 MW rooftop photovoltaic green electricity project and a 600 MW wind-solar-storage project expected to be operational by 2026 [3] Group 3: Technological Advancements - Continuous breakthroughs in core equipment technology are crucial for supporting performance, with the energy service industry in China projected to exceed 1.2 trillion yuan by 2025, growing at a compound annual growth rate of over 18% [4] - The company has achieved significant advancements in its natural ventilation direct air cooling system, which has been successfully applied in extreme conditions, filling a gap in the market [4] Group 4: Market Opportunities - The synergy between the photovoltaic sector and emerging markets strengthens the growth foundation, with the company adopting a customer-centric strategy to ensure stable supply and delivery [6] - The space photovoltaic sector is expected to open a trillion-yuan market, with Shuangliang Energy positioned to benefit from its technological capabilities in photovoltaic silicon materials and smart energy management [6] - The green hydrogen production business is emerging as a new growth driver, with the company’s alkaline water electrolysis equipment setting global benchmarks and aligning with low-carbon transition demands [6] Group 5: International Recognition - Shuangliang Energy is a core equipment supplier for the largest polysilicon project in the Middle East, showcasing its international recognition and capability to provide solutions for the photovoltaic industry [7] - The company’s diverse business layout and technological accumulation enable it to maintain stable development amid industry fluctuations, supported by national energy-saving and carbon reduction policies [7]

双良节能2025年业绩减亏 多维创新与政策红利打开增长新空间

Zhong Guo Jin Rong Xin Xi Wang· 2026-01-27 02:49

Core Viewpoint - The company, Shuangliang Energy, has significantly narrowed its overall loss for the 2025 fiscal year, despite the photovoltaic industry facing challenges in the fourth quarter, which is typically a slow season [1] Group 1: Financial Performance - Shuangliang Energy's loss is relatively small compared to leading companies in the photovoltaic sector, which are expected to incur losses between 40 billion to 100 billion yuan [1] - The company has made provisions for fixed asset impairment, reflecting a cautious financial approach, which is a contributing factor to the fourth-quarter loss [1] Group 2: Industry Position and Developments - The company has gained recognition for its zero-carbon park solutions, with its photovoltaic industrial park being selected for a national-level zero-carbon park construction [2] - The industrial park has completed a 24MW rooftop photovoltaic project and is expected to achieve additional projects by 2026, contributing to significant reductions in coal consumption and water usage [2] Group 3: Technological Advancements - Continuous breakthroughs in core equipment technology are crucial for supporting the company's performance, with the energy service industry in China projected to exceed 1.2 trillion yuan by 2025, growing at a compound annual growth rate of over 18% [3] - The company has developed a natural ventilation direct air cooling system that has passed preliminary design reviews, marking a significant advancement in extreme environment applications [3] Group 4: Market Opportunities - The space photovoltaic sector is expected to create a trillion-level market space, with the company positioned to benefit from its technological advancements in photovoltaic silicon materials and smart energy management [4] - The green hydrogen production business is emerging as a new growth driver, with the company’s alkaline water electrolysis technology setting global benchmarks and aligning with low-carbon transformation demands [4] Group 5: Long-term Outlook - The combination of stable profitability in core equipment, rapid growth in green hydrogen, and favorable national policies is expected to drive the company towards sustained profitability and long-term value for investors [5]

首个纯氢燃气轮机实现发电,绿氢应用场景持续扩展

Jianghai Securities· 2025-12-30 05:33

Investment Rating - The industry rating is "Overweight" (maintained) [6] Core Insights - The global first 30MW pure hydrogen gas turbine has achieved significant breakthroughs, marking the successful transition from blueprint to reality, with potential applications in various energy scenarios [6] - Hydrogen energy production and consumption are steadily growing, with global hydrogen production and consumption expected to reach approximately 105 million tons by the end of 2024, reflecting a year-on-year growth of about 2.9% [6] - The green hydrogen industry is entering a fast track, with a total of 865 green hydrogen projects in China as of mid-2025, and a disclosed potential capacity of 11.0616 million tons per year [6] Summary by Sections Industry Performance - Over the past 12 months, the industry has shown an absolute return of 41.06% and a relative return of 24.52% compared to the CSI 300 index [3] Investment Highlights - The hydrogen energy sector is witnessing a surge in renewable energy hydrogen production projects, with over 250,000 tons/year of cumulative capacity established, and a 42% year-on-year increase in new capacity in 2024 [6] - Investment opportunities are identified in three main areas: hydrogen production equipment, fuel cells, and green methanol [6]

绿氢闯关

Xin Hua She· 2025-12-02 02:13

Core Viewpoint - The hydrogen energy market is currently dominated by gray hydrogen, while green hydrogen faces challenges in production costs, infrastructure, and application scenarios [1][2][10]. Industry Overview - The Gansu province is actively developing its hydrogen energy industry, leveraging its rich renewable energy resources to promote green hydrogen production across the entire industry chain [1][3][8]. - Gansu has established multiple hydrogen energy projects, including the integration of green hydrogen production with ammonia and methanol production [1][3][5][8]. Production and Infrastructure - Gansu's hydrogen production capacity includes 1.4 million tons of gray hydrogen and 2,000 tons of green hydrogen annually, with ongoing projects to increase green hydrogen capacity [4][9]. - The province has seen the establishment of various hydrogen projects, including a natural gas-hydrogen blending project that has successfully integrated hydrogen into natural gas pipelines [3][4]. Technological Development - The industry is focusing on technological breakthroughs, particularly in off-grid hydrogen production and high-pressure hydrogen storage technologies [9][11]. - Companies are exploring innovative hydrogen production methods, such as the successful implementation of off-grid hydrogen production at the Dunhuang wind-solar-hydrogen storage test site [9]. Market Challenges - The green hydrogen sector is still in its infancy, facing high production costs and insufficient infrastructure, which limits its large-scale development [10][12]. - The current market for industrial hydrogen is stable but primarily supplied by cheaper gray hydrogen, which poses a challenge for green hydrogen adoption [12]. Policy Support and Future Goals - Gansu province has introduced policies to accelerate the development of renewable hydrogen projects, aiming for an annual production capacity of 200,000 tons of green hydrogen by 2030 [8][9]. - Industry experts emphasize the need for increased policy support and technological advancements to overcome existing challenges and expand hydrogen applications in various sectors [12].

我国首台套!全面投运

中国能源报· 2025-11-20 12:07

Core Viewpoint - The first integrated green hydrogen coal chemical project in China has commenced market operations, showcasing a replicable model for the green transformation of the coal chemical industry [1]. Group 1 - The project, located in Datang, utilizes a "green electricity hydrogen production + surplus electricity grid connection" collaborative model, marking a significant advancement in the industry [1]. - It has overcome key technical challenges, establishing a deep adjustment mechanism for large-capacity electrolyzers in renewable energy hydrogen production, filling a gap in the industry [1]. - The project has achieved 28 invention patents and published 3 corporate standards, and it has been selected as one of the first pilot projects in the hydrogen energy sector by the National Energy Administration [1]. Group 2 - The project is expected to produce 7.059 million cubic meters of hydrogen annually, contributing to a significant reduction in carbon dioxide emissions [2]. - It is projected to reduce CO2 emissions by 13.88 thousand tons, equivalent to the carbon absorption of 1,400 hectares of mature forest in one year [3].

我国首个绿氢煤化工项目全面投运

Yang Shi Xin Wen· 2025-11-20 09:11

Core Insights - The China Datang Corporation's 150,000 kW wind-solar-storage hydrogen integration demonstration project has fully entered market operation, marking it as the first green hydrogen coupled coal chemical demonstration project in the country [1][3] - The successful implementation of the "green electricity hydrogen production + surplus electricity grid connection" collaborative model provides a replicable practical example for the green transformation of the coal chemical industry [1] Technology and Innovation - The project has overcome key technical challenges, establishing a deep adjustment mechanism for large-capacity electrolyzers in renewable energy hydrogen production, achieving stable operation in the chemical industry [3] - It has completed 28 invention patents and published 3 enterprise standards, and has been selected as one of the first pilot projects in the hydrogen energy sector by the National Energy Administration [3] Environmental Impact - The project is expected to produce 70.59 million cubic meters of hydrogen annually, which will reduce carbon dioxide emissions by 138,800 tons, equivalent to the carbon absorption of 1,400 hectares of mature forest in one year [3]

双良节能50亿资金受限,缪氏家族的“光伏梦”碎了?

Xin Lang Cai Jing· 2025-11-11 13:01

Core Viewpoint - The financial situation of Shuangliang Energy is concerning, with significant debt pressure and a high percentage of restricted cash, raising questions about its operational sustainability and future profitability [1][3][21]. Financial Situation - As of June 30, 2025, Shuangliang Energy reported a total cash balance of 5.612 billion yuan, with 5.052 billion yuan (over 90%) being restricted [3][12]. - The company's debt-to-asset ratio stands at 84.35%, indicating a high level of leverage [3][12]. - Short-term borrowings and long-term borrowings due within one year total 8.903 billion yuan, significantly exceeding the available cash [6][12]. Customer-Supplier Relationships - A major customer, referred to as "Company B," is also the second-largest supplier, creating a complex interdependency [7][9]. - Shuangliang Energy sold 453 million yuan worth of products to "Company B" while purchasing 279 million yuan from them, raising concerns about pricing independence and potential conflicts of interest [7][9]. Industry Comparison - Shuangliang Energy's bank acceptance bill guarantee ratio is 95.13%, significantly higher than its peers, such as TCL Zhonghuan (12.28%) and Longi Green Energy (26.35%) [4][5]. - The average guarantee ratio in the industry is 39.16%, highlighting Shuangliang's unusual financial strategy [4][5]. Business Transition - The company has shifted focus from air conditioning to the photovoltaic industry, which has become its primary revenue source, accounting for 75% of total income by 2024 [10][12]. - Despite initial success in the photovoltaic sector, the company is now facing a downturn due to industry-wide overcapacity and price competition [11][12]. Future Strategies - To address financial challenges, Shuangliang Energy is pivoting towards hydrogen energy, with plans to raise 1.292 billion yuan through a new fundraising initiative [14][16]. - The company aims to develop zero-carbon intelligent manufacturing and green hydrogen equipment, reflecting a strategic shift in response to market conditions [14][16]. Historical Performance - Since its listing, Shuangliang Energy has generated a cumulative net profit of 3.624 billion yuan and distributed 4.089 billion yuan in cash dividends [19][21]. - The majority of shares are held by the founder's family, indicating a strong familial influence on corporate governance and financial decisions [19][21].

募资方案半夜生变,双良节能悄然“改行”

Sou Hu Cai Jing· 2025-10-25 07:17

Core Viewpoint - The company has significantly revised its financing plan, reducing the scale from 25.6 billion to 12.92 billion yuan, and shifting focus away from photovoltaic projects to zero-carbon intelligent manufacturing and green hydrogen equipment [2][3]. Financing Changes - The new financing plan reflects a nearly 50% reduction in scale, with the absence of the previously planned "38GW large-size monocrystalline silicon pulling project" [3]. - The company cites external market conditions and its strategic direction as reasons for the termination of the original plan [3]. Business Performance - In 2024, the company's revenue from energy-saving and water-saving equipment, new energy equipment, and photovoltaic products is projected to be 30.02 billion, 9.46 billion, and 88.62 billion yuan, respectively, with significant declines in the photovoltaic segment [3]. - The gross margin for photovoltaic products is expected to be -16.63%, a drop of 24.86 percentage points year-on-year [3]. Financial Pressure and Strategic Shift - The company is facing increased financial pressure, with the asset-liability ratio rising from 68.49% at the end of 2022 to 81.91% by September 2025 [6]. - The new fundraising plan allocates 3.85 billion yuan, nearly 30% of the total, to replenish working capital [6]. - The company aims to enhance profitability by focusing on energy-saving and hydrogen equipment, aligning with national policies [5]. Recent Performance - In Q3 2025, the company reported a net profit of 0.53 billion yuan, marking a 164.75% increase year-on-year, despite a 49.86% decline in revenue to 16.88 billion yuan [7]. - The revenue drop is attributed to reduced sales of photovoltaic products, while profit recovery is linked to improved management and cost reductions [7].

双良节能(600481):25Q3业绩转正,盈利能力有望持续修复

Shenwan Hongyuan Securities· 2025-10-24 14:42

Investment Rating - The investment rating for the company is "Buy" (maintained) [2] Core Insights - The company reported a turnaround in Q3 2025, achieving a net profit of 0.53 billion yuan, marking a significant improvement compared to previous quarters [5][8] - Despite a decline in revenue of 41.27% year-on-year for the first three quarters of 2025, the performance exceeded market expectations [5][8] - The company is focusing on cost reduction and efficiency improvements, benefiting from a recovery in silicon wafer prices [8] Financial Data and Profit Forecast - For Q1-3 2025, total revenue was 6.08 billion yuan, with a year-on-year decline of 41.3% [7] - The projected revenues for 2025, 2026, and 2027 are 9.95 billion yuan, 12.82 billion yuan, and 16.17 billion yuan respectively, with expected growth rates of -23.7%, 28.8%, and 26.1% [7] - The forecasted net profits for 2025, 2026, and 2027 are -0.47 billion yuan, 0.64 billion yuan, and 1.13 billion yuan respectively, with corresponding PE ratios of -25X, 18X, and 10X [7][8] Business Developments - The company is advancing in the energy-saving and water-saving equipment sector, with notable projects including a collaboration with Ningxia Electric Power for a cooling system [8] - In the renewable energy equipment sector, the company is expanding its hydrogen energy business, having secured contracts worth 4.5 billion yuan for green hydrogen systems [8] - The company plans to issue 26.31 million new shares to raise up to 1.29 billion yuan for various projects, including the construction of a world-class zero-carbon intelligent equipment platform [8]

双良节能拟不超12.9亿定增 连亏1年连3季近3年募61亿

Zhong Guo Jing Ji Wang· 2025-10-24 02:46

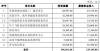

Core Viewpoint - The company, Shuangliang Energy (600481.SH), has announced a plan to issue shares to specific investors in 2025, aiming to raise up to 1.29199 billion yuan for various projects, including the construction of a zero-carbon intelligent manufacturing plant and the production of green hydrogen equipment [1][2]. Summary by Sections Share Issuance Details - The share issuance will target no more than 35 specific investors, including various financial institutions and qualified foreign investors, with all subscriptions to be made in cash at a price not lower than 80% of the average trading price over the previous 20 trading days [1][2]. - The shares will be domestic listed ordinary shares (A-shares) with a par value of 1.00 yuan each, and the total number of shares issued will not exceed 30% of the company's total share capital prior to the issuance [2]. Fundraising and Project Allocation - The total amount expected to be raised is up to 1.29199 billion yuan, which will be allocated to several projects, including: - Zero-carbon intelligent manufacturing plant construction: 499.339 million yuan - Production of 700 sets of green hydrogen equipment: 200 million yuan - R&D projects: 213.6 million yuan - Working capital: 385 million yuan [2][3]. Shareholder Structure and Control - The controlling shareholder is Shuangliang Group, with the actual controller, Miao Shuangda, holding a total of 45.93% of the shares as of September 30, 2025. Post-issuance, the total share capital will increase to approximately 2.4359 billion shares, with the actual controller's stake reducing to 35.33% [4]. Previous Issuance Termination - The company has decided to terminate its 2023 plan for issuing A-shares due to various external and internal factors, with the previous plan aimed at raising up to 2.56 billion yuan for different projects [5]. Financial Performance - For the third quarter of 2025, the company reported a revenue of 1.688 billion yuan, a decrease of 49.86% year-on-year, while the net profit attributable to shareholders was 53.18 million yuan, an increase of 164.75% year-on-year [8][9].