公路客车

Search documents

安凯客车预亏,半年内遭安徽省投资集团两度减持

Shen Zhen Shang Bao· 2026-02-25 15:47

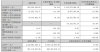

净利承压下,安凯客车半年之内遭安徽省投资集团两度减持。 2月25日,安凯客车发布公告,持股5%以上股东安徽省投资集团(下称"省投资集团")在2025年11月27日至2026年2月24日通过集中竞价交易减持220万股, 占公司总股本的0.23%。据计算,省投资集团本次减持金额约1105.14万元。 | 股东名称 | 減持方式 | 減持期间 | 减持均价 | 減持股数 | 候 | | --- | --- | --- | --- | --- | --- | | | | | (元/股) | (股) | | | 安徽省投资 | 集中竞价交易 | 2025年11月27日 | 5. 03 | 2, 197, 100 | | | 集团控股有 | | -2026年2月24日 | | | | | 限公司 | 合计 | | 5.03 | 2, 197, 100 | | 值得注意的是,省投资集团在短短半年的时间内已实施两次减持,累计套现约6592万元。2025年8月26日至2025年9月15日,省投资集团减持了939.51万股, 占公司总股本的1%,减持金额约5486.74万元。 资料显示,安徽安凯汽车股份有限公司于1997年7月2 ...

三季度亏2705万元!安凯客车陷“割裂”局面

Shen Zhen Shang Bao· 2025-10-25 01:41

Core Points - The company reported a revenue of 8.54 billion CNY in Q3, a year-on-year increase of 56.2%, but the net profit loss expanded from 12.62 million CNY to 27.05 million CNY [1] - The main business of the company includes the research, development, manufacturing, sales, and service of buses and automotive parts, focusing on various types of buses including public transport and new energy buses [1] - The financial report indicates that while revenue increased, the net profit continued to show losses, attributed to rising operating costs and significant asset impairment losses [1][2] Financial Summary - For the first three quarters of 2025, the company reported a revenue of 24.46 billion CNY, a 44.37% increase compared to the same period in 2024 [4] - Operating costs rose to 22.50 billion CNY, an increase of 46.22%, primarily due to increased sales volume [2] - Asset impairment losses surged by 361.96% to 24.67 million CNY, mainly due to increased inventory write-downs [2] Market Performance - As of October 24, the company's stock price was 5.75 CNY per share, with a total market capitalization of 54.02 billion CNY [3] - The stock experienced a slight increase of 0.52% on the same day [3] - Key financial metrics include a P/E ratio of 146.83 and a market-to-book ratio of 6.15 [5]

中通客车:海外市场占有率持续提升

Zheng Quan Ri Bao Wang· 2025-08-14 12:08

Group 1 - The company, Zhongtong Bus, emphasizes a customer-oriented approach to meet market demands, offering a wide range of products including highway buses, public transport, tourism, group, high-end business, school buses, logistics vehicles, and special vehicles [1] - The company has been expanding its overseas market presence, leading to a continuous increase in its market share in the global bus industry, establishing itself as a representative brand [1]

安凯客车股价小幅回落 7月销量同比增长39.38%

Jin Rong Jie· 2025-08-07 19:43

Core Viewpoint - Ankai Bus's stock price is currently at 5.84 yuan, reflecting a decline of 1.02% from the previous trading day, with a total market capitalization of 5.487 billion yuan and a price-to-earnings ratio of 313.87 [1] Group 1: Company Performance - Ankai Bus primarily engages in the research, development, manufacturing, and sales of buses and components, including various types of highway buses, tourist buses, and public transport buses [1] - The company's revenue for 2024 is expected to come entirely from the manufacturing sector [1] - In the first quarter of 2025, Ankai Bus achieved a revenue of 658 million yuan and a net profit attributable to shareholders of 4.37 million yuan [1] Group 2: Sales and Production Data - In July 2025, the total vehicle sales reached 668 units, with a cumulative sales figure of 4,410 units for the year, representing a year-on-year growth of 39.38% [1] - The production output in July was 524 units, with a cumulative production of 4,613 units for the year [1] Group 3: Market Activity - On August 7, the net inflow of main funds was 7.4765 million yuan, accounting for 0.17% of the circulating market value [1] - Over the past five days, the net outflow of main funds was 46.9781 million yuan, representing 1.1% of the circulating market value [1] Group 4: Management Changes - The company's securities affairs representative, Zhao Baojun, resigned for personal reasons and will no longer hold any position [1]