公交客车

Search documents

安凯客车预亏,半年内遭安徽省投资集团两度减持

Shen Zhen Shang Bao· 2026-02-25 15:47

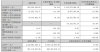

净利承压下,安凯客车半年之内遭安徽省投资集团两度减持。 2月25日,安凯客车发布公告,持股5%以上股东安徽省投资集团(下称"省投资集团")在2025年11月27日至2026年2月24日通过集中竞价交易减持220万股, 占公司总股本的0.23%。据计算,省投资集团本次减持金额约1105.14万元。 | 股东名称 | 減持方式 | 減持期间 | 减持均价 | 減持股数 | 候 | | --- | --- | --- | --- | --- | --- | | | | | (元/股) | (股) | | | 安徽省投资 | 集中竞价交易 | 2025年11月27日 | 5. 03 | 2, 197, 100 | | | 集团控股有 | | -2026年2月24日 | | | | | 限公司 | 合计 | | 5.03 | 2, 197, 100 | | 值得注意的是,省投资集团在短短半年的时间内已实施两次减持,累计套现约6592万元。2025年8月26日至2025年9月15日,省投资集团减持了939.51万股, 占公司总股本的1%,减持金额约5486.74万元。 资料显示,安徽安凯汽车股份有限公司于1997年7月2 ...

宇通1.7万辆霸榜 金龙/海格大涨 安凯杀疯!2025客车出口超7.8万辆 | 头条

第一商用车网· 2026-01-26 06:59

Core Viewpoint - In December 2025, China's bus exports reached a record high, with total exports exceeding 10,000 units for the first time, marking a significant year-end surge in the industry [1][4]. Export Performance - In 2025, a total of 78,313 buses were exported, a 26.68% increase from 61,820 units in 2024 [1][11]. - December 2025 saw exports of 11,975 buses, a year-on-year increase of 63.73% and a month-on-month increase of 112.51% [1][4]. Market Segmentation - All segments (large, medium, and light buses) experienced significant growth in December 2025, with large buses exporting 5,070 units (up 35.89%), medium buses 4,028 units (up 214.44%), and light buses 2,877 units (up 24.98%) [3][4]. - The overall export volume in December was nearly double that of November, indicating a strong recovery after two months of decline [4][8]. Company Rankings - Yutong Bus led the export rankings with 17,149 units, a 22.49% increase from 14,000 units in 2024 [10][11]. - Xiamen Jinlong followed with 12,255 units, a remarkable 64.90% increase, while Ankai Bus saw a dramatic rise of 152.84% to 5,034 units [10][12]. Segment Leaders - In the seating bus category, Xiamen Jinlong topped the list with 9,953 units exported, a 57.63% increase, while Yutong followed with 8,392 units [17][18]. - For public buses, Yutong also led with 8,460 units, a 37.61% increase, followed by BYD with 4,173 units [26][27]. Future Outlook - The bus export market is expected to remain strong in 2026, with potential for further growth as the industry recovers from previous declines [8][29].

政策预期向上修复-26年车市如何展望

2025-12-31 16:02

Summary of Conference Call Records Industry Overview - The records primarily discuss the **automobile industry**, focusing on the **new energy vehicle (NEV)** market and related government policies impacting vehicle sales and subsidies [1][2][4]. Key Points and Arguments Policy Changes and Subsidies - The **subsidy policy for new energy vehicles** is expected to decrease by **20%-30%**, amounting to approximately **¥220 billion to ¥230 billion**. This adjustment aims to enhance fund management and reduce fraudulent activities [1][2]. - The new policy introduces a **proportional subsidy** based on the new vehicle price, with a maximum of **¥20,000**, transitioning from fixed subsidies to a more flexible approach [2]. - Different vehicle types will see adjusted subsidy amounts, with **low-end models** like micro electric vehicles receiving reduced support, while **mid to high-end models** will benefit from increased subsidies [4][3]. Market Dynamics - The **2025 equipment update policy** offers substantial support for trucks, with a **¥45,000 subsidy** for scrapping heavy diesel trucks and **¥95,000** for purchasing new energy trucks, totaling **¥140,000** [7]. - The **2025 fourth quarter** saw a decline in retail sales, with December experiencing a **32%** drop in the first week compared to November, indicating a potential **zero to negative growth** in NEV demand due to expiring tax exemptions and supply pressures [15][2]. Economic Impact - The **economic outlook** suggests that **low-income groups** will struggle to increase purchasing power, limiting growth in the mid to low-end vehicle market. The overall automotive consumption is expected to maintain a **0% growth** rate in 2026, with a focus on high-quality development [18][16]. - The **2026 NEV market** is projected to have a **60% penetration rate**, with an expected growth rate of **14%** in the first quarter, indicating a positive trend despite challenges [20]. Challenges and Solutions - Challenges in policy implementation include **fund management** and **audit processes**, with recommendations for improved data sharing and stricter verification mechanisms to combat fraud [5][6]. - The **cross-regional subsidy issue** is addressed by requiring that new vehicle invoices and license plates belong to the same province, aiming to stabilize sales fluctuations across regions [17]. Future Trends - The **export market** for Chinese automobiles is anticipated to grow significantly, with a **25% increase** expected in January 2026, driven by high demand and favorable conditions [21]. - The competitive landscape in the automotive industry is shifting towards **innovation and technology**, with traditional brands facing pressure while new energy and luxury brands may thrive under supportive policies [22]. Additional Important Content - The **2026 passenger vehicle trade-in policy** has been adjusted to prevent short-term arbitrage, requiring vehicles to be registered in the owner's name for at least one year prior to the policy announcement [11]. - The **battery supply shortage** and rising lithium carbonate prices are attributed to high demand driven by subsidies for new energy trucks, leading to market imbalances [8][9]. This comprehensive summary encapsulates the critical insights from the conference call records, highlighting the evolving landscape of the automobile industry and the implications of government policies on market dynamics.

金龙破1.1万辆直追宇通!福田/安凯大涨!前11月客车出口6.6万辆 | 头条

第一商用车网· 2025-12-22 09:04

Core Viewpoint - After ending the "21 consecutive months of growth," China's bus exports showed a mixed trend in November 2025, with a total export of 56,635 units, reflecting a year-on-year decline of 1.76% but a month-on-month increase of 10.38% [1][3]. Export Volume Overview - In the first 11 months of 2025, China's total bus exports reached 66,338 units, an increase of 11,832 units compared to the same period last year, representing a year-on-year growth of 21.71% [1][3]. - November 2025 saw a total export of 5,635 units, marking a significant improvement from October, with the year-on-year decline narrowing by 20.61 percentage points [1]. Segment Performance - In November 2025, large and medium buses experienced positive year-on-year growth, while light buses saw a decline of over 40% [4]. - Large bus exports totaled 2,638 units, up 5.69% year-on-year, while medium bus exports surged by 77.58% to 1,687 units [5]. - Light bus exports were 1,310 units, down 42.79% year-on-year, although there was a month-on-month recovery [5]. Functional Attributes - In November 2025, the export of seat buses was 3,545 units, down 11% year-on-year, while public transport buses saw an increase of 15.09% with 2,014 units exported [7][8]. - The export of school buses and other buses showed significant fluctuations, with school bus exports increasing by 3,000% to 31 units, while other buses saw a decline of 39.18% [8]. Company Rankings - In the first 11 months of 2025, Yutong and King Long led the export rankings with over 10,000 units each, capturing 19.30% and 16.65% market shares, respectively [14][15]. - Other notable companies included Xiamen Jinlv and Suzhou King Long Haige, both exceeding 7,000 units, while Zhongtong Bus remained in the top five with nearly 6,000 units exported [14]. Monthly Export Leaders - In November 2025, the top exporters were Xiamen King Long (1,166 units), Yutong (1,064 units), and Jiangling Jingma (636 units), with Xiamen King Long achieving a year-on-year growth of 41.85% [17][18]. Market Trends - The overall market pressure remains significant, with the seat bus segment experiencing a widening year-on-year decline of 11%, particularly in large seat buses, which hit a yearly low [12]. - The bus export landscape is characterized by a slow market recovery, leading to uncertainty in December 2025's export trends [12].

中通客车(000957) - 000957中通客车投资者关系管理信息20251204

2025-12-04 10:34

Group 1: Company Overview - The company offers over 140 types of products, including highway passenger vehicles, public buses, tourist buses, commuter vehicles, high-end business vehicles, school buses, and special vehicles [2] - After years of development, the company has established a presence in all provinces and cities across China and operates in multiple countries and regions globally [2] Group 2: Domestic Market Demand - The domestic public bus market has shifted to a stage dominated by replacement demand, with the peak of new demand having passed [2] - Last year, the sales volume of medium and large buses was approximately 30,000 units, indicating a gradual differentiation in market structure [2] - There is an increasing demand for small buses serving the "last mile" of urban transport, while the number of traditional large buses is gradually decreasing [2] Group 3: Export Business Advantages - The company's core advantages in export business include excellent cost-performance ratio and shorter delivery times compared to international brands [3] - Chinese new energy buses have surpassed similar foreign products in terms of product capability [3] - The "Belt and Road" initiative enhances global influence, creating favorable conditions for Chinese companies to expand internationally [3] Group 4: Future Dividend and Growth Plans - The company plans to consider market conditions, cash flow from operations, and future funding needs when determining dividend levels to boost investor confidence [3] - Focus will be on expanding overseas markets, enhancing product quality, and optimizing management to continuously improve competitiveness and profitability, thereby creating greater value for investors [3]

中通客车:目前的产品主要以载客类公路车、公交、旅游等客车产品为主

Zheng Quan Ri Bao Wang· 2025-11-19 11:42

Core Viewpoint - Zhongtong Bus (000957) primarily focuses on passenger road vehicles, including buses and tourist coaches, and has not yet ventured into the field of unmanned logistics vehicles [1] Company Summary - The company's current product lineup consists mainly of passenger road vehicles, including public transport buses and tourist coaches [1]

宇通破万 金龙/安凯暴涨 欧辉超去年全年 前9月客车出口超5.5万辆 | 头条

第一商用车网· 2025-10-31 07:05

Core Viewpoint - China's bus exports have shown significant growth, with a total of 55,598 buses exported from January to September 2025, marking a year-on-year increase of 31.77% [1][10]. Group 1: Export Performance - In September 2025, a total of 7,228 buses were exported, reflecting a month-on-month increase of 8.71% and a year-on-year increase of 37.36% [1][3]. - The overall monthly export volume has exceeded 7,000 units for three consecutive months, indicating a trend towards higher export volumes [3]. - The export of large buses reached 4,744 units in September, a year-on-year increase of 78.61%, setting a new monthly record [5][10]. Group 2: Market Segmentation - The export of large buses has been particularly strong, while the medium bus segment saw a decline, and light buses experienced a slight recovery [5][6]. - In September, the export of seated buses and public transport buses maintained robust growth, with seated buses exporting 3,749 units (up 33.7%) and public transport buses exporting 3,473 units (up 93.16%) [8][9]. - The large public bus segment showed a significant increase, with exports reaching 2,878 units, a year-on-year surge of 124.14% [9]. Group 3: Company Rankings - Yutong led the export rankings with 10,742 units from January to September 2025, a year-on-year increase of 18.17% [10][12]. - The Xiamen Golden Dragon group followed closely with exports of 9,152 units, reflecting a substantial year-on-year growth of 77.99% [10][12]. - Ankai Bus and Foton Ouhui also showed significant growth, with Ankai's exports increasing by 178.21% year-on-year [10][12]. Group 4: Future Outlook - The future of China's bus export market appears promising, with a need for companies to align with overseas demand, optimize product structures, and enhance technology and services to capture broader market opportunities [31].

三季度亏2705万元!安凯客车陷“割裂”局面

Shen Zhen Shang Bao· 2025-10-25 01:41

Core Points - The company reported a revenue of 8.54 billion CNY in Q3, a year-on-year increase of 56.2%, but the net profit loss expanded from 12.62 million CNY to 27.05 million CNY [1] - The main business of the company includes the research, development, manufacturing, sales, and service of buses and automotive parts, focusing on various types of buses including public transport and new energy buses [1] - The financial report indicates that while revenue increased, the net profit continued to show losses, attributed to rising operating costs and significant asset impairment losses [1][2] Financial Summary - For the first three quarters of 2025, the company reported a revenue of 24.46 billion CNY, a 44.37% increase compared to the same period in 2024 [4] - Operating costs rose to 22.50 billion CNY, an increase of 46.22%, primarily due to increased sales volume [2] - Asset impairment losses surged by 361.96% to 24.67 million CNY, mainly due to increased inventory write-downs [2] Market Performance - As of October 24, the company's stock price was 5.75 CNY per share, with a total market capitalization of 54.02 billion CNY [3] - The stock experienced a slight increase of 0.52% on the same day [3] - Key financial metrics include a P/E ratio of 146.83 and a market-to-book ratio of 6.15 [5]

中通客车首次进入迪拜公交系统

Shang Wu Bu Wang Zhan· 2025-09-16 09:52

Core Viewpoint - Zhongtong Bus has successfully won a bid for 91 buses in Dubai, marking the first entry of a Chinese bus brand into the Dubai public transport system, with 40 of these being pure electric buses, representing the largest batch of electric bus orders in UAE history [1] Group 1: Company Achievements - Zhongtong Bus's successful bid showcases the company's ability to compete with international brands in a high-end market known for its stringent quality and technology standards [1] - The buses are equipped with advanced intelligent systems, including driver behavior monitoring, automatic passenger counting, and electronic driver identity verification [1] Group 2: Industry Implications - The entry into Dubai's public transport system signifies a strategic shift for Chinese manufacturing from a focus on price advantages to value advantages [1] - The buses feature user-friendly configurations such as Wi-Fi, mobile charging ports, low-floor design, bicycle racks, and child seats, aligning with modern consumer expectations [1]

安凯客车股价小幅回落 7月销量同比增长39.38%

Jin Rong Jie· 2025-08-07 19:43

Core Viewpoint - Ankai Bus's stock price is currently at 5.84 yuan, reflecting a decline of 1.02% from the previous trading day, with a total market capitalization of 5.487 billion yuan and a price-to-earnings ratio of 313.87 [1] Group 1: Company Performance - Ankai Bus primarily engages in the research, development, manufacturing, and sales of buses and components, including various types of highway buses, tourist buses, and public transport buses [1] - The company's revenue for 2024 is expected to come entirely from the manufacturing sector [1] - In the first quarter of 2025, Ankai Bus achieved a revenue of 658 million yuan and a net profit attributable to shareholders of 4.37 million yuan [1] Group 2: Sales and Production Data - In July 2025, the total vehicle sales reached 668 units, with a cumulative sales figure of 4,410 units for the year, representing a year-on-year growth of 39.38% [1] - The production output in July was 524 units, with a cumulative production of 4,613 units for the year [1] Group 3: Market Activity - On August 7, the net inflow of main funds was 7.4765 million yuan, accounting for 0.17% of the circulating market value [1] - Over the past five days, the net outflow of main funds was 46.9781 million yuan, representing 1.1% of the circulating market value [1] Group 4: Management Changes - The company's securities affairs representative, Zhao Baojun, resigned for personal reasons and will no longer hold any position [1]