旅游客车

Search documents

宇通中标!

第一商用车网· 2026-02-17 05:33

近日,济南公共交通集团文化旅游有限公司旅游客车采购项目(项目编号:SDXSJ26–0118)正式公示中标结果。宇通客车股份有限 公司成功中标,成为该项目的最终供应商。 济南公共交通集团文化旅游有限公司旅游客车采购项目 中标公示 一、项目名称:济南公共交通集团文化旅游有限公司旅游客车采购项目 二、项目编号: SDXSJ26-0118 三、开标日期:2026年2月12日 四、评审结果: 中标人名称:宇通客车股份有限公司 中标金额:5690000.00元(大写:伍佰陆拾玖万元整) 五、评标委员会成员名单:郑明刚、彭伟利、张振河、闫成春、杜斌 六、中标公示期限:2026年02月14日至2026年02月24日 七、成交公示发布媒介 中国招标投标公共服务平台、山东省采购与招标网 八、监督部门 济南公共交通集团有限公司企业发展部,电话:0531-88515098 九、其他补充事宜:无 十、联系方式 采购人:济南公共交通集团文化旅游有限公司 地址:济南市历下区解放路 18 号 1-1 室 联系人:李新丽 联系电话: 0531-69982888-616 . 两年年 星高照 at 迎書迎春边富音 接财接福按平 0 CD 3 商用 ...

近3000万元!新一批公交动力电池更新采购招标来了

第一商用车网· 2026-01-24 13:28

Group 1 - The core project involves the procurement of a complete set of power batteries for 118 new energy buses by Chaohu Public Transport Group, with a total budget and maximum limit of 29.24 million yuan [1][2]. - The procurement includes battery packs, BMS battery management systems, high-voltage boxes, and cooling systems, with a fixed unit price of 247,800 yuan per bus [2]. - The project requires a warranty service of no less than 8 years or 400,000 kilometers, including free maintenance and technical support during the warranty period [2]. Group 2 - The battery type specified for the project is lithium iron phosphate, which is the mainstream application type for buses, with a system voltage compatible with existing vehicles (approximately 540V-600V) [2]. - The technical requirements include an energy density of at least 140 Wh/kg, a cycle life of at least 3,000 times (with 80% capacity retention), and a protection level of IP67 [2]. - Bidders must have independent civil liability, good commercial reputation, and relevant qualifications, including ISO9001 and ISO14001 certifications, and must be battery manufacturers, not agents [2]. Group 3 - The contract performance period is set to complete the supply, installation, and acceptance of the 118 vehicle-mounted power batteries within 30 working days from the contract signing [3]. - The procurement agency for this project is Anhui Tianshun Engineering Cost Consulting Co., Ltd. [3].

中通客车(000957) - 000957中通客车投资者关系管理信息20251204

2025-12-04 10:34

Group 1: Company Overview - The company offers over 140 types of products, including highway passenger vehicles, public buses, tourist buses, commuter vehicles, high-end business vehicles, school buses, and special vehicles [2] - After years of development, the company has established a presence in all provinces and cities across China and operates in multiple countries and regions globally [2] Group 2: Domestic Market Demand - The domestic public bus market has shifted to a stage dominated by replacement demand, with the peak of new demand having passed [2] - Last year, the sales volume of medium and large buses was approximately 30,000 units, indicating a gradual differentiation in market structure [2] - There is an increasing demand for small buses serving the "last mile" of urban transport, while the number of traditional large buses is gradually decreasing [2] Group 3: Export Business Advantages - The company's core advantages in export business include excellent cost-performance ratio and shorter delivery times compared to international brands [3] - Chinese new energy buses have surpassed similar foreign products in terms of product capability [3] - The "Belt and Road" initiative enhances global influence, creating favorable conditions for Chinese companies to expand internationally [3] Group 4: Future Dividend and Growth Plans - The company plans to consider market conditions, cash flow from operations, and future funding needs when determining dividend levels to boost investor confidence [3] - Focus will be on expanding overseas markets, enhancing product quality, and optimizing management to continuously improve competitiveness and profitability, thereby creating greater value for investors [3]

中通客车:目前的产品主要以载客类公路车、公交、旅游等客车产品为主

Zheng Quan Ri Bao Wang· 2025-11-19 11:42

Core Viewpoint - Zhongtong Bus (000957) primarily focuses on passenger road vehicles, including buses and tourist coaches, and has not yet ventured into the field of unmanned logistics vehicles [1] Company Summary - The company's current product lineup consists mainly of passenger road vehicles, including public transport buses and tourist coaches [1]

中通客车(000957.SZ):无人物流车辆暂未涉及

Ge Long Hui· 2025-11-19 08:26

Core Viewpoint - Zhongtong Bus (000957.SZ) primarily focuses on passenger transport vehicles, including public buses and tourist coaches, and has not yet ventured into the field of unmanned logistics vehicles [1] Company Summary - The company's current product lineup is centered around passenger-oriented road vehicles, specifically buses and tourist coaches [1] - There is no involvement in unmanned logistics vehicles at this time [1]

三季度亏2705万元!安凯客车陷“割裂”局面

Shen Zhen Shang Bao· 2025-10-25 01:41

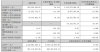

Core Points - The company reported a revenue of 8.54 billion CNY in Q3, a year-on-year increase of 56.2%, but the net profit loss expanded from 12.62 million CNY to 27.05 million CNY [1] - The main business of the company includes the research, development, manufacturing, sales, and service of buses and automotive parts, focusing on various types of buses including public transport and new energy buses [1] - The financial report indicates that while revenue increased, the net profit continued to show losses, attributed to rising operating costs and significant asset impairment losses [1][2] Financial Summary - For the first three quarters of 2025, the company reported a revenue of 24.46 billion CNY, a 44.37% increase compared to the same period in 2024 [4] - Operating costs rose to 22.50 billion CNY, an increase of 46.22%, primarily due to increased sales volume [2] - Asset impairment losses surged by 361.96% to 24.67 million CNY, mainly due to increased inventory write-downs [2] Market Performance - As of October 24, the company's stock price was 5.75 CNY per share, with a total market capitalization of 54.02 billion CNY [3] - The stock experienced a slight increase of 0.52% on the same day [3] - Key financial metrics include a P/E ratio of 146.83 and a market-to-book ratio of 6.15 [5]

这一地招标804辆客车!总预算超6.5亿元

第一商用车网· 2025-08-12 04:22

Core Viewpoint - The Quanzhou Public Transport Group has initiated a public tender for the procurement of 804 electric buses and tourist vehicles for the year 2025, with a total budget of 656.327 million yuan [1]. Group 1: Tender Details - The procurement project includes 12 contract packages covering various types of electric buses and tourist vehicles [1][3]. - The highest control price for the entire procurement is set at 656.327 million yuan [1]. - The total number of vehicles to be procured is 804, including different specifications of electric buses and tourist vehicles [1]. Group 2: Contract Packages Summary - Contract Package 1: 231 units of 8.5 meters or longer low-entry electric buses, with a maximum unit price of 893,000 yuan, totaling 206.283 million yuan [1]. - Contract Package 2: 72 units of 10.5 meters or longer low-entry electric buses, with a maximum unit price of 1.05 million yuan, totaling 75.600 million yuan [1]. - Contract Package 3: 238 units of 8 meters or longer low-entry electric buses, with a maximum unit price of 820,000 yuan, totaling 195.160 million yuan [1]. - Contract Package 4: 72 units of 5.9 meters or longer low-entry electric buses, with a maximum unit price of 601,000 yuan, totaling 43.272 million yuan [1]. - Contract Package 5: 59 units of 8.5 meters or longer low-floor electric buses, with a maximum unit price of 988,000 yuan, totaling 58.292 million yuan [1]. - Contract Package 6: 67 units of 7 meters or longer low-entry electric buses, with a maximum unit price of 730,000 yuan, totaling 48.910 million yuan [1]. - Contract Package 7: 25 units of 9-seat "Xiaobai" sightseeing cars at 143,000 yuan each, and 5 units of 17-seat "Xiaobai" sightseeing cars at 149,000 yuan each, totaling 4.32 million yuan [1]. - Contract Package 8: 5 units of 6 meters or longer non-standing electric buses, with a maximum unit price of 662,000 yuan, totaling 3.310 million yuan [1]. - Contract Package 9: 20 units of 8 meters or longer non-standing electric buses, with a maximum unit price of 785,000 yuan, totaling 15.700 million yuan [1]. - Contract Package 10: 7 units of 50-seat tourist buses, with a maximum unit price of 610,000 yuan, totaling 4.270 million yuan [1]. - Contract Package 11: 2 units of 38-seat tourist buses, with a maximum unit price of 460,000 yuan, totaling 0.920 million yuan [1]. - Contract Package 12: 1 unit of 19-seat tourist bus, with a maximum unit price of 290,000 yuan, totaling 0.290 million yuan [1].

安凯客车股价小幅回落 7月销量同比增长39.38%

Jin Rong Jie· 2025-08-07 19:43

Core Viewpoint - Ankai Bus's stock price is currently at 5.84 yuan, reflecting a decline of 1.02% from the previous trading day, with a total market capitalization of 5.487 billion yuan and a price-to-earnings ratio of 313.87 [1] Group 1: Company Performance - Ankai Bus primarily engages in the research, development, manufacturing, and sales of buses and components, including various types of highway buses, tourist buses, and public transport buses [1] - The company's revenue for 2024 is expected to come entirely from the manufacturing sector [1] - In the first quarter of 2025, Ankai Bus achieved a revenue of 658 million yuan and a net profit attributable to shareholders of 4.37 million yuan [1] Group 2: Sales and Production Data - In July 2025, the total vehicle sales reached 668 units, with a cumulative sales figure of 4,410 units for the year, representing a year-on-year growth of 39.38% [1] - The production output in July was 524 units, with a cumulative production of 4,613 units for the year [1] Group 3: Market Activity - On August 7, the net inflow of main funds was 7.4765 million yuan, accounting for 0.17% of the circulating market value [1] - Over the past five days, the net outflow of main funds was 46.9781 million yuan, representing 1.1% of the circulating market value [1] Group 4: Management Changes - The company's securities affairs representative, Zhao Baojun, resigned for personal reasons and will no longer hold any position [1]