兴银中证港股通科技ETF

Search documents

刘帆离任兴银基金旗下9只基金

Zhong Guo Jing Ji Wang· 2025-10-14 07:49

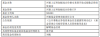

Core Insights - Liu Fan has resigned from multiple funds managed by Xingyin Fund Management, including the Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Price ETF and others [1][4][5][6] - The resignation is part of a broader management change within the firm, with other fund managers continuing to oversee the affected funds [4][5][6] Fund Performance Summary - Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Price ETF has a cumulative return of 35.74% since its inception on May 27, 2025 [1] - Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Index Enhanced Fund A/C has returns of 5.89% and 5.77% since its inception on July 11, 2025 [1] - Xingyin CSI Dividend Low Volatility Index Fund A/C has cumulative returns of -3.93% and -3.95% since its inception on July 21, 2025 [1] - Xingyin CSI Sci-Tech Innovation and Entrepreneurship 50 Index A/C has a year-to-date return of 52.01% and a cumulative return of -0.37% since its inception on July 14, 2021 [2] - Xingyin National Standard New Energy Vehicle Battery ETF has a year-to-date return of 63.95% and a cumulative return of -12.60% since its inception on August 6, 2021 [2] - Xingyin MSCI China A50 Connect Index Fund A/C has a cumulative return of 2.98% since its inception on August 25, 2025 [2] - Xingyin CSI Hong Kong Stock Connect Technology ETF has a cumulative return of 16.12% and 15.87% since its inception on March 24, 2025 [2] - Xingyin CSI Hong Kong Stock Connect Technology ETF has a year-to-date return of 50.47% and a cumulative return of 53.12% since its inception on January 31, 2023 [2] - Xingyin CSI All-Index Public Utilities Index Fund A/C has cumulative returns of 4.83% and 4.74% since its inception on June 4, 2025 [3]

中证港股通科技指数下跌0.61%

Jin Rong Jie· 2025-08-12 13:02

Core Points - The China Securities Index Hong Kong Stock Connect Technology Index (CSI Hong Kong Technology, 931573) experienced a decline of 0.61%, closing at 3373.85 points with a trading volume of 76.047 billion yuan on August 12 [1] - Over the past month, the CSI Hong Kong Technology Index has increased by 7.35%, by 11.64% over the last three months, and by 41.30% year-to-date [1] - The index comprises 50 large-cap technology companies with high R&D investment and revenue growth, reflecting the overall performance of technology leaders within the Hong Kong Stock Connect [1] Market Composition - The CSI Hong Kong Technology Index is fully composed of stocks listed on the Hong Kong Stock Exchange, with a 100% allocation [1] - The sector distribution of the index includes: Consumer Discretionary at 37.12%, Information Technology at 26.79%, Communication Services at 17.89%, Healthcare at 17.18%, and Industrials at 1.03% [1] Index Adjustment Mechanism - The sample of the CSI Hong Kong Technology Index is adjusted biannually, with changes implemented on the next trading day following the second Friday of June and December [2] - Weight factors are generally fixed until the next scheduled adjustment, with special circumstances allowing for temporary adjustments [2] - New securities entering the Hong Kong Stock Connect that rank in the top ten by market capitalization will be added to the index on the eleventh trading day after their listing [2]

中小基金公司争相入局 ETF赛道越来越“卷”

Xin Hua Wang· 2025-08-12 05:48

Core Viewpoint - The ETF market is experiencing rapid growth, with both large and small fund companies actively participating, leading to increased competition and the need for differentiation among smaller firms [1][4]. Group 1: Market Dynamics - Approximately 20 small and medium-sized fund companies are currently involved in the ETF business, including notable names like Xizang Dongcai Fund and Pengyang Fund [3]. - The recent regulatory changes, such as the reduction of index publication time from six months to three months, are expected to enhance the efficiency of ETF product development [4]. - The proportion of ETF market size relative to the overall public fund industry is increasing, particularly as actively managed equity funds have underperformed this year [4]. Group 2: Challenges and Opportunities - Small fund companies face significant resource constraints when launching ETF products, which require substantial investment in system development, sales, and operations [5]. - Despite the challenges, the passive nature of ETFs allows smaller firms to leverage their strengths without heavily relying on research resources, presenting an opportunity for them to innovate and differentiate [5][6]. Group 3: Strategic Recommendations - Small fund companies are advised to focus on creating differentiated products that meet market demand, such as complementary wide-base products and long-term valuable themes [7]. - Collaborating with sales channels and enhancing brand visibility is crucial for small fund companies to increase their management scale [7]. - Expanding ETF business models through partnerships with brokerages in various areas, including sales, trading, and investor education, is recommended to navigate the competitive landscape [8].

中证港股通科技指数上涨2.46%

Jin Rong Jie· 2025-06-24 12:36

Core Points - The China Securities Index Hong Kong Stock Connect Technology Index (CSI Hong Kong Technology, 931573) opened lower but closed higher, increasing by 2.46% to 3184.52 points with a trading volume of 68.697 billion yuan [1] - Over the past month, the CSI Hong Kong Technology Index has decreased by 1.56%, and over the past three months, it has declined by 3.92%, while year-to-date it has risen by 29.38% [1] - The index selects 50 large-cap technology leading companies with high R&D investment and good revenue growth from the Hong Kong Stock Connect, reflecting the overall performance of these companies [1] Index Adjustment and Management - The sample of the CSI Hong Kong Technology Index is adjusted every six months, with adjustments implemented on the next trading day after the second Friday of June and December each year [2] - Weight factors are generally fixed until the next scheduled adjustment, with special circumstances allowing for temporary adjustments [2] - New securities that rank in the top ten by market capitalization will enter the index on the eleventh trading day after being included in the Hong Kong Stock Connect [2] Fund Tracking - Public funds tracking the CSI Hong Kong Technology Index include various funds such as Invesco Great Wall CSI Hong Kong Technology Connect C, Invesco Great Wall CSI Hong Kong Technology Connect A, and several ETFs [2]