兴银国证新能源车电池ETF

Search documents

基金经理扩容!开年46人上岗 出于蓝如何胜于蓝?

Zhong Guo Jing Ji Wang· 2026-02-02 00:36

Group 1 - A total of 46 new fund managers have started their roles since the beginning of the year, primarily managing equity funds [1][2] - The new fund managers come from 35 different fund companies, including both large and small public funds, with a majority focusing on equity funds [2][3] - The educational background of the new fund managers is diverse, with all holding at least a master's degree, and many having experience as researchers or assistants before becoming fund managers [4][5] Group 2 - The trend of "sell-side to buy-side" career progression remains prevalent, with many new managers having transitioned from research roles [4][6] - New fund managers are generally younger, with many being born in the 1980s and 1990s, and they exhibit strong educational qualifications [4][7] - The average tenure from researcher to fund manager is around 6 to 8 years, with some achieving this in as little as 3 years [5][6] Group 3 - New fund managers often face challenges such as low initial attention and small management scales, requiring them to develop their investment frameworks [7][8] - Collaboration with experienced fund managers is common, allowing new managers to learn and grow in their roles [7][8] - Emphasis is placed on long-term performance and risk control, with a shift towards evaluating managers based on their ability to generate sustainable returns [8][9]

基金经理扩容!开年46人上岗,出于蓝如何胜于蓝?

券商中国· 2026-02-01 08:23

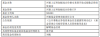

新年新气象,基金经理新人密集上岗。 | 周波昂 | 男 | 侧工 | 2026-01-23 | 甲庚星金 | | --- | --- | --- | --- | --- | | 潘科 | 男 | 硕士 | 2026-01-22 | 安信基金 | | 张子健 | 男 | 硕士 | 2026-01-21 | 鹏非基金 | | 于智伟 | 場 | 硕士 | 2026-01-21 | 九泰基金 | | 胡涛 | 男 | 硕士 | 2026-01-21 | 平安基金 | | रूर्य | 女 | 硕士 | 2026-01-20 | 长盛基金 | | 王梦恺 | 男 | 硕士 | 2026-01-20 | 南华基金 | | 陈祥 | 男 | 博士 | 2026-01-20 | 天弘基金 | | 李嘉琪 | 女 | 博士 | 2026-01-20 | 长江证券(上海)资管 | | 郭威 | 男 | 硕士 | 2026-01-20 | 国联基金 | | 丁仲元 | 男 | 硕士 | | 2026-01-20 国泰海通证券资管 | | 卓佳亮 | 男 | | 2026-01-19 | 天治基金 | | 刘裴 。 | E | ...

兴银基金旗下5只基金增聘李浩

Zhong Guo Jing Ji Wang· 2026-01-29 10:14

中国经济网北京1月29日讯 今日,兴银基金公告,兴银上证科创板综合价格ETF、兴银国证新能源 车电池ETF、兴银中证科创创业50指数、兴银MSCI中国A50互联互通指数发起、兴银中证全指公用事业 指数发起增聘李浩。 李浩历任国盛证券有限责任公司研究所助理金融工程研究员、上海珠池资产管理有限公司量化研究 员、上海驰泰资产管理有限公司量化研究员、西藏东财基金管理有限公司资深量化研究员。 兴银上证科创板综合价格ETF成立于2025年05月27日,截至2026年01月28日,其今年来收益率为 14.52%,成立来收益率为50.20%,累计净值为1.5020元。 兴银国证新能源车电池ETF成立于2021年08月06日,截至2026年01月28日,其今年来收益率为 2.06%,成立来收益率为-11.25%,累计净值为0.8875元。 | 基金名称 | 兴银MSCI 中国A50互联互通指数发起式证券投资基 | | --- | --- | | | 金 | | 基金简称 | 兴银 MSCI 中国 A50 互联互通指数发起 | | 基金主代码 | 023775 | | 基金管理人名称 | 兴银基金管理有限责任公司 | | 公告依 ...

三花智控股价涨1.15%,兴银基金旗下1只基金重仓,持有50.95万股浮盈赚取28.02万元

Xin Lang Cai Jing· 2025-12-30 01:57

Group 1 - The core viewpoint of the news is that Sanhua Intelligent Control Co., Ltd. has shown a positive stock performance, with a 1.15% increase in share price, reaching 48.28 yuan per share, and a total market capitalization of 203.16 billion yuan [1] - Sanhua Intelligent Control is primarily engaged in the production of refrigeration and air conditioning electrical components and automotive components, with a revenue composition of 63.88% from refrigeration and air conditioning parts and 36.12% from automotive parts [1] - The company operates through two main divisions: the refrigeration and air conditioning electrical components division and the automotive components division, focusing on HVAC systems and automotive thermal management [1] Group 2 - According to data, the Xinyin National Index New Energy Vehicle Battery ETF (159767) has increased its holdings in Sanhua Intelligent Control by 212,700 shares, bringing the total to 509,500 shares, which constitutes 7.44% of the fund's net value [2] - The Xinyin National Index New Energy Vehicle Battery ETF has achieved a year-to-date return of 62.05%, ranking 293 out of 4,195 in its category, and a one-year return of 59.04%, ranking 265 out of 4,179 [2] - The fund manager, Weng Zichen, has a tenure of 1 year and 158 days, with the best fund return during this period being 102.46% [3]

刘帆离任兴银基金旗下9只基金

Zhong Guo Jing Ji Wang· 2025-10-14 07:49

Core Insights - Liu Fan has resigned from multiple funds managed by Xingyin Fund Management, including the Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Price ETF and others [1][4][5][6] - The resignation is part of a broader management change within the firm, with other fund managers continuing to oversee the affected funds [4][5][6] Fund Performance Summary - Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Price ETF has a cumulative return of 35.74% since its inception on May 27, 2025 [1] - Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Index Enhanced Fund A/C has returns of 5.89% and 5.77% since its inception on July 11, 2025 [1] - Xingyin CSI Dividend Low Volatility Index Fund A/C has cumulative returns of -3.93% and -3.95% since its inception on July 21, 2025 [1] - Xingyin CSI Sci-Tech Innovation and Entrepreneurship 50 Index A/C has a year-to-date return of 52.01% and a cumulative return of -0.37% since its inception on July 14, 2021 [2] - Xingyin National Standard New Energy Vehicle Battery ETF has a year-to-date return of 63.95% and a cumulative return of -12.60% since its inception on August 6, 2021 [2] - Xingyin MSCI China A50 Connect Index Fund A/C has a cumulative return of 2.98% since its inception on August 25, 2025 [2] - Xingyin CSI Hong Kong Stock Connect Technology ETF has a cumulative return of 16.12% and 15.87% since its inception on March 24, 2025 [2] - Xingyin CSI Hong Kong Stock Connect Technology ETF has a year-to-date return of 50.47% and a cumulative return of 53.12% since its inception on January 31, 2023 [2] - Xingyin CSI All-Index Public Utilities Index Fund A/C has cumulative returns of 4.83% and 4.74% since its inception on June 4, 2025 [3]

国轩高科股价涨5.66%,兴银基金旗下1只基金重仓,持有15.13万股浮盈赚取39.94万元

Xin Lang Cai Jing· 2025-10-09 03:03

Group 1 - The core point of the news is that Guoxuan High-Tech's stock price increased by 5.66% to 49.32 CNY per share, with a trading volume of 3.944 billion CNY and a turnover rate of 4.73%, resulting in a total market capitalization of 89.451 billion CNY [1] - Guoxuan High-Tech Co., Ltd. is located in Hefei, Anhui Province, and was established on January 23, 1995, with its listing date on October 18, 2006. The company's main business involves power lithium batteries and power distribution equipment [1] - The revenue composition of Guoxuan High-Tech includes: power battery systems 72.37%, energy storage battery systems 23.52%, other (supplementary) 2.84%, and power distribution products 1.27% [1] Group 2 - From the perspective of the top ten heavy stocks in funds, data shows that Xinyin Fund has a fund heavily invested in Guoxuan High-Tech. The Xinyin Guozheng New Energy Vehicle Battery ETF (159767) increased its holdings by 3,200 shares in the second quarter, holding a total of 151,300 shares, accounting for 4.06% of the fund's net value, ranking as the seventh largest heavy stock [2] - The Xinyin Guozheng New Energy Vehicle Battery ETF (159767) was established on August 6, 2021, with a latest scale of 121 million CNY. Year-to-date returns are 69.69%, ranking 162 out of 4,221 in its category; the one-year return is 65.56%, ranking 413 out of 3,848; and since inception, it has a loss of 9.54% [2] - The fund managers of the Xinyin Guozheng New Energy Vehicle Battery ETF are Liu Fan and Weng Zichen. Liu Fan has a tenure of 4 years and 89 days, with a total fund asset scale of 1.511 billion CNY, achieving a best fund return of 62.03% and a worst fund return of -9.54% during his tenure [2]

机构风向标 | 新莱福(301323)2025年二季度机构持仓风向标

Xin Lang Cai Jing· 2025-08-26 01:53

Group 1 - New Life Fortune (301323.SZ) released its semi-annual report for 2025 on August 26, 2025 [1] - As of August 25, 2025, a total of 10 institutional investors disclosed holdings in New Life Fortune A-shares, with a total holding of 69.3134 million shares, accounting for 66.06% of the total share capital [1] - The top ten institutional investors include Ningbo New Life Fortune Proprietary Fund Investment Partnership, Guangzhou Yishang Investment Co., Ltd., Jun Cai Co., Ltd., and others, with the top ten investors' combined holding ratio decreasing by 0.25 percentage points compared to the previous quarter [1] Group 2 - Three new public funds were disclosed in this period compared to the previous quarter, including the Jiaoyin New Vitality Flexible Allocation Mixed A, the China Post Core Technology Innovation Flexible Allocation Mixed, and the Xingyin National Standard New Energy Vehicle Battery ETF [1]

兴银上证科创板综合指数增强发起A基金经理变动:增聘刘帆为基金经理

Sou Hu Cai Jing· 2025-07-16 01:39

Group 1 - The core point of the news is the appointment of Liu Fan as the fund manager for the Xingyin Shanghai Stock Exchange Science and Technology Innovation Board Comprehensive Index Enhanced Fund (024182), effective from July 16, 2025 [1] - As of July 11, 2025, the net value of the Xingyin Shanghai Stock Exchange Science and Technology Innovation Board Comprehensive Index Enhanced Fund is 0.9999 [1] Group 2 - Liu Fan holds a master's degree in Financial Engineering from Nankai University and is a Financial Risk Manager (FRM) [2] - Liu Fan has previously worked at Ping An Fund Management Co., Ltd. and has been with Xingyin Fund Management Co., Ltd. since November 2020, currently serving as the fund manager for several funds [2] - The funds managed by Liu Fan include the Xingyin Zhongzheng Science and Technology Innovation 50 Index A, which has a scale of 2.22 billion and a return of -34.40% since July 14, 2021 [2] - The Xingyin Zhongzheng Science and Technology Innovation 50 Index A has seen a significant estimated return of 117.84% on a stock called Haiguang Information, held since the fourth quarter of 2023 [2]

公募掌舵人变更再添一例!中小公司“换帅”最高频,券商系扎堆,包括海富通基金、兴银基金、东海基金、天治基金、先锋基金等

Sou Hu Cai Jing· 2025-06-06 14:27

Core Viewpoint - The recent management changes in the public fund industry, particularly the resignation of the chairman of Hongtu Innovation Fund, highlight deep-rooted issues within the industry, including a trust crisis, investment style drift, and a wave of fund liquidations [1][3]. Group 1: Management Changes - As of June 6, 2025, there have been 88 fund companies with executive changes, totaling 178 executives, including 21 companies that changed their chairpersons [1]. - The management change at Hongtu Innovation Fund, where the chairman resigned on June 5, 2025, is part of a broader trend of high executive turnover in the industry [1][3]. Group 2: Industry Challenges - The public fund industry is facing a trust crisis, where funds are perceived to profit while investors do not, alongside ongoing issues of investment style drift and a looming fund liquidation crisis [1][3]. - Smaller fund companies are particularly affected, with management changes often driven by shareholder pressure for improved performance and rapid capital appreciation [3][4]. Group 3: Market Competition - Intense competition from larger fund companies is squeezing smaller firms, forcing them to frequently adjust strategies, which can lead to management being scapegoated for poor performance [4][5]. - Internal governance issues, such as poor decision-making processes and conflicts within management, exacerbate the challenges faced by smaller fund companies [4][5]. Group 4: Opportunities Amidst Challenges - New management can bring fresh strategic insights and management practices, potentially enhancing innovation and market competitiveness [5]. - To navigate the challenges posed by management changes, smaller fund companies must improve governance structures, clarify responsibilities, and develop long-term strategies focused on differentiation [5]. Group 5: Performance Metrics - Hongtu Innovation Fund's management scale peaked at 25.068 billion yuan by the end of 2024 but fell below 20 billion yuan in the first quarter of 2025, currently standing at 18.266 billion yuan [9][7]. - The fund's product distribution is primarily in money market funds, bond funds, and REITs, with a relatively low proportion of equity funds [9][6].

ETF基金周报丨金融科技相关ETF上周涨幅居前,机构:稳定币监管框架的完善为全球跨境支付提供了更合规、高效的结算工具

Sou Hu Cai Jing· 2025-06-03 02:18

Market Overview - The Shanghai Composite Index decreased by 0.03% to 3347.49 points, while the Shenzhen Component Index fell by 0.91% to 10040.63 points, and the ChiNext Index dropped by 1.4% to 1993.19 points during the week of May 26 to May 30 [1] - In contrast, major global indices saw gains, with the Nasdaq Composite rising by 2.01%, the Dow Jones Industrial Average increasing by 1.6%, and the S&P 500 up by 1.88% [1] - In the Asia-Pacific region, the Hang Seng Index declined by 1.32%, while the Nikkei 225 rose by 2.17% [1] ETF Market Performance - The median weekly return for stock ETFs was -0.27%, with the highest performing being the E Fund ChiNext Mid-Cap 200 ETF at 2.49% [2] - The top five stock ETFs by weekly gain included the Huabao CSI Financial Technology Theme ETF (5.22%) and the Bosera CSI Financial Technology Theme ETF (4.69%) [5] - Conversely, the worst performers included the Jianxin National Standard New Energy Vehicle Battery ETF (-5.62%) and the GF CSI All-Index Automotive ETF (-5.45%) [6] ETF Liquidity - Average daily trading volume for stock ETFs increased by 4.2%, while average daily turnover rose by 0.4%, with a slight decrease in turnover rate by 0.01% [7] ETF Fund Flows - The top five stock ETFs by inflow included the Huaxia SSE Sci-Tech 50 ETF with an inflow of 376 million yuan, and the Jiashi SSE Sci-Tech Chip ETF with an inflow of 181 million yuan [9] - The largest outflows were seen in the Southern CSI 500 ETF, which had an outflow of 1.236 billion yuan, followed by the Huatai-PB CSI 300 ETF with an outflow of 1.066 billion yuan [10] ETF Financing and Margin Trading - The financing balance for stock ETFs decreased from 41.232 billion yuan to 30.940 billion yuan, while the margin balance dropped from 2.0587 billion shares to 1.6405 billion shares [12] ETF Market Size - The total market size for ETFs reached 4,097.885 billion yuan, with stock ETFs accounting for 2,947.685 billion yuan [15] - Stock ETFs represented 81.2% of the total number of ETFs and 71.9% of the total market size, indicating their dominance in the ETF market [17] ETF Issuance and Establishment - No new ETFs were issued last week, but six new ETFs were established, including the Guotai ChiNext New Energy ETF and the Invesco SSE Sci-Tech 50 Enhanced Strategy ETF [18]