兴银MSCI中国A50互联互通指数发起

Search documents

兴银基金旗下5只基金增聘李浩

Zhong Guo Jing Ji Wang· 2026-01-29 10:14

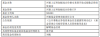

中国经济网北京1月29日讯 今日,兴银基金公告,兴银上证科创板综合价格ETF、兴银国证新能源 车电池ETF、兴银中证科创创业50指数、兴银MSCI中国A50互联互通指数发起、兴银中证全指公用事业 指数发起增聘李浩。 李浩历任国盛证券有限责任公司研究所助理金融工程研究员、上海珠池资产管理有限公司量化研究 员、上海驰泰资产管理有限公司量化研究员、西藏东财基金管理有限公司资深量化研究员。 兴银上证科创板综合价格ETF成立于2025年05月27日,截至2026年01月28日,其今年来收益率为 14.52%,成立来收益率为50.20%,累计净值为1.5020元。 兴银国证新能源车电池ETF成立于2021年08月06日,截至2026年01月28日,其今年来收益率为 2.06%,成立来收益率为-11.25%,累计净值为0.8875元。 | 基金名称 | 兴银MSCI 中国A50互联互通指数发起式证券投资基 | | --- | --- | | | 金 | | 基金简称 | 兴银 MSCI 中国 A50 互联互通指数发起 | | 基金主代码 | 023775 | | 基金管理人名称 | 兴银基金管理有限责任公司 | | 公告依 ...

刘帆离任兴银基金旗下9只基金

Zhong Guo Jing Ji Wang· 2025-10-14 07:49

Core Insights - Liu Fan has resigned from multiple funds managed by Xingyin Fund Management, including the Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Price ETF and others [1][4][5][6] - The resignation is part of a broader management change within the firm, with other fund managers continuing to oversee the affected funds [4][5][6] Fund Performance Summary - Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Price ETF has a cumulative return of 35.74% since its inception on May 27, 2025 [1] - Xingyin Shanghai Stock Exchange Sci-Tech Innovation Board Comprehensive Index Enhanced Fund A/C has returns of 5.89% and 5.77% since its inception on July 11, 2025 [1] - Xingyin CSI Dividend Low Volatility Index Fund A/C has cumulative returns of -3.93% and -3.95% since its inception on July 21, 2025 [1] - Xingyin CSI Sci-Tech Innovation and Entrepreneurship 50 Index A/C has a year-to-date return of 52.01% and a cumulative return of -0.37% since its inception on July 14, 2021 [2] - Xingyin National Standard New Energy Vehicle Battery ETF has a year-to-date return of 63.95% and a cumulative return of -12.60% since its inception on August 6, 2021 [2] - Xingyin MSCI China A50 Connect Index Fund A/C has a cumulative return of 2.98% since its inception on August 25, 2025 [2] - Xingyin CSI Hong Kong Stock Connect Technology ETF has a cumulative return of 16.12% and 15.87% since its inception on March 24, 2025 [2] - Xingyin CSI Hong Kong Stock Connect Technology ETF has a year-to-date return of 50.47% and a cumulative return of 53.12% since its inception on January 31, 2023 [2] - Xingyin CSI All-Index Public Utilities Index Fund A/C has cumulative returns of 4.83% and 4.74% since its inception on June 4, 2025 [3]

兴银基金刘帆:指数化投资迎来“风口”

Shang Hai Zheng Quan Bao· 2025-08-17 13:36

Core Insights - Index investment is experiencing a significant surge, with pure index fund assets surpassing 4 trillion yuan in Q2, reflecting a 7.4% increase from Q1, driven by changes in resident asset allocation and the inherent advantages of index products [1][2]. Group 1: Market Trends - The shift in resident asset allocation is characterized by an increase in risk appetite, a trend referred to as "deposit migration," and a rising demand for quality equity assets [2][4]. - The number of aggressive risk-tolerant individual investors has increased by 1.25 percentage points over the past year, indicating a growing preference for higher risk-return products in a low-interest-rate environment [2]. Group 2: Product Characteristics - Index funds are becoming essential tools for asset allocation, offering benefits such as risk diversification, enhanced returns, increased transparency, and reduced management costs [2][4]. - New product categories like sci-tech bond ETFs and cross-market ETFs are emerging, providing diversified investment options and gaining market recognition [2]. Group 3: Future Growth Potential - The value of equity asset allocation is becoming increasingly evident, with index funds viewed as high-quality tools for entering the equity market [4]. - Three types of capital are expected to inject momentum into the equity market: insurance funds favoring high-dividend large-cap assets, household savings exceeding 120 trillion yuan, and foreign capital seeking stable, liquid blue-chip stocks [4][5]. Group 4: Internationalization and Foreign Investment - The increase in A-share profitability has attracted foreign investors, who prefer fundamentally strong, liquid leading stocks and passive investment strategies, thereby promoting value and index investment concepts [5][6]. - Since A-shares were first included in the MSCI Emerging Markets Index in 2018, the proportion of foreign ownership in total circulating market value has risen from approximately 1.3% in 2012 to 3.7% in 2020, with a notable acceleration post-MSCI inclusion [6][7]. Group 5: Market Evolution - The entry of long-term foreign capital has improved liquidity, pricing efficiency, and corporate governance transparency, aligning the market with international practices [7]. - As Chinese companies gain global influence, the process of foreign capital allocation to A-shares is expected to continue, leading to further innovations in product offerings and trading mechanisms [7].