存储芯片概念

Search documents

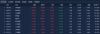

10月24日连板股分析:连板股晋级率40% 大盘成长股领涨

Xin Lang Cai Jing· 2025-10-24 08:20

转自:智通财经 【10月24日连板股分析:连板股晋级率40% 大盘成长股领涨】今日共57股涨停,连板股总数10只,其 中三连板及以上个股4只,上一交易日共10只连板股,连板股晋级率40%(不含ST股、退市股)。个股 方面,华建集团3连一字跌停,高度板大有能源开盘跳水,短线炒作情绪被压制。大盘成长股表现占 优,寒武纪、中际旭创、新易盛、胜宏科技、阳光电源等涨幅居前。板块方面,科技股多点开花,存储 芯片概念走强,盈新发展(维权)5连板,时空科技3连板,普冉股份、香农芯创20CM涨停,恒烁股 份、神工股份、江波龙涨超15%;PCB板块卷土重来,生益电子竞价涨停,公司预计三季度净利同比增 长476%至519%,科翔股份20CM涨停,广合科技、方正科技、晨丰科技、江南新村等个股涨停。 ...

沪指再创十年新高

财联社· 2025-10-24 07:19

Market Overview - The A-share market experienced a rebound, with the Shanghai Composite Index reaching a ten-year high and the ChiNext Index leading the gains [1] - The total trading volume in the Shanghai and Shenzhen markets was 1.97 trillion yuan, an increase of 330.3 billion yuan compared to the previous trading day [1][7] Sector Performance - The computing hardware sector saw significant growth, with CPO concept stocks leading the rally. Major players in the "optical module" sector also performed well, with Zhongji Xuchuang rising over 12% to reach a historical high [1] - Storage chip stocks showed strong performance, with both Shannon Chip and Purun Co., Ltd. hitting the daily limit and achieving new highs [1] - The commercial aerospace sector experienced a surge, with over ten stocks, including Aerospace Science and Technology, reaching the daily limit [1] - Conversely, coal stocks faced a collective adjustment, with Antai Group hitting the daily limit down [1][2] Index Performance - As of the market close, the Shanghai Composite Index rose by 0.71%, the Shenzhen Component Index increased by 2.02%, and the ChiNext Index surged by 3.57% [3][4]

收评:沪指放量涨0.71%续创10年新高,存储芯片、算力硬件板块集体大涨

Xin Lang Cai Jing· 2025-10-24 07:10

Market Performance - The three major A-share indices collectively rose, with the Shanghai Composite Index increasing by 0.71%, the Shenzhen Component Index by 2.02%, and the ChiNext Index by 3.57% [1] - The North Stock 50 Index also saw a rise of 1.15% [1] Trading Volume - The total trading volume in the Shanghai and Shenzhen markets reached 1.9916 trillion yuan, an increase of 330.9 billion yuan compared to the previous day [2] - Over 3,000 stocks in the market experienced gains [2] Sector Performance - The storage chip, computing hardware, commercial aerospace, military equipment, photolithography machine, and humanoid robot sectors saw significant gains [2] - Conversely, sectors such as Shenzhen state-owned enterprise reform, coal mining and processing, gas, liquor, real estate, steel, and retail experienced declines [2] Notable Stocks - The storage chip sector saw a collective surge, with stocks like Purun Co., Jiangbolong, Jucheng Co., Xiangnong Chip, and Baiwei Storage hitting new highs, while Demingli and Shennan Circuit saw multiple stocks hit the daily limit [2] - The computing hardware sector continued to strengthen in the afternoon, with Zhongji Xuchuang rising by 10% to reach a new high, and stocks like Founder Technology, Huanxu Electronics, and Guanghe Technology also performing well [2] - Other technology-related sectors, including robotics, photolithography machines, and commercial aerospace, also showed strong performance [2] Declining Stocks - Local Shenzhen stocks mostly retreated, with companies like Shenzhen Water Planning Institute, Shenzhen Properties A, and Jian Ke Institute adjusting downwards [2] - Resource stocks, including coal and gas, also faced declines, with companies like Antai Group, Yunmei Energy, Baichuan Energy, and Guo Xin Energy hitting the daily limit down [2]

沪指再创年内新高,一度至3946点,商业航天板块掀起涨停潮

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:59

板块上,存储芯片、商业航天、卫星导航等方向涨幅居前。其中,储存芯片存储芯片概念表现活跃,香 农芯创涨超17%创新高,普冉股份20cm涨停,西测测试、江波龙等跟涨。商业航天板块走高,航天环 宇、航天智装20cm涨停,达华智能、神开股份、上海港湾、中国卫星等涨停。 (声明:文章内容仅供参考,不构成投资建议。投资者据此操作,风险自担。) 0:00 10月24日,沪指突破前期高点3936.58点,一度涨至3946.16点,再创年内新高,截至10:23,报3935.37 点,涨0.33%,创业板指涨超2%,深成指涨超1%。沪深京三市上涨个股超2800只。 ...

A股午评:沪指刷新年内新高,商业航天板块强势爆发

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:57

Market Performance - The market experienced a morning surge with increased trading volume, leading to the Shanghai Composite Index reaching a new high for the year, while the ChiNext Index rose over 2% [1] - As of the morning close, the Shanghai Composite Index increased by 0.42%, the Shenzhen Component Index rose by 1.3%, and the ChiNext Index gained 2.09% [1] Sector Highlights - The storage chip sector saw significant gains, with companies like Chang'an Chip and Puran Co. both hitting new highs [1] - The commercial aerospace sector had a strong performance, with Dahua Intelligent Technology achieving two consecutive trading limit ups, and over ten commercial aerospace stocks hitting the daily limit [1] - The computing hardware sector also experienced fluctuations, with Zhongji Xuchuang reaching a new high [1] Trading Volume and Individual Stocks - The total trading volume for the Shanghai and Shenzhen markets reached 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [3] - Zhongji Xuchuang led individual stock trading with a transaction volume exceeding 13.2 billion yuan, followed by Shenghong Technology, Luxshare Precision, and Xinyi Sheng with high trading volumes [4]

近3000股上涨,商业航天股批量涨停,有新股半日涨近400%

21世纪经济报道· 2025-10-24 03:56

Market Overview - The A-share market experienced a significant upward movement on October 24, with the Shanghai Composite Index breaking previous highs, reaching 3946.16 points, a new annual high. The index closed up 0.42%, while the Shenzhen Component Index rose by 1.3% and the ChiNext Index increased by 2.09% [1][2]. Sector Performance - The storage chip sector saw substantial gains, with companies like Changsha Chip and Puran Co. achieving new highs. The commercial aerospace sector also experienced a strong surge, with multiple stocks hitting the daily limit [1][4]. - Conversely, the coal sector faced a collective decline, with companies such as Antai Group and Yunmei Energy hitting the daily limit down [3]. Commercial Aerospace Developments - The commercial aerospace sector is witnessing a boom, with several stocks, including Tongyi Aerospace and Aerospace Intelligent Equipment, experiencing significant price increases. The sector is expected to benefit from the acceleration of domestic commercial rocket launches and IPO processes for various companies [4][7]. Storage Chip Market Dynamics - The storage chip market is on an upward trajectory, driven by increased capital expenditure from major internet companies like Alibaba and ByteDance in AI infrastructure. This trend is expected to enhance the market share of domestic storage manufacturers [9]. Foreign Investment Sentiment - Foreign institutions are optimistic about the A-share market's future. Analysts from Zhongyin Securities and Galaxy Securities highlight the potential for a market rebound supported by macroeconomic policies and improved investor confidence [11][12]. - Major foreign investment firms, including Goldman Sachs and Morgan Stanley, have expressed positive outlooks for the Chinese market, predicting a slow bull market and increased allocations to Chinese equities by global investors [13][14].

A股午评 | 沪指涨0.42%刷新年内新高 存储芯片、商业航天概念走强 煤炭等板块回调

智通财经网· 2025-10-24 03:52

Core Viewpoint - The A-share market experienced a rally, with the Shanghai Composite Index reaching a new high for the year, driven by active sectors such as storage chips and commercial aerospace following the Fourth Plenary Session's announcements on technology independence and market expansion [1][3]. Group 1: Market Performance - As of the midday close, the Shanghai Composite Index rose by 0.42%, the Shenzhen Component Index increased by 1.3%, and the ChiNext Index gained 2.09% [1]. - The Fourth Plenary Session's communiqué emphasized accelerating high-level technological self-reliance and building a strong domestic market, which is expected to catalyze market performance in the coming weeks [1]. Group 2: Active Sectors - The storage chip sector showed significant activity, with companies like Xicai Testing and Yingxin Development hitting the daily limit up, driven by anticipated price increases of up to 30% for DRAM and NAND flash memory due to rising AI-driven demand [4]. - The commercial aerospace sector also surged, with stocks like Aerospace Changfeng and Aerospace Science & Technology reaching their daily limit up, spurred by the new focus on becoming a space power in the recent policy announcements [5]. Group 3: Institutional Insights - Tianfeng Securities noted that financial and cyclical sectors are currently at historical low valuations, suggesting potential for a shift towards blue-chip stocks with stable earnings as the market approaches the end of the year [6]. - Debon Securities indicated that despite short-term volatility, the increase in M1 and M2 growth rates could support a medium to long-term market uptrend, with value stocks likely to outperform in the near term [7]. - Oriental Securities expressed concerns about insufficient momentum from main funds, indicating that the market may remain in a narrow range until a breakthrough occurs [9].

A股午评:沪指涨0.42%创年内新高 存储芯片、商业航天概念股大涨

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:50

Market Overview - The Shanghai Composite Index rose by 0.42%, reaching a new high for the year, while the ChiNext Index increased by over 2% [1][2] - The total trading volume in the Shanghai and Shenzhen markets was 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [1][2] Sector Performance - The storage chip sector saw significant gains, with companies like Xiangnong Chip and Purun Co. both hitting new highs [1][2] - The commercial aerospace sector experienced a strong surge, with Dahua Intelligent achieving two consecutive trading limit increases, and over ten commercial aerospace stocks hitting the daily limit [1][2] - The computing hardware sector also saw a rebound, with Zhongji Xuchuang reaching a new high [1][2] Declining Sectors - The coal sector faced a collective decline, with companies such as Antai Group and Yunmei Energy hitting the daily limit down [1][2] - Other sectors that experienced declines included local Shenzhen stocks and gas-related stocks [1][2]

中长线资金新建仓股曝光!

Zheng Quan Shi Bao· 2025-10-24 03:26

Market Overview - Major market indices opened higher on October 24, with the Sci-Tech 50 Index rising over 3% in early trading [1] - The storage chip sector saw significant gains, with companies like Purun Co. and Aerospace Zhizhuang hitting the daily limit up, while others like Shikong Technology and Xianggang Technology also reached the limit [1] Commercial Aerospace Sector - The commercial aerospace concept experienced a surge, with Aerospace Hanyu and other companies hitting the daily limit up [2] Sector Performance - Strong sectors from the previous day, including Shenzhen state-owned enterprise reform, coal, and oil and gas extraction services, showed signs of pullback in early trading [3] New Stock Listings - N Chaoying debuted with a price increase of over 310%, opening at 70.1 yuan, focusing on the R&D, production, and sales of printed circuit boards, particularly in automotive electronics [4] - Daming Electronics began subscription with a total issuance of 40.01 million shares at a price of 12.55 yuan, focusing on automotive electronic components [4] Institutional Investment Trends - Social security funds established new positions in 17 stocks, while pension funds entered 15 new stocks during the third quarter [5] - The top new holdings by social security funds included Zhuoyi Information, with two funds appearing among the top ten shareholders [5][6] - The highest new holding by pension funds was Keta Bio, with a holding ratio of 2.71% [7][8] Margin Trading Activity - As of October 23, the total margin balance was 2.43 trillion yuan, with a decrease of 16.22 billion yuan from the previous trading day [9] - A total of 384 stocks saw net purchases exceeding 10 million yuan, with 17 stocks having net purchases over 100 million yuan, led by Shenghong Technology with 466 million yuan [9][10]

A股开盘速递 | A股震荡走高!沪指突破前期高点 存储芯片概念活跃

智通财经网· 2025-10-24 01:56

Core Viewpoint - The A-share market is experiencing a rally, with the Shanghai Composite Index reaching a new high for the year, driven by active sectors such as storage chips and positive sentiment following the Fourth Plenary Session of the Communist Party [1][2]. Market Performance - As of 9:41 AM, the Shanghai Composite Index rose by 0.41%, the Shenzhen Component Index increased by 1.07%, and the ChiNext Index gained 1.41% [1]. - The storage chip sector showed significant activity, with stocks like Xicai Testing and Yingxin Development hitting the daily limit, while others like Demingli also saw gains [1][2]. Sector Analysis - The storage chip concept is particularly vibrant, with major suppliers like Samsung and SK Hynix expected to raise DRAM and NAND flash prices by up to 30% in Q4 to meet the surging demand driven by AI [2]. - The overnight performance of U.S. storage stocks, such as SanDisk, which rose over 13% to reach a historical high, further supports this trend [2]. Institutional Insights - Tianfeng Securities suggests that financial and cyclical sectors are currently undervalued, presenting opportunities for a shift towards large-cap blue chips as the market approaches the end of the year [4]. - Debon Securities indicates that despite short-term volatility, the increase in "liquid money" could support a medium to long-term market uptrend, with value stocks likely to continue outperforming [5][6]. - Dongfang Securities notes that market sentiment is cautious due to external trade tensions, and while some funds are shifting towards speculative plays, the overall market is likely to remain in a state of fluctuation [7].