煤炭开采加工

Search documents

10天9板、月涨138%!大有能源发布风险提示公告

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 23:09

多地出现断崖式降温,二级市场再次将目光投向煤炭板块。 10月23日,煤炭板块异动,成为当日A股市场涨幅最突出的行业,其中山西焦化、云煤能源等多只个股 涨停。 不过,与以上公司不同,大有能源股价早已走出独立上涨行情,在10月走出了10天9板的暴涨行情,其 月度涨幅亦增加至138.18%,涨幅远超其他同业公司。 追根溯源,大有能源的异动始于9月下旬的一份重组公告。根据公告,河南省委、省政府决定,对公司 间接控股股东河南能源集团,与中国平煤神马控股集团有限公司(下称"平煤神马集团")实施战略重 组。 此后,公司股价经过短暂异动后开始连续涨停,直至23日煤炭板块集体"补涨",大有能源引发了市场更 多的关注。 对于股价异常波动,公司也于22日晚间发布产销经营数据、风险提示公告为二级市场降温。 2021年4月,河南能源集团将持有的阿拉尔豫能投资有限责任公司100%股权转让给大有能源,将优质煤 炭资产榆树岭煤矿、榆树泉煤矿注入大有能源,在一定程度上减少了二者间的同业竞争。 2022年5月,河南能源集团的同业竞争承诺到期。 "由于所属煤矿数量多、分布广,加之资产重组对标的资产质量要求高,规范整改所需时间较长,整合 方式仍需持 ...

河南大有能源股份有限公司股票交易风险提示公告

Shang Hai Zheng Quan Bao· 2025-10-23 19:06

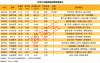

Core Viewpoint - The company has disclosed a strategic restructuring involving its controlling shareholder, which is not expected to significantly impact its operations. However, there are concerns regarding the stock price surge and valuation risks due to recent performance declines [2][5][6]. Group 1: Production and Operations - The company is currently operating normally, with no significant changes in market conditions or industry policies [4]. Group 2: Major Events - On September 26, 2025, the company announced a strategic restructuring involving its indirect controlling shareholder, Henan Energy Group Co., Ltd., and China Pingmei Shenma Group Co., Ltd. This restructuring is not expected to affect the company's operational activities significantly [2][5]. Group 3: Risk Alerts - The company's stock price increased by 146.68% from October 10 to October 23, 2025, while the Shanghai Composite Index decreased by 0.29%, indicating a potential irrational speculation risk [6][7]. - The company's latest price-to-book ratio is 4.77, significantly higher than the coal mining and processing industry average of 1.74, suggesting a valuation risk [3][7]. - For the first half of 2025, the company reported a revenue of 1.92 billion, a decrease of 680 million compared to the same period last year, and a net loss of 851 million, indicating a disconnect between stock price and fundamental performance [3][7].

仅4股获北向资金净买入

Zheng Quan Shi Bao· 2025-10-23 14:19

Market Overview - On October 23, A-shares saw all three major indices rise, with the Shanghai Composite Index and Shenzhen Component Index both increasing by 0.22%, and the ChiNext Index rising by 0.09% [1] - The total trading volume for the day was 1.66 trillion yuan, a decrease of over 29 billion yuan compared to the previous trading day [1] - Nearly 3,000 stocks closed higher, with 72 stocks hitting the daily limit up [1] Sector Performance - The Shenzhen state-owned enterprise reform concept led the market, with stocks like JianKexueYuan, GuangTian Group, and TeFa Information hitting the daily limit up [1] - Other sectors that saw gains included coal mining and processing, energy metals, and film and television lines [1] - Conversely, sectors such as cultivated diamonds, engineering machinery, and non-metallic materials experienced significant declines [1] Historical Highs - A total of 16 stocks reached their historical closing highs, with notable concentrations in the non-ferrous metals and machinery equipment sectors, which had 5 and 3 stocks respectively [2] - The average price increase for stocks that hit historical highs was 5.23%, with stocks like Dongfang Tantalum and Fashilong reaching their daily limit up [2] Institutional Trading - In the Dragon and Tiger List, 11 stocks had net purchases, while 16 stocks had net sales [4] - The top net purchase was by Beifang Co., with an amount of 101 million yuan, followed by Xingfu Lanhai and Yunhan Xincheng, both exceeding 31 million yuan [4] - On the selling side, Beifang Changlong saw the highest net sell at 132 million yuan, followed by Huanghe Xuanfeng and Lanfeng Biochemical [4] Company Announcements - Shuangliang Energy reported a net loss of 544 million yuan for the first three quarters, marking a year-on-year decline [7] - Huawu Co. announced a significant increase in net profit by 4202% in the third quarter, with a noticeable recovery in the gross profit margin of wind power brake products [7] - Hush Silicon Industry plans to reduce its stake by no more than 2% [7] - HaiLanXin reported a net profit increase of 290.58% year-on-year for the first three quarters [7] - NewMeiXing reported a net profit increase of 191.95% year-on-year for the first three quarters [7]

200亿煤炭妖股10天9板,半年巨亏8个亿

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 13:29

记者丨董鹏 多地出现断崖式降温,二级市场再次将目光投向煤炭板块。 10月23日,煤炭板块异动,成为当日A股市场涨幅最突出的行业,其中山西焦化、云煤能源等多只个股 涨停。 不过,与以上公司不同,大有能源股价早已走出独立上涨行情,在10月走出了10天9板的暴涨行情,其 月度涨幅亦增加至138.18%,涨幅远超其他同业公司。 此后,公司股价经过短暂异动后开始连续涨停,直至23日煤炭板块集体"补涨",大有能源才引发了市场 更多的关注。 对于股价异常波动,公司也于22日晚间发布产销经营数据、风险提示公告为二级市场降温。 其中,在上半年亏损8.51亿元的基础上,公司三季度煤炭销售业务依旧处于亏损,整体经营压力依旧突 出。 追根溯源,大有能源的异动始于9月下旬的一份重组公告。根据公告,河南省委、省政府决定,对公司 间接控股股东河南能源集团,与中国平煤神马控股集团有限公司(下称"平煤神马集团")实施战略重 组。 2022年5月,河南能源集团的同业竞争承诺到期。 "由于所属煤矿数量多、分布广,加之资产重组对标的资产质量要求高,规范整改所需时间较长,整合 方式仍需持续深入论证,其他历史遗留问题尚需进一步解决等原因,仍然无法在承诺 ...

200亿煤炭妖股10天9板,半年巨亏8个亿

21世纪经济报道· 2025-10-23 13:26

Core Viewpoint - The coal sector has gained significant attention in the secondary market due to a sharp drop in temperatures, with companies like Dayou Energy experiencing a remarkable stock surge, driven by a strategic restructuring announcement [1][2][3]. Group 1: Market Performance - On October 23, the coal sector was the best-performing industry in the A-share market, with stocks like Shanxi Coking Coal and Yunmei Energy hitting the daily limit [1]. - Dayou Energy's stock price has seen an independent surge, achieving a monthly increase of 138.18% and a 116% rise from early October to October 22, significantly outperforming its peers [1][9]. - Other comparable companies in the coal sector, such as Baotailong and Pingmei Shenma Group, reported much lower increases of 33.33% and 8.63%, respectively, during the same period [9]. Group 2: Company Background and Restructuring - The unusual activity in Dayou Energy's stock began with a restructuring announcement in late September, involving its indirect controlling shareholder, Henan Energy Group, and Pingmei Shenma Group [2][7]. - Henan Energy Group has been working to resolve competition issues with Dayou Energy since 2019, but challenges remain in fully addressing these concerns [5][6]. - The recent strategic restructuring decision by the provincial government has increased expectations for asset injections into Dayou Energy, which could enhance its operational capabilities [7]. Group 3: Financial Performance - Despite the stock price surge, Dayou Energy reported a loss of 8.51 billion yuan in the first half of the year, with continued losses in the third quarter [3][11]. - The company's revenue for the third quarter was 10.54 billion yuan, a decrease of 7.13% year-on-year, while operating costs rose by 9.25% [11][12]. - The company's gross profit margin turned negative in the third quarter, indicating ongoing financial struggles despite the stock price rally [12]. Group 4: Valuation Concerns - Dayou Energy's current price-to-book ratio stands at 4.34, significantly higher than the coal mining industry's average of 1.74, suggesting that the stock price has diverged from the company's fundamentals [3][14]. - The stock price has approached levels not seen since the 2015 bull market, raising concerns about sustainability [14]. Group 5: Market Risks - The surge in Dayou Energy's stock has attracted significant leveraged buying, with financing purchases increasing dramatically since late September [16]. - If market sentiment shifts, there is a risk of a sharp decline in Dayou Energy's stock price, particularly for recent investors [16].

市场尾盘回升,A500ETF易方达(159361)、沪深300ETF易方达(510310)等产品助力布局核心资产

Sou Hu Cai Jing· 2025-10-23 10:54

Group 1 - The A-share market saw a collective surge in the three major indices, with nearly 3,000 stocks rising, particularly in sectors such as coal mining, energy metals, film and television, and quantum technology [1] - The CSI A500 index and the CSI 300 index both increased by 0.3%, while the ChiNext index rose by 0.1%, and the STAR Market 50 index fell by 0.3% [1][3] - The Hang Seng Index rebounded in the afternoon, with large internet stocks leading the gains, and the Hang Seng China Enterprises Index rose by 0.8% [1][5] Group 2 - The CSI 300 index consists of 300 stocks from the Shanghai and Shenzhen markets, covering 11 primary industries, with a rolling P/E ratio of 14.4 times [3] - The CSI A500 index is made up of 500 securities with larger market capitalization and liquidity, covering 91 out of 93 tertiary industries, with a rolling P/E ratio of 16.9 times [3] - The Hang Seng China Enterprises Index tracks 50 large-cap, actively traded stocks listed in Hong Kong, with nearly 85% of its composition from consumer discretionary, information technology, financials, and energy sectors [5]

揭秘涨停丨超导和煤炭板块多股涨停

Zheng Quan Shi Bao Wang· 2025-10-23 10:52

Group 1: Stock Performance - On October 23, 2023, 24 stocks had closing limit orders exceeding 100 million yuan, with top three being Yingxin Development, Zhujiang Piano, and Guangtian Group, with order volumes of 1.96 million, 1.08 million, and 630,800 shares respectively [2] - Zhujiang Piano's limit order amount reached 668 million yuan, while Yingxin Development and other stocks also had significant limit order amounts above 200 million yuan [2] Group 2: Company Strategies - Zhujiang Piano is focusing on a strategic plan termed "one insistence, three transformations," aiming to operate existing cultural tourism projects while actively expanding into new business areas [3] - The company successfully acquired the operational rights for the Bai Shui Zhai Scenic Area, planning to develop a core space layout that includes Bai Shui Xian Waterfall Scenic Area, Shima Long Music Town, and Pai Tan Sports Park [3] Group 3: Industry Trends - In the superconducting sector, stocks like Guolan Testing and Dongfang Tantalum experienced limit increases, with Guolan Testing focusing on inspection services for high-end cables used in nuclear power and fusion applications [4] - The coal mining and processing sector saw stocks such as Shanxi Coking Coal and Yunmei Energy also hitting limit increases, with Yunmei Energy's 2024 capacity utilization projected at 94.51% for its 2 million ton coking project [5] Group 4: Market Activity - Four stocks on the Dragon and Tiger list had net purchases exceeding 50 million yuan, with Keda Guokuan leading at 139 million yuan [7] - Institutional participation was notable in stocks like Happy Blue Sea and Yunhan Chip City, with net purchases of 74.15 million yuan and 56.01 million yuan respectively [7]

揭秘涨停 | 超导和煤炭板块多股涨停

Zheng Quan Shi Bao· 2025-10-23 10:34

Core Insights - The stock market saw significant activity on October 23, with 24 stocks having closing limit orders exceeding 1 billion yuan, indicating strong investor interest [1][3]. Group 1: Stock Performance - The top three stocks by closing limit order volume were Yingxin Development, Zhujiang Piano, and Guangtian Group, with limit order volumes of 1.96 million, 1.08 million, and 0.63 million shares respectively [2]. - Zhujiang Piano's limit order amount reached 668 million yuan, while Yingxin Development and Shikang Machinery also showed strong performance with limit orders exceeding 470 million yuan and 356 million yuan respectively [3][4]. Group 2: Company Strategies - Zhujiang Piano is a comprehensive enterprise focusing on pianos, musical instruments, and cultural tourism, and it plans to expand into new business areas while enhancing existing projects [3]. - The company successfully acquired the operational rights to the Bai Shui Zhai scenic area, aiming to develop a cultural and tourism hub [3]. Group 3: Sector Highlights - The superconducting concept stocks, including Guolan Testing and Dongfang Tantalum, saw notable gains, with Guolan Testing focusing on high-end cable technology for nuclear and superconducting applications [5]. - In the coal mining sector, companies like Shanxi Coking Coal and Yunnan Coal Energy reported strong performances, with Yunnan Coal Energy's project achieving a 94.51% capacity utilization rate [6][7]. Group 4: Emerging Trends - The short drama gaming sector is gaining traction, with companies like Haikan Co. and Huanrui Century actively engaging in interactive entertainment projects [9]. - The stock market also witnessed significant net purchases from institutional investors in companies like Huanrui Century and Yunhan Chip City, indicating strong institutional interest [11].

10天9板、月涨138%!千万融资资金缘何爆炒大有能源?

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 10:01

Core Viewpoint - The coal sector has gained significant attention in the secondary market due to a sharp drop in temperatures, with companies like Dayou Energy experiencing substantial stock price increases, despite ongoing operational losses [1][3][19]. Group 1: Market Performance - On October 23, the coal sector was the best-performing industry in the A-share market, with stocks like Shanxi Coking Coal and Yunnan Coal Energy hitting the daily limit [1]. - Dayou Energy's stock price has surged independently, achieving a 138.18% increase in October, with a remarkable 10 out of 10 trading days showing price increases [1][16]. - From October 1 to October 22, Dayou Energy's stock rose by 116%, significantly outperforming its peers, with the second-best performer, Baotailong, only increasing by 33.33% [17]. Group 2: Company Background and Restructuring - Dayou Energy's stock movement began following a strategic restructuring announcement involving its indirect controlling shareholder, Henan Energy Group, and China Pingmei Shenma Group [3][12]. - The restructuring aims to resolve the competition between Henan Energy Group and Dayou Energy in the coal business, which has been an ongoing issue since 2019 [8][9]. - Despite previous commitments to resolve this competition, Henan Energy Group has struggled to fulfill these promises, leading to increased speculation about asset injections into Dayou Energy [10][24]. Group 3: Financial Performance - In the first half of the year, Dayou Energy reported a revenue of 1.92 billion yuan, a 26.14% year-on-year decline, and a net loss of 851 million yuan, a 73.81% decrease compared to the previous year [19]. - For the third quarter, coal sales revenue was 1.054 billion yuan, down 7.13% year-on-year, while operating costs rose by 9.25% to approximately 1.09 billion yuan [20][22]. - The company's coal sales gross profit turned from a profit of 138 million yuan in the previous year to a loss of 36 million yuan in the third quarter [22]. Group 4: Valuation Concerns - Dayou Energy's current price-to-book ratio stands at 4.34, significantly higher than the coal mining industry's average of 1.74, indicating a disconnection between stock price and fundamental performance [5][24]. - The stock price has approached levels not seen since the 2015 bull market, raising concerns about sustainability given the company's ongoing losses [24]. Group 5: Market Sentiment and Risks - The recent surge in Dayou Energy's stock has been accompanied by a notable increase in margin trading, with daily buy amounts rising sharply post-September 26 [25][26]. - As the market sentiment shifts, there is a potential risk of a rapid decline in stock prices, particularly for investors who have recently entered the market [28].

八连板大有能源:股价短期涨幅过大 需注意交易风险

Xin Lang Cai Jing· 2025-10-23 08:52

Core Points - The company's stock price increased by 146.68% from October 10 to October 23, 2025, while the Shanghai Composite Index decreased by 0.29% during the same period [1] - The coal mining and processing industry index rose by 14.98% in the same timeframe, indicating a significant deviation in the company's stock performance compared to both the broader market and its industry [1] - The company warns investors about potential irrational speculation risks due to the substantial short-term price increase [1]