照明工程

Search documents

翻倍牛股,重大资产重组预案出炉!今起复牌

Zhong Guo Zheng Quan Bao· 2025-10-22 23:09

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% of Jiahe Jingwei through a combination of share issuance and cash payment, marking a significant asset restructuring and related party transaction [1][2]. Group 1: Acquisition Details - The acquisition involves 19 parties, including major shareholders, with a share issuance price set at 23.08 yuan per share, which is 80% of the average trading price over the last 20 trading days [2]. - The total amount of funds raised through the share issuance will not exceed 100% of the asset purchase price, with the number of shares issued capped at 30% of the company's total share capital prior to the issuance [4]. Group 2: Fund Utilization - The raised funds will be used for cash payment for the transaction, intermediary fees, taxes, and to supplement working capital for both the listed company and the target company, as well as to repay debts and invest in project construction [4]. - The proportion of funds used for working capital and debt repayment will not exceed 25% of the transaction price or 50% of the total raised funds [4]. Group 3: Business Expansion - Jiahe Jingwei specializes in the research, design, production, and sales of storage products, including memory bars and solid-state drives, with three major product lines [4]. - Following the acquisition, Shikong Technology aims to enter the storage sector, creating a second growth curve and enhancing its profitability and sustainable earnings capacity [4]. Group 4: Financial Performance - In the first half of 2025, Shikong Technology reported revenues of approximately 144 million yuan, a year-on-year decrease of 10.95%, while the net profit attributable to shareholders was approximately -66.27 million yuan, indicating a reduction in losses [6]. - The company's revenue from nighttime economy business remained stable at 87.19 million yuan, while the smart city business revenue decreased by 23.32% to 56.21 million yuan due to reduced demand in the multi-story parking industry [6].

605178 重大资产重组!周四复牌

Shang Hai Zheng Quan Bao· 2025-10-22 15:17

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% equity of Shenzhen Jiahe Jingwei Technology Co., Ltd. to enter the storage sector and create a second growth curve, enhancing its profitability and transforming its production capabilities [1][5]. Group 1: Acquisition Details - The acquisition will be executed through issuing shares and cash payments to 19 parties, with a share price set at 23.08 yuan per share [2]. - The company aims to raise funds not exceeding 100% of the asset purchase price, with a maximum issuance of 30% of the total share capital prior to the issuance [2]. - The raised funds will be allocated for cash payments, intermediary fees, taxes, and to support working capital and debt repayment [2]. Group 2: Target Company Overview - Jiahe Jingwei specializes in the R&D, design, production, and sales of storage products, including memory bars and solid-state drives, with three main product lines [3]. - The company has shown consistent revenue growth, with projected revenues of 854 million yuan in 2023, 1.344 billion yuan in 2024, and 1.123 billion yuan for the first eight months of 2025 [3]. Group 3: Financial Performance - Jiahe Jingwei's financials indicate total assets of approximately 1.299 billion yuan and total liabilities of about 693.5 million yuan as of August 31, 2025 [4]. - The net profit for 2024 is projected at 42.71 million yuan, with a net profit of 42.29 million yuan reported for the first eight months of 2025 [3][4]. Group 4: Strategic Implications - The acquisition is expected to enhance the company's asset quality and risk resilience, facilitating its transition and growth in the information technology sector [5]. - The controlling shareholder, Gong Lanhai, has committed to a 36-month lock-up period for both newly issued and existing shares [6].

翻倍牛股,重大资产重组预案出炉!明起复牌

Zhong Guo Zheng Quan Bao· 2025-10-22 15:05

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% of Jiahe Jingwei through a share issuance and cash payment, marking a significant asset restructuring and related party transaction [1][2]. Group 1: Acquisition Details - The acquisition involves 19 parties, including major shareholders, with a share issuance price set at 23.08 yuan per share, which is 80% of the average trading price over the last 20 trading days [2]. - The total amount of funds raised through the share issuance will not exceed 100% of the asset purchase price, with the number of shares issued capped at 30% of the company's total shares prior to the issuance [2]. Group 2: Fund Utilization - The raised funds will be used for cash payments related to the transaction, intermediary fees, taxes, and to supplement working capital for both the company and the target company, as well as to repay debts and invest in project construction [3]. - The proportion of funds used for working capital and debt repayment will not exceed 25% of the transaction price or 50% of the total raised funds [3]. Group 3: Business Expansion - Jiahe Jingwei specializes in the research, design, production, and sales of storage products such as memory bars and solid-state drives, with three major product lines [3]. - Following the acquisition, Shikong Technology aims to enter the storage sector, creating a second growth curve and enhancing its profitability and sustainable earnings capacity [3]. Group 4: Financial Performance - In the first half of 2025, Shikong Technology reported revenues of approximately 144 million yuan, a year-on-year decrease of 10.95%, with a net profit attributable to shareholders of approximately -66.27 million yuan, indicating a reduction in losses compared to the previous year [4][5]. - The company's revenue from nighttime economy business was 87.19 million yuan, while the smart city business revenue was 56.21 million yuan, down 23.32% year-on-year, primarily due to reduced demand in the multi-story parking industry [4].

豪尔赛股价涨5.34%,诺安基金旗下1只基金位居十大流通股东,持有83.59万股浮盈赚取71.05万元

Xin Lang Cai Jing· 2025-10-21 03:48

Group 1 - The core viewpoint of the news is that Haosai Technology Group Co., Ltd. has seen a stock price increase of 5.34%, reaching 16.78 yuan per share, with a total market capitalization of 2.523 billion yuan [1] - The company was established on June 7, 2000, and went public on October 28, 2019, primarily engaged in lighting engineering construction, design, research and development, and sales of lighting products [1] - The revenue composition of the company shows that lighting engineering construction accounts for 96.93%, other income is 2.65%, and lighting engineering design contributes 0.42% [1] Group 2 - Among the top ten circulating shareholders of Haosai, the Noan Multi-Strategy Mixed A Fund (320016) has entered the list in the second quarter, holding 835,900 shares, which is 0.68% of the circulating shares [2] - The Noan Multi-Strategy Mixed A Fund has achieved a year-to-date return of 63.06%, ranking 289 out of 8162 in its category, and a one-year return of 83.07%, ranking 80 out of 8024 [2] - The fund manager, Kong Xianzheng, has a tenure of 4 years and 330 days, with the fund's total asset size at 4.607 billion yuan and a best return of 74.29% during his tenure [3]

时空科技跨界存储谋转型,连续亏损暗藏经营隐忧

Xin Lang Zheng Quan· 2025-10-16 03:40

Core Viewpoint - The company, Shikong Technology, is making a significant shift from its core lighting engineering business to the semiconductor storage sector, which is seen as a critical move to escape its ongoing operational difficulties [1][12]. Group 1: Business Challenges - Shikong Technology has faced severe challenges in the lighting engineering sector due to shrinking industry demand and intensified competition, leading to consecutive years of losses [2][3]. - The company's previous attempts to pivot towards smart city initiatives, such as smart parking and smart streetlights, have not yielded the expected improvements in business performance [3][4]. Group 2: Financial Issues - The company has been experiencing financial vulnerabilities, including a high level of accounts receivable and extended collection periods, which exert pressure on cash flow [5][6]. - There have been unusual spikes in revenue during the fourth quarter, raising concerns from regulatory bodies [7]. Group 3: Strategic Moves - Recently, Shikong Technology has planned a series of significant actions in the capital market, including a proposed acquisition of Shenzhen Jiahe Jingwei Electronics Technology Co., Ltd., to enter the semiconductor storage field [8][10]. - Prior to the announcement of this major restructuring, the company's stock price exhibited unusual movements, indicating a potential "early reaction" to the news [11]. Group 4: Risks of Transformation - Each transformation attempt has been accompanied by challenges such as goodwill impairment and integration difficulties, making the current move into semiconductor storage appear as a high-stakes gamble for the company [12].

青海苏泰照明工程有限公司成立 注册资本20万人民币

Sou Hu Cai Jing· 2025-10-15 10:22

Core Viewpoint - Recently, the establishment of Qinghai Sutai Lighting Engineering Co., Ltd. has been registered, indicating a potential growth in the renewable energy and lighting sectors in China [1] Company Summary - Qinghai Sutai Lighting Engineering Co., Ltd. has a registered capital of 200,000 RMB [1] - The legal representative of the company is Xu Qiangqiang [1] Industry Summary - The company operates in various sectors including power generation technology services, solar power technology services, and sales of lighting fixtures [1] - The business scope includes manufacturing and sales of photovoltaic equipment and components, as well as advertising services [1] - Additional activities include landscape greening engineering construction and sales of solar thermal power products [1]

连续四年亏损,控制权变更无果,这家照明龙头要跨界芯片

IPO日报· 2025-10-15 00:55

Core Viewpoint - Beijing New Time Space Technology Co., Ltd. (referred to as "Time Space Technology") is attempting a strategic transformation by acquiring a controlling stake in Shenzhen Jiahe Jingwei Electronics Technology Co., Ltd. (referred to as "Jiahe Jingwei"), despite facing four consecutive years of losses totaling nearly 700 million yuan [1][5][6]. Group 1: Company Background - Time Space Technology, established in 2004, has focused on smart lighting engineering and has developed two main business systems centered around "night economy" and "smart city" [4]. - The company has experienced significant financial difficulties, with net losses of 18 million yuan, 209 million yuan, 207 million yuan, and 262 million yuan from 2021 to 2024, totaling approximately 696 million yuan [5]. Group 2: Acquisition Details - The acquisition plan involves issuing shares and cash payments, with the transaction price based on an assessment report from a valuation agency. The actual controller will remain unchanged, indicating a focus on business transformation rather than a change in control [7]. - Jiahe Jingwei, founded in 2012, specializes in storage chip products used in various technology sectors, including mobile devices and data centers. The company has made significant advancements, such as producing China's first memory bar and launching DDR5 memory modules [9][10]. Group 3: Industry Context - The semiconductor storage industry is experiencing a surge due to global shifts and the rise of AI technology, positioning storage chips at a strategic height [11]. - Historically dominated by international giants like Samsung and Micron, the Chinese storage industry is now witnessing breakthroughs led by domestic manufacturers like Jiahe Jingwei, filling critical gaps in the supply chain [12].

连续四年亏损,控制权变更无果,这家照明龙头要跨界芯片

Guo Ji Jin Rong Bao· 2025-10-14 11:53

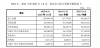

Company Overview - Beijing New Time Space Technology Co., Ltd. (referred to as "Time Space Technology") has been focusing on smart lighting engineering and has accumulated losses of nearly 700 million yuan over the past four years [1][4] - The company has established two main business systems centered around "night economy" and "smart city," covering various fields such as landscape lighting and smart parking operations [3] Financial Performance - Time Space Technology has reported continuous losses from 2021 to 2024, with net losses of -0.18 billion, -2.09 billion, -2.07 billion, and -2.62 billion yuan respectively, totaling approximately -6.96 billion yuan [4] - In the first half of 2025, the company incurred an additional loss of 66.27 million yuan, and as of June 2025, accounts receivable exceeded 400 million yuan [4] Acquisition Strategy - The company plans to acquire a controlling stake in Shenzhen Jiahe Jingwei Electronics Technology Co., Ltd. (referred to as "Jiahe Jingwei") through a combination of issuing shares and cash payments, marking a strategic shift towards the semiconductor storage sector [1][4] - The acquisition is seen as a critical move for Time Space Technology to seek a "second growth curve" after previous attempts to change control were unsuccessful [4] Target Company Profile - Jiahe Jingwei, established in 2012, specializes in storage chip products used in various technology sectors, including mobile devices and data centers [5] - The company has made significant advancements, such as producing China's first memory bar and being a pioneer in DDR5 memory module production [5] Industry Context - The global semiconductor industry is undergoing significant changes, driven by the rise of AI technology, which is elevating the strategic importance of storage chips [6] - The Chinese storage industry is experiencing a breakthrough period, with domestic manufacturers like Jiahe Jingwei filling critical gaps in the supply chain [6]

豪尔赛股价涨5.08%,诺安基金旗下1只基金位居十大流通股东,持有83.59万股浮盈赚取60.18万元

Xin Lang Cai Jing· 2025-10-14 06:00

Group 1 - The core viewpoint of the news is that Haosai Technology Group has experienced a significant stock price increase, with a 5.08% rise on October 14, reaching 14.90 yuan per share, and a cumulative increase of 10.35% over the past five days [1] - Haosai's main business involves lighting engineering construction, with 96.93% of its revenue coming from this segment, while other income sources contribute 2.65% and lighting engineering design accounts for 0.42% [1] - The total market capitalization of Haosai is reported to be 2.24 billion yuan, with a trading volume of 96.93 million yuan and a turnover rate of 5.82% [1] Group 2 - Noan Fund's Noan Multi-Strategy Mixed A (320016) has entered the top ten circulating shareholders of Haosai, holding 835,900 shares, which is 0.68% of the circulating shares [2] - The fund has generated a floating profit of approximately 601,800 yuan today and a total of 1,111,700 yuan during the five-day price increase [2] - The fund has achieved a year-to-date return of 61.61%, ranking 452 out of 8,162 in its category, and a one-year return of 91.23%, ranking 143 out of 8,015 [2] Group 3 - The fund managers of Noan Multi-Strategy Mixed A are Kong Xianzheng and Wang Haichang, with Kong having a tenure of 4 years and 323 days and a best fund return of 76.38% during his management [3] - Wang has a tenure of 3 years and 85 days, with a best fund return of 63.97% during his management [3]

605178,重大资产重组!跨界收购存储芯片企业

中国基金报· 2025-10-10 00:48

Core Viewpoint - The article discusses the significant asset restructuring plan of Shikong Technology, which aims to acquire a controlling stake in Shenzhen Jiahe Jingwei Electronics Technology Co., Ltd. through a combination of share issuance and cash payment, while not changing the actual controller of the company [5][7]. Group 1: Company Overview - Shikong Technology's main business includes lighting engineering system integration, cultural tourism night tour innovation development, and smart city projects, covering areas such as landscape lighting, cultural tourism night tours, smart streetlights, and smart parking operations [7]. - In the first half of 2025, Shikong Technology reported revenue of 144 million yuan, a decrease of 10.95% year-on-year, and a net loss attributable to shareholders of 66.27 million yuan [7]. Group 2: Financial Challenges - The company faces increasing competition in the landscape lighting industry, leading to compressed profit margins [7]. - As of June 30, 2025, Shikong Technology's accounts receivable exceeded 400 million yuan, indicating worsening issues with overdue payments [7]. Group 3: Recent Developments - On July 25, 2025, Shikong Technology announced that its controlling shareholder was planning a significant matter that could lead to a change in control, but this was later terminated due to failure to reach agreement on key terms [7]. - The current acquisition target, Jiahe Jingwei, established in 2012, focuses on storage products and related applications, providing various types of storage solutions for multiple technology sectors [8]. Group 4: Acquisition Details - The acquisition is still in the planning stage, with the initial identified counterparties holding a combined 50.19% stake in Jiahe Jingwei [8][9]. - Shikong Technology has signed a letter of intent for acquisition, intending to purchase the controlling stake through share issuance and cash payment, with the final price determined by an evaluation report from a qualified assessment agency [9]. Group 5: Market Performance - Prior to the suspension of trading, Shikong Technology's stock price hit the daily limit, closing at 35.83 yuan per share, which corresponds to a total market capitalization of 3.55 billion yuan [9].