半导体存储器

Search documents

万润科技:公司重点打造以LED和半导体存储器为主的新一代信息技术业务

Zheng Quan Ri Bao· 2026-02-05 09:13

Group 1 - The company is focusing on developing a new generation of information technology business primarily centered around LED and semiconductor memory, aiming to expand revenue scale and increase the proportion of income and profitability from these sectors [2] - The existing advertising media business will be maintained under a principle of stabilizing existing operations and controlling risks, while undergoing transformation and efficiency enhancement [2]

万润科技:公司密切关注半导体存储器行业的发展趋势

Zheng Quan Ri Bao Wang· 2026-01-12 12:40

Group 1 - The company is closely monitoring the development trends in the semiconductor memory industry [1] - The company is conducting procurement and sales activities based on market dynamics and the actual situation of upstream and downstream partners [1] - The aim is to expand the scale of the memory business and enhance profitability [1]

万润科技:公司积极努力构建以LED、半导体存储器为主业的新一代信息技术业务

Zheng Quan Ri Bao Wang· 2025-12-17 12:43

Core Viewpoint - Wanrun Technology (002654) is focusing on building a new generation of information technology business primarily centered around LED and semiconductor memory, aiming to enhance market share and expand business scale [1] Group 1 - The company is actively cultivating and developing valuable customers, including large clients, brand clients, and direct sales clients [1] - The information regarding partnerships is considered a commercial secret by the company [1] - The company aims to increase the proportion of its main business through these efforts [1]

中国存储,全球第二

半导体芯闻· 2025-12-12 10:24

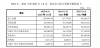

如果您希望可以时常见面,欢迎标星收藏哦~ 在本文中,我们将探讨中国半导体存储器市场和中国半导体制造商的分析结果。 首先,我们将考察中国的半导体存储器市场。就2024年DRAM市场和NAND闪存市场的区域份额 (基于总部所在地)而言,预计中国将位居第二(美洲在这两个市场中均将位居第一)。 Yole Group 还分析了主要 DRAM 和 NAND 闪存供应商在中国市场的销售额占比(2024 年)。 三星电子、SK 海力士和美光科技在三大 DRAM 公司中,中国市场的销售额占比最高,其次是 SK 海力士,最后是美光。即使是占比最高的三星,其在中国市场的销售额也仅占 30% 左右,并 不算高。与此同时,中国DRAM公司将其所有 DRAM 产品都销往中国。 有趣的是,这六大公司合计占据了约25%的NAND闪存市场份额。中国闪存公司也将其所有NAND 闪存产品都销往中国。 Yole Group 估计,中国将占 DRAM 市场 26% 的份额(价值 250 亿美元),以及 NAND 闪存市 场 33% 的份额(价值 220 亿美元)。其中,NAND 闪存的份额最大。 如果简单地将DRAM和NAND闪存的总价值加起来,全球 ...

佰维存储回购加码上限提至1.5亿 投资联芸科技浮盈1.28亿拟择机减持

Chang Jiang Shang Bao· 2025-12-02 23:44

Core Viewpoint - The company Bawei Storage (688525.SH) plans to reduce its stake in the affiliated company Lianyun Technology (688449.SH) to enhance asset liquidity and efficiency while also increasing its share buyback plan significantly [1][2][4]. Group 1: Stake Reduction in Lianyun Technology - Bawei Storage announced its intention to sell part or all of its shares in Lianyun Technology, which will be tradable starting December 1, 2025, with a maximum sale of 1% of the total share capital [2]. - The company holds 374.47 million shares of Lianyun Technology, representing 0.81% of its total shares, with a strategic placement price of 11.25 yuan per share [1][3]. - The current market value of Bawei Storage's stake in Lianyun Technology is approximately 1.7 billion yuan, resulting in a book profit of about 1.28 billion yuan [3]. Group 2: Share Buyback Plan - Bawei Storage has revised its share buyback plan, increasing the total amount from a range of 20 million to 40 million yuan to a new range of 80 million to 150 million yuan [4]. - The maximum buyback price has been adjusted from 97.9 yuan per share to 182.07 yuan per share, reflecting a significant increase in investor confidence [4][5]. - As of November 30, 2025, the company has repurchased 41,123 shares at an average price of 97.24 yuan per share, totaling approximately 39.99 million yuan [5]. Group 3: Financial Performance - Bawei Storage reported a record high in revenue and net profit for the third quarter of 2025, achieving 26.63 billion yuan in revenue, a year-on-year increase of 68.06%, and a net profit of 2.56 billion yuan, up 563.77% year-on-year [6]. - The company has experienced fluctuations in profitability, with a loss of 6.24 billion yuan in 2023, followed by a recovery in 2024 with a revenue of 66.95 billion yuan, marking an 86.46% increase [5][6]. - The company indicated that its operational performance continues to improve into the fourth quarter of 2025 [7].

大为股份跌2.03%,成交额7.67亿元,主力资金净流出4991.77万元

Xin Lang Zheng Quan· 2025-11-27 05:19

Core Viewpoint - Dawi Co., Ltd. has experienced significant stock price fluctuations, with a year-to-date increase of 99.72% but a recent decline of 26.15% over the past five trading days [1] Financial Performance - For the period from January to September 2025, Dawi Co., Ltd. achieved a revenue of 879 million yuan, representing a year-on-year growth of 9.90% [2] - The company reported a net profit attributable to shareholders of -7.5262 million yuan, which is a year-on-year increase of 71.58% [2] Stock Market Activity - As of November 27, Dawi Co., Ltd.'s stock price was 27.06 yuan per share, with a market capitalization of 6.425 billion yuan [1] - The stock has been on the "龙虎榜" (a trading board for stocks with significant trading activity) 27 times this year, with the most recent appearance on November 20, where it recorded a net buy of -74.1382 million yuan [1] Shareholder Information - As of September 30, the number of shareholders for Dawi Co., Ltd. was 51,900, a decrease of 19.26% from the previous period [2] - The average circulating shares per shareholder increased by 24.10% to 3,979 shares [2] Business Overview - Dawi Co., Ltd. operates primarily in the new generation information technology and automotive manufacturing sectors, with semiconductor memory accounting for 92.16% of its main business revenue [2] - The company is categorized under the electronic-semiconductor-digital chip design industry and is involved in various concept sectors including lithium batteries and data centers [2]

3D NAND,如何演进?

3 6 Ke· 2025-11-10 01:37

Core Insights - The introduction of NAND flash memory has fundamentally transformed data storage and retrieval since the late 1980s, with applications spanning from smartphones to data centers [1] - The semiconductor industry is competing to increase NAND flash memory density while reducing cost per bit, transitioning from 2D to 3D NAND technology to overcome traditional size limitations [1][7] - Significant advancements include the shift from floating gate transistors to charge trap cells, which enhance read/write performance and allow for higher storage density [1][3] Group 1: Technological Advancements - The semiconductor industry is exploring new technologies to tightly pack storage cells both horizontally and vertically, with imec developing innovations like air gap integration and charge trap layer separation [2] - The GAA (Gate-All-Around) architecture is being applied in 3D NAND flash memory, allowing for vertical stacking of storage cells and improved density [3][7] - Current mainstream manufacturers are producing 3D NAND flash chips with over 300 layers, with expectations to reach 1000 layers by 2030, equating to approximately 100 Gbit/mm² storage capacity [7] Group 2: Challenges and Solutions - Maintaining uniformity in wire diameter across stacked layers poses challenges, increasing process complexity and costs [7] - Companies are investing in tools to enhance 3D NAND storage density, including increasing bit counts per cell and reducing GAA cell spacing [9] - The introduction of air gaps between adjacent word lines is a potential solution to reduce cell interference, with imec proposing a precise integration method [13][17] Group 3: Future Directions - The integration of air gaps and charge trap layer separation is seen as crucial for achieving future z-axis scaling in 3D NAND flash memory [24] - imec is developing new technologies for controlled charge trap cutting, which could enhance the storage window and prevent charge migration [20][24] - Innovative architectures are being considered to maintain leadership in memory development beyond 2030, driven by demands from cloud computing and artificial intelligence applications [24]

605178 重大资产重组!周四复牌

Shang Hai Zheng Quan Bao· 2025-10-22 15:17

Core Viewpoint - The company, Shikong Technology, plans to acquire 100% equity of Shenzhen Jiahe Jingwei Technology Co., Ltd. to enter the storage sector and create a second growth curve, enhancing its profitability and transforming its production capabilities [1][5]. Group 1: Acquisition Details - The acquisition will be executed through issuing shares and cash payments to 19 parties, with a share price set at 23.08 yuan per share [2]. - The company aims to raise funds not exceeding 100% of the asset purchase price, with a maximum issuance of 30% of the total share capital prior to the issuance [2]. - The raised funds will be allocated for cash payments, intermediary fees, taxes, and to support working capital and debt repayment [2]. Group 2: Target Company Overview - Jiahe Jingwei specializes in the R&D, design, production, and sales of storage products, including memory bars and solid-state drives, with three main product lines [3]. - The company has shown consistent revenue growth, with projected revenues of 854 million yuan in 2023, 1.344 billion yuan in 2024, and 1.123 billion yuan for the first eight months of 2025 [3]. Group 3: Financial Performance - Jiahe Jingwei's financials indicate total assets of approximately 1.299 billion yuan and total liabilities of about 693.5 million yuan as of August 31, 2025 [4]. - The net profit for 2024 is projected at 42.71 million yuan, with a net profit of 42.29 million yuan reported for the first eight months of 2025 [3][4]. Group 4: Strategic Implications - The acquisition is expected to enhance the company's asset quality and risk resilience, facilitating its transition and growth in the information technology sector [5]. - The controlling shareholder, Gong Lanhai, has committed to a 36-month lock-up period for both newly issued and existing shares [6].

万润科技上半年实现营收25.48亿元,净利润同比下降46.07%

Ju Chao Zi Xun· 2025-08-30 03:25

Financial Performance - The company reported a revenue of 2,547,589,270.04 yuan for the first half of 2025, representing a year-on-year increase of 27.44% [2][3] - The net profit attributable to shareholders was 15,535,249.59 yuan, a decrease of 46.07% compared to the same period last year [2][3] - The net profit after deducting non-recurring gains and losses was 10,734,361.75 yuan, down 23.42% year-on-year [2][3] - The net cash flow from operating activities was -68,200,050.23 yuan, an improvement of 21.69% from the previous year [3] - Basic and diluted earnings per share were both 0.02 yuan, reflecting a decline of 33.33% [3] - The weighted average return on equity was 0.97%, down 0.90% from the previous year [3] Asset and Equity Position - As of the end of the reporting period, total assets amounted to 4,738,773,738.19 yuan, a decrease of 1.14% year-on-year [2][3] - The net assets attributable to shareholders were 1,552,793,643.09 yuan, showing a growth of 1.01% compared to the end of the previous year [2][3] Business Expansion and Market Development - The company is focused on expanding production, market development, and stabilizing operations to achieve new breakthroughs in overall business scale [2] - In the LED lighting sector, the company has made significant progress in consumer electronics, automotive electronics, and fire safety markets, securing contracts for major projects [4] - The company is actively expanding its international business, successfully establishing partnerships with quality distributors in Thailand and Malaysia [4] Semiconductor Storage Business - The semiconductor storage segment achieved a revenue of 473 million yuan, marking a substantial year-on-year growth of 444.58% [5] - The company is advancing in R&D, focusing on testing technology, hardware development, and automotive-grade product development, while also securing multiple patents [5] - Key projects include the development of enterprise-level PCIe 5.0 SSDs and successful mass production of DDR5 4800 memory modules [5]

佰维存储:研发向上突破 加速朝价值链高端攀升

Zhong Guo Zheng Quan Bao· 2025-08-25 20:08

Core Viewpoint - The company emphasizes the importance of self-built testing and packaging capabilities to enhance product competitiveness and pricing power in the semiconductor storage industry [1][2][3] Group 1: Company Strategy - The company has established a dual strategy focusing on "solution development + self-packaging and testing" to meet market demands for high-capacity, miniaturized, and low-power storage solutions [2][3] - By integrating research and testing capabilities, the company aims to penetrate high-tech fields such as smartphones, PCs, and smart wearables, thereby avoiding intense competition and enhancing differentiation [2][3] Group 2: R&D Investment - The company has significantly increased its R&D investment from 51 million yuan in 2018 to 447 million yuan in 2024, representing a growth of over 7 times [3] - The company maintains a commitment to innovation even during industry downturns, allowing it to seize opportunities during recovery periods [3] Group 3: Market Expansion - The company has successfully entered the supply chains of major brands such as OPPO, VIVO, Lenovo, and Xiaomi with its embedded storage and SSD products [4] - Future focus areas include smart wearables and smart vehicles, with enterprise storage and data center products being prioritized for medium to long-term growth [4][5] Group 4: Emerging Markets - The company anticipates significant growth in the smart glasses segment, projecting revenues exceeding 1 billion yuan in 2024, with a year-on-year increase of nearly 300% [5] - In the automotive sector, the company has begun bulk deliveries of LPDDR RAM and eMMC products to leading car manufacturers, with expectations for increased sales in vehicle-grade storage [5] Group 5: Industry Positioning - The company's transition from reliance on external testing to an integrated approach reflects a strong commitment to self-sufficiency in the domestic storage industry [6] - The company is leveraging its R&D capabilities and global presence to transform challenges into growth opportunities, aiming to move up the value chain in the industry [6]