星妈会

Search documents

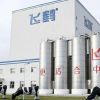

飞鹤,急速打响市场保卫战

21世纪经济报道· 2025-10-23 03:08

Group 1 - The core viewpoint of the article highlights that China Feihe is taking various measures to stabilize its position in the market amid pressure, including launching new products that replicate breast milk nutrition [1][2] - Feihe has introduced several new products, such as Qicui and Jicui, which are set to be launched soon, indicating the urgency of product innovation [1] - The company reported a revenue decline of 9.36% year-on-year to 9.151 billion yuan in the first half of the year, with specific product lines experiencing varying revenue changes [1] Group 2 - Feihe has achieved the status of the number one brand in national sales of infant formula for six consecutive years, but the growth momentum in the infant formula market is currently weak [2] - The decline in marriage registrations in China by over 20% in 2024 suggests a likely decrease in newborn numbers, intensifying the competition in the existing market [2] - Feihe possesses relative advantages in milk source, research and development, and production processes, which are crucial for maintaining its market position [2]

飞鹤,急速打响市场保卫战

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 02:33

Core Viewpoint - China Feihe is taking various measures to stabilize its position in the market amid sales pressure, including launching new products that replicate the nutritional ecology of breast milk [1][2]. Group 1: Product Development and Market Strategy - Feihe has introduced several new products, including Qicui and Jicui, which are set to launch soon, indicating the urgency of product innovation [1]. - The company has over 85 million members in its "Star Mom Club" and plans to offer a free developmental self-assessment tool tailored to Chinese babies [1]. Group 2: Financial Performance - In the first half of the year, Feihe's revenue declined by 9.36% year-on-year to 9.151 billion yuan, attributed to increased competition and a proactive reduction in milk powder channel inventory [2]. - Revenue breakdown shows that ultra-high-end, high-end, regular, and adult milk powder segments generated 6.19 billion, 1.69 billion, 0.33 billion, and 0.29 billion yuan respectively, with declines of 13%, 14%, 3% growth, and a 4% decline [2]. Group 3: Market Dynamics - The infant formula market is experiencing weak growth momentum, with a projected decline of over 20% in marriage registrations in 2024, likely leading to a decrease in newborn numbers [3]. - Feihe emphasizes its position as the top seller in the infant formula market for six consecutive years, despite facing pressure from both leading brands and emerging mid-tier brands [2][3]. Group 4: Competitive Landscape - The competitive landscape in the infant formula market is intensifying, with major brands like Yili, New Dihua, and FrieslandCampina expanding their market presence [2][6]. - Feihe's advantages in milk sourcing, research and development, and production processes are crucial for maintaining its market position [5].

飞鹤,急速打响市场保卫战丨消费参考

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-23 02:24

Core Viewpoint - Under market pressure, China Feihe is taking various measures to stabilize its position, including launching new products that replicate the nutritional ecology of breast milk [1][2]. Company Performance - Feihe's revenue for the first half of the year decreased by 9.36% year-on-year to 9.151 billion yuan, with sales pressure attributed to increased competition and a deliberate reduction in milk powder channel inventory [3]. - The revenue breakdown shows that ultra-high-end, high-end, regular, and adult milk powder segments generated revenues of 6.19 billion, 1.69 billion, 330 million, and 290 million yuan, respectively, with declines of 13%, 14%, 3% growth, and 4% decline year-on-year [3]. Market Dynamics - The infant formula market is experiencing intensified competition, with leading brands like Yili, Nutricia, and FrieslandCampina expanding, while mid-tier brands like a2 are also showing strong growth potential [3][7]. - Feihe has maintained its position as the top seller in the infant formula market for six consecutive years, but the growth momentum in the market appears weak, with a projected decline in newborn numbers due to a significant drop in marriage registrations [4][5]. Membership and Tools - Feihe's "Star Mom Club" membership has surpassed 85 million, and the company plans to offer a free developmental self-assessment tool tailored to Chinese babies through this platform [2].