3纳米(N3)芯片

Search documents

AI见顶?台积电打脸!指数级增长!

Xin Lang Cai Jing· 2025-10-17 10:04

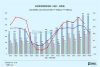

Core Viewpoint - TSMC's Q3 2025 financial report showcases significant growth driven by AI demand, with revenue reaching $33.1 billion, exceeding market expectations and reflecting a 41% year-over-year increase, while net profit surged by 39% [1][2] Revenue and Profitability - TSMC's quarterly revenue of $33.1 billion surpassed market expectations of $31.5 billion, with a quarter-over-quarter increase of 10.1% and a year-over-year increase of 41%, translating to an average daily revenue of nearly $1.1 million [2] - Adjusted EPS reached $2.92, a 39% increase year-over-year, exceeding expectations by $0.33, with a net profit margin of 45.7%, positioning TSMC among the few tech giants maintaining a margin above 40% [2] Gross Margin - Gross margin improved to 59.5%, up 1.7 percentage points year-over-year and 0.9 percentage points quarter-over-quarter, surpassing the expected 58.9% [3][4] - Key drivers include a surge in shipments of 3nm and 5nm processes, a reduction in inventory turnover days to 74, and high capacity utilization rates [3] Advanced Process and AI Demand - Advanced processes (7nm and below) contributed 74% of wafer revenue, with 5nm accounting for 37% and 3nm for 23%, indicating a strong market position [6] - AI demand is expanding beyond cloud services to include enterprise and sovereign AI, with TSMC's CEO noting a stronger demand than three months prior, supported by three main drivers: cloud, enterprise, and sovereign AI [10] Technology Roadmap - TSMC's N2 family (2nm) is set to begin mass production by the end of 2025, with expectations of significant contributions to revenue by 2026 [14][15] - The N2 process is anticipated to have superior profitability compared to N3, with a 20% increase in logic density and a 30% reduction in power consumption [15] Global Expansion and Capital Expenditure - TSMC is advancing its global production capabilities, including a major facility in Arizona and expansions in Japan and Germany, to meet AI demand [18][19][20] - The capital expenditure for 2025 has been narrowed to $40-42 billion, with a clear allocation strategy focusing on advanced processes and special processes [21] Non-AI Market and Competition - The smartphone market is recovering, with a 19% quarter-over-quarter increase, while automotive electronics are also seeing growth, indicating a healthy inventory situation [23] - TSMC's "Foundry 2.0" strategy aims to build a competitive moat by offering comprehensive solutions, including front-end processing and back-end packaging [24] Future Indicators - Key indicators to monitor for TSMC's growth include Q4 revenue performance, the ramp-up speed of the N2 process, and the management of overseas factory gross margin dilution [26]

AI需求依然给力!台积电Q2销售额9338亿新台币,同比增长38.6%超预期

Hua Er Jie Jian Wen· 2025-07-10 07:15

Core Insights - TSMC's June sales reached NT$263.71 billion, a 26.9% increase year-over-year, despite a 17.7% month-over-month decline [2][3] - For Q2, TSMC's sales were NT$933.796 billion (approximately US$31.95 billion), significantly exceeding company guidance and market expectations, with a year-over-year growth of 38.6% [2][3] - Cumulative sales for the first half of the year totaled NT$1,773.046 billion, reflecting a 40.0% increase compared to the same period last year [2][3] Financial Performance - TSMC's Q2 revenue surpassed analyst expectations, with LSEG SmartEstimate predicting NT$927.831 billion [4] - Morgan Stanley forecasts a 17% quarter-over-quarter growth in Q2 revenue, driven by strong demand for 3nm and 5nm processes, despite currency pressures [4] - TSMC's CEO reaffirmed a 20% sales growth target in USD for 2025, alongside a commitment to invest US$100 billion to expand manufacturing capabilities in the U.S., Japan, and Germany [4] Market Dynamics - The strong demand for AI chips from major companies like NVIDIA and increasing outsourcing orders from Intel are key drivers for TSMC's sales performance [5] - Despite challenges in the mobile and consumer sectors, TSMC's annual sales growth target of 25% remains achievable [5] - Concerns about tariffs and their impact on the global economy and electronics industry persist, affecting investor sentiment [5]