7纳米芯片

Search documents

1秒赚30000元,台积电把光刻机“干冒烟”

3 6 Ke· 2026-01-16 02:30

Core Insights - TSMC reported a significant increase in revenue and profit for Q4 2025, with revenue reaching $33.73 billion, a year-on-year growth of 25.5%, and net profit of $16.297 billion, up 40.2% year-on-year [1][6][12] - The company anticipates a strong growth trajectory for 2026, projecting nearly 30% revenue growth based on its leadership in advanced processes and packaging technologies [1][12] Financial Performance - Q4 2025 revenue was $33.73 billion, exceeding guidance of $32.2-33.4 billion, with a gross margin of 62.3%, surpassing the previous guidance of 59%-61% [6][9] - TSMC's net income attributable to shareholders was $505.74 million, reflecting a 35% increase year-on-year [6][9] - Capital expenditures for Q4 2025 were $11.51 billion, with a total of $40.90 billion for the year, indicating a strong investment in capacity expansion [11][10] Advanced Technology and Market Trends - Advanced processes (7nm and below) accounted for 77% of total wafer revenue, with 5nm contributing 35% due to high-performance computing (HPC) demand [2][8] - Revenue from AI accelerators constituted a significant portion of total revenue, with a projected compound annual growth rate (CAGR) of nearly 50% for AI accelerator revenue from 2024 to 2029 [3][4][13] - The company is transitioning to 2nm production, with expectations of significant contributions from this node in 2026 [15][22] Customer and Geographic Insights - North American customers contribute approximately 75% of TSMC's revenue, while customers from mainland China accounted for 9% in Q4 2025 [5][12] - TSMC is expanding its manufacturing footprint in the U.S. and Japan, with plans for multiple fabs to support AI and HPC demands [14][15] Future Outlook - TSMC's CEO expressed confidence in the sustainability of AI demand, emphasizing that AI has become integral to core business processes for major cloud service providers [16][17] - The company aims to maintain a long-term gross margin target of over 53%, despite rising operational costs associated with overseas manufacturing [20][21] - TSMC is committed to a flexible capital expenditure strategy to ensure that investments translate into future earnings growth [23]

台积电利润大增35%

财联社· 2026-01-15 06:52

Core Viewpoint - TSMC reported strong fourth-quarter earnings driven by robust demand for AI chips, achieving a 35% year-over-year profit growth, marking the eighth consecutive quarter of profit increase [2][3]. Financial Performance - Revenue reached NT$1.046 trillion (approximately RMB 230.85 billion), a 20.5% year-over-year increase and a 5.7% quarter-over-quarter increase, surpassing expectations of NT$1.034 trillion (approximately RMB 228.20 billion) [3]. - Net profit was NT$505.74 billion (approximately RMB 111.62 billion), reflecting a 35% year-over-year growth and an 11.8% quarter-over-quarter increase, exceeding the forecast of NT$478.37 billion (approximately RMB 105.58 billion) [3]. - Gross margin stood at 62.3%, up from 59.0% in the previous quarter, while operating margin improved to 54.0% [3]. Revenue Breakdown - Advanced chips (7nm and below) accounted for 77% of TSMC's total wafer revenue, with 3nm technology contributing 28%, 5nm at 35%, and 7nm at 14% [5][6]. - High-performance computing (HPC) and smartphones represented 55% and 32% of net revenue, respectively, with IoT, automotive, and data communication devices contributing smaller shares [8]. Future Outlook - TSMC plans to significantly increase capital expenditures, projecting between $52 billion to $56 billion for 2026, following a total of $40.9 billion in 2025 [10][11]. - The company anticipates nearly 30% growth in sales in dollar terms by 2026, driven by AI accelerators and other growth platforms including smartphones and automotive sectors [11].

台积电日本厂,要做2nm?

半导体行业观察· 2025-12-22 01:49

Core Viewpoint - TSMC is considering changing the production technology for its Kumamoto second factory from the originally planned 6nm to a more advanced 4nm process due to declining demand in the automotive semiconductor market and increasing demand for AI-related products [1][2][4] Group 1: Construction Status - Reports indicate that the construction of the Kumamoto second factory has effectively stopped, with heavy machinery cleared from the site by early December [3] - TSMC's president of the Kumamoto factory, Yuichi Horita, stated that construction is still ongoing and that discussions with partners regarding the details and progress of the construction are continuing [1][3] Group 2: Production Plans - The first Kumamoto factory is set to begin mass production in December 2024, with a production cycle time comparable to TSMC's facilities in Taiwan, and is expected to employ 2,400 people, increasing to over 3,400 after the second factory starts production [1] - The second factory, initially planned to produce 6nm and 7nm chips, may now focus on 4nm technology, which is more suitable for AI semiconductors, reflecting a shift in market demand [2][4] Group 3: Market Dynamics - The demand for 6nm and 7nm chips has decreased, impacting TSMC's production capacity utilization rates at its main facility in Taiwan [3] - TSMC is also considering introducing advanced chip packaging technology in Japan, which is crucial for manufacturing AI chips, and there are discussions about potentially skipping 4nm technology altogether in favor of 2nm due to anticipated market shifts [4]

台积电再建一座4nm工厂?

半导体芯闻· 2025-12-11 10:11

Core Viewpoint - TSMC is considering advancing its chip production technology at its second factory in Japan to meet the demand for AI-related products, which may lead to construction delays and design changes [3][4]. Group 1: Factory Development - TSMC's second factory in Kumamoto, Japan, which began construction in late October, is now contemplating a shift to 4nm process technology, moving away from the initially planned 6nm and 7nm chips [3]. - The construction of the Kumamoto factory has reportedly been paused, with heavy machinery cleared from the site by early December [3]. - TSMC has informed suppliers that it will not add equipment to its existing factory in Kumamoto until at least 2026, as demand for 6nm and 7nm chips has decreased [4]. Group 2: Market Demand and Technology Shift - The demand for 6nm and 7nm chips has declined, impacting TSMC's production capacity utilization at its main facility in Taichung, Taiwan [4]. - TSMC has a history of adjusting its construction plans based on market demand, as seen with its facility in Kaohsiung, which shifted from mature processes to advanced 2nm technology [4]. - TSMC is also considering introducing advanced chip packaging technology in Japan, which is crucial for AI chip manufacturing [5]. Group 3: Partnerships and Support - TSMC's projects in Japan are supported by companies such as Sony Semiconductor Solutions, Denso, and Toyota [5].

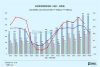

AI需求+先进制程双引擎驱动,台积电10月营收大增16.9%!

Sou Hu Cai Jing· 2025-11-10 08:11

Core Insights - TSMC reported record revenue for October 2025, with sales reaching NT$367.47 billion, marking an 11.0% increase from September and a 16.9% increase year-over-year, setting a new monthly and annual record [1] - Cumulative sales from January to October reached NT$3.13 trillion, a 33.8% increase compared to the same period in 2024, also a record high [2] - The company's performance is driven by advancements in process technology and increased orders from key clients, alongside long-term benefits from global AI computing demand [3] Revenue Trends - Despite the strong performance, TSMC's monthly sales growth is showing signs of slowing down, with a year-over-year growth of 31.4% in September [4] - TSMC's stock has risen over 46% this year, although recent global market concerns have put pressure on tech stocks [5] Future Outlook - TSMC's CEO emphasized that both revenue and profit are expected to reach record highs this year and in the future, with a focus on the continuation of 3nm expansion and advanced packaging orders [6] - For Q4, TSMC projects sales between $32.2 billion and $33.4 billion, with a gross margin forecast of 59% to 61% [11] Market Position - TSMC's market share in the pure foundry market has increased from 63% in Q1 2024 to 71% in Q2 2025, driven by enhanced 3nm capacity and high utilization of AI GPUs [9] - Advanced technologies (7nm and above) account for 74% of TSMC's total wafer revenue, highlighting the company's strength in advanced processes [9] Sector Contributions - The recovery in consumer electronics and automotive chip markets is also supporting TSMC's revenue growth, with significant orders from Apple and Qualcomm [13] - In the automotive sector, TSMC has seen nearly a 20% year-over-year increase in orders for specialized 28nm/16nm chips for autonomous driving and AI applications [14] Expansion Plans - TSMC is actively expanding its overseas presence, with the construction of a second wafer fab in Japan and plans to accelerate capacity expansion at its Arizona facility [15][16]

台积电实力无人能及

美股研究社· 2025-10-22 10:09

Core Viewpoint - TSMC's third-quarter financial results demonstrate strong performance, with a significant year-over-year revenue increase, and the company is expected to maintain its solid future outlook despite potential short-term growth slowdowns [1][5][8]. Financial Performance - TSMC reported third-quarter sales of approximately $33 billion, a substantial year-over-year increase of 41%, exceeding analyst expectations by $1.5 billion [5]. - Advanced technology nodes contributed significantly to revenue, with 3nm chips accounting for 23%, 5nm for 37%, and 7nm for 14%, totaling 74% of wafer revenue [5]. - The gross margin slightly improved to 59.5%, with an operating margin of around 50.6% and a net profit margin of 45.7%, showcasing strong profitability for a capital-intensive manufacturing company [5][6]. - The return on equity (ROE) reached 37.8%, indicating effective management of investor funds [6]. Market Position and Strategy - TSMC is a critical player in the AI sector, with major tech companies relying on its manufacturing capabilities for advanced chips, particularly for AI and data center applications [10][11]. - The company plans to increase capital expenditures to $40-$42 billion by 2025 to strengthen its market position amid rising AI demand [10]. - TSMC's advanced process technologies, including the upcoming 2nm node, are expected to further enhance its competitive edge [12]. Pricing Power and Future Outlook - TSMC is anticipated to raise prices for its advanced processes by 5%-10%, with potential increases for the new 2nm process reaching up to 50%, which could significantly boost profitability [13][14]. - The company is projected to achieve an average sales growth rate of about 30% over the next five years, driven by ongoing demand in the AI sector [18]. Valuation - Based on current assumptions, TSMC's fair stock price is estimated to be around $359 per share, indicating substantial upside potential [19]. Conclusion - The ongoing AI race is expected to benefit TSMC significantly, although there are concerns about market prudence in capital investments [21].

AI见顶?台积电打脸,指数级增长

3 6 Ke· 2025-10-17 11:44

Group 1 - The core viewpoint of the article highlights TSMC's impressive Q3 2025 financial results, showcasing a significant revenue increase driven by AI demand and advanced process technology [1][28] - TSMC's Q3 revenue reached $33.1 billion, exceeding market expectations of $31.5 billion, with a year-on-year growth of 41% [2][28] - The net profit for Q3 was $15.1 billion, marking a 39% increase year-on-year, which translates to a daily profit of approximately $168 million [1][2] Group 2 - TSMC raised its 2025 revenue growth forecast from 30% to nearly 35%, targeting $121.6 billion, which is $1 billion above market expectations [1][28] - The company narrowed its capital expenditure range to $40-42 billion, indicating a strong commitment to investing in AI advanced processes [1][28] Group 3 - TSMC's gross margin reached 59.5%, up 1.7 percentage points year-on-year, driven by increased shipments of 3nm and 5nm processes [4][28] - The average selling price (ASP) of wafers increased to $7,040, reflecting a 15% year-on-year growth, indicating a higher value contribution from advanced processes [9][28] Group 4 - Advanced processes (7nm and below) accounted for 74% of wafer revenue, with 5nm contributing 37% and 3nm 23% [6][28] - The high-performance computing (HPC) segment, primarily driven by AI servers, represented 57% of revenue, demonstrating resilience in demand [8][28] Group 5 - TSMC's CEO emphasized that AI demand is in its early explosive phase, supported by three main drivers: cloud, enterprise, and sovereign AI [11][28] - The company is proactively engaging with over 500 end customers to anticipate AI application needs, ensuring a robust demand forecast [13][28] Group 6 - TSMC's N2 process technology is set to begin mass production by the end of Q4 2025, with significant orders already secured from major clients [14][28] - The company is expanding its global production capacity across four major sites, including Arizona, Japan, Germany, and Taiwan, to meet rising AI demand [19][20][21][22][28] Group 7 - TSMC's capital expenditure strategy is closely linked to revenue growth, with a projected return of $1.5 to $2 for every $1 spent on CapEx over the next 3-5 years [23][28] - The company aims to maintain a competitive edge through its "Foundry 2.0" strategy, which integrates front-end processing, back-end packaging, and software services [26][28]

AI见顶?台积电打脸!指数级增长!

Xin Lang Cai Jing· 2025-10-17 10:04

Core Viewpoint - TSMC's Q3 2025 financial report showcases significant growth driven by AI demand, with revenue reaching $33.1 billion, exceeding market expectations and reflecting a 41% year-over-year increase, while net profit surged by 39% [1][2] Revenue and Profitability - TSMC's quarterly revenue of $33.1 billion surpassed market expectations of $31.5 billion, with a quarter-over-quarter increase of 10.1% and a year-over-year increase of 41%, translating to an average daily revenue of nearly $1.1 million [2] - Adjusted EPS reached $2.92, a 39% increase year-over-year, exceeding expectations by $0.33, with a net profit margin of 45.7%, positioning TSMC among the few tech giants maintaining a margin above 40% [2] Gross Margin - Gross margin improved to 59.5%, up 1.7 percentage points year-over-year and 0.9 percentage points quarter-over-quarter, surpassing the expected 58.9% [3][4] - Key drivers include a surge in shipments of 3nm and 5nm processes, a reduction in inventory turnover days to 74, and high capacity utilization rates [3] Advanced Process and AI Demand - Advanced processes (7nm and below) contributed 74% of wafer revenue, with 5nm accounting for 37% and 3nm for 23%, indicating a strong market position [6] - AI demand is expanding beyond cloud services to include enterprise and sovereign AI, with TSMC's CEO noting a stronger demand than three months prior, supported by three main drivers: cloud, enterprise, and sovereign AI [10] Technology Roadmap - TSMC's N2 family (2nm) is set to begin mass production by the end of 2025, with expectations of significant contributions to revenue by 2026 [14][15] - The N2 process is anticipated to have superior profitability compared to N3, with a 20% increase in logic density and a 30% reduction in power consumption [15] Global Expansion and Capital Expenditure - TSMC is advancing its global production capabilities, including a major facility in Arizona and expansions in Japan and Germany, to meet AI demand [18][19][20] - The capital expenditure for 2025 has been narrowed to $40-42 billion, with a clear allocation strategy focusing on advanced processes and special processes [21] Non-AI Market and Competition - The smartphone market is recovering, with a 19% quarter-over-quarter increase, while automotive electronics are also seeing growth, indicating a healthy inventory situation [23] - TSMC's "Foundry 2.0" strategy aims to build a competitive moat by offering comprehensive solutions, including front-end processing and back-end packaging [24] Future Indicators - Key indicators to monitor for TSMC's growth include Q4 revenue performance, the ramp-up speed of the N2 process, and the management of overseas factory gross margin dilution [26]

AI见顶?台积电打脸!指数级增长!

格隆汇APP· 2025-10-17 09:47

Core Insights - TSMC's Q3 2025 financial report showcases a significant revenue of $33.1 billion, exceeding market expectations by $1.6 billion and reflecting a year-on-year growth of 41% [2][3] - The company has revised its 2025 revenue growth forecast from 30% to nearly 35%, targeting $121.6 billion, which is $1 billion above market expectations [2][3] - TSMC's net profit reached $15.1 billion, marking a 39% year-on-year increase, equating to a daily net profit of $168 million [2][3] Revenue and Profitability - TSMC's quarterly revenue of $33.1 billion surpassed market expectations of $31.5 billion, with a quarter-on-quarter increase of 10.1% and a year-on-year increase of 41% [4] - The adjusted EPS reached $2.92, a 39% increase year-on-year, exceeding expectations by $0.33, with a net profit margin of 45.7% [4] Gross Margin - The gross margin reached 59.5%, up 1.7 percentage points year-on-year and 0.9 percentage points quarter-on-quarter, exceeding the expected 58.9% [6] - Key drivers include a surge in 3nm and 5nm process shipments and effective internal cost control [6] Process and Platform Structure - Advanced processes contributed 74% of wafer revenue, with 5nm accounting for 37% and 3nm for 23% [8] - The high-performance computing (HPC) segment, primarily driven by AI servers, accounted for 57% of revenue, indicating strong demand resilience [10] Implicit Highlights - The average selling price (ASP) of wafers reached $7,040, a 15% year-on-year increase, reflecting the value added by advanced processes [11] - Free cash flow was NT$139.38 billion (approximately $4.56 billion), a 12% year-on-year increase, providing ample resources for future expansion and R&D [11] AI Demand - TSMC's CEO stated that AI demand is stronger than three months ago, indicating an early stage of a long-term trend supported by three main drivers: cloud, enterprise, and sovereign AI [13] - The number of AI tokens is growing exponentially, necessitating stronger computing power, with TSMC's AI revenue growth forecast of nearly 35% for 2025 being lower than token growth due to technological iterations [14] Technology Roadmap - TSMC's N2 family of technologies is set to drive growth over the next decade, with N2 production starting in Q4 2025 and expected to contribute 5% of wafer revenue by 2026 [17][18] - N2P and A16 technologies are also in the pipeline, targeting high-end AI training and HPC applications, respectively [19][20] Global Expansion - TSMC is advancing its global production capabilities, with significant projects in Arizona, Japan, Germany, and Taiwan to support AI demand [21][22][24][26] - The company aims to achieve over 1 million 12-inch equivalent wafers in Arizona by 2027, leveraging government subsidies to reduce costs [22] Capital Expenditure - TSMC has narrowed its 2025 capital expenditure (CapEx) forecast to $40-42 billion, with 70% allocated to advanced processes [26] - The company expects a return of $1.5-$2 for every $1 spent on CapEx over the next 3-5 years, indicating a strong growth outlook [27] Non-AI Market and Competition - The smartphone market is recovering, with a 19% quarter-on-quarter increase, while automotive electronics are also gaining momentum [29] - TSMC's "Foundry 2.0" strategy aims to build a competitive moat by offering comprehensive solutions, including advanced packaging services [31] Future Signals - To validate TSMC's $65 billion revenue target for 2030, key indicators to monitor include Q4 2025 revenue performance, N2 process ramp-up speed, and overseas factory margin dilution [33] Conclusion - TSMC's Q3 2025 performance exemplifies the benefits of AI-driven advanced processes, solidifying its position as a cornerstone of the global semiconductor industry [35]

台积电最新业绩,超出市场预期

Xin Lang Cai Jing· 2025-10-16 08:20

Core Insights - TSMC's Q3 financial results exceeded market expectations, with revenue of NT$989.92 billion (approximately US$33.1 billion), a year-on-year increase of 30.3%, and a net profit of NT$452.3 billion, marking a record high with a 39.1% year-on-year growth [1] - The strong performance is attributed to the increasing demand for AI chips, with advanced technology (7nm and above) accounting for 74% of total wafer revenue [1][2] - TSMC's optimistic outlook for Q4 includes projected sales of US$32.2 billion to US$33.4 billion and a gross margin of 59% to 61% [1] Company Performance - TSMC's Q3 revenue in USD was US$33.1 billion, surpassing the market expectation of US$31.6 billion [1] - The company reported that 3nm chip shipments accounted for 23% of total wafer revenue, while 5nm and 7nm chips contributed 37% and 14%, respectively [1] - TSMC's market capitalization is approximately US$1.22 trillion, nearly three times that of its competitor Samsung Electronics [3] Industry Trends - The demand for AI applications is driving the need for high-performance computing chips, leading analysts to raise their earnings and revenue forecasts for TSMC [2][3] - TSMC is preparing for the construction of multiple 2nm wafer fabs in Taiwan, with mass production expected to begin in late Q4 [3] - The semiconductor industry is entering a super cycle, as evidenced by the strong performance of both TSMC and Samsung Electronics, which reported an 8.7% year-on-year sales increase and a 31.8% rise in operating profit [3]