可转债发行

Search documents

双乐股份不超8亿可转债获深交所通过 浙商证券建功

Zhong Guo Jing Ji Wang· 2025-10-31 03:05

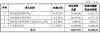

Core Viewpoint - The Shenzhen Stock Exchange's listing review committee approved Shuangle Pigment Co., Ltd.'s issuance of convertible bonds, indicating compliance with issuance, listing, and information disclosure requirements [1] Group 1: Issuance Details - Shuangle Pigment plans to raise up to RMB 80 million through the issuance of convertible bonds, which will be allocated to various projects and working capital [2] - The projects funded by the issuance include high-performance blue-green pigments, high-performance yellow-red pigments, a research center for high-performance functional pigments, and working capital [3] Group 2: Project Investment Breakdown - The total investment for the high-performance blue-green pigment project is RMB 18.5 million, with RMB 16.62 million from the raised funds [3] - The high-performance yellow-red pigment project has a total investment of RMB 46.35 million, with RMB 41.58 million allocated from the raised funds [3] - The research center for high-performance functional pigments requires a total investment of RMB 6 million, with RMB 3.80 million from the raised funds [3] - The working capital will utilize the full RMB 18 million from the raised funds [3] Group 3: Convertible Bond Terms - The convertible bonds will have a duration of six years, with the conversion period starting six months after issuance [3] - The initial conversion price will be determined based on the average stock price over the twenty trading days prior to the announcement of the fundraising plan [4] - The controlling shareholder, Yang Hanzhou, holds 35.23% of the company's shares directly and controls an additional 15.10% indirectly [4]

赛恩斯:拟发5.65亿可转债 前次IPO募投项目效益未达标

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-30 03:04

Core Viewpoint - Company Sains (688480.SH) plans to issue convertible bonds to raise up to 565 million yuan, with funds allocated to three main projects, including expansion of reagent production and working capital supplementation [1] Fundraising and Project Allocation - The company intends to raise a total of 565 million yuan, with 160 million yuan allocated for the expansion of reagent production, 325 million yuan for a project to produce 100,000 tons of efficient flotation reagents annually, and 80 million yuan for working capital [1] Previous Fund Utilization - The previous fundraising for the construction of an environmental equipment production base did not meet expectations, with cumulative benefits of 15.79 million yuan by September 30, 2025, falling short of promised benefits due to market changes and seasonal factors [1] Financial Performance - For the first three quarters of 2025, the company reported revenue of 677 million yuan, a year-on-year increase of 15.81%, while net profit attributable to shareholders decreased by 48.32% to 74 million yuan [1] - As of September 30, 2025, the company had total assets of 1.94 billion yuan, a debt-to-asset ratio of 41.57%, and a current ratio of 1.71 [1]

格隆汇公告精选︱TCL科技:拟295亿元投资建设第8.6代印刷OLED生产线项目;剑桥科技:目前不生产含CPO技术的芯片

Ge Long Hui· 2025-10-29 17:10

Key Highlights - Cambridge Technology currently does not produce chips containing CPO technology [1] - TCL Technology plans to invest 29.5 billion yuan in the construction of an 8.6-generation printed OLED production line [1] - Huakang Clean has won the bid for a "medical service construction project" [1] - Aotewei intends to acquire an 8.99% stake in its subsidiary Songci Electromechanical [1] - Shanghai Yizhong plans to repurchase shares worth 30 million to 35 million yuan [1] - Huaton Co. reported a pig sales revenue of 338 million yuan in August [1] - Tianma Technology has accumulated approximately 11,921.59 tons of eel out of the pool from January to August [1] - Mars Man's controlling shareholder plans to reduce holdings by no more than 2.94% [1] - Zhiwei Intelligent's actual controller plans to reduce holdings by no more than 2.9749% [1] - Donglin Investment plans to reduce holdings in Jin'an Guoji by no more than 2.878% [1] - Zhonglun New Materials intends to issue convertible bonds not exceeding 1.068 billion yuan [1] - Tuojing Technology plans to raise no more than 4.6 billion yuan through a private placement [1] Investment Projects - TCL Technology (000100.SZ) plans to invest 29.5 billion yuan in the construction of an 8.6-generation printed OLED production line [1] - Guangdong Jianke (301632.SZ) intends to invest in the implementation of the second phase of the Guangdong Jianke·Zhongshan Smart Gathering Project [1] - Nanfeng Co. (300004.SZ) plans to invest 50 million yuan in fixed assets for a 3D printing service project [1] Contracts and Acquisitions - Huakang Clean (301235.SZ) has won the bid for a "medical service construction project" [1] - Aotewei (688516.SH) intends to acquire an 8.99% stake in its subsidiary Songci Electromechanical [1] - Tianhua New Energy (300390.SZ) plans to acquire a 75% stake in Suzhou Tianhua Times [1] Share Buybacks - Chuangyuan Co. (300703.SZ) plans to repurchase 1.55% to 2.05% of its shares [2] - Yishitong (688733.SH) intends to repurchase shares worth 30 million to 55 million yuan [2] - Shanghai Yizhong (688091.SH) plans to repurchase shares worth 30 million to 35 million yuan [2] Operational Data - Huaton Co. (002840.SZ) reported a pig sales revenue of 338 million yuan in August [2] - Tianma Technology (603668.SH) has accumulated approximately 11,921.59 tons of eel out of the pool from January to August [2] Shareholding Changes - Sudda Co. (001277.SZ) plans to reduce holdings by no more than 3% [2] - Mars Man (300894.SZ) plans to reduce holdings by no more than 2.94% [2] - Zhiwei Intelligent (001339.SZ) plans to reduce holdings by no more than 2.9749% [2] - Jin'an Guoji (002636.SZ) plans to reduce holdings by no more than 2.878% [2] Other Financial Activities - China Merchants Shekou (001979.SZ) plans to issue preferred shares to raise no more than 8.2 billion yuan for real estate project construction [2] - Zhonglun New Materials (301565.SZ) intends to issue convertible bonds not exceeding 1.068 billion yuan [2] - Keli'er (002892.SZ) plans to raise no more than 1.006 billion yuan through a private placement [2] - Tuojing Technology (688072.SH) plans to raise no more than 4.6 billion yuan through a private placement [2]

公告精选︱金帝股份:拟投资2.88亿元建设高端精密轴承保持器数字化转型升级项目

Ge Long Hui A P P· 2025-10-29 16:19

Group 1 - Linyi Intelligent Manufacturing plans to issue H-shares and list on the Hong Kong Stock Exchange [1] - Jindi Co., Ltd. intends to invest 288 million yuan in a digital transformation project for high-end precision bearing retainers [1] - Tenda Construction has won contracts totaling 1.231 billion yuan in the first three quarters [1] - Huali Co., Ltd. plans to acquire 51% of Zhongke Huilian's shares to accelerate digital transformation [1] - Hemai Co., Ltd. intends to repurchase shares worth 100 million to 200 million yuan [1] - Zhongwei Company reported a net profit of 1.211 billion yuan in the first three quarters, a year-on-year increase of 32.66% [1] - LvTian Machinery's shareholder plans to reduce holdings by no more than 3% [1] Group 2 - Chuangye Heima has signed a strategic cooperation agreement with Shanghai Xinhong, which is an elite partner of NVIDIA [2] - Jindi Co., Ltd. plans to issue convertible bonds to raise no more than 1 billion yuan [2] - Longyuan Power plans to raise no more than 5 billion yuan through a private placement for wind power projects [2] - Sains plans to issue convertible bonds to raise no more than 565 million yuan for the construction of a high-efficiency flotation reagent project with an annual capacity of 100,000 tons [2]

美股异动丨TeraWulf盘初一度跌超5.6%,拟私募发行5亿美元可转债

Ge Long Hui· 2025-10-29 14:42

Core Viewpoint - TeraWulf plans to raise $500 million through a private placement of convertible senior unsecured notes, which has led to a decline in its stock price by over 5.6% [1] Group 1: Company Actions - TeraWulf announced a private placement of a total of $500 million in convertible senior unsecured notes, maturing on May 1, 2032 [1] - The company is offering an option to initial purchasers for an additional $75 million within 13 days [1] - The funds raised are intended for the construction of the Abernathy data center in Texas and for general corporate purposes [1]

苏州天脉:拟发行不超7.86亿元可转债投建甪直基地项目

Xin Lang Cai Jing· 2025-10-28 11:39

Core Viewpoint - Suzhou Tianmai plans to issue convertible bonds to raise no more than 786 million yuan (including principal) for the construction of its Zhuzhi base for intelligent manufacturing of thermal conduction and heat dissipation products, with a total project investment of 1.36 billion yuan [1] Group 1: Fundraising and Project Details - The company intends to raise funds through a public offering of convertible bonds, with a maximum amount of 786 million yuan [1] - The total investment for the project is 1.36 billion yuan, indicating a significant commitment to expanding production capacity [1] - Prior to the fundraising, the company will use self-raised funds for initial investments [1] Group 2: Production Capacity and Market Impact - Upon completion, the project will add an annual production capacity of 30 million high-end isothermal plates [1] - The company asserts that the project is necessary and feasible, which will enhance its market competitiveness and profitability [1]

本川智能回复可转债审核问询函 对外投资不构成财务性投资 现金流下降具备合理性

Xin Lang Cai Jing· 2025-10-24 12:56

Core Viewpoint - Company confirms that its external investments do not constitute financial investments and that the decline in operating cash flow is reasonable, with sufficient debt repayment capability [1][4]. Group 1: External Investments - All external investments are categorized as industrial investments, not financial investments. The company has invested a total of 16.0044 million yuan in three enterprises, focusing on the upstream and downstream of the industrial chain [2]. - Specific investments include 9 million yuan in Baoteng Fushun, which focuses on electronic components and semiconductors, 5 million yuan in Shanghai Xinhua Rui, which specializes in automotive power semiconductor modules, and 202.44 thousand yuan in Thailand Luocheng, which is involved in PCB assembly in the new energy sector [2]. Group 2: Operating Cash Flow - The company's operating cash flow has shown a declining trend from 110.4502 million yuan in 2022 to -12.8591 million yuan in the first half of 2025. This decline is attributed to changes in customer payment structures and increased procurement payments due to order growth [3]. - The cash received from sales as a percentage of revenue dropped to 73.39% in 2024, and procurement cash payments increased by 64.28% year-on-year in the first half of 2025 [3]. Group 3: Financial Structure and Debt Repayment Capability - The company plans to issue up to 490 million yuan in convertible bonds, which will increase the debt-to-asset ratio from 27.64% to 46.36% before conversion, aligning with the industry average [4]. - After full conversion, the debt-to-asset ratio is expected to decrease to 20.49%. The company has sufficient cash resources for debt repayment, with 117 million yuan available as of June 2025, alongside an unused bank credit limit of 290 million yuan [4].

联瑞新材可转债发行申请获审核通过

Ju Chao Zi Xun· 2025-10-23 13:02

Core Viewpoint - Lianrui New Materials (688300.SH) has received approval for its public offering of convertible bonds, marking a significant step in its refinancing project [1][3] Group 1: Company Overview - Lianrui New Materials plans to issue convertible bonds to unspecified investors, aiming to raise a total of 720 million yuan, which will be used for business expansion and upgrading of the industrial chain [3] - The company specializes in the research, production, and sales of spherical silicon micro-powder, with applications in semiconductor packaging materials, electrical insulation, and new energy sectors [3] Group 2: Financial Implications - The issuance of convertible bonds is expected to optimize the company's capital structure and enhance its financial strength, supporting future expansion and technological upgrades [3] - Convertible bonds possess both debt and equity characteristics, allowing for flexible financing while maintaining stable operations [3] Group 3: Industry Outlook - The semiconductor and new materials industries are experiencing a recovery, indicating a promising outlook for the high-end electronic materials market where Lianrui operates [3] - Successful implementation of the fundraising projects is anticipated to further enhance the company's competitiveness and profitability in the new materials sector [3]

科博达(603786.SH)拟发行可转债募资不超14.91亿元

智通财经网· 2025-10-23 10:09

Group 1 - The company, Kobot, plans to issue convertible bonds to unspecified investors, with a total fundraising amount not exceeding 1.491 billion yuan [1] - The net proceeds from the fundraising, after deducting issuance costs, will be invested in several projects, including the expansion of production capacity for automotive central computing platforms and intelligent driving domain control products [1] - Additional investments will be made in the construction of the second phase of Kobot's automotive electronics base in Anhui, as well as the expansion of automotive electronics product capacity at Zhejiang Kobot Industrial Co., Ltd. [1] Group 2 - The funds will also support the headquarters' technology research and development and information technology construction projects of Kobot Technology Co., Ltd. [1] - A portion of the raised funds will be allocated to supplement working capital [1]

联瑞新材不超6.95亿可转债获上交所通过 国泰海通建功

Zhong Guo Jing Ji Wang· 2025-10-23 02:53

Core Viewpoint - Lianrui New Materials (688300.SH) has received approval from the Shanghai Stock Exchange's Listing Review Committee for its application to issue convertible bonds to unspecified investors, pending final approval from the China Securities Regulatory Commission (CSRC) [1][2]. Summary by Sections Issuance Details - The company plans to raise a total of up to 69.5 million yuan (approximately 9.5 million USD) through the issuance of convertible bonds, which will be allocated to three main projects: high-performance ultra-pure spherical powder materials for high-speed substrates, high thermal conductivity ultra-pure spherical powder materials, and supplementing working capital [2][4]. Project Investment Breakdown - The total investment for the projects is 101.09 million yuan (approximately 14 million USD), with the following allocations: - High-performance ultra-pure spherical powder materials project: 42.32 million yuan (approximately 5.9 million USD), with 25.5 million yuan (approximately 3.5 million USD) from the bond issuance - High thermal conductivity ultra-pure spherical powder materials project: 38.77 million yuan (approximately 5.4 million USD), with 24 million yuan (approximately 3.3 million USD) from the bond issuance - Supplementing working capital: 20 million yuan (approximately 2.8 million USD), fully funded by the bond issuance [4]. Shareholder Information - The controlling shareholder of the company is Li Xiaodong, who directly holds 20.18% of the shares and indirectly holds 17.45% through a personal enterprise. Together with his son, Li Changzhi, they control a total of 37.92% of the shares, significantly influencing the company's major decisions and management [6]. Underwriter Information - The lead underwriter for the bond issuance is Guotai Junan Securities Co., Ltd., with representatives Zhao Qingchen and Qin Yinzhen overseeing the process [7].