国产芯片发展

Search documents

国内高校“芯”实力爆发 4只低估值潜力芯片股获融资客重点埋伏

Zheng Quan Shi Bao· 2025-10-19 23:48

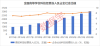

Core Insights - Chinese universities have recently made significant breakthroughs in the chip field, showcasing their growing strength in "hard technology" [1][2][4] Group 1: Research Achievements - Tsinghua University developed the world's first sub-angstrom snapshot spectral imaging chip, "Yuheng," marking a major advancement in intelligent photonics technology [2] - Peking University created a high-precision, scalable analog matrix computing chip based on resistive random-access memory, achieving analog computing precision comparable to digital systems [2] - Shanghai Jiao Tong University and the National Center for Nanoscience and Technology successfully demonstrated efficient excitation and path separation of nano-optical signals on a chip, laying the groundwork for next-generation photonic chips [2] - Fudan University introduced the world's first two-dimensional silicon-based hybrid architecture flash memory chip, addressing storage speed challenges [3] Group 2: Funding and Investment - China's higher education institutions have seen a steady increase in technology funding, with investments rising from under 100 billion yuan in 2015 to 306.55 billion yuan in 2024, representing a historical high of 8.44% of total social technology funding [4] - The surge in research output reflects both the commitment of universities to independent R&D and international recognition of China's research capabilities [4] Group 3: Market Trends - The semiconductor sector in China is experiencing a significant influx of investment, with 112 chip stocks in the A-share market seeing an average increase of over 35% in share price this year [9] - Notable companies like XChip Technology and Hezhong Technology have seen their stock prices double, while others like Zhaori Technology have faced declines [9] - The financing balance for these 112 stocks reached 181.88 billion yuan as of October 16, 2023, marking a nearly 54% increase from the end of the previous year [9] Group 4: Company Performance - Companies such as Aobi Zhongguang and Ruixin Microelectronics reported significant profit increases, with Aobi Zhongguang expected to turn a profit of 108 million yuan in the first three quarters of the year [10] - Ruixin Microelectronics anticipates a profit of up to 800 million yuan, reflecting a year-on-year growth of 127% due to the ongoing evolution of AI technology [10] - Several companies, including Haiguang Information and Zhongke Shuguang, reported profit growth exceeding 20% in the same period [11]

VIP机会日报芯片股午后爆发 栏目解读海外映射 提及产业焦点公司2日最高涨超19%

Xin Lang Cai Jing· 2025-08-12 09:52

Group 1: Market Trends - The domestic chip industry is expected to experience significant growth this year due to rapid increases in computing power consumption [7] - Micron Technology's stock rose by 6.28% as it enters the platform verification stage for DDR6, with DDR4 prices expected to continue rising until the end of 2025 [8] - The advanced packaging sector is identified as a foundation for domestic computing power development, with companies like Yongxi Electronics showing a revenue increase in wafer-level packaging products [11] Group 2: AI and Computing Technologies - Huawei is set to release breakthrough technologies in AI inference at a forum on August 12 [13] - Optical chips are highlighted as the new engine for computing power in the AI inference era, with significant commercial applications anticipated as technology matures and costs decrease [20] - The brain-computer interface industry is receiving policy support, with key technology breakthroughs expected by 2027 [22] Group 3: Company Highlights - Innovation Medical has seen a stock increase of 26.86% over five days, driven by its involvement in brain-computer interface projects and partnerships with hospitals [23][24] - Source Technology and Zhizhang Technology experienced stock increases of 10.71% and a 20% limit up, respectively, following news of advancements in optical chips [20] - Changcheng Military Industry's stock rose by 25.56% as AI in military applications is expected to change future warfare dynamics [25]

中信智库:预计国内云厂商日均Token消耗达到60万亿时开始出现一定算力缺口

news flash· 2025-07-27 09:05

Core Insights - The report from CITIC Think Tank indicates that domestic cloud service providers in China will experience a tight computing power situation when daily Token consumption reaches 30 trillion Tokens, and a significant computing power gap will emerge at 60 trillion Tokens [1] Group 1: Market Trends - Rapid growth in computing power consumption is anticipated in the domestic market, with a steep increase in the growth rate [1] - Domestic chip manufacturers are expected to have a significant development year, as domestic chips are gradually entering mass production and delivery [1] Group 2: Market Concentration - The report predicts a notable increase in market concentration among domestic cloud service providers as they face rising demand for computing power [1]

商道创投网·会员动态|为旌科技·完成1亿元A2轮融资

Sou Hu Cai Jing· 2025-06-03 14:30

Group 1 - The core viewpoint of the article highlights that Weijingtai Technology has recently completed a 100 million yuan A2 round financing led by Junxin Capital, with continued investment from notable semiconductor institutions such as Shenzhen Capital Group and Yuanjing Capital [2] - Weijingtai Technology, established in 2020, focuses on the research and development of high-end intelligent perception SoC chips, aiming to become a leader in edge-side SoC chips with applications in smart driving, smart cities, and robotics [3] - The funds from this round of financing will be directed towards the mass production of high-end smart vision chips and the research and development of intelligent driving chips, enhancing technological innovation and promoting the localization of high-end SoC chips [4] Group 2 - Junxin Capital recognizes Weijingtai Technology's strong technical capabilities and market potential in the high-end SoC chip sector, noting the company's mastery of key technologies and successful product mass production, which has garnered high recognition from leading industry clients [5] - The current government is actively promoting the independent and controllable development of the semiconductor industry, implementing a series of supportive policies, which has led to increased responsiveness and execution among industry practitioners [6]