芯片技术突破

Search documents

对上市传闻沉默 阿里平头哥高调上线自研AI芯片“真武”

Di Yi Cai Jing· 2026-01-29 03:24

1月29日,记者关注到,阿里平头哥官网上线了自研AI芯片"真武810E"的产品信息,这也是2025年9月《新闻联播》披露的平头哥自研芯片"PPU"的正式亮 相。 对于镇岳510,平头哥早早做下了"要完全跑通产业化、商业化"的产品定位,2023年至2025年,镇岳510用一年多的时间,在阿里云内部获得了规模化的、充 分的验证,证明除了云服务、AI外,其顶尖性能对高性能企业存储(AI、OLTP等)也有很大的吸引力。 目前,镇岳510已在阿里云EBS规模化部署,广泛应用于AI训练、AI推理、分布式存储、在线交易等业务场景。同时,镇岳510与忆恒创源、得瑞领新、佰维 存储、长江万润等存储厂商的合作及生态建设也在加快。 此外,平头哥发布的公开信息显示,2025年9月,平头哥羽阵系列产品的规模化应用也进入了新阶段。2025 IOTE国际物联网展上,平头哥展出了羽阵611超 高频RFID电子标签芯片在零售、物流、供应链、洗涤和畜牧管理等行业的解决方案,并首次公开了与菜鸟联合打造的RFID解决方案,麦当劳中国成为这个 解决方案的大客户之一。 根据平头哥官网介绍,"真武"PPU采用自研并行计算架构和片间互联技术,配合全栈自研软 ...

MiniMax公开发售获1209倍超额认购,港股科技ETF天弘(159128)跟踪指数三连阳,近20日“吸金”大幅领先同标的产品

2 1 Shi Ji Jing Ji Bao Dao· 2026-01-07 01:23

Group 1 - The Hong Kong stock market experienced a volatile rise, with the National Index of Hong Kong Stock Connect Technology increasing by 0.76%, marking three consecutive days of gains [1] - Notable stocks leading the gains include SenseTime, which rose nearly 6%, along with Li Auto, JD Health, Tongcheng Travel, and Xpeng Motors [1] - The Tianhong Hong Kong Stock Technology ETF (159128) recorded a trading volume of nearly 430 million yuan, with a significant net inflow of approximately 650 million yuan over the past 20 days, achieving a net flow rate of 61.77% [1] Group 2 - Zhongtai Securities anticipates a strong spring market, suggesting that the upcoming trends will likely focus on high-prosperity industries amid a marginally improving macroeconomic environment [2] - Guotai Junan highlights the robust and certain growth of China's emerging technology and capital goods in the context of AI and industrialization trends in emerging markets [2] - The report emphasizes the ongoing global breakthroughs in chip technology and rising storage prices, alongside a domestic shortage of computing power infrastructure, which is expected to accelerate domestic production [2]

豪威集团:技术突破推动公司成为中国芯片设计龙头

Ju Chao Zi Xun· 2025-11-12 14:21

Core Insights - Company ranked ninth globally among fabless IC design firms in Q1 2025, leading among mainland enterprises [1] - Significant advancements in image sensors, analog solutions, and display solutions across multiple industries [3] Group 1: Image Sensors - Company holds the third position globally in CIS shipment volume, with 50MP sensors adopted by major brands like Huawei and Xiaomi, breaking Sony's market dominance [3] - In the automotive sector, company achieved a 32.9% market share, surpassing ON Semiconductor, becoming the leader in the global automotive CIS market with over 130 million units shipped [3] Group 2: Display Solutions - Company made technological breakthroughs in display solutions through TDDI chips and LCOS technology, widely applied in consumer electronics, automotive displays, and commercial displays [3] - Provided micro-displays for Meta's first consumer AR glasses, Hypernova, and achieved mass production in automotive AR-HUDs [3] Group 3: Analog Solutions - Progress in automotive electronic analog solutions, particularly with SBC and PMIC chip combinations, optimizing space and cost [3] - Revenue from automotive analog ICs grew by 45.51% year-on-year, entering testing phases with leading Tier 1 manufacturers, with expectations for mass production in 2026 [3] Group 4: Financial Performance - Company reported revenue of 10.346 billion yuan in the first half of 2025, with automotive revenue increasing by 30.04% year-on-year and emerging markets surging by 249.42%, becoming a core growth driver [3] - Investment firm Dongfang Securities initiated coverage with a "buy" rating, projecting revenues of 28.733 billion yuan, 34.591 billion yuan, and 38.700 billion yuan for 2025-2027, with corresponding net profits of 4.136 billion yuan, 5.381 billion yuan, and 6.171 billion yuan [4]

国内高校“芯”实力爆发 4只低估值潜力芯片股获融资客重点埋伏

Zheng Quan Shi Bao· 2025-10-19 23:48

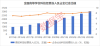

Core Insights - Chinese universities have recently made significant breakthroughs in the chip field, showcasing their growing strength in "hard technology" [1][2][4] Group 1: Research Achievements - Tsinghua University developed the world's first sub-angstrom snapshot spectral imaging chip, "Yuheng," marking a major advancement in intelligent photonics technology [2] - Peking University created a high-precision, scalable analog matrix computing chip based on resistive random-access memory, achieving analog computing precision comparable to digital systems [2] - Shanghai Jiao Tong University and the National Center for Nanoscience and Technology successfully demonstrated efficient excitation and path separation of nano-optical signals on a chip, laying the groundwork for next-generation photonic chips [2] - Fudan University introduced the world's first two-dimensional silicon-based hybrid architecture flash memory chip, addressing storage speed challenges [3] Group 2: Funding and Investment - China's higher education institutions have seen a steady increase in technology funding, with investments rising from under 100 billion yuan in 2015 to 306.55 billion yuan in 2024, representing a historical high of 8.44% of total social technology funding [4] - The surge in research output reflects both the commitment of universities to independent R&D and international recognition of China's research capabilities [4] Group 3: Market Trends - The semiconductor sector in China is experiencing a significant influx of investment, with 112 chip stocks in the A-share market seeing an average increase of over 35% in share price this year [9] - Notable companies like XChip Technology and Hezhong Technology have seen their stock prices double, while others like Zhaori Technology have faced declines [9] - The financing balance for these 112 stocks reached 181.88 billion yuan as of October 16, 2023, marking a nearly 54% increase from the end of the previous year [9] Group 4: Company Performance - Companies such as Aobi Zhongguang and Ruixin Microelectronics reported significant profit increases, with Aobi Zhongguang expected to turn a profit of 108 million yuan in the first three quarters of the year [10] - Ruixin Microelectronics anticipates a profit of up to 800 million yuan, reflecting a year-on-year growth of 127% due to the ongoing evolution of AI technology [10] - Several companies, including Haiguang Information and Zhongke Shuguang, reported profit growth exceeding 20% in the same period [11]

麒麟芯片时隔4年重现华为发布会,搭载于华为第二款三折叠手机

Qi Lu Wan Bao· 2025-09-04 10:40

Group 1 - Huawei launched the world's second commercial tri-fold smartphone, the Mate XTs, showcasing advancements in mobile technology [1][3] - The Mate XTs features the Kirin 9020 chip, marking Huawei's first presentation of its mobile chip in over four years, signaling a breakthrough in its chip development [1][3] - The performance of the Mate XTs has improved by 36% due to system-level optimizations and soft-hard cloud collaboration [3] Group 2 - The new tri-fold smartphone is the first in the industry to integrate with the China Earthquake Early Warning Network, enhancing earthquake warning capabilities by 2.5 times [8] - The camera system has been upgraded with RYYB sensors and a 40% increase in light intake, along with a new red maple color camera for improved color accuracy [8] - The number of devices supporting HarmonyOS 5 has surpassed 14 million, with over 50 models, including the Mate 70 and Mate X6 series, now compatible with HarmonyOS 5.1 [8]

北斗芯片打破国外垄断,让国外GPS芯片由1000元降到6元

Xin Lang Cai Jing· 2025-09-01 17:16

Core Insights - The article presents a viewpoint on the current market trends and investment opportunities within a specific industry, highlighting key financial metrics and performance indicators [1] Group 1 - The industry has experienced significant growth, with a reported increase in revenue by 15% year-over-year, reaching $5 billion [1] - Key players in the market are expanding their operations, with Company A announcing a $200 million investment in new technology [1] - Consumer demand remains strong, with a 10% increase in sales volume compared to the previous quarter [1] Group 2 - The competitive landscape is evolving, with new entrants disrupting traditional business models, leading to a 5% decline in market share for established companies [1] - Regulatory changes are anticipated, which may impact operational costs and profit margins in the upcoming fiscal year [1] - Analysts predict a continued upward trend in stock prices for leading firms, with an expected average growth rate of 8% over the next 12 months [1]