并购驱动增长

Search documents

并购战略持续驱动增长!法巴力挺TransDigm(TDG.US) 重申“跑赢大盘”评级

Zhi Tong Cai Jing· 2026-01-05 02:48

Core Viewpoint - BNP Paribas reaffirms TransDigm's "outperform" rating, highlighting the company's acquisition strategy as a solid driver of growth [1] Group 1: Acquisition Details - TransDigm announced the acquisition of Stellant for $960 million from Arlington Capital Partners, which specializes in high-power electronic products for aerospace, defense, medical, and industrial markets [1] - Stellant is expected to generate approximately $300 million in revenue by 2025 and currently employs around 950 people in the U.S. [1] Group 2: Business Model and Strategy - TransDigm's core business involves designing, producing, and supplying highly engineered aircraft components essential for the safe and effective operation of commercial and military aircraft [2] - The company operates through its wholly-owned subsidiary, TransDigm Inc., and is divided into three main segments: Power & Control, Airframe, and Non-Aerospace [2] - TransDigm's business model is primarily acquisition-driven, having completed over 60 acquisitions in 25 years, creating a supply chain network of 123 subsidiaries [2] Group 3: Analyst Insights - Analyst Matthew Akers notes that the acquisition of Stellant reflects TransDigm's ongoing momentum in mergers and acquisitions, alleviating market concerns about the scarcity of quality acquisition targets [2] - BNP Paribas believes Stellant's strategic fit with TransDigm is strong, citing its approximately 50% exposure to the aftermarket and significant potential for operational improvements [3] - The estimated revenue per employee at Stellant is about half of TransDigm's current level, indicating room for efficiency enhancements [3] - Assuming a synergy effect of about 4% of the acquired business's sales, the transaction is expected to increase TransDigm's earnings per share by approximately 1% for the fiscal year 2027, with more aggressive pricing assumptions potentially raising this to 3% to 5% [3] - The analyst raised the target price for TransDigm from $1,775 to $1,900, based on higher comparable company valuation multiples while maintaining a conservative premium relative to historical transaction levels [3]

“卤味第一股”商誉飙升!“买来的”净利润高增长能否持续?

Shen Zhen Shang Bao· 2025-10-21 07:54

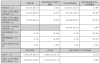

Core Viewpoint - The financial report of Huangshanghuang (002695) for Q3 2025 shows a mixed performance with a slight revenue increase but significant profit growth, largely driven by non-recurring gains from acquisitions and government subsidies [1][3]. Financial Performance Summary - Q3 revenue reached 394.41 million yuan, a year-on-year increase of 0.62% [2] - Net profit attributable to shareholders was 24.11 million yuan, up 34.31% year-on-year [2] - For the first three quarters, revenue totaled 1.38 billion yuan, a decline of 5.08% compared to the previous year [2] - Net profit for the first three quarters was 101.03 million yuan, an increase of 28.59% year-on-year [2] - The company received government subsidies amounting to 14.21 million yuan in Q3, contributing over 14% to net profit [3] Acquisition Impact - In August 2025, the company acquired 51% of Fujian Lixing Food Co., Ltd. for 495 million yuan, which was included in the consolidated financial statements in September [3] - This acquisition significantly contributed to the net profit growth, with a substantial portion of the increase being "bought" through this transaction [3] - Accounts receivable surged by 603.71% to 128 million yuan due to the consolidation of the new subsidiary [3] Financial Position Changes - Prepayments increased by 64.43%, and short-term borrowings rose from 0 to 91.79 million yuan, attributed to the new acquisition [4] - Goodwill skyrocketed from 22.42 million yuan to 335 million yuan, indicating potential future impairment risks [5] - Other payables increased by 154.27% to 320 million yuan, primarily due to installment payments for the equity acquisition [5] Business Growth Challenges - The company has faced ongoing challenges with sluggish growth in its core business, with revenue declining for several consecutive years [7] - Historical revenue figures from 2021 to 2024 show a consistent downward trend, with 2025 Q3 continuing this pattern [8][10] - Despite attempts to expand through acquisitions, the core processed food business remains slow-growing [10]

昊海生科实控人涉内幕交易被查!“医美神话”背后暗藏迷雾

Xin Lang Zheng Quan· 2025-05-14 04:56

Group 1 - The core issue revolves around the investigation of the controlling shareholder, Jiang Wei, for insider trading, which has raised concerns about potential related party transactions and market trust in the company [1][2] - The company reported a significant decline in revenue growth, with a 1.64% increase projected for 2024, marking a four-year low, while traditional business segments are experiencing revenue declines [2][3] - The company's reliance on acquisitions for growth is being questioned, as the integration of acquired entities has shown mixed results, and R&D investment has decreased significantly [3][4] Group 2 - The company faces internal challenges, including governance issues and declining performance, while external pressures from industry competition and pricing strategies are intensifying [4] - The medical aesthetics sector is becoming increasingly competitive, with other players also facing challenges, indicating a potential end to the high-growth phase for hyaluronic acid products [3][4] - To regain market confidence, the company must address compliance, innovate in R&D, and diversify its business operations [4]