卤制品

Search documents

推动农村三次产业深度融合 培育中小企业特色产业集群县域富民产业迎发展新机遇

Xin Lang Cai Jing· 2026-02-04 20:31

(来源:经济参考报) 产业兴旺是乡村振兴的物质基础,也是农民增收的重要渠道。中央一号文件着眼促进农民稳定增收,提 出培育壮大县域富民产业,推动农村一二三产业深度融合,完善公平分享产业发展收益机制。专家表 示,下一步,要从完善产业体系、强化供应链建设、完善配套设施条件等多方面发力,补齐县域富民产 业发展短板;构建风险共担、利益共享的共同体机制,推动农民从"原料提供者"转变为"产业合伙人"。 临近春节,在黑尊牛(黑龙江)产业管理集团有限公司的智能化生产车间里,战斧牛排、原切肥牛等高 端产品正陆续下线,通过冷链物流发往全国各地。 "这条智能化生产线年屠宰量达1万余头,一头牛的加工分解仅需15分钟,大幅提升了生产效率。"公司 董事长岳永超说。为进一步提升产品附加值,企业还配套建成食品加工厂,研发生产牛肉薄脆、牛肉 酱、牛肉肠、卤制品等深加工产品,年产能达2000吨,累计实现销售产值6.25亿元。 当前,我国"三农"工作重心已历史性地转移到全面推进乡村振兴上来。产业振兴是乡村振兴的重中之 重。相关部门引导各地有序开发乡村特色资源,优化产业结构和区域布局,推动农产品加工业持续升 级。 数据显示,2025年,全国规模以上农 ...

“绝味鸭脖们”越来越难卖了

Di Yi Cai Jing· 2025-10-30 03:39

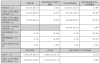

Core Viewpoint - The ready-to-eat food industry, particularly the marinated food segment, is experiencing a slowdown in growth and significant adjustments, as indicated by the declining revenues of major players like ST Juewei and Huangshanghuang [1][4]. Group 1: Company Performance - ST Juewei reported a revenue of 1.441 billion yuan for Q3 2025, a year-on-year decrease of 13.98%, with a net profit of 105 million yuan, down 26.46% [1]. - For the first three quarters of 2025, ST Juewei's revenue was 4.260 billion yuan, a decline of 15.04% year-on-year, and net profit fell by 36.07% to 280 million yuan [1]. - Huangshanghuang's revenue for the first three quarters decreased by 5.08% to 1.379 billion yuan, while net profit increased by 28.59% to 101 million yuan [1][2]. Group 2: Market Challenges - The marinated food industry is facing challenges due to changing consumer preferences, with high prices and insufficient cost-performance ratios impacting sales [1][4]. - ST Juewei attributed its declining net profit primarily to a decrease in sales volume of its main products due to adverse market conditions [1]. - Huangshanghuang noted that changes in consumption scenarios and a decline in single-store revenue contributed to its revenue drop, with a reduction of 762 stores from the previous year [2]. Group 3: Industry Trends - The overall price level of marinated food is considered high, and the lack of value for money is becoming more pronounced as consumer willingness to spend decreases [4]. - The industry is witnessing increased competition from new brands, which is eroding the market share of traditional marinated food brands [4]. - Health consciousness among consumers is rising, leading to reduced demand for high-salt and high-fat marinated products [4].

“卤味第一股”商誉飙升!“买来的”净利润高增长能否持续?

Shen Zhen Shang Bao· 2025-10-21 07:54

Core Viewpoint - The financial report of Huangshanghuang (002695) for Q3 2025 shows a mixed performance with a slight revenue increase but significant profit growth, largely driven by non-recurring gains from acquisitions and government subsidies [1][3]. Financial Performance Summary - Q3 revenue reached 394.41 million yuan, a year-on-year increase of 0.62% [2] - Net profit attributable to shareholders was 24.11 million yuan, up 34.31% year-on-year [2] - For the first three quarters, revenue totaled 1.38 billion yuan, a decline of 5.08% compared to the previous year [2] - Net profit for the first three quarters was 101.03 million yuan, an increase of 28.59% year-on-year [2] - The company received government subsidies amounting to 14.21 million yuan in Q3, contributing over 14% to net profit [3] Acquisition Impact - In August 2025, the company acquired 51% of Fujian Lixing Food Co., Ltd. for 495 million yuan, which was included in the consolidated financial statements in September [3] - This acquisition significantly contributed to the net profit growth, with a substantial portion of the increase being "bought" through this transaction [3] - Accounts receivable surged by 603.71% to 128 million yuan due to the consolidation of the new subsidiary [3] Financial Position Changes - Prepayments increased by 64.43%, and short-term borrowings rose from 0 to 91.79 million yuan, attributed to the new acquisition [4] - Goodwill skyrocketed from 22.42 million yuan to 335 million yuan, indicating potential future impairment risks [5] - Other payables increased by 154.27% to 320 million yuan, primarily due to installment payments for the equity acquisition [5] Business Growth Challenges - The company has faced ongoing challenges with sluggish growth in its core business, with revenue declining for several consecutive years [7] - Historical revenue figures from 2021 to 2024 show a consistent downward trend, with 2025 Q3 continuing this pattern [8][10] - Despite attempts to expand through acquisitions, the core processed food business remains slow-growing [10]

煌上煌:公司卤制品原材料无直接从国外采购的情况

Zheng Quan Ri Bao Wang· 2025-10-14 10:44

Core Viewpoint - The company, Huangshanghuang (002695), confirmed that it does not directly procure raw materials from abroad, mitigating the impact of the current trade tariff war on its supply chain [1] Group 1 - The company sources certain products (such as beef, chicken feet, and chicken tips) through domestic trading companies, indicating a limited reliance on international procurement [1] - The current trade tariff war has not had a direct effect on the company's raw material procurement, ensuring stable supply [1]

绝味食品被罚,董事长等人被警告

Zhong Guo Xin Wen Wang· 2025-10-01 11:46

Core Viewpoint - ST Juewei has been penalized for failing to disclose revenue accurately from 2017 to 2021, leading to a fine of 4 million yuan and warnings for key executives [2][3][4]. Group 1: Regulatory Actions - ST Juewei received an administrative penalty decision from Hunan Securities Regulatory Bureau, confirming violations of information disclosure laws [1][2]. - The company was found to have underreported revenue from franchise store renovation, with discrepancies in annual reports ranging from 1.64% to 5.48% over the years [2][4]. - The penalties include a warning and fines for the company and its executives, totaling 4 million yuan for the company, 200,000 yuan for the chairman, and lesser amounts for other executives [3][4]. Group 2: Financial Performance - In the first half of 2025, ST Juewei reported revenue of 2.82 billion yuan, a year-on-year decrease of 15.57%, and a net profit of 175 million yuan, down 40.71% [4]. - The company attributed the performance decline to a decrease in sales volume during the reporting period [4]. Group 3: Future Actions - ST Juewei plans to adjust its financial statements in response to the penalty and strengthen internal control processes [4]. - The company aims to apply for the removal of risk warnings once conditions are met [4].

未如实披露营收 ST绝味被罚款400万元

Mei Ri Jing Ji Xin Wen· 2025-09-30 14:41

Core Viewpoint - ST Juewei (603517.SH) has been fined 4 million yuan by the Hunan Securities Regulatory Bureau for underreporting revenue from franchise store renovation services from 2017 to 2021, leading to penalties for key executives [1][2][3] Group 1: Regulatory Actions - The company received an administrative penalty notice from the Hunan Securities Regulatory Bureau, which included a fine of 4 million yuan for underreporting revenue [1][3] - Key executives, including former Chairman Dai Wenjun, former CFO Peng Caigang, and former Secretary of the Board Peng Gangyi, were fined 2 million yuan, 1.5 million yuan, and 1 million yuan respectively [1][3] - The company plans to adjust its financial statements and strengthen internal control processes in response to the penalties [3] Group 2: Financial Reporting Issues - From 2017 to 2021, ST Juewei failed to recognize revenue from franchise store renovation, resulting in underreported revenue percentages of 5.48%, 3.79%, 2.20%, 2.39%, and 1.64% for each respective year [2] - Evidence supporting the violations includes contracts, bank statements, and inquiry records [2] Group 3: Company Strategy and Operations - ST Juewei is adjusting its store model, sales channels, and supply chain management in response to changing external conditions [4] - The company is shifting its strategic focus from "deepening the duck neck main business" to "focusing on the braised food sector and deepening niche demands" [4]

研报掘金丨开源证券:煌上煌经营相对稳健,维持“增持”评级

Ge Long Hui A P P· 2025-08-12 09:52

Core Viewpoint - The report from Kaiyuan Securities indicates that Huangshanghuang's revenue has slightly declined, but the company is expected to see a bottom reversal as it is a leading brand in the marinated food industry. With the recovery of external demand, store expansion is anticipated, and the company's operations remain relatively stable, maintaining a "buy" rating [1] Group 1 - In the first half of 2025, the company achieved revenue of 980 million, a year-on-year decline of 7.2%, while the net profit attributable to shareholders reached 77 million, a year-on-year increase of 26.9% [1] - As of the end of Q2 2025, the company had 2,898 fresh goods stores, with a net closure of 762 stores in the first half of the year, indicating ongoing impacts from the external consumption environment [1] Group 2 - By region, in the first half of 2025, the company generated revenue of 440 million, 85 million, and 320 million in Jiangxi, Guangdong, and Zhejiang respectively, with year-on-year declines of 7.1%, 27.0%, and 2.6%. The Guangdong region experienced the most significant impact [1]

起底绝味食品“加盟乱象” 15 亿扩产能保住百亿市值吗?

Sou Hu Cai Jing· 2025-04-25 10:44

Core Viewpoint - The recent financial struggles of Juewei Foods (603517.SH) highlight significant issues in cost control, strategic planning, and brand management, exacerbated by a recent health certificate forgery scandal that has raised concerns about its franchise model [3][6]. Financial Performance - In 2024, Juewei Foods reported a revenue of 6.257 billion yuan, a decrease of 13.84% year-on-year, while net profit fell to 227 million yuan, down 34.04% [3]. - In Q1 2025, the downward trend continued, with revenue and net profit declining by 11.47% and 27.29% respectively [3]. - Sales expenses surged by 23.31% in 2024, reaching 667 million yuan, and further increased by 8.93% in Q1 2025 to 146 million yuan, without effectively boosting performance [4]. Debt and Liquidity Concerns - As of Q1 2025, Juewei Foods had total current liabilities of 1.732 billion yuan, while cash reserves stood at only 905 million yuan, indicating potential liquidity issues [4]. Franchise Model Challenges - The rapid expansion through franchising has led to management challenges, including quality control and compliance issues among franchisees, highlighted by the recent health certificate forgery incident [5][6]. - The company has faced criticism for its inadequate oversight of franchise operations, which has negatively impacted brand reputation [6]. Expansion and Capacity Utilization - Juewei Foods has budgeted 1.56 billion yuan for significant construction projects aimed at expanding processing capacity, despite facing operational pressures [7][9]. - Several processing projects have not achieved expected returns due to underutilization of capacity, raising questions about the feasibility of the expansion plans [9]. Market Dynamics and Brand Management - The evolving market demands higher standards for product quality, service, and brand image, making mere capacity expansion insufficient for maintaining competitive advantage [10].

绝味食品(603517):2024年报及2025年一季报点评:24压力延续,25求变破局

Huachuang Securities· 2025-04-10 03:11

Investment Rating - The report maintains a "Recommended" rating for the company, with a target price of 19.6 yuan [2][8]. Core Views - The company experienced continued pressure in 2024, with total revenue of 6.257 billion yuan, a year-on-year decrease of 13.84%, and a net profit attributable to shareholders of 227 million yuan, down 34.04% year-on-year. The fourth quarter of 2024 saw a revenue drop of 23.8% year-on-year, resulting in a net loss of 211 million yuan [2][4]. - In the first quarter of 2025, total revenue was 1.501 billion yuan, a decrease of 11.47% year-on-year, with a net profit of 120 million yuan, down 27.29% year-on-year [2][4]. - The company is actively exploring changes to improve its situation, focusing on brand upgrades, digital transformation, and lean operations. It aims to stabilize store numbers and improve same-store sales [2][8]. Financial Summary - **2024 Financial Performance**: - Total revenue: 6,257 million yuan - Year-on-year growth rate: -13.8% - Net profit: 227 million yuan - Year-on-year growth rate: -34.0% - Gross margin: 30.5% [4][9] - **2025 Financial Projections**: - Total revenue expected: 5,877 million yuan - Year-on-year growth rate: -6.1% - Net profit expected: 501 million yuan - Year-on-year growth rate: 120.4% - EPS forecast: 0.83 yuan [4][9] - **Valuation Ratios**: - PE ratio for 2025: 20 times - PE ratio for 2026: 16 times - PE ratio for 2027: 14 times [4][9] Market Performance - The company's stock price has shown significant volatility, with a current price of 16.12 yuan, reflecting a challenging market environment [4][8]. Operational Insights - The company faced challenges with store closures, estimating around 2,000 net closures in 2024, impacting revenue and same-store sales negatively [2][8]. - The company is focusing on improving operational efficiency and exploring digital applications in collaboration with Tencent to enhance its business model [2][8].