颜料

Search documents

环球新材国际(06616.HK):11月19日南向资金减持125.6万股

Sou Hu Cai Jing· 2025-11-19 23:40

Core Viewpoint - Southbound funds reduced their holdings in Universal New Materials International (06616.HK) by 1.256 million shares on November 19, 2025, while showing a net increase in holdings over the past trading days [1] Group 1: Southbound Fund Activity - In the last five trading days, southbound funds increased their holdings on four occasions, with a total net increase of 10.378 million shares [1] - Over the past 20 trading days, there were 16 days of net increases, totaling 85.9921 million shares [1] - As of now, southbound funds hold 38.7 million shares of Universal New Materials International, accounting for 31.19% of the company's issued ordinary shares [1] Group 2: Company Overview - Universal New Materials International Holdings Limited primarily engages in the production and sales of pearlescent pigment products and mica-related functional products [2] - The company's pearlescent pigment products include natural mica-based, synthetic mica-based, glass flake-based, silica-based, alumina-based, and aluminum-based pearlescent pigments [2] - The company operates in both the domestic market in China and international markets such as South Korea [2]

港股异动 | 环球新材国际(06616)涨超3% 机构指公司产能扩张或将有利于快速消化收购需求端红利

智通财经网· 2025-11-19 01:54

Core Viewpoint - Global New Materials International (06616) is experiencing a stock price increase of over 3%, currently at HKD 6.87, with a trading volume of HKD 14.8758 million. The company plans to redeem USD 40 million of convertible bonds due on November 8. [1] Company Summary - The company has purchased a total of 1.1218 million shares of its non-wholly owned subsidiary CQV from July to October this year, increasing its total holdings in CQV to 5.5118 million shares, which represents approximately 50.75% of CQV's total issued shares. [1] - The company has made strategic acquisitions of CQV in South Korea and Merck's surface solutions business in Germany, positioning itself as an industry leader and entering the high-end market. [1] - Future plans include expanding domestic pearl pigment production capacity to approximately 48,700 tons, which may help the company quickly capitalize on acquisition-related demand and achieve cost reduction and efficiency improvements through cost control and economies of scale. [1] Industry Summary - The pearlescent pigment industry is considered undervalued by the market, with high growth potential, low price sensitivity, and strong brand moats, naturally leading to high valuation factors. [1] - The global market size for the pearlescent pigment industry has a CAGR of 13.99% from 2016 to 2023, with downstream demand in high-margin and high-priced sectors such as cosmetics and automotive growing even faster. [1]

双乐股份11月12日获融资买入142.63万元,融资余额8063.73万元

Xin Lang Cai Jing· 2025-11-13 01:27

Core Viewpoint - The financial performance of Shuangle Co., Ltd. shows a decline in both revenue and net profit for the first nine months of 2025, alongside low financing balance and high short-selling metrics, indicating potential challenges ahead for the company [1][2]. Financing Summary - On November 12, Shuangle Co., Ltd. had a financing buy-in amount of 1.4263 million yuan, with a financing repayment of 3.4025 million yuan, resulting in a net financing buy of -1.9762 million yuan [1]. - The total financing and securities balance for Shuangle Co., Ltd. as of November 12 is 80.6373 million yuan, which accounts for 2.33% of the circulating market value, indicating a low financing balance compared to the past year [1]. - The company had no short-selling activity on November 12, with a short-selling balance of 0 yuan, which is at a high level compared to the past year [1]. Financial Performance Summary - For the period from January to September 2025, Shuangle Co., Ltd. reported an operating income of 1.11 billion yuan, a year-on-year decrease of 4.94% [2]. - The net profit attributable to the parent company for the same period was 49.4625 million yuan, reflecting a significant year-on-year decline of 49.03% [2]. - Since its A-share listing, the company has distributed a total of 178 million yuan in dividends, with 98 million yuan distributed over the past three years [2]. Company Overview - Shuangle Co., Ltd. is located in Taizhou, Jiangsu Province, and was established on November 28, 1994, with its listing date on July 29, 2021 [1]. - The company's main business involves the research, production, and sales of phthalocyanine and chromium-based pigments, with revenue composition as follows: phthalocyanine pigments 73.45%, chromium-based pigments 16.25%, purple pigments 4.91%, copper phthalocyanine 2.93%, and others 2.45% [1].

港股异动 | 环球新材国际(06616)午后涨近9% 公司近期增持CQV股份 产能投放支撑销量增长

智通财经网· 2025-11-07 06:01

Core Viewpoint - Global New Materials International (06616) is experiencing a significant stock price increase, attributed to its plans for bond redemption and strategic share acquisitions in its subsidiary CQV [1] Company Developments - The company plans to redeem $40 million convertible bonds due on November 8 [1] - From July to October, the company purchased a total of 1.1218 million shares of its non-wholly owned subsidiary CQV, increasing its total holdings to 5.5118 million shares, representing approximately 50.75% of CQV's total issued shares [1] Industry Insights - According to Guojin Securities, the domestic operational entity of Global New Materials has a current production capacity of 33,000 tons for pearlescent pigments, with a long-term plan to increase this capacity to 48,000 tons [1] - The CQV facility in South Korea has a combined production capacity of 2,600 tons [1] - The Tonglu factory's synthetic mica production capacity of 100,000 tons is expected to be completed and operational by the second half of 2025, with expectations for expansion in Guangxi and acquisitions of CQV/Merck to provide channels for capacity digestion [1] - Current domestic synthetic mica production costs remain higher than those of natural mica, with expectations for cost reduction following capacity expansion [1]

双乐股份:公司主要从事酞菁系列及铬系颜料的研发、生产、销售,产品用于油墨、涂料和塑料等领域的着色

Mei Ri Jing Ji Xin Wen· 2025-11-04 02:57

Group 1 - The company primarily engages in the research, production, and sales of phthalocyanine series and chromium-based pigments [2] - The products are utilized in coloring for inks, coatings, and plastics [2] - The company responded to an investor inquiry regarding its involvement in the processing of aromatic amine raw materials, clarifying that its operations do not primarily include the synthesis production of aromatic amines [2]

股市必读:双乐股份(301036)11月3日董秘有最新回复

Sou Hu Cai Jing· 2025-11-03 18:20

Core Viewpoint - The stock of Shuangle Co., Ltd. (301036) closed at 34.81 yuan on November 3, 2025, marking a 2.14% increase with a turnover rate of 3.68% and a trading volume of 25,900 shares, resulting in a transaction value of 89.67 million yuan [1]. Group 1: Company Performance - Shuangle Co., Ltd. experienced a stock price increase of 2.14% on November 3, 2025, closing at 34.81 yuan [1]. - The trading volume for the day was 25,900 shares, with a total transaction value of 89.67 million yuan [1]. Group 2: Investor Relations - The company is currently collaborating with downstream partners on the development of panel-use pigments, indicating a focus on high-tech applications involving nanotechnology and surface chemistry [2]. - The company has not announced any plans to implement stock buybacks as suggested by the China Securities Regulatory Commission, stating that any such plans will be disclosed in accordance with legal regulations [2]. - The main business of the company is focused on phthalocyanine series pigments, clarifying that it does not produce biphenylamine yellow pigments [2]. Group 3: Market Activity - On November 3, 2025, there was a net inflow of 629.08 million yuan from major funds, indicating increased short-term interest in the stock [3]. - Retail investors showed a net outflow of 1,132.82 million yuan, while speculative funds had a net inflow of 503.74 million yuan [3].

双乐股份不超8亿可转债获深交所通过 浙商证券建功

Zhong Guo Jing Ji Wang· 2025-10-31 03:05

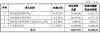

Core Viewpoint - The Shenzhen Stock Exchange's listing review committee approved Shuangle Pigment Co., Ltd.'s issuance of convertible bonds, indicating compliance with issuance, listing, and information disclosure requirements [1] Group 1: Issuance Details - Shuangle Pigment plans to raise up to RMB 80 million through the issuance of convertible bonds, which will be allocated to various projects and working capital [2] - The projects funded by the issuance include high-performance blue-green pigments, high-performance yellow-red pigments, a research center for high-performance functional pigments, and working capital [3] Group 2: Project Investment Breakdown - The total investment for the high-performance blue-green pigment project is RMB 18.5 million, with RMB 16.62 million from the raised funds [3] - The high-performance yellow-red pigment project has a total investment of RMB 46.35 million, with RMB 41.58 million allocated from the raised funds [3] - The research center for high-performance functional pigments requires a total investment of RMB 6 million, with RMB 3.80 million from the raised funds [3] - The working capital will utilize the full RMB 18 million from the raised funds [3] Group 3: Convertible Bond Terms - The convertible bonds will have a duration of six years, with the conversion period starting six months after issuance [3] - The initial conversion price will be determined based on the average stock price over the twenty trading days prior to the announcement of the fundraising plan [4] - The controlling shareholder, Yang Hanzhou, holds 35.23% of the company's shares directly and controls an additional 15.10% indirectly [4]

超五成收入依赖贸易商,颜料紫产品毛利率较低遭监管问询 双乐股份回复

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 02:36

Group 1 - The core viewpoint of the article highlights the increasing revenue share from trade customers for Shuangle Co., which rose from 45.02% in 2022 to 51.94% in the first three quarters of 2025, surpassing production customers [1] - The company justifies its strategy of selling through trade customers due to the diverse downstream applications of pigments, including inks, coatings, and plastics, which require a broad customer base that the company's sales system cannot fully cover [1] - The model aligns with industry practices, as competitors like Baihehua and Shenlanhua have trade customer revenue shares exceeding 70% and 55%, respectively, indicating that Shuangle's current share is within a reasonable range [1] Group 2 - The gross margin for the company's purple pigment products is significantly lower than other categories, with figures of -6.41% in 2022 and 5.44% in the first three quarters of 2025, primarily due to the lack of coverage in the more profitable synthetic segment and low capacity utilization rates [2] - The company has taken measures to control asset impairment risks, with inventory already provisioned for price declines, and the recoverable amount of fixed assets assessed to be above the book value through 2024, indicating no need for impairment provisions [2]

信凯科技10月22日获融资买入313.63万元,融资余额8048.47万元

Xin Lang Cai Jing· 2025-10-23 01:51

Group 1 - The core viewpoint of the news is that Xinkai Technology's stock performance and financial metrics indicate a stable but cautious investment environment, with notable changes in shareholder numbers and financial results [1][2]. Group 2 - As of October 22, Xinkai Technology's stock price remained unchanged at 0.00%, with a trading volume of 22.286 million yuan [1]. - On the same day, the company had a financing buy-in amount of 3.1363 million yuan and a financing repayment of 8.0463 million yuan, resulting in a net financing buy of -4.9101 million yuan [1]. - The total balance of margin trading for Xinkai Technology as of October 22 was 80.4847 million yuan, accounting for 9.15% of its market capitalization [1]. - The company has not engaged in any short selling activities on October 22, with no shares sold or repaid [1]. - Xinkai Technology, established on August 28, 1996, specializes in the development, sales, and services of organic pigments, with a revenue composition of 65.59% from azo pigments, 19.30% from heterocyclic pigments, and smaller contributions from other pigment types [1]. Group 3 - As of October 20, the number of shareholders for Xinkai Technology was 11,500, a decrease of 26.54% from the previous period [2]. - The average number of circulating shares per shareholder increased by 38.93% to 2,043 shares [2]. - For the first half of 2025, Xinkai Technology reported a revenue of 699 million yuan, reflecting a year-on-year growth of 4.91%, and a net profit attributable to shareholders of 54.5651 million yuan, which is an 18.47% increase year-on-year [2]. - The company has distributed a total of 14.0609 million yuan in dividends since its A-share listing [2].

环球新材国际(06616.HK):10月22日南向资金增持1526.2万股

Sou Hu Cai Jing· 2025-10-22 20:47

Core Viewpoint - Southbound funds have significantly increased their holdings in Universal New Materials International (06616.HK), indicating strong investor interest and confidence in the company [1]. Group 1: Shareholding Changes - On October 22, southbound funds increased their holdings by 15.262 million shares, representing a 5.08% change [2]. - Over the past five trading days, there have been five days of net increases, totaling 20.295 million shares [1]. - In the last 20 trading days, there were 13 days of net increases, amounting to 28.427 million shares [1]. Group 2: Current Shareholding Status - As of now, southbound funds hold a total of 316 million shares of Universal New Materials International, which accounts for 25.48% of the company's total issued ordinary shares [1]. Group 3: Company Overview - Universal New Materials International Holdings Limited primarily engages in the production and sales of pearlescent pigment products and mica-related functional products [2]. - The company's product range includes natural mica-based, synthetic mica-based, glass flake-based, silica-based, alumina-based, and aluminum-based pearlescent pigments [2]. - The company operates in both domestic and international markets [2].