碳化硅外延

Search documents

一周港股IPO:遇见小面、拉卡拉等9家递表;赛力斯、小马智行等5家通过聆讯

Cai Jing Wang· 2025-10-20 10:52

Core Viewpoint - The Hong Kong Stock Exchange reported that during the week from October 13 to October 19, 9 companies submitted listing applications, 5 companies passed the hearing, 4 companies launched their IPOs, and 2 new stocks were listed [1]. Group 1: Companies Submitted Listing Applications - Hantian Technology (Xiamen) Co., Ltd. is a leader in the global silicon carbide (SiC) epitaxy industry, focusing on the R&D, mass production, and sales of SiC epitaxy chips, with a projected market share of over 30% in 2024 [2]. - Impression Co., Ltd. is a state-owned cultural tourism service enterprise, ranking eighth in China's cultural tourism performance market in 2024, with revenues of approximately 63.04 million yuan in 2022 [3]. - Guangzhou Yujian Noodle Restaurant Co., Ltd. is the fourth largest operator of Chinese noodle restaurants in China, with a market share of 0.5% in 2024 [4]. - Baishan Cloud Holdings Ltd. is the second largest independent edge cloud service provider in China, with a market share of approximately 2.0% in 2024 [5][6]. - Shouchuang Securities Co., Ltd. is a financial service provider with a strong asset management capability, ranking fifth in revenue growth among 42 A-share listed securities companies from 2022 to 2024 [7]. - Chongqing Qianli Technology Co., Ltd. focuses on AI and mobility solutions, with stable growth in automotive products [8]. - Nanjing Qingtian All Tax Information Technology Co., Ltd. is a leading digital service provider for cross-border enterprises, ranking first in the smart tax solution market in China with a market share of 1.7% in 2024 [9]. - Lakala Payment Co., Ltd. is a leading digital payment provider in Asia, with a market share of 9.4% in 2024 [10]. - Sichuan Xin Hehua Traditional Chinese Medicine Co., Ltd. is one of the largest suppliers of traditional Chinese medicine products in China, ranking second in the market with a 0.4% market share in 2024 [12]. Group 2: Companies Passed Hearing - Seres Group Co., Ltd. focuses on the research, manufacturing, and sales of new energy vehicles, achieving revenues of approximately 340.56 billion yuan in 2022 [13]. - Minglue Technology is a leading data intelligence application software company in China, with revenues of approximately 12.69 billion yuan in 2022 [14]. - Pony AI Inc. specializes in autonomous driving services, with a total operational area exceeding 2000 square kilometers [15]. - Ningbo Joyson Electronic Corp. is a global leader in smart automotive technology solutions, ranking second in China and fourth globally in smart cockpit domain control systems [16][17]. - WeRide Inc. is a pioneer in L4 autonomous driving, with operations in over 30 cities across 11 countries [18]. Group 3: Companies Launched IPOs - Yunji Technology launched its IPO with a subscription that was oversubscribed by 5677 times, raising approximately 189.1 billion HKD [19]. - Haixi New Drug's IPO was delayed for regulatory approval, with a price range of 69.88-86.40 HKD per share [20]. - Jushuitan's IPO was set at 30.60 HKD per share, with a total of 681.66 million shares offered [21]. - Guanghetong's IPO was priced between 19.88-21.5 HKD per share, with a total of approximately 135 million shares offered [21]. Group 4: Newly Listed Stocks - Xuan Bamboo Biotechnology was listed on October 15, 2025, with a closing price of 26.30 HKD per share, reflecting a gain of 126.72% [22]. - Yunji was listed on October 16, 2025, with a closing price of 120.5 HKD per share, reflecting a gain of 26.05% [24].

瀚天天成加码投入备战8英寸外延片竞赛,全球龙头新布局能否扭转业绩?

Zhi Tong Cai Jing· 2025-10-15 13:24

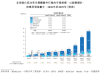

Industry Overview - The silicon carbide (SiC) market is rapidly expanding due to growth in sectors such as electric vehicles, photovoltaic energy storage, data centers, and AR glasses. The global sales of SiC power semiconductor devices are projected to reach $2.6 billion in 2024, with a compound annual growth rate (CAGR) of 45.4% from 2020 to 2024. By 2029, the market size is expected to increase to $13.6 billion, with the penetration rate in the global power semiconductor market rising from 4.9% in 2024 to 17.1% in 2029 [1][4]. Company Performance - Hantian Technology (Xiamen) Co., Ltd. is a leading player in the global SiC epitaxy industry, holding a significant market position. In 2024, the company is expected to capture 31.6% of the global sales volume and 29.2% of the revenue, both ranking first globally. Hantian Technology has been at the forefront of industry innovation, being the first in China to achieve commercial production of 3-inch, 4-inch, 6-inch, and 8-inch SiC epitaxy wafers [6][7]. Revenue Trends - Hantian Technology's revenue has shown volatility, with total revenues of 441 million yuan in 2022, 1.143 billion yuan in 2023, and a projected 974 million yuan in 2024. The revenue structure indicates that sales of epitaxy wafers have consistently been the largest source of income, increasing from 63% in 2022 to 86.4% in 2024. Conversely, the contribution from epitaxy wafer foundry services has declined significantly [7][10]. Market Dynamics - The price of SiC epitaxy wafers has been on a downward trend due to reduced raw material costs and technological advancements. For instance, the average price of 6-inch SiC epitaxy wafers is expected to drop from 11,400 yuan in 2020 to approximately 4,400 yuan by 2029, indicating a potential decline of nearly 40% [11][12]. Strategic Initiatives - To ensure sustained growth, Hantian Technology is focusing on technological innovation and scaling up production to reduce costs. The company has made significant progress in 8-inch SiC epitaxy technology, which is anticipated to enhance production efficiency and lower unit costs. By expanding the production of 8-inch wafers, Hantian Technology aims to capture a larger market share and improve profitability [12][13].

新股前瞻|瀚天天成加码投入备战8英寸外延片竞赛,全球龙头新布局能否扭转业绩?

智通财经网· 2025-10-15 13:19

Industry Overview - The silicon carbide (SiC) market is rapidly expanding due to growth in sectors such as electric vehicles, photovoltaic energy storage, data centers, and AR glasses. The global sales of SiC power semiconductor devices are projected to reach $2.6 billion in 2024, with a compound annual growth rate (CAGR) of 45.4% from 2020 to 2024. By 2029, the market size is expected to grow to $13.6 billion, increasing the penetration rate from 4.9% in 2024 to 17.1% in 2029 [1][4]. Company Performance - Hantian Technology (Xiamen) Co., Ltd. is a leading player in the global SiC epitaxy industry, holding a significant market share of 31.6% in sales and 29.2% in revenue in 2024. The company has established itself as a pioneer in the commercialization of various sizes of SiC epitaxial wafers [6][7]. - The company's revenue has shown volatility, with total revenues of 441 million yuan in 2022, 1.143 billion yuan in 2023, and a decline to 974 million yuan in 2024. The revenue from epitaxial wafer sales has consistently increased, accounting for 86.4% of total revenue in 2024 [7][10]. Market Dynamics - The SiC epitaxial wafer market is expected to grow from $1.2 billion in 2024 to $5.8 billion by 2029, with a CAGR of 38.2%. The quality of SiC epitaxial wafers is crucial, as they represent about 25% of the value chain of SiC power devices [4]. - The average price of 6-inch SiC epitaxial wafers has been declining, projected to drop from 7,300 yuan in 2024 to 4,400 yuan by 2029, indicating a potential decrease of nearly 40% [11]. Strategic Initiatives - Hantian Technology is focusing on technological innovation and scaling up production to maintain its competitive edge. The company has successfully developed 8-inch SiC epitaxial wafer technology and established partnerships with 18 companies for mass supply [12][13]. - The sales of 8-inch SiC epitaxial wafers are expected to increase significantly, from 285 units in 2023 to 7,466 units in 2024, with 2,914 units sold in the first five months of 2025, reflecting a substantial growth trajectory [13].

瀚天天成递表港交所 中金公司为独家保荐人

Zheng Quan Shi Bao Wang· 2025-10-15 00:26

Core Viewpoint - Hantian Technology has submitted a listing application to the Hong Kong Stock Exchange, with CICC as the sole sponsor [1] Group 1: Company Overview - Hantian Technology is the world's first mass producer of 8-inch silicon carbide (SiC) epitaxial chips and the first in China to achieve mass supply of 3, 4, 6, and 8-inch SiC epitaxial chips [1] - As of 2023, Hantian Technology is the largest SiC epitaxial supplier globally by sales volume, with a market share exceeding 30% projected for 2024 [1] - The company has sold over 164,000 SiC epitaxial chips cumulatively by 2024, with total deliveries exceeding 500,000 chips during the historical performance period [1] Group 2: Industry Leadership - Hantian Technology leads the global SiC epitaxial industry and has established the first and only SEMI industry standard for SiC epitaxy [1] - The company's customer base includes 4 out of the top 5 global SiC power device giants and 7 out of the top 10 power device companies [1] Group 3: Application Areas - SiC epitaxial chips are applicable in a wide range of sectors, including electric vehicles, charging infrastructure, renewable energy, energy storage, home appliances, AI computing, data centers, smart grids, and eVTOL [1]

瀚天天成再度递表港交所 为全球率先实现8英吋碳化硅外延芯片大批量外供的生产商

Zhi Tong Cai Jing· 2025-10-14 22:47

Core Viewpoint - Hantian Technology (Xiamen) Co., Ltd. has submitted a new listing application to the Hong Kong Stock Exchange, with CICC as the sole sponsor. The company is a leader in the silicon carbide (SiC) epitaxy industry and has achieved significant milestones in the mass production of SiC epitaxy chips [1][4]. Group 1: Company Overview - Hantian Technology is the world's first manufacturer to achieve mass production of 8-inch silicon carbide epitaxy chips and is the first in China to commercialize 3-inch, 4-inch, 6-inch, and 8-inch SiC epitaxy chips [1]. - The company is recognized as the largest supplier of silicon carbide epitaxy chips globally, with a market share exceeding 30% in 2024 [4]. - Hantian Technology has established the first and only international industry standard for silicon carbide epitaxy through the Semiconductor Equipment and Materials International (SEMI) association [9]. Group 2: Market Position and Clientele - The company has a broad and loyal customer base, serving 123 clients, including 4 out of the top 5 global silicon carbide power device manufacturers and 7 out of the top 10 [9]. - The applications of Hantian Technology's SiC epitaxy chips include electric vehicles, charging infrastructure, renewable energy, energy storage systems, and emerging applications such as home appliances, AI computing, data centers, smart grids, and eVTOL [9]. Group 3: Financial Performance - The revenue figures for Hantian Technology are as follows: approximately 441 million RMB in 2022, 1.144 billion RMB in 2023, 974 million RMB in 2024, and 266 million RMB for the first five months of 2025 [10][11]. - The profit figures for the same periods are approximately 143 million RMB, 122 million RMB, 166 million RMB, and 14 million RMB respectively [10][11]. - The company has experienced significant growth in revenue, with a notable increase in sales volume of SiC epitaxy chips, totaling over 164,000 chips sold in 2024 and over 500,000 chips delivered during the historical record period [9][10].

新股消息 | 瀚天天成港股IPO招股书失效

智通财经网· 2025-10-09 12:04

Group 1 - The core point of the article is that Hantian Technology (Xiamen) Co., Ltd. has seen its Hong Kong IPO application expire after six months, with CICC serving as the sole sponsor during the application process [1] - Hantian Technology is recognized as a leader and innovator in the global silicon carbide (SiC) epitaxy industry [2] - According to a report by Zhi Shi Consulting, Hantian Technology is the largest supplier of silicon carbide epitaxy globally in terms of sales volume since 2023, with a market share exceeding 30% in 2024 [2]

瀚天天成港股IPO招股书失效

Zhi Tong Cai Jing· 2025-10-09 12:03

Group 1 - The company Hantian Technology (Xiamen) Co., Ltd. submitted its Hong Kong IPO prospectus on April 8, which became invalid after six months on October 8, with China International Capital Corporation (CICC) as the sole sponsor [1] - Hantian Technology is recognized as a leader and innovator in the global silicon carbide (SiC) epitaxy industry [2] - According to a report by Zhi Shi Consulting, Hantian Technology is the largest supplier of silicon carbide epitaxy globally in terms of sales volume since 2023, with a market share exceeding 30% in 2024 [2]

港股IPO周报:碳化硅外延巨头瀚天天成递表 正力新能招股获微幅超额申购

Xin Lang Cai Jing· 2025-04-13 06:10

Group 1: New Listings and Filings - Five companies submitted applications for listing on the Hong Kong Stock Exchange from April 7 to April 13, 2023 [2] - Hantian Technology (Xiamen) Co., Ltd. is a global leader in the silicon carbide (SiC) epitaxy industry, with a projected market share exceeding 30% in 2024 [2] - IFBH Limited, a rapidly growing beverage and food company based in Thailand, has a market share of approximately 34% in the coconut water market in mainland China for 2024 [3] - Jihong Co., Ltd. focuses on cross-border social e-commerce and packaging solutions, ranking second in the B2C export e-commerce sector in China with a market share of 1.3% [3] - Jiangxi Biological Products Research Institute is the largest provider of human tetanus antitoxin in China, with a market share of 65.8% in 2024 [4] Group 2: Financial Performance - Hantian Technology's projected revenues for 2022, 2023, and 2024 are approximately RMB 441 million, RMB 1.143 billion, and RMB 974 million, respectively [2] - IFBH Limited's revenues for 2023 and 2024 are expected to be approximately RMB 87.44 million and about USD 158 million, with net profits of RMB 16.75 million and USD 33.32 million [3] - Jihong Co., Ltd. anticipates revenues of approximately RMB 5.376 billion, RMB 6.695 billion, and RMB 5.529 billion for 2022, 2023, and 2024, respectively [3] - Jiangxi Biological's projected revenues for 2022, 2023, and 2024 are approximately RMB 142 million, RMB 198 million, and RMB 221 million, respectively [4] - Ming Kee Hospital Group, the largest private hospital group in East China, expects revenues of approximately RMB 2.336 billion, RMB 2.688 billion, and RMB 2.659 billion for 2022, 2023, and 2024 [5] Group 3: Upcoming IPOs - Zhengli New Energy plans to offer 121.5 million H-shares at an IPO price of HKD 8.27, with net proceeds of HKD 928 million [5] - Ying'en Biotechnology-B is set to offer 15.0716 million shares with a price range of HKD 94.6 to HKD 103.2, expected to start trading on April 15, 2025 [6]