碳化硅功率半导体

Search documents

长飞先进完成超10亿元A+轮融资,董事长庄丹三年从长飞光纤领薪1663万元

Sou Hu Cai Jing· 2026-02-09 06:41

Core Viewpoint - Changfei Advanced Semiconductor Co., Ltd. has successfully completed an A+ round of equity financing exceeding 1 billion yuan, led by Jiangcheng Fund and Changjiang Industrial Group, with participation from other institutions [1][4] Group 1: Financing Details - The financing will primarily be used for the technological layout of the silicon carbide power semiconductor full industry chain, aiming to accelerate the company's capture of the global market in emerging fields [4] - The company was established in January 2018 and focuses on the research and manufacturing of silicon carbide power semiconductor products, possessing full industry chain capabilities from epitaxial growth to module packaging [4] Group 2: Product and Application - Changfei Advanced has a 6-inch production line and offers products including SiC SBD and MOSFET series, which are applied in sectors such as new energy vehicles, photovoltaics, energy storage, charging piles, and power grids [4] Group 3: Leadership and Compensation - The chairman of Changfei Advanced is Zhuang Dan, who holds a doctorate and previously served as the financial director of Changfei Optical Fiber, now acting as the executive director and president [4] - Zhuang Dan has led the strategic layout and development of the company in the third-generation semiconductor field, positioning it as a leading player in the domestic silicon carbide power semiconductor sector [4] - According to data from Dongfang Caifu, Zhuang Dan's compensation from Changfei Optical Fiber exceeded 5 million yuan annually from 2022 to 2024, totaling 16.63 million yuan over three years [4]

长飞光纤光缆午前涨逾16% 机构看好公司业绩随光纤价格上涨改善

Xin Lang Cai Jing· 2026-02-09 03:39

Group 1 - The core viewpoint of the article highlights that Changfei Optical Fiber and Cable (06869) has seen a significant stock price increase, reaching a new high of 106.20 HKD, with a current price of 105.10 HKD, reflecting a 15.75% rise and a trading volume of 2.095 billion HKD [1] - Huayuan Securities notes that fiber optic prices have been steadily increasing for about six months, with G.652.D bare fiber prices rising from less than 20 RMB per core kilometer, and are expected to accelerate after 2026 due to a reversal in supply and demand dynamics [1] - The increase in fiber optic prices is driven by a supply-side capacity reduction and accelerated demand from AI data center construction, leading to a supply shortage across various types of fiber optics [1] Group 2 - Changfei Optical Fiber and Cable's subsidiary announced the completion of over 1 billion RMB in A+ round equity financing on February 6, with investments led by Jiangcheng Fund and Changjiang Industrial Group, among others [1] - The financing will primarily be used for the technological layout of the silicon carbide power semiconductor full industry chain, aiming to accelerate the company's entry into emerging global markets [1]

新股前瞻|瀚天天成加码投入备战8英寸外延片竞赛,全球龙头新布局能否扭转业绩?

智通财经网· 2025-10-15 13:19

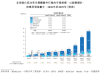

Industry Overview - The silicon carbide (SiC) market is rapidly expanding due to growth in sectors such as electric vehicles, photovoltaic energy storage, data centers, and AR glasses. The global sales of SiC power semiconductor devices are projected to reach $2.6 billion in 2024, with a compound annual growth rate (CAGR) of 45.4% from 2020 to 2024. By 2029, the market size is expected to grow to $13.6 billion, increasing the penetration rate from 4.9% in 2024 to 17.1% in 2029 [1][4]. Company Performance - Hantian Technology (Xiamen) Co., Ltd. is a leading player in the global SiC epitaxy industry, holding a significant market share of 31.6% in sales and 29.2% in revenue in 2024. The company has established itself as a pioneer in the commercialization of various sizes of SiC epitaxial wafers [6][7]. - The company's revenue has shown volatility, with total revenues of 441 million yuan in 2022, 1.143 billion yuan in 2023, and a decline to 974 million yuan in 2024. The revenue from epitaxial wafer sales has consistently increased, accounting for 86.4% of total revenue in 2024 [7][10]. Market Dynamics - The SiC epitaxial wafer market is expected to grow from $1.2 billion in 2024 to $5.8 billion by 2029, with a CAGR of 38.2%. The quality of SiC epitaxial wafers is crucial, as they represent about 25% of the value chain of SiC power devices [4]. - The average price of 6-inch SiC epitaxial wafers has been declining, projected to drop from 7,300 yuan in 2024 to 4,400 yuan by 2029, indicating a potential decrease of nearly 40% [11]. Strategic Initiatives - Hantian Technology is focusing on technological innovation and scaling up production to maintain its competitive edge. The company has successfully developed 8-inch SiC epitaxial wafer technology and established partnerships with 18 companies for mass supply [12][13]. - The sales of 8-inch SiC epitaxial wafers are expected to increase significantly, from 285 units in 2023 to 7,466 units in 2024, with 2,914 units sold in the first five months of 2025, reflecting a substantial growth trajectory [13].

韩国芯片,急了

半导体行业观察· 2025-09-16 01:39

Group 1: South Korea's Semiconductor Dominance - South Korea's semiconductor industry, led by SK Hynix and Samsung, holds a significant market share in DRAM and NAND, with a combined 70% share in DRAM and nearly half in NAND [1][3] - The country's semiconductor exports are projected to reach a record $142 billion in 2024, accounting for one-fifth of total exports [1] Group 2: AI Chip Development - The South Korean government announced a plan to invest 150 trillion KRW (approximately $108 billion) over the next five years to develop AI, semiconductors, biotechnology, defense, robotics, and green transportation [3] - Rebellions, a South Korean AI chip company, has raised $225 million since its inception in 2020 and is known for its energy-efficient AI computing chips [4] - Sapeon Korea, an AI chip startup under SK Telecom, became South Korea's first AI chip unicorn with a valuation of 1.3 trillion KRW (approximately $1 billion) [4] Group 3: SiC Semiconductor Focus - South Korea aims to increase its self-sufficiency in SiC (silicon carbide) power semiconductors from 10% to 20% by 2028, with a government investment of 902 billion KRW [9][10] - SK Siltron CSS holds a 6% share of the global SiC wafer market and has signed a long-term supply contract with Infineon Technologies [10] - The South Korean government is also focusing on developing core technologies for SiC chips and has plans to build demonstration infrastructure [10][11] Group 4: Industry Challenges and Opportunities - South Korea has approximately 160 fabless companies, significantly fewer than China's over 3,000, indicating a need for growth in this sector [16][17] - The local market's capacity to absorb semiconductor production remains a concern, especially in the context of geopolitical tensions affecting global supply chains [17]

6家SiC企业竞相布局,将抢占哪些风口?

行家说三代半· 2025-04-22 09:45

插播: 英诺赛科、能华半导体、致能半导体、京东方华灿光电、镓奥科技等已确认参编《2024-2025氮化镓(GaN)产业调研白皮书》, 参 编咨询 请联系许若冰(hangjiashuo999)。 近期,碳化硅功率半导体领域进展不断,三菱电机、 华润微电子、 方正微电子、 至信微电子、 派恩杰半导体、 纳微半导体纷纷推出创新产品。这些新品凭 借高效、节 能、可靠的性能优势,正加速推动各应用领域的技术升级与能效提升。 三菱电机: 发布家电用SiC模块 4月15日, 三菱电机集团宣布,将于4月22日开始供应两款新型空调及家电用SLIMDIP系列功率半导体模块样品——全SiC SLIMDIP(PSF15SG1G6)和混合 SiC SLIMDIP(PSH15SG1G6)。 作为该企业SLIMDIP系列中首款采用SiC技术的紧凑型端子优化模块,这两款产品在小型至大型电器应用中均能实现优异的输出性能与功耗降低,显著提升能 效表现。 此外,三菱电机新开发的SiC MOSFET芯片已集成至两款新型SLIMDIP封装中。与现行硅基逆导型绝缘栅双极晶体管(RC-IGBT)SLIMDIP模块相比,新型SiC 模块可为大容量家电提供更高 ...