碳化硅外延晶片

Search documents

华为加持!国内SiC厂商冲击港股IPO

Sou Hu Cai Jing· 2026-02-09 07:48

2026年2月6日,中国证监会官网正式发布《瀚天天成电子科技(厦门)股份有限公司境外发行上市及境 内未上市股份"全流通"备案通知书》,标志着瀚天天成赴港上市已完成境内监管层面关键前置程序,即 将进入港交所聆讯与挂牌流程。 公司产品覆盖6英寸、8英寸等主流规格外延片,广泛应用于新能源汽车、光伏储能、工业电源、轨道交 通等战略性新兴领域,可满足车规级、工业级等不同场景的高端应用需求。 根据证监会备案通知书内容,瀚天天成拟发行不超过3767.89万股境外上市普通股,同时,公司39名股 东拟将所持合计9743.16万股境内未上市股份转为境外上市股份,在香港联合交易所上市流通。 股东结构上,创始人赵建辉直接持股28.85%,为控股股东;华为旗下哈勃科技以4.03%持股位列第五大 股东,与华润微电子(2.69%)、厦门国资等形成战略股东阵营。 | 股东信息 # 云股网站 股东维度 43 | 27 1732 历史般用值值 历史般东银师 | 更新日期:2025-10-07 发起人类型 · | 特龄比例 = | Q 点击进行假家 | 《企查费 ■ 合示 | | --- | --- | --- | --- | --- | --- ...

66岁厦大博士,创业15年二闯IPO

3 6 Ke· 2025-10-21 00:19

Core Insights - Hantian Technology has submitted a listing application to the Hong Kong Stock Exchange after previously attempting to list on the Sci-Tech Innovation Board without success [1] - The company is the largest supplier of silicon carbide epitaxial wafers globally, holding over 30% market share in 2024 and leading in shipment volumes for two consecutive years [1][2] - Hantian Technology's products are widely used in electric vehicles, renewable energy, and smart appliances, among other applications [2] Financial Performance - Revenue figures from 2022 to May 2025 show significant fluctuations, with revenues of 440 million, 1.143 billion, 974 million, and 266 million yuan respectively [2] - Net profits during the same period were 143 million, 122 million, 166 million, and 14 million yuan, indicating a strong correlation with market demand and competitive pressures [2][3] Market Challenges - The company faces increased competition and price wars due to domestic capacity expansion in silicon carbide epitaxial wafers, leading to a decline in its foundry business, which constituted nearly one-third of its operations [3] - The sales contribution of 6-inch silicon carbide epitaxial wafers remains high at 94.8%, while the 8-inch wafers have seen a rise to 4.9% [3] Technological Leadership - Hantian Technology is recognized for being the first to achieve mass production of 8-inch silicon carbide epitaxial wafers and has developed various sizes for commercial supply [2][4] - The company’s founder, Zhao Jianhui, has over 35 years of experience in silicon carbide technology and has led significant advancements in the field [4][5] Investment and Partnerships - The company has received substantial support from Xiamen state-owned assets, with multiple rounds of investment totaling 1.03 billion yuan for expansion and production upgrades [5] - Hantian Technology has established partnerships with 18 global enterprises for 8-inch products, aiming for an annual production capacity of 463,000 wafers by 2029 [6]

瀚天天成加码投入备战8英寸外延片竞赛,全球龙头新布局能否扭转业绩?

Zhi Tong Cai Jing· 2025-10-15 13:24

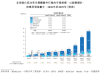

Industry Overview - The silicon carbide (SiC) market is rapidly expanding due to growth in sectors such as electric vehicles, photovoltaic energy storage, data centers, and AR glasses. The global sales of SiC power semiconductor devices are projected to reach $2.6 billion in 2024, with a compound annual growth rate (CAGR) of 45.4% from 2020 to 2024. By 2029, the market size is expected to increase to $13.6 billion, with the penetration rate in the global power semiconductor market rising from 4.9% in 2024 to 17.1% in 2029 [1][4]. Company Performance - Hantian Technology (Xiamen) Co., Ltd. is a leading player in the global SiC epitaxy industry, holding a significant market position. In 2024, the company is expected to capture 31.6% of the global sales volume and 29.2% of the revenue, both ranking first globally. Hantian Technology has been at the forefront of industry innovation, being the first in China to achieve commercial production of 3-inch, 4-inch, 6-inch, and 8-inch SiC epitaxy wafers [6][7]. Revenue Trends - Hantian Technology's revenue has shown volatility, with total revenues of 441 million yuan in 2022, 1.143 billion yuan in 2023, and a projected 974 million yuan in 2024. The revenue structure indicates that sales of epitaxy wafers have consistently been the largest source of income, increasing from 63% in 2022 to 86.4% in 2024. Conversely, the contribution from epitaxy wafer foundry services has declined significantly [7][10]. Market Dynamics - The price of SiC epitaxy wafers has been on a downward trend due to reduced raw material costs and technological advancements. For instance, the average price of 6-inch SiC epitaxy wafers is expected to drop from 11,400 yuan in 2020 to approximately 4,400 yuan by 2029, indicating a potential decline of nearly 40% [11][12]. Strategic Initiatives - To ensure sustained growth, Hantian Technology is focusing on technological innovation and scaling up production to reduce costs. The company has made significant progress in 8-inch SiC epitaxy technology, which is anticipated to enhance production efficiency and lower unit costs. By expanding the production of 8-inch wafers, Hantian Technology aims to capture a larger market share and improve profitability [12][13].

新股前瞻|瀚天天成加码投入备战8英寸外延片竞赛,全球龙头新布局能否扭转业绩?

智通财经网· 2025-10-15 13:19

Industry Overview - The silicon carbide (SiC) market is rapidly expanding due to growth in sectors such as electric vehicles, photovoltaic energy storage, data centers, and AR glasses. The global sales of SiC power semiconductor devices are projected to reach $2.6 billion in 2024, with a compound annual growth rate (CAGR) of 45.4% from 2020 to 2024. By 2029, the market size is expected to grow to $13.6 billion, increasing the penetration rate from 4.9% in 2024 to 17.1% in 2029 [1][4]. Company Performance - Hantian Technology (Xiamen) Co., Ltd. is a leading player in the global SiC epitaxy industry, holding a significant market share of 31.6% in sales and 29.2% in revenue in 2024. The company has established itself as a pioneer in the commercialization of various sizes of SiC epitaxial wafers [6][7]. - The company's revenue has shown volatility, with total revenues of 441 million yuan in 2022, 1.143 billion yuan in 2023, and a decline to 974 million yuan in 2024. The revenue from epitaxial wafer sales has consistently increased, accounting for 86.4% of total revenue in 2024 [7][10]. Market Dynamics - The SiC epitaxial wafer market is expected to grow from $1.2 billion in 2024 to $5.8 billion by 2029, with a CAGR of 38.2%. The quality of SiC epitaxial wafers is crucial, as they represent about 25% of the value chain of SiC power devices [4]. - The average price of 6-inch SiC epitaxial wafers has been declining, projected to drop from 7,300 yuan in 2024 to 4,400 yuan by 2029, indicating a potential decrease of nearly 40% [11]. Strategic Initiatives - Hantian Technology is focusing on technological innovation and scaling up production to maintain its competitive edge. The company has successfully developed 8-inch SiC epitaxial wafer technology and established partnerships with 18 companies for mass supply [12][13]. - The sales of 8-inch SiC epitaxial wafers are expected to increase significantly, from 285 units in 2023 to 7,466 units in 2024, with 2,914 units sold in the first five months of 2025, reflecting a substantial growth trajectory [13].

瀚天天成招股书解读:营收下滑29.99%,毛利率降26pct,多风险待解

Xin Lang Cai Jing· 2025-10-15 00:30

Core Viewpoint - Hantian Technology (Xiamen) Co., Ltd. is pursuing an IPO in Hong Kong, revealing significant financial and operational information in its prospectus, indicating notable revenue and gross margin fluctuations alongside various risks [1] Business Focus - The company specializes in the research, production, and sales of silicon carbide (SiC) epitaxial wafers, becoming the largest global supplier by sales volume in 2023, with a projected market share exceeding 30% in 2024. Its products are utilized in electric vehicles and charging infrastructure [2] Business Models - Hantian operates two business models: direct sales of epitaxial wafers, where it procures raw materials and produces the wafers, and a contract manufacturing model, where clients provide substrates, and the company grows the epitaxial layers, charging for materials and services [3] Financial Performance - Revenue experienced significant growth of 159.3% in 2023, reaching 1.1425 billion yuan, but is projected to decline to 974.3 million yuan in 2024, a decrease of 14.7%, primarily due to reduced sales in the contract manufacturing model. For the first five months of 2025, revenue was 266.4 million yuan, down 29.99% from the same period in 2024 [4][5] - Net profit fluctuated, with figures of 143.4 million yuan in 2022, 121.9 million yuan in 2023, and a projected decline in 2025 due to lower chip prices and ongoing costs [5][6] - Gross margin decreased from 44.7% in 2022 to 39.0% in 2023, further dropping to 34.1% in 2024, and 18.7% in the first five months of 2025, reflecting challenges from service mix changes and increased competition [6][7] - Net profit margin also showed a declining trend, with rates of approximately 32.54% in 2022, 10.67% in 2023, and 5.29% in the first five months of 2025 [8] Revenue Composition - The revenue from epitaxial wafer sales constituted a significant portion of total income, with figures of 847.7 million yuan in 2023 and 839.6 million yuan in 2024. Contract manufacturing revenue decreased from 292.8 million yuan in 2023 to 121.1 million yuan in 2024 [9] Operational Risks - The company faces risks from related party transactions, with overlapping identities among major clients and suppliers, leading to potential conflicts of interest [10] - The semiconductor industry is undergoing inventory adjustments, impacting sales and pricing, with the company implementing strategies to expand its customer base [10] - Intense competition exists within the industry, necessitating continuous innovation to maintain market leadership [11] - High customer concentration poses risks, as the top five clients accounted for 86.5% of sales in 2022, with potential impacts from any decline in their purchasing [12] - Supplier concentration is also high, with the top five suppliers representing a significant portion of procurement costs, which could affect operations if their financial health changes [13] - The ownership structure may pose risks, as a concentrated shareholding could lead to decisions that may not align with broader shareholder interests [14] - Concerns exist regarding the incentive structure for core management, which may lead to increased compensation and impact overall performance [15] - The company faces multiple risks, including technological innovation, market competition, pricing pressures, and geopolitical factors [16]

瀚天天成递表港交所 高额政府补助支撑利润增长

Ju Chao Zi Xun· 2025-10-14 15:17

Core Viewpoint - Hantian Technology (Xiamen) Co., Ltd. has submitted an IPO application to the Hong Kong Stock Exchange, with CICC as the exclusive sponsor, amidst a competitive global semiconductor industry and China's push for self-sufficiency in the supply chain [1][3]. Group 1: Company Overview - Hantian Technology specializes in the research, production, and sales of silicon carbide (SiC) epitaxial wafers, which are crucial for third-generation wide bandgap semiconductor materials [3]. - The company's products have extensive applications in sectors such as electric vehicles, photovoltaic power generation, smart grids, rail transportation, and aerospace [3]. Group 2: Financial Performance - The company's revenue for the years 2022 to 2024 was reported as 441 million yuan, 1.143 billion yuan, and 974 million yuan, respectively, indicating a revenue decline of 14.72% in 2024 [3]. - Despite the revenue drop, the company's profit for 2024 increased to 166 million yuan, a year-on-year growth of 36.52% [3]. - The significant increase in profit is largely attributed to government subsidies, which rose to 1.35 billion yuan, 4.74 billion yuan, and 1.119 billion yuan over the same period, with subsidies accounting for 67.24% of the profit in 2024 [3][4]. Group 3: Operational Adjustments - The company has significantly reduced its workforce from a peak of 833 employees at the end of 2023 to 592 by the end of 2024, resulting in a turnover rate of 28.93% [4]. - This reduction in personnel is seen as a strategy to maintain profit margins amid declining revenue, raising concerns about the company's business expansion pace and internal management [4]. Group 4: Future Prospects - Hantian Technology aims to raise funds through its IPO to enhance its research capabilities and expand production capacity, capitalizing on the long-term growth in demand for silicon carbide driven by global energy transition [4].

瀚天天成电子科技(厦门)股份有限公司(H0085) - 申请版本(第一次呈交)

2025-10-13 16:00

香港交易及結算所有限公司、香港聯合交易所有限公司與證券及期貨事務監察委員會對本申請版本的內容 概不負責,對其準確性或完整性亦不發表任何意見,並明確表示概不就因本申請版本全部或任何部分內容 而產生或因倚賴該等內容而引致的任何損失承擔任何責任。 Epiworld International Co., Ltd. 瀚天天成电子科技(厦门)股份有限公司 (「本公司」) (於中華人民共和國註冊成立的股份有限公司) 的申請版本 警告 本申請版本乃根據香港聯合交易所有限公司(「聯交所」)及證券及期貨事務監察委員會(「證監 會」)的要求而刊發,僅用作提供資料予香港公眾人士。 本文件為草擬本,屬不完整並可予更改,且本文件須與本文件封面「警告」一節一併閱讀。 重要提示 重要提示:如 閣下對本文件任何內容有任何疑問,應徵詢獨立專業意見。 Epiworld International Co., Ltd. 瀚天天成电子科技(厦门)股份有限公司 (於中華人民共和國註冊成立的股份有限公司) [編纂] [編纂]的[編纂]數目 : [編纂]股H股(視乎[編纂] 行使情況而定) [編纂]數目 : [編纂]股H股(可予重新分配) [編纂]數目 : ...

瀚天天成赴港IPO:全球最大碳化硅外延晶片供应商,近三年毛利率持续下滑

Sou Hu Cai Jing· 2025-05-20 07:53

Core Viewpoint - Hantian Technology is planning to go public on the Hong Kong Stock Exchange, focusing on the development, mass production, and sales of silicon carbide (SiC) epitaxial wafers, with a significant market share in the industry [1][4]. Group 1: Company Overview - Hantian Technology was established in 2011 and specializes in SiC epitaxial wafer technology, with applications in electric vehicles (EVs), ultra-fast charging stations, energy storage systems (ESS), energy supply, and data centers [1]. - The company is entering new markets, including next-generation home appliances, high-speed rail, electric ships, and low-altitude flight applications [1]. - According to a report by Zhaoshang Consulting, Hantian Technology is the largest supplier of SiC epitaxial wafers globally in terms of sales volume since 2023, with a market share exceeding 30% in 2024 [1]. Group 2: Business Model - Hantian Technology operates under two business models: sales of epitaxial wafers and epitaxial wafer foundry services [1]. - In the sales model, the company procures raw materials, produces, and delivers products, providing a one-stop solution [1]. - In the foundry model, clients provide substrates, while the company procures other auxiliary materials, grows the SiC epitaxial layer, and delivers the final product to clients [1]. Group 3: Financial Performance - The company's revenue for 2022, 2023, and 2024 was 441 million, 1.143 billion, and 974 million respectively, indicating revenue volatility with a 14.72% year-on-year decline in 2024 [1][4]. - The gross profit margin decreased from 44.7% in 2022 to 34.1% in 2024, primarily due to a decline in SiC epitaxial wafer prices [1]. - Net profit figures for the same years were 143 million, 122 million, and 166 million, with the increase in 2024 attributed to government subsidies amounting to 112 million, which constituted 67.24% of total profit [4]. Group 4: IPO Plans - Hantian Technology previously applied for a listing on the Sci-Tech Innovation Board in December 2023 but withdrew the application in June 2024 based on its corporate development strategy [4]. - The company plans to use the proceeds from the IPO to expand SiC epitaxial chip production capacity, enhance research and development, and for general corporate purposes [6].

260亿,厦门超级IPO来了

投中网· 2025-04-23 06:35

将投中网设为"星标⭐",第一时间收获最新推送 厦门冲出一个明星独角兽。 作者丨 鲁智高 来源丨 投中网 一家厦门的明星独角兽,正朝着港股冲去。 近日,瀚天天成申请在港上市。在赵建辉的带领下,这家碳化硅外延晶片提供商,三年共卖出超过 45 万片晶片,一年的收入接近 10 亿元。 这个成功的故事背后,离不开厦门的大力支持。在厦门的邀请下,已经是美国罗格斯大学终身教授的赵建辉最终选择回国创业,这才有了瀚天天成。此 后,在政策、资金等方面,厦门为这家公司的发展提供了众多帮助。 一路走来,瀚天天成获得赛富投资基金、哈勃投资、厦门高新投、厦门火炬集团、中南创投、海通新能源、华润微电子、金圆集团、工银投资、工银资 本等青睐,同时还成为 AIC 股权投资扩大试点政策出台后,厦门首个双落地 AIC 基金首单投资项目,估值超过 260 亿元。 通过专注于碳化硅技术发展研究和开发,赵建辉不仅成为最早一批开展第三代半导体碳化硅研究的学者,同时还是全球首位因对碳化硅技术研究和产业 应用做出重大贡献而获选 IEEE Fellow 的研究者。 为了让国人享受到碳化硅半导体带来的转型发展红利,更是要让这一产业的核心技术实现"中国造",赵建辉 ...

这家“全球第一”来IPO了!近七成收入靠亚洲!仅3.4%来自北美!

IPO日报· 2025-04-15 08:57

制图:佘诗婕 业绩波动 瀚天天成成立于2011年,主要从事碳化硅外延晶片的研发、量产及销售。 星标 ★ IPO日报 精彩文章第一时间推送 近日,瀚天天成电子科技(厦门)股份有限公司 ( 下称" 瀚天天成 ")在港交所递交招股书,拟在港交所主板上市,独家保荐人是中金公 司。 作为全球最大的碳化硅外延供应商,瀚天天成拥有全球前5大碳化硅功率器件巨头中的4家作客户,年收入9.74亿元,毛利率高达34.1%,近七成 收入来自亚洲客户,仅有3.4%的收入来自北美洲客户。 此前,瀚天天成曾于2023年12月向上交所提交了A股上市申请,但半年后主动终止了上市之旅,这次谋求港交所IPO,能成功吗? 2022年-2024年(下称"报告期"),瀚天天成实现营业收入分别为4.41亿元、11.43亿元和9.74亿元, 相应的净利润分别为1.43亿、1.22亿和1.66亿 元,相应的经调整净利润分别为1.72亿元、3.78亿元和3.21亿元。 不难看出,瀚天天成营业收入和经调整净利润先升后降,净利润先降后升,均有明显波动。 资料显示,相较传统硅晶片,碳化硅外延晶片具备多项优势,包括但不限于更卓越的温度稳定性、更高的击穿电压及更优异的导 ...