LCoS

Search documents

研报掘金丨国盛证券:维持豪威集团“买入”评级,非手机业务正在起势,龙头成长动能已然切换

Ge Long Hui A P P· 2025-12-19 06:51

Core Viewpoint - The report from Guosheng Securities indicates that OmniVision's non-mobile business is gaining momentum, and the growth drivers have shifted. The market is overly pessimistic about the company, primarily due to its perception as a pure mobile CIS chip supplier, while its business structure is changing significantly since the beginning of the year [1] Group 1: Business Transformation - OmniVision's automotive CIS revenue is expected to surpass mobile revenue by 2025, with a solid position in the mid-to-high-end market [1] - The company is increasing its focus on automotive analog chips, promoting the validation and introduction of multiple products such as CAN/LIN, SerDes, PMIC, and SBC, which are expected to synergize well with automotive CIS [1] Group 2: Growth Opportunities - The automotive and imaging businesses are emerging as new growth drivers for the company, while the mobile business faces short-term pressure, the expansion of the product matrix may help increase market share [1] - The company's forward-looking layout in the LCoS field is expected to generate new revenue streams in AI glasses and data center OCS, further enhancing its valuation ceiling [1] Group 3: Investment Outlook - The company is viewed positively for its future development, with maintained revenue and profit forecasts, and its status as a leading domestic CIS player is considered significantly undervalued, leading to a "buy" rating [1]

集邦咨询:AR显示技术竞争随品牌布局加剧 预估2030年LEDoS技术渗透率达65%

智通财经网· 2025-11-26 06:50

Core Insights - The report by TrendForce indicates that the competition in AR glasses display technologies is intensifying, with LEDoS and LCoS technologies poised for growth opportunities by 2025 and 2030 [1][2][3] Group 1: AR Glasses Market Trends - Major brands like Meta, Apple, Amazon, and RayNeo are actively investing in AR glasses, leading to increased competition in display technologies [1] - By 2025, the penetration rates for LEDoS and LCoS technologies are projected to be 37% and 7%, respectively, with further growth expected by 2030 to 65% and 11% [1][2] Group 2: Chinese Brands and Technology Adoption - Chinese brands are the primary drivers of AR glasses shipments, initially focusing on viewing applications, which led to the adoption of the mature and cost-effective OLEDoS technology [1] - As the industry evolves, the demand for brightness and transparency in AR glasses is increasing, prompting brands to shift resources away from viewing products [1] Group 3: LEDoS Technology Development - The market for AI-assisted information display glasses is heating up, with various players, including Chinese cloud service providers and traditional consumer electronics brands, entering the LEDoS segment [2] - The penetration rate of LEDoS technology is expected to rise to 37% by 2025, driven by rapid product development and collaboration with supply chains [2] Group 4: LCoS Technology Insights - LCoS technology is favored by Meta due to its cost-effectiveness and excellent power performance under average pixel brightness [3] - The penetration rate for LCoS technology is anticipated to reach 7% by 2025, with a slower growth forecast to 11% by 2030 due to challenges in high brightness and contrast [3]

赛微电子:MEMS-OCS可用于精确调节光链路的折射方向

Zheng Quan Ri Bao Wang· 2025-11-18 11:50

Core Viewpoint - The company emphasizes the potential of MEMS-OCS technology in enhancing the performance and stability of optical systems while reducing costs and power consumption, particularly in data center networks and supercomputing clusters [1] Group 1: Technology Application - MEMS-OCS can precisely adjust the refraction direction of optical links, enabling signal switching and bidirectional transmission [1] - The technology is expected to be widely applicable in various scenarios, including data centers and supercomputing systems [1] Group 2: Relationship with Other Technologies - MEMS-OCS and LCoS are not merely substitutes; they can coexist and complement each other in applications [1] Group 3: R&D Focus - The company places a high priority on research and development, particularly in emerging industries, to mitigate innovation risks [1]

LCoS光源选型终极指南:LED与激光的对决

Xin Lang Zheng Quan· 2025-10-28 02:31

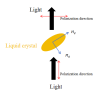

Core Viewpoint - The article discusses the selection of LCoS lighting sources and the design criteria for LCoS lighting paths in AR glasses, comparing the differences between using LED and laser as lighting sources [1][4][22]. Group 1: LCoS Technology Overview - LCoS (Liquid-Crystal-on-Silicon) utilizes liquid crystals to modulate light, similar to LCD technology, but offers advantages such as higher energy efficiency, resolution, contrast, and color richness, making it suitable for high-end projection devices and AR/VR headsets [3][4]. - In the AR glasses industry, LCoS has become a mainstream choice due to its mature technology and low cost, with several companies adopting LCoS display sources combined with waveguide technology [4][22]. Group 2: Lighting Source Comparison - The current LCoS lighting modules primarily consist of LED and laser sources. LED sources are reliable and cost-effective but have limitations in brightness due to their hemispherical emission pattern, making them unsuitable for bright environments [6][22]. - Laser sources, while more expensive and requiring advanced cooling systems, offer advantages such as strong directionality, high brightness, and better color saturation, making them more suitable for outdoor use and high-brightness applications [22][25]. Group 3: Optical Design Considerations - From an optical design perspective, lasers have a smaller emission angle compared to LEDs, allowing for easier beam manipulation and a more compact optical system [11][14][20]. - The energy utilization efficiency of laser sources is higher due to their ability to couple more effectively into waveguides, reducing the risk of stray light that can interfere with image display [16][20]. Group 4: Image Quality and Challenges - LCoS technology benefits from high-power density laser sources, which significantly enhance brightness and color saturation, surpassing LED capabilities [21][22]. - However, challenges such as speckle noise caused by coherent laser light and the high thermal demands of laser systems pose significant barriers to widespread adoption [22][23]. Group 5: Recommendations - For indoor applications with lower brightness requirements, LED sources are recommended, while laser sources are better suited for outdoor scenarios where high brightness and color fidelity are essential [25].

先进制造系列研究(二):显示行业深度:微显示技术的产业化进程与应用前景

GUOTAI HAITONG SECURITIES· 2025-09-12 12:19

Investment Rating - The report indicates a strong growth potential for the micro-display technology industry, with a projected compound annual growth rate (CAGR) exceeding 20% from 2024 to 2032 [8][10]. Core Insights - The micro-display technology is driven by the increasing demand for high-resolution, small-sized, and low-power near-eye displays, particularly in emerging applications like VR and AR, which are expected to create a significant incremental market [8][9]. - The market size for micro-display technology is estimated to reach $2.41 billion in 2023, with the near-eye device segment accounting for over 45% of industry revenue [8][9]. - Different micro-display technologies have their advantages and disadvantages, often overlapping in application scenarios, leading to competitive dynamics within the industry [13][14]. Summary by Sections 1. Market Growth - The micro-display market is expected to grow significantly, with a CAGR projected to exceed 20% from 2024 to 2032, driven by advancements in semiconductor technology and the rise of VR/AR applications [8][10]. - The near-eye device segment, including AR/VR headsets and smart glasses, is a major contributor to this growth, representing over 45% of the market revenue [8][9]. 2. Micro-Display Technologies - Micro-display technologies can be categorized into two main types: self-emissive technologies (LCD, Micro OLED, Micro LED) and reflective technologies (LCoS, DLP, LBS) [13][14]. - Each technology has unique strengths and weaknesses, with significant competition in various application areas [13][14]. 3. Key Technologies - Fast LCD technology, combined with Mini LED backlighting, enhances the performance of LCDs in micro-display applications, making it a cost-effective option [15]. - Micro OLED technology is rapidly developing but faces uncertainties in its technological path [20][21]. - Micro LED technology is seen as a future display solution, although it currently faces challenges related to mass transfer technology [27][28]. - LCoS technology has achieved high maturity and is being utilized in AR/VR and HUD applications [31]. - DLP technology is primarily used in projectors and is expanding into new fields such as AR and 3D printing [35]. - LBS technology is favored for its compact size and high efficiency, particularly in AR/VR applications [38]. 4. Market Leaders - Major players in the micro-display field include Samsung, LGD, Sony, JVC, Kopin, SMD, and BOE, each focusing on different technologies and applications [49][52][56][59][62][72]. - Samsung has made significant investments in Micro OLED technology, while LGD focuses on high-brightness Micro OLED displays [49][52]. - Sony is a leader in LCoS technology and has a strong presence in the silicon-based OLED market [56]. - BOE is actively expanding its capabilities in Micro OLED and Micro LED technologies [72].

最新报告 | 近眼显示将迎来市场成长新纪元

TrendForce集邦· 2025-08-29 03:44

Core Insights - The near-eye display device market is expected to show a lackluster performance in the short term, with global shipments projected to reach 6.2 million units by 2025 [2] - The VR/MR market, particularly Meta Quest 3s, is anticipated to see a decline in shipments to 5.6 million units by 2025, while AR devices are expected to perform more steadily, with shipments reaching 600,000 units driven by new AI+AR products and decreasing OLEDoS prices [2] - Long-term growth is expected, with global near-eye display shipments projected to rise to 46.5 million units by 2030, supported by ongoing product development from major companies like Meta and Apple, and strong growth in the AR market [2] AR Display Technology Market Development - OLEDoS remains the mainstream technology in China due to its cost advantages, but other technologies pose a threat to its dominance [6] - LCoS technology is expected to gain traction in the market due to Meta's adoption, while the growth of single green LEDoS AR glasses will enhance the penetration of LEDoS technology [6] - The demand for AR devices is increasing, with expectations for shipments using high-spec full-color LEDoS technology to reach 20.9 million units by 2030, achieving a penetration rate of 65% [7] Optical Waveguide Technology and SiC Supply Alliance Analysis - The choice of optical waveguide technology is critical for AR engine modules, with diffraction waveguides currently being the mainstream but needing efficiency improvements [9] - NIL and PL are the two main processing methods for waveguides, with NIL suitable for small-scale development and PL better for mass production [9] - The trend towards larger SiC substrates is expected to enhance cost-effectiveness, with projections indicating that 8-inch SiC substrate shipments could exceed 20% by 2030, moving towards 12-inch substrates in the long term [9] AR Product Development Trends - The specifications of AR devices are becoming standardized to control costs, with mainstream panel sizes for LEDoS and LCoS ranging from 0.13 to 0.18 inches and pixel densities exceeding 5,500 PPI [10] - Chinese brands like Xreal, RayNeo, and INMO are focusing on different strategies, such as enhancing display technology and integrating AI capabilities, reflecting a shift from hardware competition to a more complex software-hardware ecosystem [10]

2025年全球AR设备出货量增长将超四成 高于VR设备增长率

Zhong Guo Chan Ye Jing Ji Xin Xi Wang· 2025-05-19 00:14

Group 1 - The global XR (AR/VR) display shipments are expected to grow by 6% year-on-year by 2025, with AR devices experiencing a significant growth rate of 42%, compared to VR devices' modest growth of 2.5% [1] - The anticipated growth in AR is driven by the introduction of new AR smart glasses that utilize displays for AI-supported applications rather than just media consumption [1] - In 2024, a significant decline in display panel shipments is expected as XR device manufacturers clear inventory and adjust business plans, with the release of Meta Quest3S contributing to this decline due to its single LCD panel design [1] Group 2 - LCD technology is projected to dominate VR display technology, accounting for 87% of shipments in 2025, used in both entry-level and high-end devices with advanced technologies [1] - In the AR sector, the share of silicon-based OLED is expected to decrease to 75%, allowing more room for MicroLED and LCoS display technologies [1] - The report anticipates a continuation of the recovery trend in 2026, with AR display panel shipments increasing by 38% and VR by 2.1%, although uncertainties exist due to U.S. tariffs on Chinese goods affecting XR device demand [2]