LED光源

Search documents

联域股份跌3.29%,成交额9162.97万元,今日主力净流入-395.30万

Xin Lang Cai Jing· 2026-02-13 08:59

Core Viewpoint - The company, Shenzhen Lianyu Optoelectronics Co., Ltd., is actively advancing its technology in smart lighting and has begun to expand its production bases internationally, benefiting from the depreciation of the RMB and the Belt and Road Initiative [2][3][4]. Group 1: Company Developments - The company is focusing on the development of new technologies in smart lighting, including self-adaptive spectral control for plants and wireless networking for intelligent control circuits [2]. - The company has established a full subsidiary, Shenzhen Haibo, to develop charging piles and energy storage businesses, which have already generated revenue [2]. - As of the 2024 annual report, overseas revenue accounted for 95.62% of total revenue, benefiting from the depreciation of the RMB [3]. Group 2: Financial Performance - For the period from January to September 2025, the company achieved a revenue of 1.155 billion yuan, representing a year-on-year growth of 1.03%, while the net profit attributable to shareholders decreased by 79.23% to 19.5341 million yuan [8]. - The company has distributed a total of 129 million yuan in dividends since its A-share listing [9]. Group 3: Market Activity - On February 13, the company's stock price fell by 3.29%, with a trading volume of 91.6297 million yuan and a turnover rate of 6.26%, bringing the total market value to 4.384 billion yuan [1]. - The stock has shown no clear trend in major capital inflows, with a net outflow of 3.953 million yuan on the day, ranking 12th out of 14 in its industry [5][6].

联域股份跌2.40%,成交额1435.10万元

Xin Lang Cai Jing· 2026-02-06 02:03

Group 1 - The core viewpoint of the news is that Lianyu Co., Ltd. has experienced fluctuations in its stock price, with a recent decline of 2.40% to 54.56 CNY per share, while showing a year-to-date increase of 15.54% [1] - As of September 30, 2025, Lianyu Co., Ltd. reported a total revenue of 1.155 billion CNY, reflecting a year-on-year growth of 1.03%, but the net profit attributable to shareholders decreased by 79.23% to 19.5341 million CNY [2] - The company specializes in the research, production, and sales of medium and high-power LED lighting products, with its main business revenue composition being 88.43% from LED lamps, 6.55% from accessories, 4.80% from LED light sources, and 0.22% from other sources [1] Group 2 - The number of shareholders for Lianyu Co., Ltd. as of September 30, 2025, was 6,765, which is a decrease of 20.62% compared to the previous period, while the average circulating shares per person increased by 25.97% to 3,562 shares [2] - Since its A-share listing, Lianyu Co., Ltd. has distributed a total of 129 million CNY in dividends [3] - As of September 30, 2025, the top ten circulating shareholders of Lianyu Co., Ltd. saw a change, with the Noan Multi-Strategy Mixed A fund exiting the top ten list [3]

立达信跌1.46%,成交额1.22亿元,近5日主力净流入1806.55万

Xin Lang Cai Jing· 2026-01-14 07:51

2、通过大量试验数据以及产品真实环境下的运行数据,公司已构建起持续优化的影像、声音和光学方 面的算法模型,拥有包括人脸影像侦测\识别、移动人形侦测和声音识别等安防监控领域的算法模型, 并已成功导入发行人开发的智能监控类和传感类产品。 3、公司主营业务为LED照明产品、智能家居和智慧建筑等物联网领域产品的研发、制造、销售及服 务。公司主要产品有LED光源、LED灯具、IoT产品、CFL节能灯。在照明领域,立达信系中国照明电 器行业十强企业和中国轻工业科技百强企业,是全国LED照明行业的领军企业之一,已连续多年排名全 国LED照明产品出口规模第一。 4、立达信物联科技股份有限公司的主营业务是LED照明产品、智能家居和智慧建筑等物联网领域产品 的研发、制造、销售及服务。公司的主要产品是照明产品及配件、IoT产品及配件、家电类及配件、其 他产品。 5、根据2024年年报,公司海外营收占比为89.22%,受益于人民币贬值。 来源:新浪证券-红岸工作室 1月14日,立达信跌1.46%,成交额1.22亿元,换手率0.99%,总市值122.24亿元。 异动分析 跨境电商+人工智能+家用电器+物联网+人民币贬值受益 1、根据2 ...

联域股份12月18日获融资买入585.91万元,融资余额5829.34万元

Xin Lang Zheng Quan· 2025-12-19 01:23

Group 1 - The core viewpoint of the news is that Lianyu Co., Ltd. has shown a mixed performance in terms of stock trading and financial results, with a notable decline in net profit despite a slight increase in revenue [1][2]. - On December 18, Lianyu's stock rose by 1.49%, with a trading volume of 30.34 million yuan. The financing buy amount was 5.86 million yuan, while the financing repayment was 7.41 million yuan, resulting in a net financing buy of -1.55 million yuan [1]. - As of December 18, the total balance of margin trading for Lianyu was 58.29 million yuan, accounting for 4.17% of its market capitalization, indicating a high level compared to the past year [1]. Group 2 - As of September 30, the number of shareholders for Lianyu was 6,765, a decrease of 20.62% from the previous period, while the average circulating shares per person increased by 25.97% to 3,562 shares [2]. - For the period from January to September 2025, Lianyu achieved an operating income of 1.155 billion yuan, representing a year-on-year growth of 1.03%. However, the net profit attributable to the parent company was 19.53 million yuan, a significant decrease of 79.23% year-on-year [2]. - Since its A-share listing, Lianyu has distributed a total of 129 million yuan in dividends. Notably, as of September 30, 2025, the fund "Noan Multi-Strategy Mixed A" has exited the top ten circulating shareholders [3].

合规经营诚信纳税案例丨税务合规托举“小块头”迸发“大能量”

Sou Hu Cai Jing· 2025-11-03 10:04

Core Insights - The article emphasizes the importance of compliance in the growth of specialized and innovative "little giant" enterprises in Zhejiang, which play a crucial role in the new industrialization process [1][2][6] Group 1: Growth of "Little Giant" Enterprises - Zhejiang has over 1,800 national-level specialized and innovative "little giant" enterprises, ranking among the top three in China [1] - Hangzhou and Ningbo have 478 and 418 such enterprises respectively, placing them in the top ten cities nationwide [1] - Compliance in operations is highlighted as a key factor for the growth of these enterprises [2][4] Group 2: Risk Management - Specialized and innovative enterprises face significant challenges in risk management compared to larger companies [2] - The president of Ningbo Haiber Group emphasizes the need for enhanced compliance, particularly in financial and tax matters, to mitigate risks [2][4] Group 3: Compliance and Internal Control - Haiber Group has established a comprehensive internal control system integrating finance, customs, legal, and business operations, which has helped avoid potential risks and recover losses exceeding 10 million yuan [4] - The internal control system standardizes operations across various business processes, significantly reducing tax-related risks [4][5] Group 4: Tax Benefits and Compliance - Zhejiang Shuangyuan Technology has benefited from various tax incentives, including over 9 million yuan in VAT reductions and more than 4 million yuan in corporate income tax exemptions over the past five years [7][9] - The company's dedicated tax compliance department ensures timely adaptation to new tax policies and conducts regular risk assessments [9] Group 5: Credit as a Competitive Advantage - "Little giant" enterprises prioritize credit building as a core competitive asset, with Ningbo David Medical Instruments emphasizing the importance of maintaining a high tax credit rating [11][13] - David Medical's A-level tax credit has provided significant advantages in competitive bidding processes, leading to a higher success rate in securing contracts [13][14] Group 6: Incentives for Compliance - Tax authorities in Hangzhou and Ningbo are expanding incentives for A-level taxpayers, enhancing the value of maintaining a good tax credit rating [14]

LCoS光源选型终极指南:LED与激光的对决

Xin Lang Zheng Quan· 2025-10-28 02:31

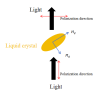

Core Viewpoint - The article discusses the selection of LCoS lighting sources and the design criteria for LCoS lighting paths in AR glasses, comparing the differences between using LED and laser as lighting sources [1][4][22]. Group 1: LCoS Technology Overview - LCoS (Liquid-Crystal-on-Silicon) utilizes liquid crystals to modulate light, similar to LCD technology, but offers advantages such as higher energy efficiency, resolution, contrast, and color richness, making it suitable for high-end projection devices and AR/VR headsets [3][4]. - In the AR glasses industry, LCoS has become a mainstream choice due to its mature technology and low cost, with several companies adopting LCoS display sources combined with waveguide technology [4][22]. Group 2: Lighting Source Comparison - The current LCoS lighting modules primarily consist of LED and laser sources. LED sources are reliable and cost-effective but have limitations in brightness due to their hemispherical emission pattern, making them unsuitable for bright environments [6][22]. - Laser sources, while more expensive and requiring advanced cooling systems, offer advantages such as strong directionality, high brightness, and better color saturation, making them more suitable for outdoor use and high-brightness applications [22][25]. Group 3: Optical Design Considerations - From an optical design perspective, lasers have a smaller emission angle compared to LEDs, allowing for easier beam manipulation and a more compact optical system [11][14][20]. - The energy utilization efficiency of laser sources is higher due to their ability to couple more effectively into waveguides, reducing the risk of stray light that can interfere with image display [16][20]. Group 4: Image Quality and Challenges - LCoS technology benefits from high-power density laser sources, which significantly enhance brightness and color saturation, surpassing LED capabilities [21][22]. - However, challenges such as speckle noise caused by coherent laser light and the high thermal demands of laser systems pose significant barriers to widespread adoption [22][23]. Group 5: Recommendations - For indoor applications with lower brightness requirements, LED sources are recommended, while laser sources are better suited for outdoor scenarios where high brightness and color fidelity are essential [25].

联域股份涨8.29%,成交额3.16亿元,近5日主力净流入4884.85万

Xin Lang Cai Jing· 2025-09-24 10:04

Core Viewpoint - The company, Shenzhen Lianyu Optoelectronics Co., Ltd., is experiencing significant growth in its stock price and market activity, driven by advancements in smart lighting technology and favorable currency conditions [1][2]. Company Overview - Shenzhen Lianyu Optoelectronics Co., Ltd. was established on February 16, 2012, and went public on November 9, 2023. The company specializes in the research, production, and sales of medium and high-power LED lighting products [7]. - The main revenue composition includes LED lighting products (88.43%), accessories (6.55%), LED light sources (4.80%), and others (0.22%) [7]. Financial Performance - For the first half of 2025, the company reported a revenue of 769 million yuan, a slight decrease of 0.35% year-on-year, while the net profit attributable to shareholders dropped by 78.85% to 16.15 million yuan [8]. - As of September 10, 2025, the number of shareholders increased by 4.94% to 8,522, with an average of 2,828 circulating shares per person, a decrease of 4.71% [8]. Market Activity - On September 24, 2023, the company's stock rose by 8.29%, with a trading volume of 316 million yuan and a turnover rate of 27.29%, resulting in a total market capitalization of 3.607 billion yuan [1]. - The stock has seen a net inflow of 30.59 million yuan from major investors, indicating a positive trend in investment interest [4][5]. Technological Advancements - The company is actively developing new technologies in the smart lighting sector, including adaptive plant control spectrum and wireless networking for intelligent control circuits [2][3]. - It has obtained a U.S. invention patent for its self-developed LED lighting standard interface technology, which integrates various smart sensors for enhanced automation and remote control capabilities [2][3]. International Expansion - The company has established production bases in Vietnam and Mexico, contributing to its international revenue, which accounted for 95.62% of total revenue in 2024, benefiting from the depreciation of the Chinese yuan [3][4]. Investment Themes - The company is positioned within several growth sectors, including smart home technology, charging stations, the Belt and Road Initiative, and the Internet of Things [2][7].

深圳市联域光电股份有限公司_招股说明书(注册稿)

2023-07-07 07:16

深圳市联域光电股份有限公司 SHENZHEN SNC OPTO ELECTRONIC CO.,LTD (深圳市宝安区燕罗街道罗田社区象山大道 172 号正大安工业 城 6 栋 101-601;7 栋 101-301;12 栋 101-301;17 栋 101-301; 21 栋 101-201) 首次公开发行股票并在主板上市 招股说明书 (注册稿) 本公司的发行申请尚需经深圳证券交易所及中国证监会履行相应的程序。本招股说明 书(注册稿)不具有据以发行股票的法律效力,仅供预先披露之用。投资者应当以正 式公告的招股说明书作为投资决定的依据。 保荐人(主承销商) (北京市朝阳区安立路 66 号 4 号楼) 深圳市联域光电股份有限公司 招股说明书 声明及承诺 中国证监会、交易所对本次发行所作的任何决定或意见,均不表明其对发 行人注册申请文件及所披露信息的真实性、准确性、完整性作出保证,也不表 明其对发行人的盈利能力、投资价值或者对投资者的收益作出实质性判断或保 证。任何与之相反的声明均属虚假不实陈述。 根据《证券法》规定,股票依法发行后,发行人经营与收益的变化,由发 行人自行负责;投资者自主判断发行人的投资价值,自主 ...

深圳市联域光电股份有限公司_招股说明书(上会稿)

2023-05-04 08:22

深圳市联域光电股份有限公司 SHENZHEN SNC OPTO ELECTRONIC CO.,LTD (深圳市宝安区燕罗街道罗田社区象山大道 172 号正大安工业 城 6 栋 101-601;7 栋 101-301;12 栋 101-301;17 栋 101-301; 21 栋 101-201) 首次公开发行股票并在主板上市 招股说明书 (上会稿) 本公司的发行申请尚需经深圳证券交易所及中国证监会履行相应的程序。本招股说明 书(上会稿)不具有据以发行股票的法律效力,仅供预先披露之用。投资者应当以正 保荐人(主承销商) (北京市朝阳区安立路 66 号 4 号楼) 式公告的招股说明书作为投资决定的依据。 深圳市联域光电股份有限公司 招股说明书 声明及承诺 中国证监会、交易所对本次发行所作的任何决定或意见,均不表明其对发 行人注册申请文件及所披露信息的真实性、准确性、完整性作出保证,也不表 明其对发行人的盈利能力、投资价值或者对投资者的收益作出实质性判断或保 证。任何与之相反的声明均属虚假不实陈述。 根据《证券法》规定,股票依法发行后,发行人经营与收益的变化,由发 行人自行负责;投资者自主判断发行人的投资价值,自主 ...

深圳市联域光电股份有限公司_招股说明书(申报稿)

2023-04-18 11:16

深圳市联域光电股份有限公司 SHENZHEN SNC OPTO ELECTRONIC CO.,LTD (深圳市宝安区燕罗街道罗田社区象山大道 172 号正大安工业 城 6 栋 101-601;7 栋 101-301;12 栋 101-301;17 栋 101-301; 21 栋 101-201) 首次公开发行股票并在主板上市 招股说明书 (申报稿) 本公司的发行申请尚需经深圳证券交易所及中国证监会履行相应的程序。本招股说明 保荐人(主承销商) 式公告的招股说明书作为投资决定的依据。 (北京市朝阳区安立路 66 号 4 号楼) 书(申报稿)不具有据以发行股票的法律效力,仅供预先披露之用。投资者应当以正 深圳市联域光电股份有限公司 招股说明书 声明及承诺 中国证监会、交易所对本次发行所作的任何决定或意见,均不表明其对发 行人注册申请文件及所披露信息的真实性、准确性、完整性作出保证,也不表 明其对发行人的盈利能力、投资价值或者对投资者的收益作出实质性判断或保 证。任何与之相反的声明均属虚假不实陈述。 根据《证券法》规定,股票依法发行后,发行人经营与收益的变化,由发 行人自行负责;投资者自主判断发行人的投资价值,自主 ...