激光光源

Search documents

炬光科技20251031

2025-11-03 02:36

Summary of Key Points from the Conference Call of Juguang Technology Company Overview - **Company**: Juguang Technology - **Industry**: Laser optics and photonics manufacturing Financial Performance - **Revenue Growth**: 34% increase in revenue for the first three quarters of 2025, reaching 613 million yuan [2][4] - **Gross Margin**: Improved to 38% from 28% year-on-year, with gross profit increasing by nearly 100 million yuan [2][8] - **Net Profit**: Net profit for the first three quarters was 22.25 million yuan, a significant improvement from a loss of over 54 million yuan in the previous year [4][21] - **Cash Flow**: Operating cash flow turned positive, reaching 89.22 million yuan, compared to a negative 23.27 million yuan in the previous year [9] Business Segments Performance - **Laser Optical Business**: Contributed nearly half of total revenue, with a 109% growth in the optical communication sector [2][11] - **Automotive Solutions**: Revenue increased by 41% year-on-year, driven by higher demand for automotive lighting [16] - **Photonics Manufacturing Services**: Revenue surged by 106% quarter-on-quarter, attributed to acquisitions and service agreements [2][20] - **Laser Light Source**: Revenue decreased by 13% year-on-year due to declining overseas demand [15] Market Contribution - **Domestic vs. International**: International markets contributed 55% of total revenue, with Europe being the largest market at 43% [12] - **Optical Communication**: Revenue in this sector reached 39.79 million yuan, marking a 109% increase year-on-year [13] Strategic Developments - **Acquisitions**: The integration of Swiss and Haber acquisitions is ongoing, with the Swiss acquisition maintaining profitability while Haber is still operating at a loss [23][24] - **Business Transformation**: Shift from traditional industrial and automotive sectors towards networking, consumer electronics, and photonics manufacturing [26] - **CPO Development**: Currently in the R&D phase, focusing on high-end products like 800G and 1.6T [27] Future Outlook - **Revenue Projections**: Expected revenue growth of at least 20% in 2026, with optical communication and consumer electronics as primary growth drivers [5][30] - **Market Expansion**: Plans to expand production capacity in Singapore, Dongguan, and Malaysia to meet increasing demand [34] Challenges and Risks - **Profitability Concerns**: Despite revenue growth, the company still faces challenges in achieving stable profitability, with non-recurring losses impacting net profit [6][50] - **Inventory Management**: Increased inventory turnover days from 212 to 229 days, indicating potential issues with sales velocity and revenue recognition [10] Additional Insights - **R&D Investment**: R&D expenses increased by 82% year-on-year, reflecting a focus on innovation and product development [8] - **Market Positioning**: The company aims to avoid price wars and instead focus on improving product quality and production efficiency to enhance margins [55][56] This summary encapsulates the key points discussed in the conference call, highlighting Juguang Technology's financial performance, business segment contributions, strategic developments, future outlook, and associated challenges.

LCoS光源选型终极指南:LED与激光的对决

Xin Lang Zheng Quan· 2025-10-28 02:31

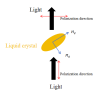

Core Viewpoint - The article discusses the selection of LCoS lighting sources and the design criteria for LCoS lighting paths in AR glasses, comparing the differences between using LED and laser as lighting sources [1][4][22]. Group 1: LCoS Technology Overview - LCoS (Liquid-Crystal-on-Silicon) utilizes liquid crystals to modulate light, similar to LCD technology, but offers advantages such as higher energy efficiency, resolution, contrast, and color richness, making it suitable for high-end projection devices and AR/VR headsets [3][4]. - In the AR glasses industry, LCoS has become a mainstream choice due to its mature technology and low cost, with several companies adopting LCoS display sources combined with waveguide technology [4][22]. Group 2: Lighting Source Comparison - The current LCoS lighting modules primarily consist of LED and laser sources. LED sources are reliable and cost-effective but have limitations in brightness due to their hemispherical emission pattern, making them unsuitable for bright environments [6][22]. - Laser sources, while more expensive and requiring advanced cooling systems, offer advantages such as strong directionality, high brightness, and better color saturation, making them more suitable for outdoor use and high-brightness applications [22][25]. Group 3: Optical Design Considerations - From an optical design perspective, lasers have a smaller emission angle compared to LEDs, allowing for easier beam manipulation and a more compact optical system [11][14][20]. - The energy utilization efficiency of laser sources is higher due to their ability to couple more effectively into waveguides, reducing the risk of stray light that can interfere with image display [16][20]. Group 4: Image Quality and Challenges - LCoS technology benefits from high-power density laser sources, which significantly enhance brightness and color saturation, surpassing LED capabilities [21][22]. - However, challenges such as speckle noise caused by coherent laser light and the high thermal demands of laser systems pose significant barriers to widespread adoption [22][23]. Group 5: Recommendations - For indoor applications with lower brightness requirements, LED sources are recommended, while laser sources are better suited for outdoor scenarios where high brightness and color fidelity are essential [25].

今年前三季度,深圳进出口规模居内地外贸城市首位 3.36万亿元!深圳领跑

Shen Zhen Shang Bao· 2025-10-20 23:34

Group 1: Shenzhen Foreign Trade Performance - Shenzhen's total import and export volume reached 3.36 trillion RMB in the first three quarters, maintaining its position as the leading foreign trade city in mainland China, with a year-on-year growth of 0.1% [1] - Exports accounted for 2.04 trillion RMB, while imports were 1.32 trillion RMB, showing an increase of 8.4% [1] - Private enterprises contributed significantly, with their import and export volume reaching 2.32 trillion RMB, representing 68.9% of the total [1] Group 2: Key Companies and Innovations - Jieput Optical Co., Ltd. has strengthened its core competitiveness in laser light sources and optical intelligent equipment, achieving nearly 30% growth in exports from January to August [1] - Xidesheng, a leading high-end bicycle manufacturer, has developed a carbon fiber frame weighing only 560 grams, showcasing advanced technology and performance [2] - The bicycle export value from Shenzhen reached 770 million RMB, with a year-on-year increase of 34.5%, and exports to the EU grew by 61% [2] Group 3: Foreign Investment and Trade Partners - Foreign-invested enterprises in Shenzhen recorded an import and export volume of 926.88 billion RMB, growing by 12.7% and accounting for 27.6% of the total [2] - Shenzhen's trade with its top ten partners totaled 2.63 trillion RMB, representing a growth of 2.2% and accounting for 78.3% of total trade [3] - The general trade method accounted for 53.8% of Shenzhen's total import and export value, with a volume of 1.81 trillion RMB [3] Group 4: Import Trends - The import of electromechanical products reached 1.08 trillion RMB, growing by 10.7% and making up 81.4% of total imports [3] - Integrated circuit imports were valued at 591.75 billion RMB, with a growth rate of 17.7%, while computer components saw a 24.3% increase [3] - Agricultural product imports totaled 75.23 billion RMB, with significant growth in grain and aquatic products, increasing by 117.6% and 34.2% respectively [3]

杰普特: 2025年第一次临时股东会会议资料

Zheng Quan Zhi Xing· 2025-07-24 16:20

Core Viewpoint - Shenzhen Jieput Light Technology Co., Ltd. is preparing for its 2025 Extraordinary General Meeting of Shareholders, focusing on maintaining order and protecting shareholder rights during the meeting [1][2][3]. Meeting Procedures - The meeting will verify the identity of attendees and require timely registration to ensure orderly proceedings [1][2]. - Shareholders and their representatives have the right to speak, inquire, and vote, but must register in advance for speaking [2][3]. - The meeting will follow a structured agenda, including the announcement of attendance and voting results [5][6]. Shareholder Rights and Responsibilities - Shareholders must respect the rights of others and maintain order during the meeting, with the possibility of being denied the right to speak if they disrupt proceedings [2][3]. - Voting will be conducted both on-site and online, with specific time frames for each method [5][6]. Incentive Plan Overview - The company proposes a 2025 Restricted Stock Incentive Plan to attract and retain talent, aligning the interests of shareholders, the company, and employees [6][8]. - A total of 475,000 shares will be granted, representing 0.50% of the company's total share capital, with 380,000 shares for initial grants and 95,000 shares reserved [7][8]. Performance Assessment Criteria - The performance assessment for the incentive plan will focus on annual revenue growth rates, with specific targets set for 2025-2028 [9][10]. - The plan includes both company-level and individual-level performance evaluations, determining the actual number of shares awarded based on performance ratings [11]. Authorization for Implementation - The company seeks authorization from shareholders for the board to manage all matters related to the stock incentive plan, including adjustments for capital changes and the granting of shares [12][14]. - The board will also be empowered to handle necessary approvals and documentation related to the incentive plan [14].

制造领先:永艺股份、浩洋股份

2025-05-13 15:19

Summary of Conference Call Records Industry and Companies Involved - **Industry**: Manufacturing, specifically focusing on export-oriented companies affected by tariffs - **Companies**: 永艺股份 (Yongyi Co.), 浩洋股份 (Haoyang Co.) Key Points and Arguments Tariff Impact on Export Companies - The U.S. has imposed a 30% tariff on Chinese goods, which includes a 20% increase and an additional 10% tariff. China has also imposed a 10% tariff on U.S. goods. This has short-term operational impacts on export companies, but costs can be shared with downstream customers or passed on to end consumers. [3][4] - After tariffs return to a reasonable level, domestic shipping schedules are expected to normalize, with a recovery in orders anticipated in Q2. However, downstream companies are cautious about inventory levels due to previous high stock phases. [1][4] Company-Specific Insights - **永艺股份 (Yongyi Co.)**: - Holds an irreplaceable position in the office chair segment, with a strong supply chain that creates customer barriers. Recent orders are optimistic, with the Vietnam factory ramping up shipments to take advantage of tariff windows. Profit margins remain largely unaffected. [1][8] - The 2025 profit forecast is approximately 380 million yuan, with a current valuation of 10 times earnings, indicating a high cost-performance ratio within the export chain. The company is seen as a resilient choice with a dividend yield exceeding 4%. [10] - **浩洋股份 (Haoyang Co.)**: - Demonstrates cost efficiency and product innovation in stage lighting and performance equipment manufacturing. The company is actively developing new products, such as laser light sources, which are expected to drive long-term growth. [1][11] - The 2025 profit forecast is slightly above 300 million yuan, with a current valuation of about 14 times earnings, which is considered low compared to historical levels. The sentiment in U.S. business is improving, which is a positive factor for overall export sentiment. [13][14] Long-term Outlook and Valuation - Export companies are experiencing a valuation drop due to tariff pressures, but those with strong core advantages and a high proportion of overseas factories, like Yongyi and Haoyang, are less affected. Their valuations are now aligned with growth potential, making them suitable for long-term investment. [5][12] - The long-term growth drivers for Haoyang are expected to shift more towards proprietary brands and laser products rather than OEM business, which will enhance profitability and optimize product structure. [12] Additional Considerations - The overall sentiment regarding orders is improving as the actual burden of tariffs on end consumers is expected to be minimal. This could lead to a further recovery in order expectations in the short term. [9] - The selection of export chain companies should prioritize those with high growth potential, especially in the context of changing tariff environments. [15]