CMRU(01636)

Search documents

中国金属利用(01636) - 截至31/01/2026 的股份发行人的证券变动月报表

2026-02-04 07:15

FF301 股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2026年1月31日 狀態: 新提交 致:香港交易及結算所有限公司 公司名稱: 中國金屬資源利用有限公司(於開曼群島註冊成立之有限公司) 呈交日期: 2026年2月4日 I. 法定/註冊股本變動 | 1. 股份分類 | 普通股 | 股份類別 | 不適用 | | 於香港聯交所上市 (註1) | | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 01636 | 說明 | | | | | | | | | | 法定/註冊股份數目 | | | 面值 | | 法定/註冊股本 | | | 上月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | | 增加 / 減少 (-) | | | | | | HKD | | | | 本月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | ...

中国金属利用(01636) - 有关对本公司截至二零二四年十二月三十一日止年度的财务报表之无法表示意...

2026-01-30 08:34

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負責,對其準確性或完 整性亦不發表任何聲明,並明確表示,概不對因本公告全部或任何部份內容而產生或因倚賴該等內 容而引致的任何損失承擔任何責任。 CHINA METAL RESOURCES UTILIZATION LIMITED 中國金屬資源利用有限公司 (於開曼群島註冊成立的有限公司) (股份代號:1636) 有關對本公司截至二零二四年十二月三十一日止年度的 財務報表之無法表示意見 本公司核數師對本公司截至二零二四年十二月三十一日止年度之財務報表的持續經 營問題出具無法表示意見(「無法表示意見」)。本公告旨在向投資者提供最新資料, 以便彼等知悉本公司自二零二五年十月三十日起至本公告日期(「該期間」)解決無法 表示意見事宜的措施。 茲提述我們日期為二零二五年十月三十日之公告(「十月公告」)及二零二五年七月 三十日之公告(「七月公告」),其中所使用已界定的詞彙及名稱將於本公告使用。值 得注意的是,從七月公告及十月公告可見我們的債務重組之成功乃解決無法表示意 見的關鍵,而獲得投資者投資人民幣 3億元至人民幣5億元為最重要的第一步,因 其將推動債務重組 ...

中国金属利用(01636) - 截至31/12/2025 的股份发行人的证券变动月报表

2026-01-02 14:44

FF301 股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2025年12月31日 狀態: 新提交 致:香港交易及結算所有限公司 公司名稱: 中國金屬資源利用有限公司(於開曼群島註冊成立之有限公司) 呈交日期: 2026年1月2日 I. 法定/註冊股本變動 | 1. 股份分類 | 普通股 | 股份類別 | 不適用 | | 於香港聯交所上市 (註1) | | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 01636 | 說明 | | | | | | | | | | 法定/註冊股份數目 | | | 面值 | | 法定/註冊股本 | | | 上月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | | 增加 / 減少 (-) | | | | | | HKD | | | | 本月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | ...

中国金属利用(01636) - 截至30/11/2025的股份发行人的证券变动月报表

2025-12-01 05:17

FF301 股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2025年11月30日 狀態: 新提交 致:香港交易及結算所有限公司 公司名稱: 中國金屬資源利用有限公司(於開曼群島註冊成立之有限公司) 呈交日期: 2025年12月1日 I. 法定/註冊股本變動 | 1. 股份分類 | 普通股 | 股份類別 | 不適用 | | 於香港聯交所上市 (註1) | | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 01636 | 說明 | | | | | | | | | | 法定/註冊股份數目 | | | 面值 | | 法定/註冊股本 | | | 上月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | | 增加 / 減少 (-) | | | | | | HKD | | | | 本月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 ...

中国金属利用(01636) - 截至31/10/2025的股份发行人的证券变动月报表

2025-11-03 05:21

致:香港交易及結算所有限公司 公司名稱: 中國金屬資源利用有限公司(於開曼群島註冊成立之有限公司) 呈交日期: 2025年11月3日 FF301 股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2025年10月31日 狀態: 新提交 I. 法定/註冊股本變動 | 1. 股份分類 | 普通股 | 股份類別 | 不適用 | | 於香港聯交所上市 (註1) | | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 01636 | 說明 | | | | | | | | | | 法定/註冊股份數目 | | | 面值 | | 法定/註冊股本 | | | 上月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | | 增加 / 減少 (-) | | | | | | HKD | | | | 本月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 ...

中国金属利用(01636) - 有关对本公司截至二零二四年十二月三十一日止年度的财务报表之无法表示意...

2025-10-30 08:32

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負責,對其準確性或完 整性亦不發表任何聲明,並明確表示,概不對因本公告全部或任何部份內容而產生或因倚賴該等內 容而引致的任何損失承擔任何責任。 CHINA METAL RESOURCES UTILIZATION LIMITED 中國金屬資源利用有限公司 (於開曼群島註冊成立的有限公司) (股份代號:1636) 有關對本公司截至二零二四年十二月三十一日止年度的 財務報表之無法表示意見 本公司核數師對本公司截至二零二四年十二月三十一日止年度之財務報表的持續經 營問題出具無法表示意見(「無法表示意見」)。本公告旨在向投資者提供最新資料, 以便彼等知悉本公司自二零二五年七月三十日起至本公告日期(「該期間」)解決無法 表示意見事宜的措施。 茲提述我們日期為二零二五年七月三十日之公告(「七月公告」),其中所使用已界定 的詞彙及名稱將於本公告使用。值得注意的是,從七月公告可見我們的債務重組之 成功乃解決無法表示意見的關鍵,而獲得投資者投資人民幣 3億元至人民幣5億元 為最重要的第一步,因其將推動債務重組的整個進程。因此,本公司於該期間一直 專心致力尋找及爭取 ...

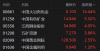

港股异动丨铜业股大涨 中国大冶有色金属涨超14% 中国有色矿业涨5.3%

Ge Long Hui· 2025-10-27 02:17

Group 1 - The core viewpoint of the article highlights a significant rise in Hong Kong copper stocks, driven by a surge in copper prices, which reached a historical high of $11,035 per ton on the London Metal Exchange (LME) [1] - Copper prices have increased by approximately 25% this year, recovering from a sharp sell-off triggered by the escalation of the trade war in April [1] - Supply challenges have become a focal point for investors, particularly due to the suspension of operations at Freeport-McMoRan's Grasberg mine in Indonesia following a landslide [1] Group 2 - Citigroup's recent research report indicates that global manufacturing sentiment remains mixed, and cyclical demand growth continues to face pressure [1] - Data from Citigroup shows that copper consumption growth in August was weak, rising only 1.3% year-on-year, which is below the strong performance driven by the solar industry in the first half of the year [1] - The bank anticipates that copper consumption growth will remain moderate for the remainder of the year, but maintains a positive outlook for copper prices, predicting they will rise to $12,000 per ton by the second quarter of next year [1] Group 3 - Notable stock performances include China Daye Non-Ferrous Metals rising over 14%, China Nonferrous Mining up 5.3%, Jiangxi Copper and Minmetals Resources increasing by 4%, China Gold International rising by 2.5%, and China Metal Resources up by 1.2% [1]

见证历史!刚刚,集体爆发!

券商中国· 2025-10-08 08:10

Core Viewpoint - The article highlights a significant surge in gold prices, which have surpassed $4000 per ounce for the first time, driven by global economic and geopolitical uncertainties, with notable institutional interest in gold as a safe-haven asset [1][2][3]. Group 1: Gold Price Surge - On October 8, gold prices reached a historic high, breaking the $4000 per ounce mark, with a year-to-date increase of 53.6% [2][3]. - The surge in gold prices has led to a substantial rise in gold stocks in the Hong Kong market, with companies like Chifeng Jilong Gold Mining seeing an increase of over 17% [1][2]. Group 2: Catalysts for Gold Price Increase - The U.S. government shutdown has been identified as a direct catalyst for the recent rise in gold prices, causing delays in key economic data releases and increasing market uncertainty regarding Federal Reserve interest rate decisions [4][5]. - Political instability in France and Japan has further fueled concerns about fiscal risks, contributing to the demand for gold as a safe-haven asset [6]. Group 3: Institutional Interest and Predictions - Ray Dalio, founder of Bridgewater Associates, emphasized that gold is a safer investment compared to the U.S. dollar, suggesting a strategic allocation of approximately 15% of investment portfolios to gold [7]. - Goldman Sachs has raised its gold price forecast for December 2026 to $4900 per ounce, citing strong demand from institutional investors and central banks [7][8]. Group 4: Recommendations and Market Sentiment - Investment strategies are shifting towards increasing gold allocations to hedge against dollar risks, with suggestions to raise gold holdings to around 5% of investment portfolios [9]. - Analysts caution about potential short-term corrections in gold prices due to the rapid increase, indicating that profit-taking by speculators may occur [9].

中国金属利用(01636) - 截至30/09/2025 的股份发行人的证券变动月报表

2025-10-03 08:13

FF301 股份發行人及根據《上市規則》第十九B章上市的香港預託證券發行人的證券變動月報表 截至月份: 2025年9月30日 狀態: 新提交 致:香港交易及結算所有限公司 公司名稱: 中國金屬資源利用有限公司(於開曼群島註冊成立之有限公司) 呈交日期: 2025年10月3日 I. 法定/註冊股本變動 | 1. 股份分類 | 普通股 | 股份類別 | 不適用 | | 於香港聯交所上市 (註1) | | 是 | | | --- | --- | --- | --- | --- | --- | --- | --- | --- | | 證券代號 (如上市) | 01636 | 說明 | | | | | | | | | | 法定/註冊股份數目 | | | 面值 | | 法定/註冊股本 | | | 上月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | | 增加 / 減少 (-) | | | | | | HKD | | | | 本月底結存 | | | 10,000,000,000 | HKD | | 1 HKD | | 10,000,000,000 | ...

中国金属利用(01636) - 致非登记股东之通知信函及申请表格 – 中期报告之发佈通知

2025-09-24 22:31

China Metal Resources Utilization Limited (the "Company") CHINA METAL RESOURCES UTILIZATION LIMITED 中國金屬資源利用有限公司 (Incorporated in the Cayman Islands with limited liability) (於開曼群島註冊成立的有限公司) (Stock Code: 1636) (股份代號:1636) NOTIFICATION LETTER 通知信函 Dear Non-registered Shareholder(s) (Note 1) , – Notice of Publication of 2025 Interim Report (the Current Corporate Communications") The English and Chinese versions of the Company's Current Corporate Communications are available on the Company's website at www.cmru ...