YJFC(600265)

Search documents

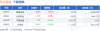

林业板块10月14日跌1.67%,ST景谷领跌,主力资金净流出3484.32万元

Zheng Xing Xing Ye Ri Bao· 2025-10-14 08:39

Core Insights - The forestry sector experienced a decline of 1.67% on October 14, with ST Jinggu leading the drop [1] - The Shanghai Composite Index closed at 3865.23, down 0.62%, while the Shenzhen Component Index closed at 12895.11, down 2.54% [1] Sector Performance - Fujian Jinsen (002679) closed at 10.85, up 1.21% with a trading volume of 75,700 shares and a transaction value of 82.48 million yuan [1] - Yong'an Forestry (000663) closed at 6.73, up 0.30% with a trading volume of 110,200 shares and a transaction value of 74.46 million yuan [1] - Pingtan Development (000592) closed at 3.56, down 1.93% with a trading volume of 1.53 million shares and a transaction value of 553 million yuan [1] - ST Jinggu (600265) closed at 20.81, down 5.02% with a trading volume of 13,100 shares and a transaction value of 28.13 million yuan [1] Capital Flow - The forestry sector saw a net outflow of 34.84 million yuan from main funds, while retail investors contributed a net inflow of 36.98 million yuan [1] - Detailed capital flow for individual stocks shows: - ST Jinggu had a main fund net inflow of 864,200 yuan but a net outflow of 1.04 million yuan from speculative funds [2] - Fujian Jinsen experienced a net outflow of 191,800 yuan from main funds but a net inflow of 2.31 million yuan from retail investors [2] - Yong'an Forestry had a net outflow of 1.99 million yuan from main funds and a net inflow of 1.54 million yuan from retail investors [2] - Pingtan Development faced a significant net outflow of 33.53 million yuan from main funds, with a net inflow of 32.94 million yuan from retail investors [2]

ST景谷(600265) - 2025年第二次临时股东会决议公告

2025-10-13 10:45

云南景谷林业股份有限公司 2025年第二次临时股东会决议公告 重要内容提示: 本次会议是否有否决议案:无 一、 会议召开和出席情况 (一)股东大会召开的时间:2025 年 10 月 13 日 (二)股东大会召开的地点:北京市朝阳区建国门外大街 2 号银泰中心 C 座 2201A 会议室 证券代码:600265 证券简称:ST 景谷 公告编号:2025-097 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 (三)出席会议的普通股股东和恢复表决权的优先股股东及其持有股份情况: | 1、出席会议的股东和代理人人数 | 104 | | --- | --- | | 2、出席会议的股东所持有表决权的股份总数(股) | 77,981,102 | | 3、出席会议的股东所持有表决权股份数占公司有表决权股 | 60.0779 | | 份总数的比例(%) | | (四)表决方式是否符合《公司法》及《公司章程》的规定,大会主持情况等。 本次股东会由公司董事会召集,董事长葛意达先生主持,会议以现场与网络 投票相结合的方式召开。出席本次股东会的股东以 ...

ST景谷(600265) - 北京市中伦律师事务所关于云南景谷林业股份有限公司2025年第二次临时股东会的法律意见书

2025-10-13 10:45

北京市中伦律师事务所 关于云南景谷林业股份有限公司 2025 年第二次临时股东会的 法律意见书 2025 年 10 月 北京 • 上海 • 深圳 • 广州 • 武汉 • 成都 • 重庆 • 青岛 • 杭州 • 南京 • 海口 • 东京 • 香港 • 伦敦 • 纽约 • 洛杉矶 • 旧金山 • 阿拉木图 Beijing • Shanghai • Shenzhen • Guangzhou • Wuhan • Chengdu • Chongqing • Qingdao • Hangzhou • Nanjing • Haikou • Tokyo • Hong Kong • London • New York • Los Angeles • San Francisco • Almaty 2025 年第二次临时股东会的法律意见书 致:云南景谷林业股份有限公司 法律意见书 北京市中伦律师事务所 关于云南景谷林业股份有限公司 北京市中伦律师事务所(以下简称"本所")接受云南景谷林业股份有限公 司(以下简称"公司")委托,指派本所律师对公司 2025 年第二次临时股东会 (以下简称"本次股东会")的合法性进行见证并出具法律意见 ...

新股发行及今日交易提示-20251013

HWABAO SECURITIES· 2025-10-13 09:16

New Stock Issuance - Marco Polo (Stock Code: 001386) issued at a price of 13.75 on October 13, 2025[1] - New material company (Stock Code: 688585) has a tender offer period from September 29 to October 28, 2025[1] - Zitian (Stock Code: 300280) entered the delisting arrangement period with the last trading day on October 13, 2025[1] Market Alerts - Significant abnormal fluctuations reported for Pinming Technology (Stock Code: 688109) on October 10, 2025[1] - Multiple companies including Kesheng Technology (Stock Code: 688788) and Borui Pharmaceutical (Stock Code: 688166) have recent announcements regarding their stock activities[1] - A total of 30 companies have been flagged for abnormal trading activities, indicating potential market volatility[2]

独家 | 2025年9月A股上市公司变更审计机构分析

Sou Hu Cai Jing· 2025-10-12 03:10

Core Insights - In September 2025, a total of 47 listed companies in Shanghai, Shenzhen, and Beijing announced changes to their auditing firms, indicating a significant shift in the auditing landscape [3][6]. Group 1: Changes in Auditing Firms - Notable changes include companies like Xiaoxin Environment switching from Xinyong Zhonghe to Deloitte, and Jian Tai Technology moving from Zhonghua to PwC Zhongtian [4][5]. - The audit fees for 2024 for these companies varied, with Xiaoxin Environment paying 4.96 million yuan and Jian Tai Technology paying 4.5 million yuan [4]. Group 2: Client Changes Among Audit Firms - The firm with the largest decrease in clients was Lixin, losing 7 clients, while Rongcheng gained the most clients, increasing by 6 [6][8]. - The detailed statistics show that Lixin and Rongcheng were the most affected firms in terms of client changes, reflecting a competitive shift in the auditing market [6][9].

周大福投资回复景谷林业股票异动问询:两项重大事项存不确定性

Xin Lang Cai Jing· 2025-10-09 10:58

点击查看公告原文>> 周大福投资有限公司10月9日回复云南景谷林业股份有限公司股票交易异常波动问询函称,目前与景谷 林业有两项重大事项,存在一定不确定性。此外,在景谷林业股票异常波动期间,周大福投资及实际控 制人不存在买卖该公司股票的情况。 周大福投资表示,一是正在筹划将持有的全资子公司上海博达数智科技有限公司51%的股权无偿捐赠给 景谷林业,该事项尚需提交景谷林业股东会审议,后续还需履行股权交割、工商变更登记等手续。二是 拟将景谷林业持有的唐县汇银木业有限公司51%的股权转让至周大福投资或其指定关联方名下,目前该 事项交易方案仍在进一步论证和沟通中。除上述事项及已披露事项外,周大福投资不存在其他与景谷林 业有关的应披露而未披露的重大信息。 声明:市场有风险,投资需谨慎。 本文为AI大模型基于第三方数据库自动发布,任何在本文出现的信 息(包括但不限于个股、评论、预测、图表、指标、理论、任何形式的表述等)均只作为参考,不构成 个人投资建议。受限于第三方数据库质量等问题,我们无法对数据的真实性及完整性进行分辨或核验, 因此本文内容可能出现不准确、不完整、误导性的内容或信息,具体以公司公告为准。如有疑问,请联 系b ...

云南景谷林业:周大福投资披露两项重大事项 存不确定性

Xin Lang Cai Jing· 2025-10-09 10:00

周大福投资有限公司于2025年10月9日回复云南景谷林业《关于对云南景谷林业股份有限公司股票交易 异常波动问询函》,披露两项重大事项,均存不确定性。 点击查看公告原文>> 声明:市场有风险,投资需谨慎。 本文为AI大模型基于第三方数据库自动发布,任何在本文出现的信 息(包括但不限于个股、评论、预测、图表、指标、理论、任何形式的表述等)均只作为参考,不构成 个人投资建议。受限于第三方数据库质量等问题,我们无法对数据的真实性及完整性进行分辨或核验, 因此本文内容可能出现不准确、不完整、误导性的内容或信息,具体以公司公告为准。如有疑问,请联 系biz@staff.sina.com.cn。 责任编辑:小浪快报 据回复,一是周大福投资与云南景谷林业正在筹划将周大福投资持有的全资子公司上海博达数智科技有 限公司51%的股权无偿捐赠给云南景谷林业,该事项尚需提交云南景谷林业股东会审议,后续还需履行 股权交割、工商变更登记等手续。二是周大福投资拟将云南景谷林业持有的唐县汇银木业有限公司51% 的股权转让至周大福投资或其指定关联方名下,目前该事项交易方案仍在进一步论证和沟通中。 此外,在云南景谷林业股票异常波动期间,周大福投资 ...

新股发行及今日交易提示-20251009

HWABAO SECURITIES· 2025-10-09 09:43

New Stock Offerings - The tender offer for Shangwei New Materials (688585) is open from September 29, 2025, to October 28, 2025[1] - Zitian Tui (300280) is in the delisting adjustment period with only 2 trading days remaining until the last trading day[1] Market Alerts - Kesi Technology (688788) and Pinming Technology (688109) have recent announcements but no specific details provided[1] - Magu Technology (688448) is experiencing severe abnormal fluctuations[1] Trading Updates - Multiple companies including Dongjing (002199) and Guosheng Jinkong (002670) have announcements dated October 9, 2025, indicating ongoing trading activities[1] - Companies like Hunan Yuneng (301358) and Wanrun New Energy (688275) have announcements from October 1, 2025, indicating recent trading updates[1] Financial Disclosures - Several companies have disclosed their financial information, with specific announcements linked to their respective stock codes[1] - The report includes links to detailed announcements for various companies, providing transparency in their financial activities[1]

ST景谷(600265) - 股票交易异常波动公告

2025-10-09 09:02

股票交易异常波动公告 证券代码:600265 证券简称:ST 景谷 公告编号:2025-096 云南景谷林业股份有限公司 本公司董事会及全体董事保证本公告内容不存在任何虚假记载、误导性陈述 或者重大遗漏,并对其内容的真实性、准确性和完整性承担法律责任。 重要内容提示: ● 云南景谷林业股份有限公司(以下简称"公司")股票于 2025 年 9 月 29 日、9 月 30 日、10 月 9 日连续 3 个交易日内日收盘价格跌幅偏离值累计超过 12%, 已触及《上海证券交易所交易规则》规定的异常波动标准。鉴于公司股票价格短 期波动较大,公司提醒广大投资者注意二级市场交易风险,理性决策,审慎投资。 ●经公司自查,并向控股股东、实际控制人及其一致行动人书面问询核实, 公司控股股东周大福投资有限公司(以下简称"周大福投资")与公司正在筹划将 周大福投资持有的全资子公司上海博达数智科技有限公司(以下简称"博达数科") 51%的股权无偿捐赠给公司,该事项尚需提交公司股东会审议,后续还需履行股 权交割、工商变更登记等手续,存在一定不确定性;周大福投资与公司拟将公司 持有的控股子公司唐县汇银木业有限公司(以下简称"汇银木业")5 ...

ST景谷(600265) - 关于对云南景谷林业股份有限公司股票交易异常波动问询函的回复

2025-10-09 09:01

关于对云南景谷林业股份有限公司 股票交易异常波动问询函的回复 除上述事项及贵公司已披露事项外,本公司不存在其他与贵公司有关的应 披露而未披露的重大信息,包括但不限于筹划涉及上市公司的重大资产重组、 股份发行、重大交易类事项、业务重组、股份回购、股权激励、破产重整、重 大业务合作、引进战略投资者等重大事项。 二、在公司股票交易异常波动期间,贵公司及公司实际控制人是否存在买 卖本公司股票的情况 回复如下:在贵公司股票异常波动期间,本公司及实际控制人不存在买卖 贵公司股票的情况。 特此回复。 云南景谷林业股份有限公司: 周大福投资有限公司(以下简称"本公司")于2025年10月9日收到贵公 司发来的《关于对云南景谷林业股份有限公司股票交易异常波动问询函》。经 周大福投资有限公司认真自查确认并电话向实际控制人确认,现回复如下: 一、截至目前,贵公司及公司实际控制人是否存在与本公司有关的应披露 而未披露的重大信息,包括但不限于筹划涉及上市公司的重大资产重组、股份 发行、重大交易类事项、业务重组、股份回购、股权激励、破产重整、重大业 务合作、引进战略投资者等重大事项 回复如下:如贵公司已批露的公告所述:1、本公司与贵公司 ...