COFC(000798)

Search documents

中水渔业(000798) - 第九届董事会第十一次会议决议公告

2025-10-23 10:45

证券代码:000798 证券简称:中水渔业 公告编号:2025-033 中水集团远洋股份有限公司 第九届董事会第十一次会议决议公告 本公司及董事会全体成员保证信息披露的内容真实、准确、完整,没有虚 假记载、误导性陈述或重大遗漏。 一、董事会会议召开情况 1.中水集团远洋股份有限公司(以下简称"公司")第九届董事 会第十一次会议于2025年10月15日以书面方式发出会议通知。 2.本次会议于2025年10月23日以现场和网络相结合的方式召开。 3.本次会议由董事(代行董事长职责)叶少华先生主持,应出席 董事8人,实际出席8人。 4.本次会议的召开符合《公司法》和《公司章程》的有关规定, 会议合法有效。 二、董事会会议审议情况 1.审议通过《2025 年第三季度报告》 1 披露的《关于续聘 2025 年度审计机构的公告》。 3.审议通过《2025 年三季度募集资金存放与使用情况专项报告》 本议案同意票 8 票,反对票 0 票,弃权票 0 票。 公司审计与合规委员会审议通过并发表审查意见。 本议案同意票 8 票,反对票 0 票,弃权票 0 票。 具体内容详见同日于巨潮资讯网 (http://www.cninfo.c ...

中水渔业:10月23日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-23 10:43

Core Viewpoint - Zhongshui Fishery (SZ 000798) announced the convening of its 11th board meeting for the 9th session on October 23, 2025, to review the proposal for reappointing the auditing firm for the fiscal year 2025 [1] Group 1: Company Financials - For the first half of 2025, Zhongshui Fishery's revenue composition is as follows: 42.3% from fishing income, 36.88% from fishery services, 20.73% from retail and processing trade, and 0.09% from other industries [1] - As of the report date, Zhongshui Fishery has a market capitalization of 3 billion yuan [1]

中水渔业:2025年前三季度净利润约5341万元

Mei Ri Jing Ji Xin Wen· 2025-10-23 10:43

Group 1 - Company reported Q3 performance with revenue of approximately 2.967 billion yuan for the first three quarters of 2025, a year-on-year decrease of 8.67% [1] - Net profit attributable to shareholders was approximately 53.41 million yuan, showing a year-on-year increase of 230.08% [1] - Basic earnings per share reached 0.146 yuan, reflecting a year-on-year increase of 230.32% [1] Group 2 - As of the report date, the market capitalization of the company is 3 billion yuan [2]

中水渔业:第三季度净利润亏损3290.21万元

Xin Lang Cai Jing· 2025-10-23 10:42

中水渔业公告,第三季度营收为12.19亿元,同比下降5.66%;净利润亏损3290.21万元。前三季度营收 为29.67亿元,同比下降8.67%;净利润为5340.81万元,同比增长230.08%。 ...

渔业板块10月23日涨0.46%,开创国际领涨,主力资金净流出3210.54万元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:14

Core Insights - The fishery sector experienced a 0.46% increase on October 23, with KaiChuang International leading the gains [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index also rose by 0.22% to 13025.45 [1] Stock Performance - KaiChuang International (600097) closed at 11.89, with a rise of 2.32% and a trading volume of 89,400 shares, amounting to a transaction value of 106 million yuan [1] - ZhongShui Fishery (000798) saw a 0.97% increase, closing at 8.33 with a trading volume of 62,700 shares and a transaction value of 51.95 million yuan [1] - DaHu Co. (600257) increased by 0.53%, closing at 5.68 with a trading volume of 122,000 shares and a transaction value of 68.95 million yuan [1] - HaoDangJia (600467) remained unchanged at 2.47, with a trading volume of 282,400 shares and a transaction value of 69.44 million yuan [1] - ZhangZiDao (002069) also remained unchanged at 3.96, with a trading volume of 89,500 shares and a transaction value of 35.24 million yuan [1] - YuanLian Aquatic Products (300094) decreased by 0.55%, closing at 3.61 with a trading volume of 248,500 shares and a transaction value of 89.31 million yuan [1] Capital Flow - The fishery sector saw a net outflow of 32.11 million yuan from main funds, while retail investors contributed a net inflow of 32.45 million yuan [1] - Detailed capital flow for key stocks indicates that KaiChuang International had a net inflow of 2.90 million yuan from main funds, while ZhongShui Fishery experienced a net outflow of 5.19 million yuan [2] - DaHu Co. and HaoDangJia also faced significant net outflows from main funds, amounting to 5.26 million yuan and 5.83 million yuan respectively [2]

渔业板块10月22日跌0.09%,獐子岛领跌,主力资金净流出3794.35万元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:19

Market Overview - On October 22, the fishery sector declined by 0.09%, with Zhuangzi Island leading the drop [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Stock Performance - Key stocks in the fishery sector showed mixed performance, with the following closing prices and changes: - Zhongshui Fishery (000798): 8.25, +0.49% - Kaichuang International (600097): 11.62, +0.43% - Haodangjia (600467): 2.47, +0.41% - Guolian Aquatic Products (300094): 3.63, -0.27% - Dahuhua (600257): 5.65, -0.70% - Zhuangzi Island (002069): 3.96, -1.00% [1] Capital Flow - The fishery sector experienced a net outflow of 37.94 million yuan from main funds and 18.56 million yuan from speculative funds, while retail investors saw a net inflow of 56.51 million yuan [1] - Detailed capital flow for key stocks includes: - Guolian Aquatic Products: Main fund net inflow of 1.55 million yuan, retail net inflow of 2.11 million yuan - Zhongshui Fishery: Main fund net outflow of 2.70 million yuan, retail net inflow of 4.19 million yuan - Kaichuang International: Main fund net outflow of 3.48 million yuan, retail net inflow of 7.73 million yuan - Zhuangzi Island: Main fund net outflow of 4.08 million yuan, retail net inflow of 6.34 million yuan - Haodangjia: Main fund net outflow of 11.32 million yuan, retail net inflow of 15.19 million yuan - Dahuhua: Main fund net outflow of 17.90 million yuan, retail net inflow of 20.95 million yuan [2]

渔业板块10月20日涨1.18%,獐子岛领涨,主力资金净流入88.83万元

Zheng Xing Xing Ye Ri Bao· 2025-10-20 08:21

Core Insights - The fisheries sector experienced a rise of 1.18% on October 20, with Zhangzidao leading the gains [1] - The Shanghai Composite Index closed at 3863.89, up 0.63%, while the Shenzhen Component Index closed at 12813.21, up 0.98% [1] Fisheries Sector Performance - Zhangzidao (002069) closed at 3.80, with an increase of 2.43% and a trading volume of 142,600 shares, amounting to a transaction value of 53.69 million yuan [1] - Haodangjia (600467) closed at 2.41, up 1.69%, with a trading volume of 276,100 shares and a transaction value of 66.06 million yuan [1] - Zhongshui Fisheries (000798) closed at 8.04, increasing by 1.52%, with a trading volume of 44,600 shares and a transaction value of 35.68 million yuan [1] - Kaichuang International (600097) closed at 11.19, up 0.81%, with a trading volume of 31,600 shares and a transaction value of 35.14 million yuan [1] - Guolian Aquatic Products (300094) closed at 3.60, with a slight increase of 0.56%, trading 173,900 shares for a total of 62.43 million yuan [1] - Dahuhua (600257) closed at 5.52, up 0.18%, with a trading volume of 109,100 shares and a transaction value of 60.10 million yuan [1] Capital Flow Analysis - The fisheries sector saw a net inflow of 888,300 yuan from institutional investors, while retail investors contributed a net inflow of 1,009,320 yuan [1] - Speculative funds experienced a net outflow of 1,098,150 yuan [1] - Specific stock capital flows included: - Haodangjia (600467) had a net inflow of 8.02 million yuan from institutional investors, but a net outflow of 6.36 million yuan from speculative funds [2] - Dahuhua (600257) saw a net inflow of 495,700 yuan from retail investors despite a net outflow from institutional and speculative funds [2] - Zhangzidao (002069) experienced a net outflow of 998,300 yuan from institutional investors, but a net inflow of 1.71 million yuan from retail investors [2] - Guolian Aquatic Products (300094) had a significant net inflow of 4.89 million yuan from retail investors despite outflows from other investor types [2]

渔业板块10月15日涨0.05%,大湖股份领涨,主力资金净流出283.84万元

Zheng Xing Xing Ye Ri Bao· 2025-10-15 08:27

Core Insights - The fishing sector experienced a slight increase of 0.05% on October 15, with Dahu Co. leading the gains [1] - The Shanghai Composite Index closed at 3912.21, up 1.22%, while the Shenzhen Component Index closed at 13118.75, up 1.73% [1] Sector Performance - Dahu Co. (600257) closed at 5.51, with a rise of 2.04% and a trading volume of 201,900 shares, amounting to a transaction value of 111 million yuan [1] - Zhanzi Island (002069) saw a closing price of 4.04, up 1.00%, with a trading volume of 93,100 shares and a transaction value of 37.49 million yuan [1] - Haodangjia (600467) closed at 2.42, up 0.41%, with a trading volume of 281,400 shares and a transaction value of 68.06 million yuan [1] - Zhongshui Fishery (000798) closed at 8.05, down 0.25%, with a trading volume of 46,000 shares and a transaction value of 36.98 million yuan [1] - Kaichuang International (600097) closed at 11.25, down 0.88%, with a trading volume of 33,900 shares and a transaction value of 38.06 million yuan [1] - Guolian Aquatic Products (300094) closed at 3.69, down 1.34%, with a trading volume of 289,800 shares [1] Capital Flow Analysis - The fishing sector saw a net outflow of 2.84 million yuan from institutional investors and 1.81 million yuan from speculative funds, while retail investors had a net inflow of 4.65 million yuan [1] - Dahu Co. had a net inflow of 9.12 million yuan from institutional investors, but a net outflow of 3.98 million yuan from speculative funds and 5.14 million yuan from retail investors [2] - Haodangjia experienced a net inflow of 1.60 million yuan from institutional investors, with a net inflow of 0.32 million yuan from speculative funds, but a net outflow of 1.92 million yuan from retail investors [2] - Zhanzi Island had a net inflow of 0.86 million yuan from institutional investors, but a significant net outflow of 4.26 million yuan from speculative funds and a net inflow of 3.39 million yuan from retail investors [2] - Kaichuang International faced a net outflow of 0.21 million yuan from institutional investors, with a net inflow of 0.24 million yuan from speculative funds and a negligible net outflow from retail investors [2] - Zhongshui Fishery had a net outflow of 0.48 million yuan from institutional investors, with a net outflow of 1.48 million yuan from speculative funds and a net inflow of 1.96 million yuan from retail investors [2] - Guolian Aquatic Products experienced a significant net outflow of 13.73 million yuan from institutional investors, but a net inflow of 7.35 million yuan from speculative funds and a net inflow of 6.38 million yuan from retail investors [2]

渔业板块10月14日涨1.08%,中水渔业领涨,主力资金净流入888.24万元

Zheng Xing Xing Ye Ri Bao· 2025-10-14 08:39

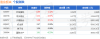

证券之星消息,10月14日渔业板块较上一交易日上涨1.08%,中水渔业领涨。当日上证指数报收于 3865.23,下跌0.62%。深证成指报收于12895.11,下跌2.54%。渔业板块个股涨跌见下表: 从资金流向上来看,当日渔业板块主力资金净流入888.24万元,游资资金净流出2033.08万元,散户资金 净流入1144.84万元。渔业板块个股资金流向见下表: | 代码 | 名称 | 主力净流入 (元) | 主力净占比 游资净流入 (元) | | 游资净占比 散户净流入 (元) | | 散户净占比 | | --- | --- | --- | --- | --- | --- | --- | --- | | 300094 国联水产 | | 2771.12万 | 15.92% | -1137.20万 | -6.53% | -1633.91万 | -9.39% | | 000798 中水渔业 | | -146.28万 | -2.68% | -445.47万 | -8.17% | 591.75万 | 10.85% | | 600097 | 开创国际 | -215.36万 | -4.17% | -199.83万 | -3 ...

渔业板块10月13日涨0.43%,国联水产领涨,主力资金净流入845.19万元

Zheng Xing Xing Ye Ri Bao· 2025-10-13 12:38

证券之星消息,10月13日渔业板块较上一交易日上涨0.43%,国联水产领涨。当日上证指数报收于 3889.5,下跌0.19%。深证成指报收于13231.47,下跌0.93%。渔业板块个股涨跌见下表: | 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | --- | --- | --- | --- | --- | --- | | 300094 | 国联水产 | 3.71 | 1.64% | 33.24万 | 1.20亿 | | 600257 | 大湖股份 | 5.34 | 0.95% | 17.37万 | 9224.33万 | | 000798 | 中水渔业 | 7.92 | 0.51% | 5.70万 | 4485.40万 | | 600467 | 好当家 | 2.40 | 0.00% | 33.69万 | 7991.21万 | | 600097 | 开创国际 | 11.15 | -0.45% | 3.67万 | 4039.23万 | | 002069 | 獐子岛 | 3.97 | -0.50% | 11.91万 | 4711.11万 | 以上内容为证券之星据公开信息整理,由 ...