Shanghai SK Petroleum and Chemical Equipment (002278)

Search documents

利好引爆!这一概念,涨停潮!

Zheng Quan Shi Bao· 2025-10-22 04:31

Group 1 - The concept of "deep earth economy" has emerged as a market highlight, with several stocks experiencing significant gains, including De Shi Co., which hit a 20% limit up [1][4] - The deep earth economy focuses on the development of underground space and deep resources, covering areas such as geological exploration, underground engineering, deep drilling equipment, and technical services, aimed at addressing the depletion of surface resources and ensuring national energy security [4] - The Ministry of Natural Resources has indicated that during the 14th Five-Year Plan period, standardization efforts will focus on emerging industries like deep sea and deep earth [4] Group 2 - The A-share market experienced fluctuations, with major indices mostly declining; the Shanghai Composite Index fell by 0.44%, while the North China 50 Index rose by 1.19% [3] - The media sector led the gains, with a peak increase of over 1%, and several stocks, including Hubei Broadcasting, hitting the limit up [3] - The real estate sector also showed strong performance, with multiple stocks such as Yingxin Development and Guangming Real Estate reaching limit up [3] Group 3 - Gold-related stocks faced significant declines due to a sharp drop in gold prices, with several stocks in the A-share market and Hong Kong market experiencing losses exceeding 5% [6][5] - The price of gold on the Shanghai Gold Exchange fell sharply, with the Au99.99 contract dropping over 5% and reaching a low of 932 yuan per gram [6] - Silver prices also plummeted, with the main silver futures contract on the Shanghai Futures Exchange experiencing a drop of over 5% [7] Group 4 - The new stock Marco Polo saw a dramatic increase of over 190% on its debut, being one of the largest manufacturers and sellers of building ceramics in China [8] - Marco Polo operates five production bases in China and the U.S., focusing on both glazed and unglazed tiles, and has established several innovation platforms and high-tech enterprises [8]

利好引爆!这一概念,涨停潮!

证券时报· 2025-10-22 04:08

Core Viewpoint - The concept of "deep earth economy" has emerged as a market highlight, with several stocks experiencing significant gains, particularly in the context of A-share market fluctuations [2][5][9]. Market Performance - On October 22, the A-share market experienced volatility, with major indices mostly declining. The Shanghai Composite Index fell by 0.44%, the Shenzhen Component Index by 0.81%, and the ChiNext Index by 0.89%. In contrast, the North Star 50 Index rose by 1.19% [4]. - The media sector led the gains, with a peak increase of over 1%, and several stocks, including Hubei Broadcasting, hitting the daily limit [4]. - The real estate sector also showed strength, with multiple stocks such as Yingxin Development and Bright Real Estate reaching their daily limit [4]. Deep Earth Economy - The deep earth economy focuses on the development of underground space and deep resources, encompassing geological exploration, underground engineering, deep drilling equipment, and technical services. This new economic model aims to address the depletion of surface resources and ensure national energy security and strategic development [8][9]. - Stocks related to the deep earth economy, such as Deshi Co., China Minmetals, and North China Holdings, saw significant price increases, with Deshi Co. hitting a 20% limit up [2][5]. Gold Sector Decline - The gold sector faced substantial declines, with multiple gold mining stocks dropping significantly. For instance, Western Gold fell over 6%, and several others saw declines exceeding 5% [11][14]. - The international gold price experienced a sharp drop, with the Shanghai Gold Exchange's Au99.99 contract price falling by over 5%, reaching a low of 932 yuan per gram [14]. New Stock Performance - The newly listed stock Marco Polo saw a dramatic increase, with its price rising over 190% during the morning session [16]. - Marco Polo is recognized as one of the largest manufacturers and sellers of building ceramics in China, with significant production capabilities across multiple locations [19].

可燃冰板块延续强势,石化油服、神开股份涨停

Mei Ri Jing Ji Xin Wen· 2025-10-22 02:18

(文章来源:每日经济新闻) 每经AI快讯,10月22日,可燃冰板块延续强势,石化油服、神开股份涨停,德石股份涨超15%,中海油 服、潜能恒信等跟涨。 ...

页岩气板块延续活跃,中裕科技创新高

Mei Ri Jing Ji Xin Wen· 2025-10-22 01:50

Group 1 - The shale gas sector continues to be active, with Zhongyu Technology reaching a new high [1] - ShenKong Co., Shihua Machinery have achieved three consecutive trading limits [1] - Other companies such as Desheng Co., Shihua Oil Service, Shandong Molong, Bingyang Technology, and Shanhe Intelligent are also experiencing upward trends [1]

页岩气板块延续活跃,神开股份、石化机械3连板

Xin Lang Cai Jing· 2025-10-22 01:31

Core Viewpoint - The shale gas sector remains active, with notable stock performances from various companies, indicating a positive trend in the industry [1] Group 1: Company Performance - Zhongyu Technology reached a new high in stock price [1] - ShenKong Co., Shihua Machinery achieved three consecutive trading limits [1] - DeShih Co., Shihua Oil Service, Shandong Molong, Bingyang Technology, and Shanhe Intelligent also experienced upward movement in stock prices [1]

揭秘涨停 | 芯片概念多股涨停

Zheng Quan Shi Bao Wang· 2025-10-21 10:52

Market Overview - On October 21, the A-share market closed with a total of 93 stocks hitting the daily limit, with 79 stocks after excluding 14 ST stocks, resulting in a limit-up rate of 80.87% [1] Top Gainers - The stock with the highest limit-up order volume was Shihua Oil Service, with 465,700 hands, followed by ShenKai Co., Zhonghua Rock Soil, and Shihua Machinery with 348,300 hands, 344,900 hands, and 325,400 hands respectively [2] - In terms of consecutive limit-up days, Pioneer Electronics and ST Zhongdi achieved three consecutive limit-ups, while ShenKai Co., Shihua Machinery, and CITIC Heavy Industries had two consecutive limit-ups [2] Significant Stocks - Pioneer Electronics achieved a limit-up with a closing price of 25.03 yuan and a limit-up order amount of 4.61 billion yuan, focusing on smart gas metering and safety monitoring [3][4] - ShenKai Co. closed at 11.21 yuan with a limit-up order amount of 3.90 billion yuan, driven by deep-sea equipment and robot concepts [3][4] - Shihua Machinery closed at 7.72 yuan with a limit-up order amount of 2.51 billion yuan, benefiting from oil and gas equipment and state-owned enterprise status [3][4] Sector Highlights Chip Sector - Multiple stocks in the chip sector, including Dawi Co., Taiji Industry, and Wentai Technology, achieved limit-ups, with Dawi Co. focusing on high-performance storage chip products [4][5][6] Real Estate Sector - Stocks such as Shangshi Development and Hefei Urban Construction saw limit-ups, with Shangshi Development reporting a signed sales amount of approximately 290 million yuan [7] Energy Equipment Sector - Stocks like Shihua Oil Service and ShenKai Co. also achieved limit-ups, with Shihua Oil Service accelerating its overseas business development [8] Investment Trends - The net buying amount for stocks on the Dragon and Tiger list included significant purchases in Shanhe Intelligent and Hefei Urban Construction, with net buying amounts of 1.88 billion yuan and 1.18 billion yuan respectively [9][10]

机械设备行业今日涨2.09%,主力资金净流入39.46亿元

Zheng Quan Shi Bao Wang· 2025-10-21 09:10

Market Overview - The Shanghai Composite Index rose by 1.36% on October 21, with 30 out of 31 sectors experiencing gains, particularly in the communication and electronics sectors, which increased by 4.90% and 3.50% respectively [1] - The mechanical equipment sector also saw an increase of 2.09% [1] - The coal sector was the only one to decline, with a drop of 1.02% [1] Capital Flow Analysis - The net inflow of capital in the two markets reached 27.724 billion yuan, with 17 sectors experiencing net inflows [1] - The electronics sector led the net inflow with 12.028 billion yuan, followed by the communication sector with 5.525 billion yuan [1] - Conversely, 14 sectors experienced net outflows, with the banking sector seeing the largest outflow of 1.705 billion yuan, followed by the coal sector with an outflow of 1.409 billion yuan [1] Mechanical Equipment Sector Performance - The mechanical equipment sector had a net capital inflow of 3.946 billion yuan, with 474 out of 531 stocks in the sector rising, and 15 stocks hitting the daily limit [2] - The top three stocks with the highest net inflow were Huagong Technology (5.30 billion yuan), Shanhai Intelligent (5.29 billion yuan), and Shenkai Co. (1.66 billion yuan) [2] - The sector also had 12 stocks with net outflows exceeding 30 million yuan, with the largest outflows from Sifangda (2.10 billion yuan), Hezhuan Intelligent (875.18 million yuan), and Julisi (723.98 million yuan) [2][3] Top Gainers in Mechanical Equipment Sector - The top gainers in the mechanical equipment sector included: - Huagong Technology: +3.81%, turnover rate 7.41%, net inflow 529.61 million yuan - Shanhai Intelligent: +10.04%, turnover rate 10.12%, net inflow 528.64 million yuan - Shenkai Co.: +10.01%, turnover rate 6.33%, net inflow 166.09 million yuan [2] Top Losers in Mechanical Equipment Sector - The top losers in the mechanical equipment sector included: - Sifangda: +11.10%, turnover rate 39.98%, net outflow -210.21 million yuan - Hezhuan Intelligent: -0.04%, turnover rate 16.72%, net outflow -87.52 million yuan - Julisi: -0.93%, turnover rate 13.47%, net outflow -72.40 million yuan [3]

【每日收评】沪指重返3900点!全市场超4600股收红,深地经济、算力硬件方向双双领涨

Xin Lang Cai Jing· 2025-10-21 08:53

智通财经10月21日讯,市场震荡反弹,创业板指涨超3%,沪指涨1.36%重返3900点。沪深两市成交额1.87万亿,较上一个交易日放量1363亿。盘面上,市场 热点轮番活跃,全市场超4600只个股上涨。深地经济概念持续走强,神开股份、石化机械双双2连板。CPO概念股全天走强,"易中天"光模块三巨头震荡拉 升,源杰科技触及20cm涨停创历史新高。苹果产业链表现活跃,环旭电子涨停,工业富联大涨。下跌方面,煤炭股走弱,安泰集团大跌。截至收盘,沪指 涨1.36%,深成指涨2.06%,创业板指涨3.02%。 板块方面 板块上,深地经济全面发酵,正元地信20cm涨停,中裕科技、德石股份、山河智能、中化岩土、山东墨龙、中信重工、山河智能等多股涨停,恒立钻具、 四方达涨超10%。 消息面上,近日,自然资源部表示,"十五五"期间,自然资源标准化工作将聚焦:加快抢占深海、深地等新兴和未来产业的标准化制高点。 机构研报分析,"深地经济"是指以地下空间开发、深部资源勘探与利用、深地技术应用为核心的战略性新兴产业,涵盖装备制造、资源开发、地下空间建 设、技术服务四大产业链环节。其中装备制造与地下空间建设是核心赛道,相关企业凭借技术壁垒 ...

“深地经济”站上风口,多股涨停,神开股份、德石股份两连板

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-21 08:32

Core Viewpoint - The three major stock indices collectively rose, with the Shanghai Composite Index increasing by over 1% to surpass 3900 points, and the ChiNext Index rising by over 3% [1] Group 1: Market Performance - The Shanghai Composite Index rose over 1% and returned above 3900 points [1] - The ChiNext Index experienced a rise of over 3% [1] Group 2: Sector Movement - Deep earth economy concept stocks showed collective movement, with Zhongyu Technology hitting the daily limit, and companies like Shenkai Co., Shihua Machinery, and Deshi Co. achieving two consecutive limit-ups [1] Group 3: Policy and Industry Focus - The Ministry of Natural Resources announced that during the 14th Five-Year Plan period, the focus of natural resource standardization work will be on accelerating the standardization of emerging and future industries, particularly in deep sea and deep earth sectors [1] - The development and utilization of deep earth resources primarily concentrate on the mining and use of deep earth mineral resources and the construction and exploration of deep space [1]

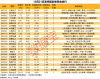

专用设备板块10月21日涨2.67%,德石股份领涨,主力资金净流入13.29亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:30

Market Overview - The specialized equipment sector increased by 2.67% on October 21, with DeShi Co., Ltd. leading the gains [1] - The Shanghai Composite Index closed at 3916.33, up 1.36%, while the Shenzhen Component Index closed at 13077.32, up 2.06% [1] Key Stocks Performance - DeShi Co., Ltd. (301158) closed at 25.66, up 20.02% with a trading volume of 187,300 shares and a transaction value of 479 million [1] - Guangli Technology (300480) closed at 18.25, up 10.67% with a trading volume of 335,900 shares [1] - Other notable performers include: - Zhongxin Chegong (601608) at 6.90, up 10.05% - ShenKai Co., Ltd. (002278) at 11.21, up 10.01% - Daqiao Crane (002523) at 4.29, up 10.00% [1] Capital Flow Analysis - The specialized equipment sector saw a net inflow of 1.329 billion in main funds, while retail investors experienced a net outflow of 783 million [2][3] - The main funds' net inflow for Tianqiao Crane (002523) was 145 million, representing 31.24% of its total [3] - Taiyuan Heavy Industry (600169) had a main fund net inflow of 127 million, accounting for 35.81% [3] Summary of Individual Stock Movements - The following stocks experienced significant movements: - ShenKai Co., Ltd. (002278) had a main fund net inflow of 104 million, with a retail net outflow of 50 million [3] - Shandong Molong (002490) saw a main fund net inflow of 7368.23 million, with retail outflows of 3724.53 million [3] - Overall, the specialized equipment sector showed a mixed capital flow, with main funds favoring certain stocks while retail investors withdrew [2][3]