FCSC(002797)

Search documents

A股公告精选 | 第一创业(002797.SZ):全资子公司一创投行被证监会立案

智通财经网· 2025-10-31 12:30

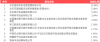

Group 1 - First Capital's wholly-owned subsidiary, Yi Chuang Investment Bank, has been investigated by the China Securities Regulatory Commission (CSRC) for failing to diligently supervise the 2019 convertible bond project of Hongda Xingye [1] - Baichuan Energy plans to invest 215 million yuan to acquire a 22.86% stake in Xi'an Zhongke Optoelectronics, a high-tech company engaged in the research and production of embodied intelligent robots [2] - Insai Group has decided to terminate its major asset restructuring plan due to changes in the external environment, which involved acquiring 80% of Zhizhe Tongxing Brand Management Consulting [3] Group 2 - CICC has elected Wang Shuguang as the vice chairman of the company, effective immediately [4] - Anfu Technology intends to acquire a 6.7402% stake in Anfu Energy for 304 million yuan, increasing its ownership in the company from 39.09% to 41.91% [5] - Time Space Technology's stock has seen a significant increase of 198.04% since September 2025, with a recent trading risk warning due to high turnover rates [6] Group 3 - Tianhua New Energy has signed a share transfer agreement with CATL to transfer 12.95% of its shares for a total consideration of 2.635 billion yuan, which will optimize the company's shareholder structure [7] - Huaxin Cement will change its stock abbreviation to "Huaxin Building Materials" starting November 6, 2025, while maintaining its stock code [8][9] - Berry Genomics has received a medical device registration certificate for its third-generation sequencing platform, Sequel® II CNDx, which is the first of its kind approved for clinical use [10] Group 4 - Zhongchuang Environmental Protection has decided to terminate its plan to issue shares to specific investors due to changes in market conditions [11] - Qingyue Technology has been investigated by the CSRC for suspected false reporting of financial data, which could lead to significant penalties [12] - Best Beauty's actual controller is under investigation by the CSRC for failing to fulfill mandatory acquisition obligations and information disclosure violations [13] Group 5 - Lanke High-tech plans to adjust its major asset restructuring plan to acquire 51% of China Air Separation for cash, which will optimize its asset structure [14] - Jintian Co. intends to invest 60 million yuan to establish an industrial fund in partnership with Zhejiang Fuhua Ruiyin Investment Management [15] - Dongfang Risen has received an administrative regulatory decision from the Ningbo Securities Regulatory Bureau for failing to disclose significant events in a timely manner [16] Group 6 - Gongjin Co. will change its controlling shareholder to Tangshan Industrial Control Group, with stock resuming trading on November 3, 2025 [17][18] - Taifu Pump Industry has terminated its plan to acquire a minimum of 51% of Nanyang Huacheng due to a lack of consensus on the final transaction plan [19] Group 7 - Wanhua Chemical has completed a share reduction plan, reducing its holdings by approximately 17 million shares, totaling 1.115 billion yuan [20] - Microchip Biotech plans to repurchase shares worth between 10 million and 15 million yuan to support employee stock ownership plans [20] - Hopu Co. has signed a 520 million yuan procurement contract for a storage system with China Energy Construction Group [21] - Hongying Intelligent has signed a 616 million yuan total contract for a storage power station project, which is expected to positively impact future business performance [21]

突发!第一创业投行被证监会立案

Sou Hu Cai Jing· 2025-10-31 12:17

Core Viewpoint - The company announced that its wholly-owned subsidiary, First Capital Securities Underwriting and Sponsorship Co., Ltd., is under investigation by the China Securities Regulatory Commission (CSRC) for alleged negligence in its supervisory duties related to the Hongda Xingye Co., Ltd. convertible bond project in 2019 [1][4]. Group 1 - The CSRC has decided to initiate a case against First Capital Securities due to the suspected failure to diligently perform its continuous supervision duties [1]. - The company stated that First Capital Securities will actively cooperate with the CSRC and will strictly adhere to regulatory requirements for information disclosure [4]. - The operational status of the company and First Capital Securities remains normal at this time [4].

第一创业(002797.SZ):子公司一创投行收到证监会立案告知书

Ge Long Hui A P P· 2025-10-31 11:48

格隆汇10月31日丨第一创业(002797.SZ)公布,公司全资子公司第一创业证券承销保荐有限责任公司 (简称"一创投行")于2025年10月31日收到中国证券监督管理委员会(简称"中国证监会")《立案告知 书》(证监立案字0102025023号)。因一创投行在鸿达兴业股份有限公司2019年可转债项目中,涉嫌持 续督导业务未勤勉尽责,根据《中华人民共和国证券法》《中华人民共和国行政处罚法》等法律法规, 2025年10月29日,中国证监会决定对一创投行立案。一创投行将积极配合中国证监会的相关工作,公司 将严格按照监管要求履行信息披露义务。 ...

第一创业:全资子公司一创投行遭中国证监会立案

Zheng Quan Shi Bao Wang· 2025-10-31 11:40

Core Viewpoint - The company announced that its wholly-owned subsidiary, Yichuang Securities, is under investigation by the China Securities Regulatory Commission (CSRC) for alleged negligence in its supervisory duties related to a convertible bond project of Hongda Xingye Co., Ltd. in 2019 [1] Group 1 - Yichuang Securities received a notice of investigation from the CSRC on October 31 [1] - The investigation is based on allegations of failure to diligently perform supervisory duties in the 2019 convertible bond project [1] - The company and its subsidiary's operational status remains normal despite the investigation [1]

第一创业(002797) - 关于全资子公司收到中国证券监督管理委员会立案告知书的公告

2025-10-31 11:38

证券代码:002797 证券简称:第一创业 公告编号:2025-066 第一创业证券股份有限公司 特此公告。 第一创业证券股份有限公司董事会 二〇二五年十一月一日 1 关于全资子公司收到中国证券监督管理委员会立案告知书的公告 本公司及董事会全体成员保证信息披露的内容真实、准确和完整,没有虚假 记载、误导性陈述或重大遗漏。 第一创业证券股份有限公司(以下简称"公司")全资子公司第一创业证券 承销保荐有限责任公司(以下简称"一创投行")于 2025 年 10 月 31 日收到中 国证券监督管理委员会(以下简称"中国证监会")《立案告知书》(证监立案 字 0102025023 号)。因一创投行在鸿达兴业股份有限公司 2019 年可转债项目中, 涉嫌持续督导业务未勤勉尽责,根据《中华人民共和国证券法》《中华人民共和 国行政处罚法》等法律法规,2025 年 10 月 29 日,中国证监会决定对一创投行 立案。 一创投行将积极配合中国证监会的相关工作,公司将严格按照监管要求履行 信息披露义务。 目前公司和一创投行的经营情况正常。相关信息以公司公告为准,敬请广大 投资者理性投资,注意投资风险。 ...

第一创业:全资子公司一创投行收到中国证监会立案告知书

Xin Lang Cai Jing· 2025-10-31 11:34

第一创业公告,全资子公司第一创业证券承销保荐有限责任公司于2025年10月31日收到中国证监会《立 案告知书》。因一创投行在鸿达兴业股份有限公司2019年可转债项目中,涉嫌持续督导业务未勤勉尽 责,根据《中华人民共和国证券法》《中华人民共和国行政处罚法》等法律法规,2025年10月29日,中 国证监会决定对一创投行立案。 ...

第一创业(002797.SZ):2025年三季报净利润为7.71亿元、同比较去年同期上涨20.21%

Sou Hu Cai Jing· 2025-10-30 22:58

Core Insights - First Capital (002797.SZ) reported a total operating revenue of 2.985 billion yuan for Q3 2025, an increase of 584 million yuan compared to the same period last year, marking a 24.32% year-on-year growth [1] - The net profit attributable to shareholders reached 771 million yuan, up by 130 million yuan from the previous year, reflecting a 20.21% increase year-on-year [1] - The company achieved a net cash inflow from operating activities of 1.707 billion yuan [1] Financial Performance - The latest debt-to-asset ratio stands at 67.89%, ranking 4th among disclosed peers, with a decrease of 0.28 percentage points from the previous quarter [1] - The return on equity (ROE) is 4.52%, an increase of 0.41 percentage points compared to the same period last year [1] - The diluted earnings per share (EPS) is 0.07 yuan [1] Efficiency Metrics - The total asset turnover ratio is 0.06 times, ranking 1st among disclosed peers, remaining stable compared to the previous year, with a year-on-year increase of 6.73% [1] Shareholder Structure - The number of shareholders is 242,700, with the top ten shareholders holding a total of 1.488 billion shares, accounting for 35.41% of the total share capital [1] - The top ten shareholders include notable entities such as Beijing State-owned Capital Operation Management Co., Ltd. and Beijing Jingguorui State-owned Enterprise Reform Development Fund [1]

第一创业(002797.SZ):前三季净利润7.7亿元 同比增长20.21%

Ge Long Hui A P P· 2025-10-30 14:07

格隆汇10月30日丨第一创业(002797.SZ)公布三季度报告,前三季营业总收入29.8亿元,同比增长 24.32%,归属于上市公司股东的净利润7.7亿元,同比增长20.21%,归属于上市公司股东的扣除非经常 性损益的净利润7.62亿元,同比增长20.33%。 ...

第一创业(002797) - 关于修订《公司章程》及其附件的公告

2025-10-30 11:29

证券代码:002797 证券简称:第一创业 公告编号:2025-065 第一创业证券股份有限公司 关于修订《公司章程》及其附件的公告 本公司及董事会全体成员保证信息披露的内容真实、准确和完整,没有虚假 记载、误导性陈述或重大遗漏。 根据《中华人民共和国公司法》《上市公司章程指引》《上市公司股东会规 则》《深圳证券交易所股票上市规则(2025 年修订)》《深圳证券交易所上市 公司自律监管指引第 1 号——主板上市公司规范运作(2025 年修订)》等有关 法律法规和准则的规定,并结合公司实际情况,公司拟修订《第一创业证券股份 有限公司章程》及其附件《第一创业证券股份有限公司股东会议事规则》《第一 创业证券股份有限公司董事会议事规则》,具体修订内容详见本公告附件。 修订后的《第一创业证券股份有限公司章程》及其附件《第一创业证券股份 有限公司股东会议事规则》《第一创业证券股份有限公司董事会议事规则》已经 公司第五届董事会第六次会议审议通过,尚需提交公司股东大会审议,并将自股 东大会审议通过之日起生效。 特此公告。 第一创业证券股份有限公司董事会 二〇二五年十月三十一日 1 附件:1、《第一创业证券股份有限公司章程》修 ...

第一创业(002797) - 第五届监事会第六次会议决议公告

2025-10-30 11:26

经审核,监事会认为公司董事会编制和审议《第一创业证券股份有限公司 2025 年第三季度报告》的程序符合法律、行政法规及中国证监会的有关规定,报告内 容真实、准确、完整地反映了公司的实际情况,不存在任何虚假记载、误导性陈 述或者重大遗漏。 表决结果:五票同意,零票反对,零票弃权。 证券代码:002797 证券简称:第一创业 公告编号:2025-063 第一创业证券股份有限公司 第五届监事会第六次会议决议公告 本公司及监事会全体成员保证信息披露的内容真实、准确和完整,没有虚假 记载、误导性陈述或重大遗漏。 第一创业证券股份有限公司(以下简称"公司")第五届监事会第六次会议 通知于 2025 年 10 月 24 日以电子邮件方式发出,会议于 2025 年 10 月 30 日在深 圳以现场与视频会议相结合的方式召开。本次会议应出席监事 5 名,实际出席监 事 5 名,会议由监事会主席张长宇先生主持,公司部分高级管理人员列席会议。 会议的召集和表决程序符合《中华人民共和国公司法》和《第一创业证券股份有 限公司章程》的有关规定。 本次会议审议了会议通知列明的议案并形成如下决议: 一、审议通过《关于<公司 2025 年第三 ...