AGRICULTURAL BANK OF CHINA(ACGBY)

Search documents

港股内银股继续上涨行情,农业银行涨超1%再创历史新高

Mei Ri Jing Ji Xin Wen· 2025-10-22 02:12

每经AI快讯,10月22日,港股内银股继续上涨行情,其中,农业银行涨超1%再创历史新高,并且录得 10连阳行情,重庆银行、浙商银行、郑州银行、招商银行、工商银行、中信银行、中国银行均有涨幅。 ...

内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 02:11

Core Viewpoint - The Hong Kong banking sector continues to experience an upward trend, with Agricultural Bank of China reaching a new historical high and recording a 10-day consecutive rise, indicating strong market performance in the sector [1]. Group 1: Market Performance - Agricultural Bank of China has increased by over 1%, achieving a new historical high [1]. - Other banks such as Chongqing Bank, Zheshang Bank, Zhengzhou Bank, China Merchants Bank, Industrial and Commercial Bank of China, CITIC Bank, and Bank of China also reported gains [1]. Group 2: Analyst Insights - Morgan Stanley believes that after a seasonal adjustment in Q3, the banking sector will present good investment opportunities in Q4 and Q1 of the following year [1]. - The upcoming dividend distributions, stabilization of interest rates, and support from a 500 billion RMB structural financial policy tool are expected to bolster the revaluation of Chinese banking stocks [1]. - Investors should focus on high-quality banks that are likely to achieve earlier and stronger rebounds in a "natural clearing" environment [1].

稳!双百亿银行ETF(512800)走出10连阳,农业银行叒新高!

Xin Lang Ji Jin· 2025-10-22 02:03

Core Viewpoint - The banking sector in A-shares is showing resilience and strength, with significant inflows into bank ETFs, indicating a preference for stable investments amid market volatility [2][4]. Group 1: Market Performance - On October 22, A-shares opened lower but the banking sector performed strongly, with the bank ETF (512800) rising by 0.49%, marking a 10-day consecutive increase [1]. - All 42 bank stocks saw gains, with notable increases from Jiangyin Bank, Wuxi Bank, Xi'an Bank, and CITIC Bank, each rising over 1% [1]. - Agricultural Bank of China has achieved a 14-day consecutive rise, reaching a market capitalization of 2.76 trillion yuan, making it the largest bank in A-shares [1]. Group 2: Investment Trends - Investors are seeking "safe havens" in the banking sector, particularly in state-owned banks, due to their low valuations, high dividend yields, and stable operations [2]. - The banking ETF (512800) tracks the CSI Bank Index, which has a price-to-book ratio (PB) of only 0.71, indicating a high value relative to historical performance [2]. - Recent data shows that the banking ETF has attracted significant capital inflows, with 59.87 billion yuan added over the past 10 days, making it the largest and most liquid bank ETF in A-shares [2]. Group 3: Future Outlook - Analysts expect that the banking sector will benefit from upcoming expansionary policies aimed at stabilizing the economy, which may enhance the sector's performance [2]. - The anticipated economic recovery and potential for interest rate cuts suggest that the banking sector could continue to provide attractive returns [2].

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

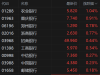

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]

银行板块再度上扬,农业银行14连阳再创新高

Xin Lang Cai Jing· 2025-10-22 01:52

Core Insights - The banking sector has experienced a significant rally, with Agricultural Bank achieving a 14-day consecutive rise, reaching a new high [1] - The banking index has also seen a 10-day consecutive increase, indicating strong overall performance in the sector [1] - Several banks, including Jiangyin Bank, CITIC Bank, Zheshang Bank, Wuxi Bank, and Chongqing Bank, have shown upward movement in their stock prices [1]

农业银行实现“13连阳”,后市怎么看

Huan Qiu Wang· 2025-10-22 01:07

Core Viewpoint - Agricultural Bank of China (ABC) has shown a strong stock performance, achieving a 54.2% increase year-to-date, outperforming the overall banking sector, and reaching a market capitalization of 2.76 trillion yuan, leading the A-share banking sector [1][3][4] Group 1: Stock Performance - ABC's stock price increased by 1.68% to 7.88 yuan per share, marking a historical high of 7.89 yuan during trading, achieving a rare "13 consecutive days of gains" [1] - In October, the banking sector as a whole rebounded, with a cumulative increase of 7.47%, indicating a shift in market focus towards banking stocks [3] - Among state-owned banks, ABC led with an 18.14% increase in October, marking its largest monthly gain of the year [4][5] Group 2: Market Dynamics - Analysts suggest that the current rally in ABC's stock is primarily driven by valuation recovery rather than a shift to growth pricing, with its dividend yield significantly higher than government bond yields [5][6] - The resilience of ABC's fundamentals, including low deposit costs and controllable non-performing loan ratios, has strengthened its market position [5][6] Group 3: Investment Trends - Insurance funds are becoming a significant source of incremental capital for the banking sector, with a preference for high-dividend, low-volatility assets [7][8] - The proportion of bank stocks in the market value of insurance funds has increased, with bank stocks accounting for 47.2% of the total as of mid-2025 [7] Group 4: Future Outlook - Multiple institutions are optimistic about the banking sector's performance in the fourth quarter, with expectations of stable net interest margins and a gradual recovery in net interest income growth [9][10] - The overall dividend yield for major state-owned banks has returned to high levels, with many exceeding 4%, indicating a favorable risk-return profile for investors [9][10]

农业银行获Ping An Asset Management Co., Ltd.增持653.1万...

Xin Lang Cai Jing· 2025-10-22 00:22

香港联交所最新数据显示,10月16日,Ping An Asset Management Co., Ltd.增持农业银行(01288) 653.1万股,每股作价5.5267港元,总金额约为3609.49万港元。增持后最新持股数目约为61.52亿股,持 股比例为20.01%。 来源:新浪港股 ...

农业银行(01288.HK)获中国平安增持4057.4万股

Ge Long Hui· 2025-10-21 23:33

| | 大發東國車輛車借錢人餐名情作出版書房 臺灣 / 臺田或地及時 國家的平均價 | | | 持有哪些的股份款目 信已發行的 南國聯生的日期 相關活躍發份 優權助機能 | | --- | --- | --- | --- | --- | | | 10 | 取时数目 | | ( [ [ ] ] = = 可投購服服 (日 / 月 / 平) 推信 | | | | | | 员目加 | | CS20251021E00198 | (1)11 ) 度 ( ) 股份有 101(L) | | 40,574,000(L) | HKD 5.6306 6,168,637,000(L) 20.06(L)20/10/2025 SEDAL | | | 禁公司 | | | | 格隆汇10月22日丨根据联交所最新权益披露资料显示,2025年10月20日,农业银行(01288.HK)获中国平 安保险(集团)股份有限公司在场内以每股均价5.6306港元增持4057.4万股,涉资约2.28亿港元。 增持后,中国平安保险(集团)股份有限公司最新持股数目为6,168,637,000股,持股比例由19.93%上升 至20.06%。 | 股份代赋: | 0 ...

农业银行手机银行注册客户数突破6亿户 农业银行手机银行月活跃客户数突破2.7亿户

Ren Min Ri Bao· 2025-10-21 21:42

Core Viewpoint - The article emphasizes the importance of sustainable development and the role of innovation in driving economic growth, highlighting the need for industries to adapt to changing market conditions and consumer preferences [2] Group 1: Industry Insights - The industry is witnessing a significant shift towards green technologies, with investments in renewable energy sources increasing by 25% year-on-year [2] - Companies are increasingly focusing on digital transformation, with 70% of firms planning to enhance their technological capabilities in the next two years [2] - The competitive landscape is evolving, with new entrants leveraging advanced technologies to disrupt traditional business models [2] Group 2: Company Developments - A leading company reported a 15% increase in revenue, driven by strong demand for eco-friendly products [2] - Another firm announced a strategic partnership aimed at developing innovative solutions for waste management, reflecting a commitment to sustainability [2] - The financial performance of several companies in the sector is expected to improve, with analysts projecting an average growth rate of 10% over the next fiscal year [2]

农业银行13连阳背后:红利资产收获新一轮“价值发现”

Shang Hai Zheng Quan Bao· 2025-10-21 18:17

Core Viewpoint - Agricultural Bank of China (ABC) has shown strong stock performance, leading the banking sector's rebound, with a 13-day consecutive rise and a new historical high in stock price, indicating a positive valuation recovery in the banking sector [1][2][4] Group 1: Stock Performance - As of October 21, ABC's A-share price reached 7.88 yuan per share, with a market capitalization exceeding 2.76 trillion yuan, reflecting a year-to-date increase of over 50% [2][3] - ABC's A-share price-to-book ratio (P/B) surpassed 1 for the first time since March 2018, breaking the long-standing "below par" situation of state-owned banks [2][4] Group 2: Market Dynamics - Analysts suggest that the high dividend yield of quality assets, combined with stable performance, is attracting capital inflow into the banking sector [2][3] - The average dividend yield of the A-share banking sector is approximately 4.39%, significantly higher than the 10-year government bond yield of 1.86%, creating a notable spread [3][5] Group 3: Financial Performance - In the first half of 2025, ABC reported operating income of 369.94 billion yuan, a year-on-year increase of 0.85%, and a net profit attributable to shareholders of 139.51 billion yuan, up 2.7%, leading among the four major state-owned banks [3] - ABC's focus on rural markets has strengthened its competitive advantage, with rural loans increasing by 91.64 billion yuan in the first half of the year, bringing the total to over 1 trillion yuan [3] Group 4: Valuation Recovery - The recent increase in ABC's P/B ratio signals a positive outlook for the banking sector, suggesting that investors are optimistic about the bank's operational prospects [4][5] - The banking sector has experienced multiple rounds of valuation recovery this year, with the average P/B ratio for 42 listed banks at 0.63 times, indicating a shift in market perception towards the long-term value of dividend assets [5]