可转换公司债券

Search documents

宁波星源卓镁技术股份有限公司向不特定对象发行可转换公司债券募集说明书提示性公告

Shang Hai Zheng Quan Bao· 2025-11-04 18:52

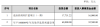

Group 1 - The company, Ningbo Xingyuan Zhuomai Technology Co., Ltd., is issuing convertible bonds totaling RMB 450 million [3][36] - The bonds will be convertible into A-shares and will be listed on the Shenzhen Stock Exchange [2][36] - The issuance includes 4.5 million bonds with a face value of RMB 100 each [4][5] Group 2 - The bonds have a maturity period of 6 years, from November 7, 2025, to November 6, 2031 [7][36] - The coupon rates are structured to increase over the years, starting at 0.20% in the first year and reaching 2.50% in the sixth year [7][36] - Interest will be paid annually, with the first payment occurring five trading days after the annual interest record date [9][36] Group 3 - The initial conversion price is set at RMB 52.30 per share [14][36] - The conversion period begins six months after the issuance and lasts until the maturity date [10][36] - The bonds are rated A+ by Zhongzheng Pengyuan Credit Rating Co., Ltd. [11][12] Group 4 - The bonds will be offered first to existing shareholders, with any remaining bonds available to the public [29][36] - The subscription date for existing shareholders is November 7, 2025 [26][36] - The public can subscribe through the Shenzhen Stock Exchange after the priority offering [29][36] Group 5 - The company will redeem the bonds at 114% of the face value plus the last interest payment within five trading days after maturity [20][36] - Conditional redemption can occur if the stock price exceeds 130% of the conversion price for a specified period or if the remaining bonds are below RMB 30 million [22][36] - Holders have the right to sell back the bonds under certain conditions if the stock price falls below 70% of the conversion price during the last two interest years [23][36]

合肥颀中科技股份有限公司 关于以集中竞价交易方式回购股份的进展公告

Zhong Guo Zheng Quan Bao - Zhong Zheng Wang· 2025-11-02 22:27

Group 1 - The company has approved a share repurchase plan using excess funds, self-owned funds, and special loan funds, with a maximum repurchase price of RMB 16.61 per share and a total repurchase amount between RMB 75 million and RMB 150 million [2][3] - As of October 31, 2025, the company has repurchased a total of 8,714,483 shares, accounting for 0.73% of the total share capital, with a total expenditure of approximately RMB 100.40 million [4][5] Group 2 - The company is issuing convertible bonds worth RMB 850 million, with each bond having a face value of RMB 100, and the issuance has been approved by the China Securities Regulatory Commission [9][10] - Original shareholders have priority in subscribing to the convertible bonds, with a subscription ratio of 0.000720 bonds per share held, and the subscription date is set for November 3, 2025 [11][19] - The total number of shares eligible for original shareholders to participate in the priority subscription is 1,180,322,805 shares after excluding repurchased shares [19] Group 3 - The issuance of convertible bonds will be conducted through an online subscription system, with a minimum subscription unit of 1 hand (1,000 RMB) and a maximum of 1,000 hands (100,000 RMB) per account [29][30] - If the total subscription amount from original shareholders and public investors is less than 70% of the total issuance, the company may consider suspending the issuance [33][34]

每周股票复盘:瑞可达(688800)Q3净利增85.41%

Sou Hu Cai Jing· 2025-11-01 21:28

Core Viewpoint - The company 瑞可达 (688800) has shown significant growth in both stock price and financial performance, indicating a positive trend in its market position and operational efficiency [1][3]. Shareholder Changes - As of September 30, 2025, the number of shareholders reached 17,300, an increase of 1,165 or 7.2% compared to June 30, 2025. The average number of shares held per shareholder decreased from 12,700 to 11,900, with an average holding value of 890,900 yuan [2][5]. Performance Disclosure Highlights - For the first three quarters of 2025, the company's main revenue was 2.321 billion yuan, a year-on-year increase of 46.04%. The net profit attributable to shareholders was 233 million yuan, up 119.89%, while the net profit excluding non-recurring items was 219 million yuan, also up 119.26%. In the third quarter alone, the main revenue was 796 million yuan, a 26.15% increase year-on-year, with a net profit of 76.016 million yuan, reflecting an 85.41% growth [3][5]. Company Announcements Summary - The 22nd meeting of the fourth Supervisory Board was held on October 29, 2025, where the third-quarter report was approved, confirming its authenticity and completeness. The board proposed to abolish the Supervisory Board, transferring its responsibilities to the Audit Committee of the Board, pending shareholder approval. Additionally, the company received approval from the China Securities Regulatory Commission for the registration of convertible bonds to be issued to unspecified investors, valid for 12 months from the date of approval [4][5].

迪威尔拟发可转债 实控人方高位附近减持套现5380万元

Zhong Guo Jing Ji Wang· 2025-10-31 02:45

Core Viewpoint - The company Diwei (688377.SH) has announced a plan to issue convertible bonds to unspecified investors, with the total amount not exceeding RMB 907.70 million, aimed at funding precision manufacturing projects for deep-sea pressure components and key parts for industrial gas turbines [1][2]. Group 1: Convertible Bond Issuance - The convertible bonds will be issued at a face value of RMB 100.00 each, with a term of six years from the issuance date [1]. - The initial conversion price will be determined based on the average trading price of the company's stock over the 20 trading days prior to the announcement [1]. - The issuance will be prioritized for existing shareholders, who have the right to waive their allocation [3]. Group 2: Fund Allocation - The total investment for the projects is RMB 930.88 million, with the funds raised from the bond issuance allocated as follows: - RMB 282.65 million for the deep-sea pressure components precision manufacturing project - RMB 625.05 million for the industrial gas turbine key components precision manufacturing project [2][3]. Group 3: Financial Performance - For the third quarter of 2025, the company reported revenue of RMB 310 million, a year-on-year increase of 33.94%, and a net profit attributable to shareholders of RMB 38.19 million, up 359.71% [9]. - Year-to-date revenue reached RMB 873 million, reflecting a 9.86% increase, with a net profit of RMB 89.71 million, a 40.59% rise [9].

赛恩斯拟发不超5.7亿可转债 前3季净利降半IPO募4.5亿

Zhong Guo Jing Ji Wang· 2025-10-30 06:29

Core Viewpoint - The company Sains (688480.SH) has announced a plan to issue convertible bonds to raise a total of up to 565 million yuan, which will be used for various projects and to supplement working capital [1][2]. Group 1: Convertible Bond Issuance - The total amount to be raised from the issuance of convertible bonds is capped at 565 million yuan, which includes the principal amount [1]. - The net proceeds after deducting issuance costs will be allocated to three main projects: the expansion of the flotation reagent project, the construction of a high-efficiency flotation reagent project with an annual production capacity of 100,000 tons, and to supplement working capital [1][2]. - The bonds will be issued at par value, with a face value of 100 yuan each, and the total number of bonds to be issued will not exceed 5,650,000 [2][3]. Group 2: Financial Performance - For the first three quarters of 2025, the company reported a revenue of 677 million yuan, representing a year-on-year increase of 15.81% [3]. - The net profit attributable to shareholders decreased by 48.32% to 74 million yuan, while the net profit excluding non-recurring gains and losses fell by 10.78% to 72 million yuan [3]. - The net cash flow from operating activities was reported at 37 million yuan [3]. Group 3: Previous Fundraising and Stock Performance - The company was listed on the Shanghai Stock Exchange's Sci-Tech Innovation Board on November 25, 2022, raising a total of 454.69 million yuan, with a net amount of 399.24 million yuan after costs [4]. - The stock price reached a new high of 64.99 yuan on October 14, 2025, marking the highest price since its listing [5].

苏州上声电子股份有限公司2025年第三季度报告

Shang Hai Zheng Quan Bao· 2025-10-30 03:31

Core Viewpoint - The company, Suzhou Shangsheng Electronics Co., Ltd., has announced adjustments to its plan for issuing convertible bonds, reducing the total amount from RMB 330 million to RMB 324.85 million, while ensuring that the funds will be used for projects related to technological innovation and enhancing operational efficiency [9][10][44]. Financial Data - The company reported that the total amount for the issuance of convertible bonds has been adjusted to not exceed RMB 324.85 million [10][45]. - The net proceeds from the issuance will be allocated entirely to specific projects after deducting issuance costs [12][46]. Board Meeting and Resolutions - The third board meeting of the company was held on October 29, 2025, where all ten directors attended, and the meeting was deemed legally valid [8]. - The board unanimously approved several resolutions, including the adjustment of the convertible bond issuance plan and the feasibility analysis of the use of raised funds [9][13][22]. Use of Proceeds - The funds raised from the convertible bond issuance will be used for projects that enhance the company's core competitiveness and sustainable development capabilities [29]. - The company plans to invest in upgrading its production lines and establishing advanced research laboratories, focusing on automotive acoustic technology [29][30]. Risk Mitigation Measures - The company has outlined measures to mitigate the potential dilution of immediate returns for existing shareholders due to the issuance of convertible bonds [34]. - These measures include improving operational efficiency, ensuring effective use of raised funds, and maintaining a stable profit distribution policy [35][37]. Commitment from Major Shareholders - Major shareholders have committed to not interfering with the company's management and to ensure the fulfillment of measures aimed at mitigating the dilution of immediate returns [39][40].

金帝股份拟发不超10亿可转债 现金流连负上市募12亿

Zhong Guo Jing Ji Wang· 2025-10-30 02:48

Core Viewpoint - JinDi Co., Ltd. (603270.SH) has announced a plan to issue convertible bonds to unspecified investors, with the total amount not exceeding 1 billion RMB, aimed at funding key manufacturing projects and supplementing working capital [1][2]. Group 1: Convertible Bond Issuance - The convertible bonds will be issued at a face value of 100.00 RMB each, with a term of six years from the date of issuance [1]. - The initial conversion price will be determined based on the average trading price of the company's stock over the 20 trading days prior to the announcement [1]. - The issuance will prioritize existing shareholders, who may waive their preemptive rights [3]. Group 2: Fund Allocation - The total investment for the projects is 1.08 billion RMB, with 1 billion RMB planned to be raised through the bond issuance [2][3]. - The funds will be allocated as follows: - 670 million RMB for high-end equipment key components intelligent manufacturing project [3]. - 168 million RMB for precision components and semiconductor heat sink intelligent manufacturing project [3]. - 162 million RMB for supplementing working capital [3]. Group 3: Financial Performance - For the third quarter of 2025, the company reported a revenue of 537 million RMB, a year-on-year increase of 63.03%, and a net profit of 32.61 million RMB, up 23.98% [5]. - Year-to-date revenue reached 1.37 billion RMB, reflecting a growth of 48.58%, with a net profit of 109 million RMB, a 30.06% increase [6][7]. - The company experienced a negative cash flow from operating activities of -246 million RMB [6].

精达股份调整减持主体实控人方拟套现6.9亿 正拟募资

Zhong Guo Jing Ji Wang· 2025-10-29 07:43

Core Viewpoint - Jingda Co., Ltd. announced an adjustment to the share reduction plan of its actual controller, Li Guangrong, who intends to reduce his holdings due to personal financial needs, with a total reduction of up to 64,300,000 shares, representing no more than 3% of the company's total share capital [1] Group 1: Share Reduction Plan - The share reduction plan's implementation subject has been changed from Li Guangrong to include his concerted action partner, Tehua Investment Holdings Co., Ltd., while the total number of shares to be reduced remains unchanged [1] - Tehua Investment currently holds 80,258,383 shares, accounting for 3.73% of the company's total share capital [1] - The reduction will occur through centralized bidding and block trading, with a maximum of 1% through centralized bidding and 2% through block trading, within three months after the announcement [1] Group 2: Financial Implications - As of the last trading day before the announcement, Jingda's share price was 10.76 yuan per share, leading to an estimated reduction amount of 692 million yuan for Li Guangrong [2] - Jingda plans to raise up to 956 million yuan through the issuance of convertible bonds, which will fund various projects including a 40,000-ton new energy copper-based electromagnetic wire project and working capital [2] Group 3: Previous Fundraising Activities - Over the past five years, Jingda has raised a total of 1.0845 billion yuan through two fundraising activities [3] - In 2020, the company issued 7.87 million convertible bonds at a face value of 100 yuan each, raising a total of 787 million yuan, with a net amount of approximately 776.75 million yuan after expenses [3] - In 2022, Jingda conducted a non-public offering of 83,333,333 shares at an issue price of 3.57 yuan per share, raising 297.5 million yuan, with a net amount of approximately 291.82 million yuan after expenses [4]

浙江华海药业股份有限公司关于可转换公司债券2025年付息公告

Shang Hai Zheng Quan Bao· 2025-10-26 18:38

Core Points - Zhejiang Huahai Pharmaceutical Co., Ltd. will begin paying interest on its convertible bonds on November 3, 2025, for the period from November 2, 2024, to November 1, 2025 [2][13] - The total issuance amount of the convertible bonds is RMB 1.8426 billion, with a total of 18,426,000 bonds issued at a face value of RMB 100 each [3][10] - The bond has a maturity period of six years, from November 2, 2020, to November 1, 2026 [2][3] Interest Payment Details - The annual interest rate for the fifth year is set at 1.8%, resulting in a payment of RMB 1.80 per bond (including tax) [3][17] - The interest payment record date is October 31, 2025, with the interest payment date being November 3, 2025 [15][16] - The interest income for individual investors is subject to a 20% personal income tax, leading to a net payment of RMB 1.44 per bond after tax [17][18] Bond Characteristics - The bond is convertible into the company's A-shares, with an initial conversion price of RMB 34.66 per share, and the latest conversion price is RMB 33.06 per share [14] - The bond does not provide any guarantees [7] - The bond's credit rating is "AA" with a stable outlook, as assessed by Shanghai New Century Credit Rating Co., Ltd. [10][11] Payment Method - The company has appointed China Securities Depository and Clearing Corporation Limited Shanghai Branch to handle the payment and settlement of the bond interest [16] - If the company fails to transfer the interest payment on time, it will be responsible for the subsequent payment process [16] Contact Information - The company is located at 88 Xunda Road, Xunqiao Town, Linhai City, Taizhou, Zhejiang Province [19] - The underwriter and trustee for the convertible bonds is Zheshang Securities Co., Ltd. [20]

湖北宜化化工股份有限公司 2025年第三季度报告

Zheng Quan Ri Bao· 2025-10-24 23:32

Core Viewpoint - The company has reported significant changes in its financial metrics for the third quarter, including a notable increase in undistributed profits and a decrease in net profit compared to the previous year, indicating a complex financial landscape influenced by recent asset restructuring and operational adjustments [4][5][12]. Financial Performance - The company's cash and cash equivalents decreased by 40% compared to the beginning of the period, primarily due to a reduction in deposits [5]. - Prepayments increased by 48%, attributed to higher advance payments for goods [5]. - Construction in progress decreased by 33%, reflecting the commissioning of certain projects [5]. - The company reported a 30% decrease in net profit compared to the same period last year, mainly due to reduced earnings [5][12]. - Undistributed profits increased by 14,896% due to the impact of significant asset restructuring [5]. Shareholder Information - The controlling shareholder, Hubei Yihua Group, has been actively increasing its stake in the company, acquiring shares worth approximately 119.83 million yuan, which represents 0.87% of the total share capital [8]. - As of the report date, Hubei Yihua Group holds 22.16% of the company's total shares [8]. Investment Projects - The company plans to invest approximately 2.233 billion yuan in a high-value utilization project for phosphorus and fluorine resources, which includes several production facilities [15][18]. - The project aims to optimize resource allocation and enhance production capacity, with a construction period of about 18 months [20][21]. Corporate Actions - The company has completed the issuance of restricted stock and has repurchased and canceled a portion of these stocks due to performance issues among certain employees [9]. - The company has also adjusted the equity structure of some subsidiaries to improve operational efficiency [10]. Market Outlook - The market for the company's products, particularly refined phosphoric acid and multifunctional compound fertilizers, is expected to grow significantly, driven by demand in the renewable energy sector and food additives [20].