可转换公司债券

Search documents

本川智能回复深交所可转债发行第二轮审核问询函 事项仍需审核与注册

Xin Lang Cai Jing· 2025-10-24 13:01

Core Points - Jiangsu Benchuan Intelligent Circuit Technology Co., Ltd. has completed its response to the second round of inquiry from the Shenzhen Stock Exchange regarding its application to issue convertible bonds to unspecified objects [1] - The company received the inquiry letter on October 17, 2025, and has since worked with relevant intermediaries to address the listed questions and update the application documents [1] - The issuance of convertible bonds is still subject to approval from the Shenzhen Stock Exchange and registration by the China Securities Regulatory Commission, indicating uncertainty in the process [1] Summary by Sections - **Company Announcement**: The company announced on October 24, 2025, that it has completed the response to the inquiry from the Shenzhen Stock Exchange [1] - **Inquiry Details**: The inquiry letter was received on October 17, 2025, and the company has provided detailed responses and supplementary documents [1] - **Regulatory Process**: The issuance of the convertible bonds requires further review by the Shenzhen Stock Exchange and approval from the China Securities Regulatory Commission, highlighting the regulatory hurdles ahead [1]

股市必读:澳弘电子(605058)10月22日主力资金净流入595.03万元,占总成交额13.83%

Sou Hu Cai Jing· 2025-10-22 19:20

Summary of Key Points Core Viewpoint - Aohong Electronics (605058) has received approval from the Shanghai Stock Exchange's Listing Review Committee for its application to issue convertible bonds to unspecified objects, pending final approval from the China Securities Regulatory Commission [1][3]. Trading Information - As of October 22, 2025, Aohong Electronics closed at 28.71 yuan, with a slight increase of 0.17% - The turnover rate was 1.05%, with a trading volume of 15,000 shares and a total transaction amount of 43.0222 million yuan [1]. Capital Flow - On October 22, 2025, the net inflow of main funds was 5.9503 million yuan, accounting for 13.83% of the total transaction amount - Retail investors experienced a net outflow of 1.6104 million yuan, representing 3.74% of the total transaction amount [1][3].

股市必读:鼎捷数智(300378)10月21日主力资金净流出928.58万元

Sou Hu Cai Jing· 2025-10-21 18:48

Core Viewpoint - Dingjie Zhizhi (300378) has received approval from the China Securities Regulatory Commission (CSRC) for the issuance of convertible bonds to unspecified investors, which is expected to enhance its capital structure and support future growth [1][3]. Trading Information Summary - As of October 21, 2025, Dingjie Zhizhi closed at 48.68 yuan, with an increase of 0.89%, a turnover rate of 4.14%, a trading volume of 111,500 lots, and a transaction amount of 539 million yuan [1]. - On the same day, the net outflow of funds from major investors was 9.29 million yuan, while retail investors saw a net inflow of 11.02 million yuan [1][3]. Company Announcement Summary - Dingjie Zhizhi has received the CSRC's approval for its application to issue convertible bonds, which is valid for 12 months from the date of approval. The company is required to adhere to the submitted documents and issuance plan during this period [1]. - The company’s board will handle the issuance matters within the stipulated timeframe and fulfill its information disclosure obligations as per relevant laws and regulations [1].

颀中科技发行可转债申请获中国证监会同意注册批复

Zhi Tong Cai Jing· 2025-10-21 08:16

Core Viewpoint - The company has received approval from the China Securities Regulatory Commission for the registration of its convertible bond issuance to unspecified investors [1] Group 1 - The company, Qizhong Technology (688352.SH), has announced that it will issue convertible bonds [1] - The approval allows the company to raise funds through the issuance of convertible bonds, which can be converted into shares at a later date [1] - This move is part of the company's strategy to enhance its capital structure and support future growth initiatives [1]

芳源股份前三季度亏1.2亿元 2021年上市两募资共10亿

Zhong Guo Jing Ji Wang· 2025-10-21 06:59

Core Insights - Fangyuan Co., Ltd. (688148.SH) reported its Q3 2025 financial results, showing a revenue of 1.49 billion RMB, a year-on-year increase of 5.29% [1] - The company recorded a net loss attributable to shareholders of 121 million RMB, slightly worsening from a loss of 119 million RMB in the same period last year [1][3] - The net cash flow from operating activities was -59.83 million RMB, compared to -27.99 million RMB in the previous year [1] Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 1.49 billion RMB, reflecting a growth of 5.29% year-on-year [1][3] - The total profit for the period was -120.70 million RMB, with a net profit attributable to shareholders also at -120.77 million RMB [3] - The net profit excluding non-recurring gains and losses was -121.73 million RMB, an improvement from -141 million RMB in the previous year [1][3] Cash Flow Analysis - The net cash flow from operating activities for the first three quarters was -59.83 million RMB, compared to -27.99 million RMB in the same period last year [1][3] - In 2024, the company reported a net cash flow from operating activities of 73.91 million RMB, a significant recovery from -326.17 million RMB in 2023 [4] Capital Raising and Financial Strategy - Fangyuan Co., Ltd. raised a total of 366 million RMB through its initial public offering, with a net amount of 301 million RMB after deducting issuance costs [5] - The company initially planned to raise 1.05 billion RMB for projects related to high-end lithium battery precursors and lithium hydroxide production [5] - The company has conducted two fundraising rounds since its listing, totaling 1.008 billion RMB [7]

宁波金田铜业(集团)股份有限公司2025年第三季度报告

Shang Hai Zheng Quan Bao· 2025-10-17 19:42

Core Viewpoint - The company, Ningbo Jintian Copper (Group) Co., Ltd., has released its third-quarter report for 2025, detailing financial performance, bond issuance, and shareholder activities, while ensuring compliance with disclosure regulations [24][31]. Financial Data - The third-quarter financial report is unaudited and covers the period from the beginning to the end of the quarter [3][20]. - The company reported a total of 39,279,469 shares held in its repurchase account, representing 2.27% of the total share capital [6]. Bond Issuance - The company issued 15 million convertible bonds named "Jintian Convertible Bonds" with a total value of RMB 150 million, which are set to mature in 2027 [7][8]. - As of September 30, 2025, a total of RMB 1,499,245,000 of the "Jintian Convertible Bonds" remains unconverted, accounting for 99.95% of the total issuance [8]. Shareholder Information - The company’s major shareholders include its controlling shareholder, Jintian Investment, and actual controller, Mr. Lou Cheng, who have been actively increasing their stakes in the company [17][18]. - As of September 30, 2025, the controlling shareholder and related parties have cumulatively increased their holdings by 12,613,593 shares, amounting to approximately RMB 79.98 million [18]. Corporate Governance - The company has decided to abolish its supervisory board, transferring its responsibilities to the audit committee of the board of directors [19]. - The company has also approved changes to its articles of association and related rules in accordance with legal requirements [19]. Capital Increase - The board approved a capital increase for its wholly-owned subsidiary, Ningbo Jintian Nonferrous Metals Materials Co., Ltd., raising its registered capital from RMB 5 million to RMB 10 million [27][28]. Upcoming Events - The company will hold a performance briefing on October 30, 2025, to discuss its third-quarter results and address investor inquiries [33][36].

祥和实业:10月16日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-17 10:52

Group 1 - The company, Xianghe Industrial, announced on October 17 that its fourth second board meeting was held on October 16, 2025, via communication voting [1] - The meeting reviewed the proposal regarding the adjustment of the company's plan to issue convertible bonds to unspecified objects [1] Group 2 - Lin Yuan, a notable figure in the investment community, responded firmly to the recent market downturn, stating "I am still here!" and emphasized his continued investment in the liquor sector as a "happy demand" while expressing concerns over technology stocks [1]

百川畅银连亏2年半 2021上市中原证券保荐2募资共8亿

Zhong Guo Jing Ji Wang· 2025-10-17 07:47

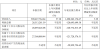

Core Viewpoint - Baichuan Changyin reported a decline in revenue and net profit for the first half of 2025, indicating ongoing financial challenges despite improvements in cash flow [1] Financial Performance - The company achieved operating revenue of 205 million yuan, a year-on-year decrease of 10.79% [1] - The net profit attributable to shareholders was -38.27 million yuan, an improvement from -44.62 million yuan in the same period last year [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was -38.82 million yuan, compared to -43.68 million yuan in the previous year [1] - The net cash flow from operating activities was 46.39 million yuan, a significant increase from -3.16 million yuan in the same period last year [1] Future Projections - For 2023 and 2024, the company expects net profits attributable to shareholders to be -97.49 million yuan and -282 million yuan, respectively [1] - The projected net profit after deducting non-recurring gains and losses for the same years is -93.81 million yuan and -253 million yuan, respectively [1] Fundraising and Financial Strategy - Baichuan Changyin raised a total of 369 million yuan from its initial public offering, with a net amount of 328 million yuan after expenses, which was 325 million yuan less than planned [2] - The company initially aimed to raise 652 million yuan, allocating funds for various projects including landfill gas utilization and information management system development [2] - In 2023, the company issued convertible bonds, raising a total of 420 million yuan, with a net amount of approximately 411 million yuan after expenses [3] - The total fundraising from both the IPO and convertible bonds amounted to 789 million yuan [3]

精达股份实控人拟套现6.8亿 正拟募资近5年募10.8亿

Zhong Guo Jing Ji Wang· 2025-10-17 07:37

Core Viewpoint - The actual controller of Jingda Co., Ltd. plans to reduce his shareholding due to personal financial needs, which may impact the company's stock performance and investor sentiment [1] Group 1: Shareholding Reduction Plan - The actual controller, Li Guangrong, intends to reduce his holdings by up to 64,300,000 shares, representing no more than 3% of the total share capital [1] - The reduction will occur through centralized bidding and block trading, with a maximum of 1% through centralized bidding and 2% through block trading [1] - The reduction period is set for three months starting from 15 trading days after the announcement, with no reductions during the window period [1] Group 2: Financial Implications - Based on the closing price of 10.55 yuan per share on October 16, 2025, the estimated amount from this reduction is approximately 678 million yuan [1] - As of the announcement date, Li Guangrong holds 83,333,333 shares, accounting for 3.88% of the total share capital [1] - Together with his associates, they hold a total of 199,333,390 shares, which is 9.27% of the total share capital [1] Group 3: Recent Fundraising Activities - Jingda Co., Ltd. plans to issue convertible bonds to raise up to 956 million yuan for various projects, including a 40,000-ton new energy copper-based electromagnetic wire project [2] - In the past five years, the company has raised funds twice, totaling 1.0845 billion yuan [3] - The company conducted a non-public stock issuance in 2022, raising 297.5 million yuan, which has been fully utilized by 2023 [4]

可川科技终止发行可转债并撤回申请文件

Zhi Tong Cai Jing· 2025-10-16 09:22

Core Viewpoint - The company, 可川科技, has decided to terminate its plan to issue convertible bonds to unspecified investors and has withdrawn the related application documents [1] Group 1 - The company has actively engaged with intermediaries to advance the relevant work since applying for the issuance [1] - The decision to terminate the bond issuance was made after careful consideration of the company's development plans and actual circumstances [1] - The company communicated and analyzed the situation thoroughly with all relevant parties before making the decision [1]