原料药制剂一体化

Search documents

诚意药业:前三季度扣非净利润增长31%,氨糖全链条布局优势持续兑现

Zheng Quan Shi Bao Wang· 2025-10-28 02:40

Core Viewpoint - Chengyi Pharmaceutical reported strong financial performance for the first three quarters of 2025, with significant revenue and profit growth driven by its core product, glucosamine, and an effective employee stock ownership plan aimed at enhancing competitiveness and employee engagement [1][2]. Financial Performance - The company achieved a revenue of 597 million yuan, representing a year-on-year increase of 14.69% [1] - The net profit attributable to shareholders reached 143 million yuan, up 21.91% year-on-year [1] - The net profit after deducting non-recurring items was 140 million yuan, reflecting a growth of 31.40% [1] - The gross profit margin improved from 68.97% in Q1 to 73.67% in Q3 [1] Product Performance - Revenue from joint-related drugs grew by 42.23% year-on-year, totaling 492 million yuan [1] - The growth in revenue is primarily driven by glucosamine, which has seen enhanced sales through diversified channels [1][2] Market Dynamics - The aging population and changing lifestyles in China are contributing to the long-term expansion of the glucosamine market [2] - The market for bone health supplements is projected to grow from 12.1 billion yuan in 2021 to 18.3 billion yuan by 2025, with glucosamine penetration nearing 50% [2] Strategic Initiatives - The company has expanded its market coverage from 9 provinces to 30 provinces following the expiration of national centralized procurement in the second half of 2023 [2] - This expansion has led to a near doubling of glucosamine sales from 254 million yuan in the first three quarters of 2023 to 492 million yuan in the same period of 2025 [2] Competitive Advantages - Chengyi Pharmaceutical benefits from an integrated production approach for glucosamine, utilizing chitin derived from local marine resources, which helps in cost and quality assurance [3] - The company has a dual licensing advantage for both raw materials and formulations, enhancing its competitive position in the market [3] Future Outlook - The company's marine biomedicine strategy is expected to drive future growth, with ongoing projects like the construction of a large-scale EPA production facility [3] - Chengyi Pharmaceutical's integrated approach may extend beyond glucosamine to other areas, such as fish oil, positioning it favorably in the evolving market landscape [3]

【太平洋医药|点评】普洛药业 :Q3业绩底部已现,看好CDMO业务持续兑现

Xin Lang Cai Jing· 2025-10-27 13:29

Core Viewpoint - The company reported a decline in revenue and profit for the first three quarters of 2025, indicating pressure on profitability and a challenging market environment [1][2]. Financial Performance - For Q1-3 2025, the company achieved revenue of 7.764 billion yuan, a year-over-year decrease of 16.43%, and a net profit attributable to shareholders of 700 million yuan, down 19.48% year-over-year [1][2]. - In Q3 2025, revenue was 2.319 billion yuan, a decline of 18.94% year-over-year, with a net profit of 137 million yuan, down 43.95% year-over-year [2]. - The gross margin for Q1-3 2025 was 25.02%, an increase of 0.79 percentage points year-over-year, while the net margin was 9.02%, a decrease of 0.34 percentage points year-over-year [2]. Business Segments - The API business generated sales of 5.19 billion yuan, down over 20% year-over-year, primarily due to weak demand for antibiotics and a strategic contraction in trading activities [3]. - The CDMO business saw significant growth, with sales of 1.69 billion yuan, a nearly 20% increase year-over-year, and a gross margin of 44.4%, contributing nearly 40% to the overall gross profit [3]. - The company has a backlog of orders worth 5.2 billion yuan for the next 2-3 years, mainly from commercial orders and secondary supply transitions to commercial production [3]. Stock Buyback - The company announced a share buyback plan of 75 to 150 million yuan to support employee stock ownership plans, with a maximum buyback price of 22 yuan per share [3]. Future Outlook - The company is expected to see a gradual improvement in net profit margins from 2026 to 2027, with projected revenues of 10.332 billion yuan, 11.194 billion yuan, and 12.504 billion yuan for 2025, 2026, and 2027 respectively [4]. - The net profit forecast for the same years is 910 million yuan, 1.097 billion yuan, and 1.375 billion yuan, corresponding to a PE ratio of 20, 17, and 14 times [4].

挪用募资、信披违规被罚,亏损中的东亚药业转型路在何方?

Bei Ke Cai Jing· 2025-10-23 10:03

Core Viewpoint - Zhejiang Dongya Pharmaceutical Co., Ltd. is facing regulatory scrutiny due to discrepancies in the use of raised funds compared to what was disclosed in its IPO prospectus, leading to a warning for its former board secretary and ongoing financial challenges for the company [1][2][3]. Group 1: Regulatory Issues - Zhejiang Securities Regulatory Bureau found that Dongya Pharmaceutical's actual use of raised funds did not align with the disclosures made in its IPO prospectus, and the company failed to follow internal review procedures for these changes [2]. - The company has been ordered to rectify these issues, and the violations will be recorded in the securities market's integrity archives [2][3]. Group 2: Financial Performance - Dongya Pharmaceutical's revenue for 2022, 2023, 2024, and the first half of 2025 were reported at 1.18 billion, 1.36 billion, 1.20 billion, and 416 million respectively, with year-on-year growth rates of 65.62%, 15.00%, -11.66%, and -35.85% [4]. - The net profit attributable to shareholders for the same periods was 104 million, 121 million, -101 million, and -30.23 million, with year-on-year growth rates of 52.46%, 16.11%, -183.02%, and -193.09% [4]. - The company's debt-to-asset ratio has increased from 25.56% in 2022 to 47.70% in the first half of 2025, indicating rising financial leverage [4]. Group 3: Business Challenges - Dongya Pharmaceutical's core antibacterial drug business is under significant pressure due to the government's "antibiotic restriction orders," which have limited the market space for antibacterial drugs [5][6]. - The company has attempted to implement a "raw material drug formulation integration" strategy, but progress has been slow, with only one of over ten submitted formulations receiving approval [7]. - The existing product structure remains heavily reliant on antibacterial drugs, exposing the company to substantial market and policy risks [7].

底部夯实,寻求“拐点、成长”共振

ZHONGTAI SECURITIES· 2025-09-10 13:14

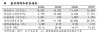

Investment Rating - The report maintains an "Accumulate" rating for the industry [5] Core Insights - The pharmaceutical and biotechnology industry is expected to experience a turning point and growth resonance, with a focus on the resilience of the raw material drug sector amidst various macro and micro factors [7][10] - The industry is characterized by a significant number of listed companies, totaling 494, with a total market value of 77,409.20 billion and a circulating market value of 70,487.38 billion [2] Summary by Sections Industry Overview - The report analyzes 47 representative raw material drug companies, indicating that despite pressures on revenue, the profit margins are showing improvement, reflecting the industry's resilience [10] - The average revenue growth rate for the 47 companies in the first half of 2025 was -5.38%, while the average growth rate of non-recurring net profit was 14.43% [10][12] Financial Performance - Key companies such as Xinhecheng, Aoruite, Tianyu Co., Meinuohua, and others have achieved over 10% growth in revenue and non-recurring net profit [10] - The report highlights that the non-recurring net profit of Xinhecheng increased significantly by 70.50% year-on-year in the first half of 2025 [10] Market Trends - The report notes that the prices of major raw materials are currently at low levels, particularly for certain categories like sartans and heparins, with expectations for gradual price recovery as excess capacity is cleared [7][10] - The investment strategy for the second half of the year focuses on identifying companies that are at a turning point in their existing business while also exploring new growth opportunities [7][10] Company Recommendations - The report suggests focusing on companies such as Tianyu Co., Sitaly, Tonghe Pharmaceutical, Meinuohua, Xianju Pharmaceutical, and Puluo Pharmaceutical for potential investment opportunities [7][10]

津药药业股份有限公司关于公司收到化学原料药上市申请批准通知书的公告

Shang Hai Zheng Quan Bao· 2025-08-29 21:40

Group 1 - The company has received the approval notice for the listing application of the chemical raw material drug Difluprednate from the National Medical Products Administration (NMPA) [1][3] - Difluprednate is a topical corticosteroid used to suppress inflammation caused by various irritants, primarily available in the form of eye drops for treating inflammation and pain related to eye surgeries [2][3] - The global sales figures for Difluprednate formulations are projected to be $49 million in 2023 and $41 million in 2024, indicating a potential market opportunity for the company [3] Group 2 - The approval of the raw material drug will enhance the company's product portfolio and leverage its integrated advantages in raw material and formulation production, aiding in business expansion [4] - The company has invested approximately 2.6 million yuan in the research and development of the Difluprednate raw material project [3]

奥锐特: 奥锐特药业股份有限公司2025年半年度报告

Zheng Quan Zhi Xing· 2025-08-29 16:18

Core Viewpoint - Aurisco Pharmaceutical Co., Ltd. reported a significant increase in revenue and net profit for the first half of 2025, driven by market expansion and new product launches [2][3][12]. Company Overview and Financial Indicators - The company specializes in the research, production, and sales of complex active pharmaceutical ingredients (APIs), intermediates, and formulations, focusing on high-quality products with significant entry barriers [4][10]. - For the first half of 2025, the company achieved a revenue of approximately 822 million RMB, a 12.5% increase from the previous year, and a net profit attributable to shareholders of approximately 235 million RMB, reflecting a 24.55% growth [3][12]. - The company’s total assets reached approximately 3.90 billion RMB, with a net asset value of approximately 2.43 billion RMB, marking a 4.19% increase from the end of the previous year [3][12]. Business Model and Operations - The company operates a customer-oriented business model, leveraging its technological platform to develop and produce market-potential products, while also engaging in the trade of pharmaceutical intermediates and APIs [4][6]. - The production process adheres strictly to domestic and international GMP standards, ensuring product safety and quality [5][14]. - The sales strategy primarily focuses on exporting APIs, with a stable customer base built through long-term partnerships with major international pharmaceutical companies [5][6]. Industry Context - The global pharmaceutical market is projected to grow from approximately 1.6 trillion USD in 2023 to about 2.2 trillion USD by 2028, driven by increased drug usage, new product launches, and the rise of biosimilars [8][9]. - The Chinese pharmaceutical manufacturing industry is experiencing slight fluctuations in revenue and profit due to policies like volume-based procurement and medical insurance cost control [10][11]. - The raw material drug sector is becoming increasingly important, with China emerging as a major producer and exporter of APIs, supported by government policies promoting high-quality development [11][12]. Competitive Advantages - The company has established a comprehensive quality management system compliant with international standards, enhancing its competitive edge in the market [15][16]. - A strong focus on R&D has led to the development of a diverse product line across various therapeutic areas, including cardiovascular, respiratory, and oncology [14][15]. - The company maintains robust relationships with major global pharmaceutical firms, ensuring a stable revenue stream and market presence [15].

东亚药业:海外注册频频获批 原料药制剂一体化稳步推进

Zheng Quan Shi Bao Wang· 2025-08-28 14:47

Core Viewpoint - East Asia Pharmaceutical's half-year report indicates a decline in revenue and profit due to industry challenges and competition, with a revenue of 416 million yuan and a net loss of 30.23 million yuan in the first half of 2025. However, the company is leveraging its strengths to explore market demand and expand its international market presence [2]. Group 1: Financial Performance - The company's revenue and profit have decreased in the first half of 2025, with revenue at 416 million yuan and a net loss of 30.23 million yuan [2]. - Despite short-term pressures, the company has identified several positive aspects in its business operations during the reporting period [2]. Group 2: Product Development and Sales Growth - The growth in sales of non-cephalosporin pharmaceutical intermediates and raw materials is a highlight, with revenue from this segment reaching 211 million yuan, a year-on-year increase of approximately 13% [3]. - The company holds over ten raw material drug approvals for non-cephalosporin products, including widely demanded varieties such as Etoposide and Levofloxacin [3]. Group 3: R&D Investment - The company invested 42.37 million yuan in R&D in the first half of 2025, accounting for 10.19% of its revenue, positioning it among the leaders in R&D intensity within the raw material drug industry [4]. - The company has submitted multiple registration applications for new raw materials, indicating a robust pipeline for future product offerings [4]. Group 4: International Market Expansion - The company is actively expanding its international market presence, having received the CEP certificate for its raw material drug, Cefaclor, from the European Medicines Agency, which is crucial for entering the European market [5]. - In the first half of 2025, the company achieved significant success in the South Korean market, with multiple products receiving registration [5]. Group 5: Strategic Milestones - The approval of the first formulation product, Levofloxacin tablets, marks a significant milestone in the company's integrated development strategy, enhancing its product line and competitive edge [7]. - The company is progressing with its capital projects funded by convertible bonds, which are expected to support future product registrations [7][8]. Group 6: Market Dynamics - The new national centralized procurement rules emphasize rational competition, which may benefit leading companies like East Asia Pharmaceutical by alleviating pricing pressures [8]. - The company's ongoing expansion into international markets, enhanced R&D capabilities, and integrated raw material and formulation development are expected to drive future growth [8].

东亚药业:海外注册频频获批,原料药制剂一体化稳步推进

Zheng Quan Shi Bao Wang· 2025-08-28 14:07

Core Viewpoint - East Asia Pharmaceutical (605177) reported a decline in revenue and profit for the first half of 2025, with operating income of 416 million yuan and a net loss attributable to shareholders of 30.23 million yuan, due to adverse industry factors and competitive pressures [1] Group 1: Financial Performance - The company's revenue and profit have been under pressure, with a reported operating income of 416 million yuan and a net loss of 30.23 million yuan for the first half of 2025 [1] - Despite short-term challenges, the company has identified areas of improvement in its operations during the reporting period [1] Group 2: Product Development and Market Expansion - The growth in sales of non-cephalosporin pharmaceutical intermediates and raw materials is a highlight, with revenue from this segment reaching 211 million yuan, a year-on-year increase of approximately 13% [2] - The company holds over ten approval certificates for non-cephalosporin raw materials, including products with significant market demand [2] - The company has increased its market development efforts for non-cephalosporin products, with revenue from anticholinergic and synthetic antispasmodic drugs growing by 25.1% to 99.47 million yuan [2] Group 3: Research and Development - The company invested 42.37 million yuan in R&D, accounting for 10.19% of its operating income, with a strong overall R&D investment intensity in the raw material drug industry [3] - The company has submitted multiple registration applications for new raw materials, indicating a robust pipeline for future product offerings [3] Group 4: International Market Strategy - The company is actively expanding its international market presence, having received the CEP certificate for cephalexin raw materials, which allows entry into the European market [4] - The company has successfully registered several products in the South Korean market, indicating a growing number of approved products in overseas markets [4] Group 5: Regulatory and Competitive Landscape - The recent changes in national centralized procurement rules are expected to benefit leading companies in the industry, including East Asia Pharmaceutical, by alleviating price pressures [7] - The company is well-positioned to leverage its enhanced R&D capabilities and integrated raw material and formulation development strategy for future growth [7]

浙江昂利康制药股份有限公司2025年半年度报告摘要

Shang Hai Zheng Quan Bao· 2025-08-28 06:20

Group 1 - The company plans to invest in a project to produce 8,000 tons of Amoxicillin and 2,000 tons of Ampicillin, with a total investment of 389.12 million RMB [27][30] - The project aims to enhance the company's production capacity and improve its competitive position in the antibiotic market [33][36] - The funding for the project will come from the company's own funds and bank loans, ensuring no impact on the company's independence or ongoing operations [36][37] Group 2 - The company has approved a profit distribution plan for the first half of 2025, proposing a cash dividend of 1.00 RMB per 10 shares, totaling approximately 19.61 million RMB [47][68] - The company's net profit for the first half of 2025 is reported at 65.93 million RMB, with cumulative distributable profits amounting to 684.12 million RMB [68][70] - The profit distribution plan is subject to approval at the upcoming shareholders' meeting [63][70] Group 3 - The company has established a management system for the use of raised funds, ensuring compliance with relevant regulations and protecting investor interests [10][12] - As of June 30, 2025, the company has two special accounts for raised funds, with specific management protocols in place [19][20] - The company has reported no significant issues in the use and disclosure of raised funds during the reporting period [25][60]

普洛药业拟中期分红超4亿元 跻身国内CDMO企业领先梯队

Zheng Quan Shi Bao Wang· 2025-08-20 05:47

Core Viewpoint - Prolo Pharmaceutical's financial performance in the first half of 2025 shows a decline in revenue and net profit, but the CDMO business is experiencing significant growth and entering a harvest phase [1][2] Financial Performance - In the first half of 2025, Prolo Pharmaceutical achieved revenue of 5.444 billion yuan, a year-on-year decrease of 15.31% - The net profit attributable to shareholders was 563 million yuan, down 9.89% year-on-year - In Q2, the company reported revenue of 2.714 billion yuan, roughly stable compared to Q1, with a net profit of 315 million yuan, reflecting a quarter-on-quarter increase of 26.51% [1] Dividend Distribution - Prolo Pharmaceutical announced a mid-year profit distribution plan, proposing a cash dividend of 3.4835 yuan per 10 shares (tax included), totaling 400 million yuan - The cash dividend ratio stands at 71.05%, marking the 22nd cumulative cash distribution since the company's listing - This distribution reflects the company's commitment to long-term development and aligns with regulatory encouragement for increased cash dividends [1] CDMO Business Growth - The CDMO business generated revenue of 1.236 billion yuan in the first half of 2025, representing a year-on-year growth of 20.32% - Gross profit from the CDMO segment reached 545 million yuan, up 32.19%, with a gross margin of 44.04%, an increase of 3.95 percentage points year-on-year - The number of ongoing projects in the CDMO business reached 1,180, a 35% increase year-on-year, with 377 projects in the commercialization phase (up 19%) and 803 in the R&D phase (up 44%) [2] Competitive Position - Prolo Pharmaceutical's CDMO business has strengthened its core competitiveness and is now among the leading CDMO companies in China - The company has established CDMO R&D centers in Hengdian, Shanghai, and Boston, employing over 500 R&D personnel - Various technical platforms, including fluid mechanics, crystallization, synthetic biology, and enzyme catalysis, continue to empower the CDMO business [2] Market Outlook - Pacific Securities anticipates that with the rapid growth of R&D phase projects and the acceleration of integrated raw material drug formulation layout, Prolo Pharmaceutical's profit growth is expected to accelerate as the proportion of CDMO and formulation business increases, maintaining a "buy" rating for the company [2]