原料药及中间体

Search documents

众生药业股价跌5.26%,泰信基金旗下1只基金重仓,持有1.5万股浮亏损失1.74万元

Xin Lang Cai Jing· 2026-01-21 01:47

Group 1 - The core point of the news is that Zhongsheng Pharmaceutical's stock price has dropped by 5.26%, currently trading at 20.90 CNY per share, with a total market capitalization of 17.764 billion CNY [1] - Zhongsheng Pharmaceutical, established on December 31, 2001, and listed on December 11, 2009, is primarily engaged in the research, production, and sales of pharmaceuticals [1] - The company's revenue composition includes 53.03% from traditional Chinese medicine sales, 38.12% from chemical drug sales, 6.13% from Chinese medicinal materials and decoction pieces, 2.14% from raw materials and intermediates, and 0.58% from other sources [1] Group 2 - From the perspective of fund holdings, one fund under Taixin Fund has a significant position in Zhongsheng Pharmaceutical, with Taixin Smart Quantitative Stock Mixed Fund A (013033) holding 15,000 shares, accounting for 1.94% of the fund's net value [2] - The estimated floating loss for the fund today is approximately 17,400 CNY [2] - Taixin Smart Quantitative Stock Mixed Fund A (013033) was established on May 22, 2025, with a current scale of 12.5156 million CNY and a year-to-date return of 8.16%, ranking 1626 out of 8844 in its category [2]

海辰药业股价跌5%,富国基金旗下1只基金位居十大流通股东,持有70万股浮亏损失185.5万元

Xin Lang Cai Jing· 2026-01-20 07:20

Group 1 - The core point of the article highlights that Haisun Pharmaceutical experienced a 5% drop in stock price, trading at 50.30 yuan per share, with a total market capitalization of 6.036 billion yuan as of the report date [1] - Haisun Pharmaceutical, established on January 15, 2003, and listed on January 12, 2017, focuses on the research, production, and sales of chemical preparations, active pharmaceutical ingredients, and intermediates [1] - The company's revenue composition is primarily from cardiovascular drugs (87.12%), followed by antibiotics (5.69%), active pharmaceutical ingredients and intermediates (1.68%), digestive drugs (1.50%), antiviral drugs (1.47%), and other categories [1] Group 2 - Among the top circulating shareholders of Haisun Pharmaceutical, the Fuguo Fund's Fuguo Steady Growth Mixed A (010624) fund entered the top ten in the third quarter, holding 700,000 shares, which is 0.85% of the circulating shares [2] - The Fuguo Steady Growth Mixed A fund has a total scale of 6.13 billion yuan, with a year-to-date return of 5.37% and a one-year return of 36.61% [2] - The fund manager, Fan Yan, has been in the position for 10 years and 88 days, with the fund's best return during this period being 187.76% and the worst being -15.11% [3]

申万宏源证券晨会报告-20260114

Shenwan Hongyuan Securities· 2026-01-14 00:45

Core Insights - The report highlights that Xinhecheng (002001) is positioned to become a global leader in the fine chemical industry by leveraging high-barrier core intermediates and focusing on domestic substitution [2][12] - The nutritional products segment is expected to recover, with methionine likely to see both volume and price increases as the impact of BASF's incident fades [12] - The flavor and fragrance segment is experiencing steady growth, with the company leading in domestic scale and continuously expanding its product offerings [12] - The new materials segment demonstrates synergy between industry and technology, with the company planning to enhance its production capacity for key intermediates like adiponitrile [12] Nutritional Products Segment - The nutritional products segment is at a turning point, with methionine demand expected to grow at 6% globally, supported by a strong cost curve and reduced overseas competition due to environmental pressures [12] - The company has a significant cost advantage by mastering core intermediates and integrating the vitamin A and E supply chain [12] - The anticipated completion of projects for 70,000 tons of solid methionine and 180,000 tons of liquid methionine in 2025 is expected to lead to volume and price increases in 2026 [12] Flavor and Fragrance Segment - The global flavor and fragrance market is dominated by a few players, with high barriers to entry, and the company is well-positioned to benefit from this concentration [12] - The segment is expected to grow as downstream manufacturers are less sensitive to price changes and seek comprehensive service offerings [12] New Materials Segment - The new materials segment is characterized by high-barrier processes and significant domestic substitution potential, with the company being the second-largest producer of PPS globally [12] - The company is planning a nylon integration project in Tianjin, with an initial capacity of 100,000 tons per year for adiponitrile and hexamethylenediamine [12] Financial Projections - Revenue projections for the company are estimated at 23.183 billion, 23.426 billion, and 24.478 billion yuan for 2025, 2026, and 2027 respectively, with net profit forecasts of 6.733 billion, 7.202 billion, and 8.058 billion yuan [12] - The expected EPS for the same years is 2.19, 2.34, and 2.62 yuan per share, indicating a compound annual growth rate (CAGR) of 11% for net profit [12] - The company's PE ratio for 2026 is projected to be around 11 times, which is below the average PE of comparable companies at 15 times [12]

奥翔药业:11月18日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-11-18 10:26

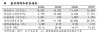

Core Viewpoint - Aoxiang Pharmaceutical (SH 603229) announced the convening of its fourth board meeting on November 18, 2025, to discuss the confirmation of the audit committee members and the convener [1] Company Summary - Aoxiang Pharmaceutical's revenue composition for the year 2024 is as follows: raw materials and intermediates account for 95.25%, while technical service fees make up 4.75% [1] - As of the report date, Aoxiang Pharmaceutical has a market capitalization of 8.5 billion yuan [1]

海辰药业跌2.02%,成交额2.10亿元,主力资金净流出68.39万元

Xin Lang Cai Jing· 2025-11-18 01:57

Core Viewpoint - Haisun Pharmaceutical's stock has experienced significant growth this year, with a year-to-date increase of 237.69%, and recent trading activity shows continued interest from institutional investors [2][3]. Group 1: Stock Performance - As of November 18, Haisun Pharmaceutical's stock price was 67.74 CNY per share, with a market capitalization of 8.129 billion CNY [1]. - The stock has seen a rise of 18.68% over the past five trading days, 19.34% over the past 20 days, and 14.81% over the past 60 days [2]. - The company has appeared on the "Dragon and Tiger List" eight times this year, with the most recent net buy of 62.603 million CNY on November 14 [2]. Group 2: Financial Performance - For the period from January to September 2025, Haisun Pharmaceutical reported revenue of 472 million CNY, reflecting a year-on-year growth of 30.80%, and a net profit attributable to shareholders of 32.6785 million CNY, up 16.22% year-on-year [3]. - Cumulative cash dividends since the company's A-share listing amount to 161 million CNY, with 18 million CNY distributed over the past three years [4]. Group 3: Shareholder Structure - As of November 10, the number of shareholders for Haisun Pharmaceutical was 22,100, a decrease of 2.84% from the previous period, with an average of 3,709 circulating shares per shareholder, an increase of 2.93% [3]. - New institutional shareholders include several funds, such as China Europe Enjoy Life Mixed A and Huashan Pharmaceutical Biological Stock Initiation A, indicating growing institutional interest [4]. Group 4: Business Overview - Haisun Pharmaceutical, established on January 15, 2003, and listed on January 12, 2017, specializes in the research, production, and sales of chemical preparations, raw materials, and intermediates [2]. - The company's main revenue sources include cardiovascular drugs (87.12%), antibiotics (5.69%), and other therapeutic categories [2].

众生药业跌2.05%,成交额2.31亿元,主力资金净流出3910.54万元

Xin Lang Cai Jing· 2025-10-28 03:27

Core Viewpoint - The stock of Zhongsheng Pharmaceutical has experienced a decline of 2.05% on October 28, with a current price of 17.66 CNY per share and a total market capitalization of 15.01 billion CNY. The company has seen a year-to-date stock price increase of 47.78% but has faced recent declines over various trading periods [1]. Financial Performance - For the first half of 2025, Zhongsheng Pharmaceutical reported a revenue of 1.3 billion CNY, a year-on-year decrease of 4.74%. However, the net profit attributable to shareholders increased significantly by 114.96% to 188 million CNY [2]. - The company has distributed a total of 2.019 billion CNY in dividends since its A-share listing, with 502 million CNY distributed over the past three years [3]. Shareholder Information - As of June 30, 2025, the number of shareholders for Zhongsheng Pharmaceutical was 89,900, a decrease of 1.32% from the previous period. The average number of circulating shares per shareholder increased by 1.33% to 8,470 shares [2]. - Among the top ten circulating shareholders, Hong Kong Central Clearing Limited is the fourth largest with 9.1731 million shares, marking its entry as a new shareholder. Other notable shareholders include Xingquan He Feng Mixed Fund and Xingquan Multi-Dimensional Value Mixed Fund, which have reduced their holdings [3]. Market Activity - The stock has been active on the "Dragon and Tiger List" three times this year, with the most recent appearance on September 22, where it recorded a net buy of -164 million CNY [1]. - The stock has seen significant trading activity, with a total transaction volume of 231 million CNY on the day of the report, and a turnover rate of 1.70% [1]. Business Overview - Zhongsheng Pharmaceutical, established on December 31, 2001, and listed on December 11, 2009, is primarily engaged in the research, production, and sales of pharmaceuticals. Its revenue composition includes 53.03% from traditional Chinese medicine sales, 38.12% from chemical drug sales, and smaller contributions from other segments [1]. - The company operates within the pharmaceutical and biotechnology sector, specifically in the traditional Chinese medicine sub-sector, and is involved in various concept boards including pharmaceutical e-commerce and NMN concepts [2].

【太平洋医药|点评】普洛药业 :Q3业绩底部已现,看好CDMO业务持续兑现

Xin Lang Cai Jing· 2025-10-27 13:29

Core Viewpoint - The company reported a decline in revenue and profit for the first three quarters of 2025, indicating pressure on profitability and a challenging market environment [1][2]. Financial Performance - For Q1-3 2025, the company achieved revenue of 7.764 billion yuan, a year-over-year decrease of 16.43%, and a net profit attributable to shareholders of 700 million yuan, down 19.48% year-over-year [1][2]. - In Q3 2025, revenue was 2.319 billion yuan, a decline of 18.94% year-over-year, with a net profit of 137 million yuan, down 43.95% year-over-year [2]. - The gross margin for Q1-3 2025 was 25.02%, an increase of 0.79 percentage points year-over-year, while the net margin was 9.02%, a decrease of 0.34 percentage points year-over-year [2]. Business Segments - The API business generated sales of 5.19 billion yuan, down over 20% year-over-year, primarily due to weak demand for antibiotics and a strategic contraction in trading activities [3]. - The CDMO business saw significant growth, with sales of 1.69 billion yuan, a nearly 20% increase year-over-year, and a gross margin of 44.4%, contributing nearly 40% to the overall gross profit [3]. - The company has a backlog of orders worth 5.2 billion yuan for the next 2-3 years, mainly from commercial orders and secondary supply transitions to commercial production [3]. Stock Buyback - The company announced a share buyback plan of 75 to 150 million yuan to support employee stock ownership plans, with a maximum buyback price of 22 yuan per share [3]. Future Outlook - The company is expected to see a gradual improvement in net profit margins from 2026 to 2027, with projected revenues of 10.332 billion yuan, 11.194 billion yuan, and 12.504 billion yuan for 2025, 2026, and 2027 respectively [4]. - The net profit forecast for the same years is 910 million yuan, 1.097 billion yuan, and 1.375 billion yuan, corresponding to a PE ratio of 20, 17, and 14 times [4].

众生药业10月16日获融资买入4717.09万元,融资余额4.91亿元

Xin Lang Cai Jing· 2025-10-17 01:30

Group 1 - The core point of the news is that Zhongsheng Pharmaceutical experienced a slight decline in stock price and had notable changes in financing activities on October 16, with a net financing outflow of 657.69 million yuan [1] - As of October 16, the total financing and securities lending balance for Zhongsheng Pharmaceutical was 493 million yuan, with a financing balance of 491 million yuan, accounting for 3.38% of the circulating market value, indicating a relatively high level compared to the past year [1] - The company reported a decrease in operating income for the first half of 2025, amounting to 1.3 billion yuan, a year-on-year decline of 4.74%, while the net profit attributable to the parent company increased significantly by 114.96% to 188 million yuan [2] Group 2 - Zhongsheng Pharmaceutical has distributed a total of 2.019 billion yuan in dividends since its A-share listing, with 502 million yuan distributed over the past three years [3] - As of June 30, 2025, the number of shareholders for Zhongsheng Pharmaceutical was 89,900, a decrease of 1.32% from the previous period, while the average circulating shares per person increased by 1.33% to 8,470 shares [2] - Among the top ten circulating shareholders, Hong Kong Central Clearing Limited is the fourth largest shareholder with 9.1731 million shares, marking a new entry, while other funds have reduced their holdings [3]

众生药业涨2.19%,成交额1.57亿元,主力资金净流出216.00万元

Xin Lang Cai Jing· 2025-09-18 02:14

Company Overview - Zhongsheng Pharmaceutical Co., Ltd. is located in Dongguan, Guangdong Province, established on December 31, 2001, and listed on December 11, 2009. The company focuses on the research, production, and sales of pharmaceuticals [1]. - The main business revenue composition includes: Traditional Chinese Medicine sales 53.03%, chemical drug sales 38.12%, Chinese medicinal materials and decoction pieces sales 6.13%, raw materials and intermediates sales 2.14%, and others 0.58% [1]. Financial Performance - For the first half of 2025, Zhongsheng Pharmaceutical achieved operating revenue of 1.3 billion yuan, a year-on-year decrease of 4.74%. However, the net profit attributable to the parent company was 188 million yuan, showing a significant year-on-year increase of 114.96% [2]. - Since its A-share listing, the company has distributed a total of 2.019 billion yuan in dividends, with 502 million yuan distributed over the past three years [3]. Stock Market Activity - As of September 18, the stock price of Zhongsheng Pharmaceutical increased by 2.19%, reaching 20.54 yuan per share, with a total market capitalization of 17.458 billion yuan [1]. - The stock has seen a year-to-date increase of 71.88%, with a recent 5-day increase of 1.68%, a 20-day decrease of 8.95%, and a 60-day increase of 36.48% [1]. - The company has appeared on the "Dragon and Tiger List" twice this year, with the most recent appearance on July 29, where it recorded a net purchase of 181 million yuan [1]. Shareholder Information - As of June 30, 2025, the number of shareholders was 89,900, a decrease of 1.32% from the previous period, with an average of 8,470 circulating shares per person, an increase of 1.33% [2]. - Among the top ten circulating shareholders, Hong Kong Central Clearing Limited is the fourth largest with 9.1731 million shares, while other notable shareholders include Xingquan He Feng Mixed Fund and Xingquan Multi-Dimensional Value Mixed Fund, which have reduced their holdings [3].

众生药业9月17日获融资买入5095.26万元,融资余额5.51亿元

Xin Lang Cai Jing· 2025-09-18 01:24

Core Insights - On September 17, Zhongsheng Pharmaceutical experienced a decline of 0.45% with a trading volume of 531 million yuan, indicating a slight decrease in market performance [1] - As of June 30, 2025, Zhongsheng Pharmaceutical reported a revenue of 1.3 billion yuan, a year-on-year decrease of 4.74%, while net profit attributable to shareholders increased by 114.96% to 188 million yuan [2] Financing and Margin Trading - On September 17, the financing buy-in amount for Zhongsheng Pharmaceutical was 50.95 million yuan, with a net financing outflow of 2.53 million yuan, indicating a higher level of financing activity [1] - The total margin trading balance for Zhongsheng Pharmaceutical reached 553 million yuan, accounting for 3.22% of its market capitalization, which is above the 70th percentile of the past year [1] Shareholder and Institutional Holdings - As of June 30, 2025, the number of shareholders for Zhongsheng Pharmaceutical was 89,900, a decrease of 1.32% from the previous period, while the average number of circulating shares per person increased by 1.33% to 8,470 shares [2] - The company has distributed a total of 2.019 billion yuan in dividends since its A-share listing, with 502 million yuan distributed over the past three years [3] - Among the top ten circulating shareholders, Hong Kong Central Clearing Limited is the fourth largest with 9.1731 million shares, marking its entry as a new shareholder [3]