产品结构改革

Search documents

味知香20260121

2026-01-22 02:43

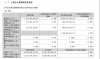

Summary of the Conference Call for Wei Zhi Xiang Company Overview - **Company Name**: Wei Zhi Xiang - **Industry**: Food and Beverage, specifically focusing on pre-prepared meals and catering services Key Points and Arguments Strategic Positioning - Wei Zhi Xiang focuses on family and restaurant customers, aiming to capture market share through differentiated products and scenario solutions [2][3] - The company has redefined its strategic direction for the next three years, emphasizing customer needs and market segmentation [3] Organizational Structure - The company has established three main business clusters: sales, product, and supply chain, creating a flat organizational structure to enhance operational efficiency [2][3][13] - New processes have been implemented to support this structure, including store opening success processes and delivery processes [3] New Store Formats - Wei Zhi Xiang plans to open street-side and community stores, offering on-site cooking services for customers [4] - The new store formats are designed to cater to young consumers looking for convenient meal options [4] Franchise Model - The company is adopting a multi-store franchise model to rapidly expand its presence [5] - Support will be provided to existing franchisees to enhance management and marketing strategies [5] Supermarket Channel Growth - Significant growth has been observed in the supermarket channel, with partnerships established with major retailers and online platforms [6] - Future plans include further strengthening this channel [6] New Product Initiatives - The company is transitioning from semi-finished products to upstream raw material supply chains, targeting group meals and chain restaurants [8] - Product structure reforms include moving from frozen to fresh products and upgrading from single items to meal combinations [9] Supply Chain Reforms - Key focus areas include improving delivery timeliness, cost reduction, and enhancing traceability throughout the supply chain [10] - Measures include building a flexible supply chain and implementing cost control [10] Transparency in Production - Each product features a QR code for consumers to trace the source and quality of ingredients [11][12] - The entire production process, including time and responsible personnel, is documented and accessible via the QR code [12] Restaurant Operations - The company has opened a restaurant in a fourth-tier city, with daily orders ranging from 100 to 200, and online orders constituting about 40% [14] - Plans for further expansion include testing and adjusting product offerings based on regional consumer preferences [14] Future Expansion Plans - In 2026, Wei Zhi Xiang aims to expand primarily in the Suzhou area, with a target of opening dozens of new stores through a combination of franchise and direct ownership [17][19] - The company is also focusing on upgrading older stores and expanding into lower-tier cities [18] Market Environment - The overall consumption environment has shown signs of gradual recovery, with rising raw material prices indicating increased demand [22] - The company anticipates a slight increase in product prices in the latter half of 2026, reflecting a stabilizing restaurant industry [22] Group Meal Business Outlook - Group meal services are identified as a key growth area, with plans to expand into educational systems and corporate cafeterias [23][24] - The company aims to provide customized products for chain restaurants to capture a larger market share [24] Performance in Group Meal Sector - In 2025, the group meal business generated approximately 50-60 million yuan, showing significant growth potential [25]

珠江啤酒发三季报:前九个月营收净利双增,第三季度增速放慢

Nan Fang Du Shi Bao· 2025-10-24 10:56

Core Viewpoint - Zhujiang Beer reported a steady growth in revenue, net profit, and sales volume for the first three quarters of the year, achieving historical highs in both revenue and net profit [1][2]. Financial Performance - Revenue for the first nine months reached approximately 5.073 billion yuan, a year-on-year increase of 3.81% [2]. - Net profit attributable to shareholders was 944 million yuan, reflecting a year-on-year growth of 17.05% [2]. - Beer sales volume was 1.2035 million tons, up 1.83% year-on-year [1]. Quarterly Analysis - In the third quarter, revenue was approximately 1.875 billion yuan, a decrease of 1.34% compared to the same period last year [2][3]. - Net profit for the third quarter was 332 million yuan, an increase of 8.16% year-on-year [2][3]. - Sales volume in the third quarter was 469,400 tons, down 2.89% from 483,400 tons in the same quarter last year [3]. Product Strategy - The company is implementing a "3+N" product strategy, focusing on products like Xuebao, Pure Draft, and other specialty products, with a notable performance from the 8 yuan price segment [3][5]. - The 8 yuan price segment has benefited from consumer shifts, effectively replacing the traditional 3-5 yuan price range [3]. Competitive Landscape - Increased competition in the 8 yuan price segment from companies like China Resources Beer and Qingdao Beer, as well as the introduction of larger packaging products, is putting pressure on Zhujiang Beer’s growth [3]. Future Outlook - Zhujiang Beer plans to enhance its product structure and innovation across five areas: product, business, promotion, brand communication, and management to sustain high growth [4]. - The company is also focusing on high-end product development, aligning with industry trends such as "tea beer" and "fruit beer" [5]. Market Performance - On October 24, Zhujiang Beer’s stock closed at 9.61 yuan per share, down 5.23% [6].