高端产品战略

Search documents

华英农业股东股份将司法拍卖,子公司资产租赁及业绩预亏

Jing Ji Guan Cha Wang· 2026-02-13 01:55

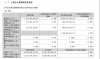

Group 1: Core Insights - The company has multiple events worth noting regarding governance, business operations, and financial performance [1] Group 2: Stock and Capital Performance - The second-largest shareholder, Henan Guangzhou Chenyue Industrial Co., Ltd., will have 135 million shares (6.33% of total shares) auctioned on March 12, 2026, which may affect the shareholding structure but will not change control of the company [2] Group 3: Subsidiary Development - A five-year asset lease agreement was signed between the subsidiary Heze Huaying Poultry Co., Ltd. and Heze Yihua Breeding Co., Ltd., with an annual rent of 7.75 million yuan, totaling 38.75 million yuan, which may impact operational efficiency and cash flow in the long term [3] Group 4: Performance and Operations - The company expects a net loss attributable to shareholders of 45 million to 65 million yuan for the fiscal year 2025, primarily due to declining product gross margins, asset impairment provisions, and reduced investment income from associates [4] - Recent resolutions from the temporary shareholders' meeting on January 15, 2026, regarding related party transactions and guarantees may influence daily operational decisions [5] - Ongoing industry challenges include price fluctuations in broiler chickens and margin pressures in the down business, prompting the company to optimize its business structure through a high-end product strategy [5]

长城汽车联名老爷车博物馆,暗示将推高端艺术品车型

Zhong Guo Jing Ying Bao· 2025-12-26 14:46

Group 1 - The core message indicates that Great Wall Motors is potentially developing a luxury brand, with a focus on high-end products and cultural value creation in the automotive industry [1][2] - Wei Jianjun, the founder of Great Wall Motors, has expressed ambitions to create a supercar, emphasizing that the project is not just a concept but is being systematically developed to enhance China's automotive global image [2] - The establishment of the "Great Wall Luxury Car Business Group" in January 2025 marks the company's strategic entry into the ultra-luxury market, targeting high-end categories such as supercars and D+ class sedans [3] Group 2 - The collaboration with the Sanhe Classic Car Museum and the exchange of a vintage Packard car highlights Great Wall Motors' commitment to integrating classic automotive aesthetics into its future product offerings [1] - The unveiling of a mysterious vehicle during the company's 35th anniversary celebration suggests that Great Wall Motors is making significant strides in the supercar segment, potentially competing with brands like Ferrari [2] - The new luxury brand aims to set a standard for "Chinese high-end cars," reflecting the company's strategic intent to move towards the top of the automotive industry chain [3]

长城汽车豪华新品牌疑浮现?

Zhong Guo Jing Ying Bao· 2025-12-26 14:17

Core Insights - Great Wall Motors is potentially contributing an artistic piece to the Chinese automotive industry, as indicated by the recent collaboration with the Chengdu Sanhe Classic Car Museum and the exchange of a vintage Packard car [2] - The dialogue between industry veterans suggests a new phase in Great Wall Motors' high-end product strategy, moving from technical upgrades to cultural and value creation [2] - The company is actively developing a supercar, which is not just a concept but part of a long-term strategic plan aimed at enhancing China's automotive global image [2] Group 1 - Great Wall Motors' founder Wei Jianjun has expressed a strong interest in high-end products, hinting at the company's exploration of various high-end product types [2] - The establishment of the "Great Wall Brand Super Luxury Car Business Group" in January 2025 marks the company's strategic entry into the ultra-luxury market, focusing on supercars and D+ class sedans [4] - The recent unveiling of a mysterious vehicle during the company's 35th anniversary celebration suggests a strategic focus on the supercar segment, potentially competing with brands like Ferrari [3][4] Group 2 - Wei Jianjun's passion for driving and understanding of vehicle performance has been a driving force behind the company's ambitions in the supercar market [3] - The collaboration with the classic car museum reflects a deep appreciation for automotive aesthetics, which may influence the design philosophy of future high-end products [2] - The company's goal is to establish a "Chinese high-end car" standard, indicating a commitment to elevating its position within the automotive industry [4]

普源精电20251027

2025-10-27 15:22

Summary of Puyuan Precision Electric Conference Call Company Overview - **Company**: Puyuan Precision Electric - **Industry**: Electronic Measurement Instruments Key Points Financial Performance - Revenue for the first three quarters of 2025 decreased by 32.38% year-on-year, but Q3 net profit increased by 121.86% quarter-on-quarter, indicating a significant recovery in profitability [2][3] - Q3 2025 revenue reached 240 million yuan, a quarter-on-quarter increase of 29.52% [3] - Overall gross margin was 55%, down 3.44% year-on-year, primarily due to changes in manufacturing costs at the Malaysia production base, shipping costs, tariffs, and market competition [3][11] Core Technology and Product Sales - Sales revenue from the self-developed core technology platform increased by 21.26% year-on-year, accounting for 46.49% of total revenue [2][4] - The proportion of self-developed digital oscilloscopes rose to 86.15%, with high-resolution digital oscilloscopes seeing a 25.75% year-on-year revenue increase [5] - High-end digital oscilloscopes accounted for 29.84% of total sales, with the DS80,000 series revenue growing by 104% year-on-year [6] New Product Launches and Market Strategy - Five new products were launched from July to October 2025, including digital oscilloscopes and microwave RF instruments, which are expected to positively impact future performance [7] - The ISA 6,000 real-time spectrum analyzer, utilizing self-developed core technology, has strong market competitiveness and has secured significant orders, positively impacting gross margin and revenue [9] IPO and Fundraising Plans - The company has submitted a prospectus to the Hong Kong Stock Exchange, planning to issue no less than 10% of the total share capital post-issue, with funds aimed at overseas R&D, acquisitions, supply chain development, and global marketing [2][8] Market Demand and Growth Potential - Demand is primarily concentrated in the communication, semiconductor, and renewable energy sectors, with strong growth expected in high-end products and solutions [22] - The company anticipates significant growth in the microwave RF product line, contributing substantially to Q4 revenue [14] Future Outlook and Strategic Planning - The company aims to enhance its international presence and product offerings, focusing on high-end and differentiated solutions to improve overall gross margin [28] - The strategic plan includes leveraging global innovation resources and talent to achieve long-term development goals [28] Competitive Landscape - The competitive landscape in the Chinese electronic measurement instrument market is intensifying, but the company maintains a unique technological path to avoid homogenization and low-end competition [21][27] - The company is confident in achieving its stock incentive trigger value for the year, with expectations for improved gross margins in Q4 [23] R&D and Profitability - Significant investments in R&D have been made, with three new R&D centers established, impacting profits but expected to stabilize as revenue increases [13] - The company projects that gross margins will remain stable throughout the year, with potential for significant improvement driven by high-end products in 2026 [12] Conclusion - Puyuan Precision Electric is positioned for recovery and growth, with a strong focus on high-end products, international expansion, and leveraging its self-developed technology to maintain competitive advantages in the electronic measurement instrument industry.

珠江啤酒发三季报:前九个月营收净利双增,第三季度增速放慢

Nan Fang Du Shi Bao· 2025-10-24 10:56

Core Viewpoint - Zhujiang Beer reported a steady growth in revenue, net profit, and sales volume for the first three quarters of the year, achieving historical highs in both revenue and net profit [1][2]. Financial Performance - Revenue for the first nine months reached approximately 5.073 billion yuan, a year-on-year increase of 3.81% [2]. - Net profit attributable to shareholders was 944 million yuan, reflecting a year-on-year growth of 17.05% [2]. - Beer sales volume was 1.2035 million tons, up 1.83% year-on-year [1]. Quarterly Analysis - In the third quarter, revenue was approximately 1.875 billion yuan, a decrease of 1.34% compared to the same period last year [2][3]. - Net profit for the third quarter was 332 million yuan, an increase of 8.16% year-on-year [2][3]. - Sales volume in the third quarter was 469,400 tons, down 2.89% from 483,400 tons in the same quarter last year [3]. Product Strategy - The company is implementing a "3+N" product strategy, focusing on products like Xuebao, Pure Draft, and other specialty products, with a notable performance from the 8 yuan price segment [3][5]. - The 8 yuan price segment has benefited from consumer shifts, effectively replacing the traditional 3-5 yuan price range [3]. Competitive Landscape - Increased competition in the 8 yuan price segment from companies like China Resources Beer and Qingdao Beer, as well as the introduction of larger packaging products, is putting pressure on Zhujiang Beer’s growth [3]. Future Outlook - Zhujiang Beer plans to enhance its product structure and innovation across five areas: product, business, promotion, brand communication, and management to sustain high growth [4]. - The company is also focusing on high-end product development, aligning with industry trends such as "tea beer" and "fruit beer" [5]. Market Performance - On October 24, Zhujiang Beer’s stock closed at 9.61 yuan per share, down 5.23% [6].

海尔智家20250828

2025-08-28 15:15

Summary of Haier's Conference Call Company Overview - **Company**: Haier Smart Home Co., Ltd. - **Industry**: Home Appliances Key Points and Arguments Market Performance and Challenges - Haier's overseas business accounts for over 50% of its revenue, primarily concentrated in the sluggish U.S. market, which is affected by a weak real estate market and price wars, leading to performance pressure [2][4] - In contrast, Midea benefits from its OEM business and inventory replenishment cycle, while Gree benefits from domestic subsidy policies, resulting in better fundamentals compared to Haier [2] - Haier's acquisition of GE has resulted in significant dollar-denominated debt, leading to high financial costs and a lower dividend yield compared to Midea and Gree by 1-2 percentage points, impacting its attractiveness to investors [2][5] ETF and Fund Dynamics - In the upcoming 2024 home appliance bull market, ETF holdings in Midea have significantly increased, while Haier has seen less passive fund interest due to its lower weight in major indices like CSI 300 and SSE 50 [2][6] - Midea's valuation is approximately 13 times earnings, while Haier is just above 11 times, creating a valuation gap of about 1.5 to 2 times, which affects Haier's performance [5] Long-term Competitive Strength - Haier maintains strong long-term competitiveness, benefiting from its international expansion and high-end product strategy, with its Casarte brand competing directly with foreign brands in the domestic market [2][10] - In the U.S. market, Haier has surpassed Whirlpool to become the leading home appliance company, achieving growth through an increased share of mid-to-high-end sub-brands [12] Future Growth Potential - The U.S. is entering a new interest rate cut cycle, which is expected to revive the real estate market, positively impacting downstream companies like Haier [3][13] - Haier's supply chain in North America is over 80%, making it well-positioned to benefit from changes in tariff policies [13] Financial and Valuation Concerns - Haier faces short-term challenges regarding dividend yield and valuation, but potential changes in fund flows and market sentiment could present buying opportunities for long-term investors [14][15] - The most significant factors influencing white goods stock prices in the coming years will be structural changes in fund flows rather than fundamental changes in the companies themselves [15] Conclusion - Haier's long-term growth prospects remain strong despite current challenges, with potential for recovery as market conditions improve and its competitive positioning strengthens in both domestic and international markets [10][14]