珠江纯生

Search documents

中国必选消费品1月价格报告:次高端及以上白酒分化加剧,本期无大众品折扣减小

Haitong Securities International· 2026-01-29 11:28

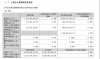

Investment Rating - The report assigns an "Outperform" rating to multiple companies in the consumer staples sector, including Guizhou Moutai, Wuliangye, Luzhou Laojiao, and others, indicating a positive outlook for these stocks [1]. Core Insights - There is an intensified divergence among mid-to-high-end baijiu products, with no discount contraction observed in food and beverage categories [1]. - The report highlights that the wholesale prices of various baijiu brands have shown stability or slight changes, with some brands experiencing price increases while others remain flat or decrease [3][4][35]. - Discounts on representative products in condiments, liquid milk, and soft drinks have widened compared to the end of December, indicating a shift in pricing strategies [19][32]. Summary by Relevant Sections Baijiu Pricing - Guizhou Moutai's wholesale prices for Feitian (case and single bottle) and Moutai 1935 are reported at 1600, 1580, and 630 yuan respectively, with changes of 0, -10, and -10 yuan compared to last month [35]. - Wuliangye's eighth-generation price is 830 yuan, reflecting a +10 yuan increase from the previous month [35]. - Luzhou Laojiao's Guojiao 1573 remains at 850 yuan, unchanged from last month [35]. Discount Trends - The average discount rate for condiments decreased from 87.1% to 85.0%, while liquid milk discounts fell from 62.8% to 61.4% [19][22]. - In contrast, discounts for beer, infant formula, and convenience foods remained stable, with beer discounts slightly increasing from 80.3% to 80.7% [20][22][32]. Company Ratings - The report lists several companies with an "Outperform" rating, including: - Guizhou Moutai - Wuliangye - Luzhou Laojiao - Qingdao Beer - China Feihe - Others [1].

珠江啤酒发三季报:前九个月营收净利双增,第三季度增速放慢

Nan Fang Du Shi Bao· 2025-10-24 10:56

Core Viewpoint - Zhujiang Beer reported a steady growth in revenue, net profit, and sales volume for the first three quarters of the year, achieving historical highs in both revenue and net profit [1][2]. Financial Performance - Revenue for the first nine months reached approximately 5.073 billion yuan, a year-on-year increase of 3.81% [2]. - Net profit attributable to shareholders was 944 million yuan, reflecting a year-on-year growth of 17.05% [2]. - Beer sales volume was 1.2035 million tons, up 1.83% year-on-year [1]. Quarterly Analysis - In the third quarter, revenue was approximately 1.875 billion yuan, a decrease of 1.34% compared to the same period last year [2][3]. - Net profit for the third quarter was 332 million yuan, an increase of 8.16% year-on-year [2][3]. - Sales volume in the third quarter was 469,400 tons, down 2.89% from 483,400 tons in the same quarter last year [3]. Product Strategy - The company is implementing a "3+N" product strategy, focusing on products like Xuebao, Pure Draft, and other specialty products, with a notable performance from the 8 yuan price segment [3][5]. - The 8 yuan price segment has benefited from consumer shifts, effectively replacing the traditional 3-5 yuan price range [3]. Competitive Landscape - Increased competition in the 8 yuan price segment from companies like China Resources Beer and Qingdao Beer, as well as the introduction of larger packaging products, is putting pressure on Zhujiang Beer’s growth [3]. Future Outlook - Zhujiang Beer plans to enhance its product structure and innovation across five areas: product, business, promotion, brand communication, and management to sustain high growth [4]. - The company is also focusing on high-end product development, aligning with industry trends such as "tea beer" and "fruit beer" [5]. Market Performance - On October 24, Zhujiang Beer’s stock closed at 9.61 yuan per share, down 5.23% [6].

珠江啤酒(002461):珠水长流四十载,鹏徙南冥势正遒

Western Securities· 2025-08-28 11:31

Investment Rating - The report initiates coverage with an "Accumulate" rating for Zhujiang Beer [6]. Core Views - Zhujiang Beer has established itself as the leading beer brand in Guangdong Province, benefiting from a strong market foundation and consumer recognition. The company has shown consistent revenue and profit growth, with a projected revenue CAGR of 7.8% and a net profit CAGR of 9.2% from 2020 to 2024 [1][2]. - The company is embracing high-end product strategies, with the proportion of high-end beer revenue increasing from 49.1% in 2019 to 70.8% in 2024, supported by a well-structured product matrix [1][2][35]. - The competitive landscape in Guangdong is shifting, with Zhujiang Beer gaining market share as Budweiser's share declines, while Yanjing Beer is also emerging through its sub-brand Liqueur [1][2][60]. Summary by Sections Company Overview - Zhujiang Beer has a 40-year history and is controlled by the Guangzhou State-owned Assets Supervision and Administration Commission, with a stake from Anheuser-Busch InBev, balancing innovation and stability [1][2][26]. - The company focuses on its core beer business, with 96.2% of revenue derived from beer sales in 2024 [33]. Market Analysis - Guangdong Province is a significant market for beer, with a large population and high economic development, presenting opportunities for consumption upgrades [1][2][55]. - The province has become the largest beer producer in China, surpassing Shandong, with a CAGR of 12.6% from 1982 to 2024 [51][52]. Competitive Landscape - Zhujiang Beer has rapidly developed its market share, with sales exceeding 1.4 million tons in 2024, while Budweiser's market share has been declining [60]. - Yanjing Beer, through its Liqueur brand, is also gaining traction in the market, although Qingdao Beer remains relatively weak in Guangdong [60][66]. Financial Projections - Revenue projections for Zhujiang Beer are estimated at 6.03 billion yuan in 2025, 6.39 billion yuan in 2026, and 6.77 billion yuan in 2027, with corresponding net profits of 982 million yuan, 1.105 billion yuan, and 1.237 billion yuan [2][4]. - The earnings per share (EPS) are projected to be 0.44 yuan in 2025, 0.50 yuan in 2026, and 0.56 yuan in 2027 [2][4].

中国必需消费品8月价格报告:多数品类价格再次回落

Haitong Securities International· 2025-08-26 14:44

Investment Rating - The report assigns an "Outperform" rating to multiple companies in the consumer staples sector, including Moutai, Wuliangye, Luzhou Laojiao, and others, indicating a positive outlook for these stocks [1]. Core Insights - The report highlights a general decline in wholesale prices across most categories of consumer staples, particularly in the baijiu segment, with significant price drops noted for Moutai and Wuliangye [3][32]. - It emphasizes the structural opportunities arising from policy catalysis in the consumer staples sector, suggesting that investors should focus on these potential growth areas [3]. Summary by Sections Price Trends - Recent wholesale prices for Moutai show a decrease, with Feitian Moutai (case) priced at 1845 yuan, down 70 yuan from the previous month, and a year-to-date decline of 395 yuan [32]. - Wuliangye's eighth-generation price remains stable at 920 yuan, with no change since the beginning of the year [32]. - The report notes that the prices of various baijiu brands have shown a downward trend, with year-on-year declines for many products [4][32]. Discount Trends - Discounts on mass-market consumer goods have widened, particularly for liquid milk, soft drinks, infant formula, seasonings, and beer, indicating a shift in consumer purchasing behavior [19][30]. - The average discount rate for liquid milk decreased from 79.1% to 74.8%, while soft drinks saw a drop from 91.8% to 88.3% [19][30]. - The report provides a detailed overview of discount rates across various categories, showing a general trend of increasing discounts in the consumer staples market [20][21].

中国必选消费8月投资策略:关注政策催化带来的结构性机会

Haitong Securities International· 2025-08-04 09:33

Investment Focus - The report highlights a focus on structural opportunities driven by policy catalysis, particularly in essential consumer sectors such as dairy products and liquor, while cautioning against the risks in the soft drink sector [7]. Demand Analysis - In July, among the eight tracked essential consumer sectors, six maintained positive growth, while two experienced negative growth. The sectors with single-digit growth included dining (+4.4%), soft drinks (+2.7%), frozen foods (+1.7%), condiments (+1.1%), dairy products (+1.1%), and beer (+0.6%). The declining sectors were high-end and above liquor (-4.0%) and mass-market liquor (-3.9%) [3][9]. - The report notes that five sectors saw a deterioration in growth rates compared to the previous month, while three improved. The new alcohol ban and adverse weather conditions were identified as significant negative factors affecting demand [3][9]. Price Trends - In July, most liquor wholesale prices stabilized after a period of decline. Specific prices included Feitian at 1915/1880/655 yuan for different packaging, with year-on-year declines of 665/500/155 yuan. The price of Wuliangye was 930 yuan, showing a slight increase of 10 yuan from the previous month [3][22][24]. - The report indicates that the prices of liquid milk and beer saw a reduction in discount rates, while soft drink discounts increased, with stable prices for infant formula, convenience foods, and condiments [4][19]. Cost Analysis - The report states that the spot cost index for various sectors, including dairy, soft drinks, frozen foods, and beer, generally decreased in July, while futures cost indices showed mixed results. For instance, the spot cost index for dairy products fell by 2.92% [4]. Fund Flow - As of the end of July, net inflows into Hong Kong Stock Connect amounted to 124.1 billion yuan, with the essential consumer sector's market capitalization share rising to 5.05%. The food additives sector saw a decrease in share, while the dairy sector experienced an increase [5]. Valuation Insights - By the end of July, the historical PE ratio for the food and beverage sector was at 16% (20.2x), remaining stable from the previous month. The report notes that the median valuation for leading A-share companies was 20x, a decrease of 1x from the previous month [6]. Sector Recommendations - The report recommends focusing on sectors benefiting from policy support, particularly dairy and liquor, while being cautious about the soft drink sector's marginal deterioration. Specific companies to watch include China Feihe, Yili, Mengniu, Master Kong, Uni-President, Yanghe, WH Group, and China Foods [7].

过度依赖华南市场、25亿募资未有效利用,珠江啤酒新帅上任即承压

Sou Hu Cai Jing· 2025-07-31 17:04

Core Viewpoint - The recent leadership changes at Zhujiang Brewery highlight the company's struggles with over-reliance on the South China market and ineffective utilization of the 2.5 billion yuan raised in funding, amidst a declining beer industry and increasing competition [1][11]. Company Overview - Zhujiang Brewery has announced a change in general manager, with Zhang Yong taking over from Huang Wensheng, who served for only about a month [6][8]. - The company has a significant dependency on the South China market, with approximately 95.81% of its revenue coming from this region, amounting to around 5.49 billion yuan in 2024 [10][12]. - The revenue from non-South China markets has decreased by 10.37% year-on-year in 2024, indicating challenges in expanding beyond its primary market [11]. Financial Performance - As of the end of 2024, Zhujiang Brewery's fixed assets reached approximately 3.216 billion yuan, up nearly 8% from the beginning of the year [13]. - The company has faced issues with project delays and adjustments in the use of raised funds, with a remaining balance of about 2.599 billion yuan as of December 31, 2024 [16]. - Interest income accounted for 23.95% of the net profit in 2024, raising concerns about the company's true profitability as this support may diminish with lower interest rates [17]. Market Challenges - The beer industry is expected to see a slight decline in overall production by 0.6% in 2024, intensifying competition among breweries [1]. - Major competitors, such as China Resources Beer, are increasing their presence in the South China market, further squeezing Zhujiang Brewery's market share [10][11]. - Analysts express concerns that frequent leadership changes may disrupt strategic continuity and affect the company's ability to execute its national expansion plans [9][11].

珠江啤酒换帅:粤啤龙头的挑战 在下个缩量周期

2 1 Shi Ji Jing Ji Bao Dao· 2025-06-26 06:10

Core Viewpoint - The appointment of Huang Wensheng as the new chairman of Zhujiang Beer marks a significant leadership change, with expectations for him to drive the company's national expansion and address challenges in a shrinking beer market [2][4][25]. Company Overview - Zhujiang Beer announced the retirement of Chairman Wang Zhibin, with General Manager Huang Wensheng taking over as the fifth leader in the company's history [2]. - Huang Wensheng, who has a background in the telecommunications industry, joined Zhujiang Beer in 2020 and has overseen a 30% revenue growth and a 40% profit increase over five years [3][11]. - Despite strong performance in Guangdong, Zhujiang Beer holds only a 4% market share nationally, indicating limited penetration in the broader beer market [3][21]. Leadership Transition - Huang Wensheng's leadership comes after a series of internal promotions in previous management, with his external appointment raising investor concerns reflected in a nearly 2% drop in stock price following the announcement [5][6]. - The transition of leadership is critical as previous leaders have successfully navigated challenges but left unresolved issues regarding national expansion [14][25]. Historical Context - Zhujiang Beer has a rich history of leadership, with past chairmen achieving significant milestones, including market dominance in Guangdong and the introduction of innovative products [13][18]. - The company has faced increasing competition from larger national brands, which have expanded aggressively into Zhujiang's home market [15][19]. Market Challenges - The beer industry is entering a new cycle of contraction, with a projected decrease in the number of suitable consumers over the next decade, posing a challenge for mid-sized breweries like Zhujiang Beer [21][22]. - The company must navigate a competitive landscape where major brands dominate over 90% of the market, necessitating strategic adjustments to maintain growth [21][22]. Strategic Focus - Zhujiang Beer aims to capitalize on the growing beer consumption in Guangdong, which has recently become the largest beer-producing province in China [22]. - The company is also exploring opportunities for expansion outside Guangdong, with initiatives like the Zhujiang raw beer experience stores designed to penetrate new markets with lower investment [24][25].

8元啤酒混战起,珠江啤酒能否入场全国赛?

Xin Lang Cai Jing· 2025-06-26 03:53

Core Viewpoint - The leadership change at Zhujiang Beer marks a critical moment as the company transitions from a focus on high-end product development to addressing its national expansion challenges, particularly in the competitive 8 yuan beer segment [1][8]. Financial Performance - In 2024, Zhujiang Beer achieved a revenue of approximately 5.731 billion yuan, a year-on-year increase of 6.56%, with beer sales reaching 143.96 million tons, up 2.62% [2][3]. - The net profit attributable to shareholders was about 810 million yuan, reflecting a significant year-on-year growth of 29.95% [2][3]. - High-end products generated revenue of 3.904 billion yuan, a 13.97% increase, accounting for nearly 70% of total revenue, with a gross margin of 48.6% [4]. Product Strategy - Zhujiang Beer has established a "3+N" product strategy, focusing on high-end brands such as the Xuebao series and the 97 Pure Draft, which has seen remarkable growth since its launch [4][6]. - The 8 yuan price segment has become a battleground for various brands, with Zhujiang Beer positioning its 97 Pure Draft as a key player in this competitive landscape [6][8]. Regional Dependency - Zhujiang Beer heavily relies on the South China market, with 95.81% of its revenue coming from this region, indicating a lack of national market penetration [8][10]. - The gross margin in Guangdong is significantly higher at 47.8%, compared to only 12.06% in markets outside the province, highlighting the disparity in profitability [10][11]. National Expansion Challenges - The company acknowledges its limited brand recognition outside of South China, facing stiff competition from established brands like Qingdao and Yanjing in other regions [11][15]. - Zhujiang Beer’s sales expenses as a percentage of operating costs are lower than competitors, suggesting a need for increased marketing investment to enhance brand presence nationally [15][16]. - The current distribution network is primarily traditional, with nearly 90% of revenue coming from these channels, indicating a need for modernization to adapt to changing consumer behaviors [16][18].

中国必选消费6月投资策略:布局“高股息+基本面改善”的股票

Haitong Securities International· 2025-06-04 11:20

Investment Focus - The report emphasizes the strategy of investing in stocks with high dividends and improved fundamentals, particularly in the essential consumer sector [1][6] - Key stocks recommended for investment include Kweichow Moutai, Wuliangye, and Yili, all rated as "Outperform" [1] Industry Overview - In May 2025, six out of eight tracked industries maintained positive growth, with the restaurant sector growing by 3.7%, beer by 3.3%, and soft drinks by 3.1% [3][8] - The industries experiencing negative growth include mass-market and above mid-range liquor, with declines of 13.0% and 2.5% respectively [3][8] Price Trends - In May, the price of Moutai continued to decline, while high-end products like Wuliangye stabilized [4] - The overall price trend in the liquor market showed more declines than increases, particularly in the mid-range segment [4][10] Cost Analysis - The cost index for soft drinks, seasonings, and other categories showed slight increases, while beer and instant noodles experienced declines [4] - Packaging material prices have decreased significantly compared to last year, with aluminum can prices up by 12.01% [4] Fund Flows - As of the end of May, net inflows into Hong Kong Stock Connect amounted to 41.99 billion yuan, with the essential consumer sector's market capitalization share at 5.65% [5] - The food additives sector saw an increase in market share, while the dairy sector experienced a slight decrease [5] Valuation Metrics - The PE historical percentile for A-share food and beverage stocks was 19% (21.5x), a decrease from the previous month [5] - H-share essential consumer sector PE historical percentile increased to 34% (18.8x), reflecting a rise in valuation [5] Recommendations - The report suggests waiting for opportunities or buying high-dividend stocks, as the current fundamentals lack catalysts for growth [6] - Key stocks with high dividend yields include Master Kong, Uni-President, and China Feihe, among others [6]