Breweries

Search documents

青岛啤酒收购即墨黄酒告吹,茅台换帅|观酒周报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 02:46

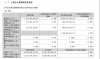

Group 1: Company Developments - Qingdao Beer announced the termination of its acquisition of the equity in Jimo Huangjiu due to unmet conditions in the share transfer agreement, which was initially valued at 665 million yuan [2] - Moutai Group has appointed Chen Hua, the former director of the Guizhou Provincial Energy Bureau, as the new chairman, replacing Zhang Deqin after only a year and a half [6] - Xifeng Wine has appointed Zhang Yong as the new general manager of its marketing company, succeeding Zhou Yanhua, who retired at the age of 55 [7] Group 2: Financial Performance - Jin Hui Wine reported a revenue of 2.305 billion yuan and a net profit of 324 million yuan for the first three quarters, with a significant decline in Q3 net profit by 33% year-on-year [11] - Yanjing Beer and Zhujiang Beer both reported slower growth in their Q3 results, with Yanjing's revenue at 4.875 billion yuan, a 1.55% increase, while Zhujiang's revenue fell by 1.34% to 1.875 billion yuan [12][13] - Heineken's Q3 net revenue decreased by 0.3%, with a projected decline in annual sales due to worsening macroeconomic challenges [14] Group 3: Market Trends - The National Bureau of Statistics reported a 1.6% year-on-year growth in the tobacco and alcohol sector for September, with a 4% increase in the first nine months of 2025 [16]

Heineken: Q3 Resilience, CMD Upside, And Attractive Valuation

Seeking Alpha· 2025-10-25 16:37

Core Insights - Heineken's Q3 results indicate a softening in the spirits and beer market, with ongoing pressure noted among lower-middle-income consumers and specific demographic groups [1] Company Performance - Heineken's performance is being analyzed in the context of its recent Q3 results and Capital Markets Day, highlighting the challenges faced in the current market environment [1] Market Trends - The overall trend in the spirits and beer industry shows a decline, affecting various companies, including Heineken, as they navigate consumer behavior changes [1]

茅台集团,即将换帅?知情人士回应

Xin Lang Cai Jing· 2025-10-25 07:23

Group 1 - The core point of the article is the potential leadership change at Kweichow Moutai Group, with reports indicating that a new chairman may be appointed soon [1] - Zhang Deqin currently serves as the chairman of both Kweichow Moutai Group and the listed company Kweichow Moutai Co., Ltd. [1] - An official announcement regarding the leadership change is expected, as indicated by a source close to the company [1]

Boston Beer Q3 Earnings Beat Estimates, Depletions Down 3% Y/Y

ZACKS· 2025-10-24 17:51

Core Insights - Boston Beer Company, Inc. (SAM) reported third-quarter 2025 results with earnings per share of $4.25, exceeding the Zacks Consensus Estimate of $3.78 and reflecting a year-over-year increase of 48.6. However, net revenues fell 11% year over year [1][9]. Financial Performance - Net revenues for the third quarter were $571.5 million, down 11% from the prior-year quarter, with revenues excluding excise taxes declining 11.2% to $537.5 million. This decline was attributed to lower shipment volumes, partially offset by higher pricing and a favorable product mix [2]. - Shipment volume decreased by 13.7% year over year to 1.9 million barrels, primarily due to lower volumes of Truly Hard Seltzer, Twisted Tea, and Samuel Adams, although brands like Sun Cruiser and Angry Orchard showed growth [3]. - Gross profit fell 2.5% year over year to $273.1 million, but gross margin improved by 450 basis points to 50.8%, driven by brewery efficiencies, procurement savings, and a favorable product mix [5][9]. Expenses and Costs - Advertising, promotional, and selling expenses rose 11.3% to $164.7 million due to increased investments in brand media and marketing, while general and administrative expenses increased by 2.5% to $44.9 million [6]. - The company anticipates advertising expenses to increase by $50-$60 million, up from a previous estimate of $30-$50 million [13]. Financial Position - As of September 27, 2025, Boston Beer had cash and cash equivalents of $250.5 million and total stockholders' equity of $911 million, with $150 million available in its line of credit [7]. - The company repurchased shares worth $161.3 million year to date, with approximately $266 million remaining on its $1.6 billion share buyback expenditure limit [8]. Future Guidance - Boston Beer updated its 2025 financial guidance, expecting mid-single-digit declines in depletions and shipments, with price increases remaining at 1-2% [10][11]. - The gross margin forecast for 2025 is now 47-48%, reflecting a change due to lower-than-expected tariff impacts [12]. - Capital spending is now projected at $50-$70 million, down from the previous range of $70-$90 million [14].

珠江啤酒发三季报:前九个月营收净利双增,第三季度增速放慢

Nan Fang Du Shi Bao· 2025-10-24 10:56

Core Viewpoint - Zhujiang Beer reported a steady growth in revenue, net profit, and sales volume for the first three quarters of the year, achieving historical highs in both revenue and net profit [1][2]. Financial Performance - Revenue for the first nine months reached approximately 5.073 billion yuan, a year-on-year increase of 3.81% [2]. - Net profit attributable to shareholders was 944 million yuan, reflecting a year-on-year growth of 17.05% [2]. - Beer sales volume was 1.2035 million tons, up 1.83% year-on-year [1]. Quarterly Analysis - In the third quarter, revenue was approximately 1.875 billion yuan, a decrease of 1.34% compared to the same period last year [2][3]. - Net profit for the third quarter was 332 million yuan, an increase of 8.16% year-on-year [2][3]. - Sales volume in the third quarter was 469,400 tons, down 2.89% from 483,400 tons in the same quarter last year [3]. Product Strategy - The company is implementing a "3+N" product strategy, focusing on products like Xuebao, Pure Draft, and other specialty products, with a notable performance from the 8 yuan price segment [3][5]. - The 8 yuan price segment has benefited from consumer shifts, effectively replacing the traditional 3-5 yuan price range [3]. Competitive Landscape - Increased competition in the 8 yuan price segment from companies like China Resources Beer and Qingdao Beer, as well as the introduction of larger packaging products, is putting pressure on Zhujiang Beer’s growth [3]. Future Outlook - Zhujiang Beer plans to enhance its product structure and innovation across five areas: product, business, promotion, brand communication, and management to sustain high growth [4]. - The company is also focusing on high-end product development, aligning with industry trends such as "tea beer" and "fruit beer" [5]. Market Performance - On October 24, Zhujiang Beer’s stock closed at 9.61 yuan per share, down 5.23% [6].

Boston Beer(SAM) - 2025 Q3 - Earnings Call Transcript

2025-10-23 22:00

Financial Data and Key Metrics Changes - Revenue for Q3 2025 decreased by 11.2% due to lower volumes, partially offset by increased pricing and favorable product mix [26] - Gross margin for Q3 2025 was 50.8%, an increase of 450 basis points year over year, marking the highest level since 2018 [26][27] - Year-to-date EPS reached $11.82, with guidance for full-year EPS revised to $7.80 to $9.80, up from $6.72 to $9.54 [28][32] Business Line Data and Key Metrics Changes - Depletions decreased by 3% in Q3 2025, with shipments down 13.7%, primarily driven by declines in Twisted Tea, Truly Hard Seltzer, and Samuel Adams [26][10] - Twisted Tea saw a year-to-date decline of 5% in dollar sales, while Angry Orchard returned to growth with increased depletions [12][24] - Sun Cruiser became the leading RTD spirits brand in on-premise channels, with significant growth in distribution and velocity [18][19] Market Data and Key Metrics Changes - The overall beer industry is estimated to be down over 4% in volume, while the beyond beer category, which represents over 85% of the company's volume, is expected to grow [6][10] - The hard seltzer category declined 4% in dollars in measured off-premise channels, as consumer preferences shift towards premium RTD spirits [21] - Hispanic consumer buying rates remain challenged, impacting brands like Twisted Tea, which has a significant portion of its drinker base from this demographic [12][13] Company Strategy and Development Direction - The company is focused on innovation, advertising investment, and margin improvement, with a strong emphasis on the beyond beer category [4][6] - Plans to expand Sun Cruiser and launch additional innovation brands in 2026 are underway, alongside increased advertising support [19][20] - The company aims to maintain share within its brand families and is investing in local market activation programs to support brand growth [8][17] Management's Comments on Operating Environment and Future Outlook - The management acknowledged a challenging macroeconomic environment affecting consumer demand, particularly among low to middle-income consumers [6][12] - Despite current headwinds, the company sees long-term growth opportunities in the beyond beer category and is committed to investing in its brands [7][10] - Management expressed confidence in the strategies and team in place to navigate the current environment and improve share trends [25] Other Important Information - The company generated over $230 million in operating cash flow in the first nine months of the year, allowing for brand investments and share repurchases [11] - The company has narrowed its volume guidance range for the year and raised its gross margin and EPS guidance, reflecting strong performance year-to-date [30][32] - The company ended the quarter with a cash balance of $250.5 million and an unused credit line of $150 million, providing flexibility for future investments [33] Q&A Session Summary Question: Clarification on promotional spend and timing - Management indicated that promotional spending will support Twisted Tea and that local marketing efforts will continue into next year [36][40] Question: Thoughts on smaller pack sizes - Management is exploring smaller pack sizes but believes that traditional sizes offer better value and margin [37][42] Question: Gross margin performance and future targets - Management expressed confidence in maintaining high gross margins and achieving targets through ongoing savings projects [46][50] Question: Top-line growth outlook - Management is optimistic about Sun Cruiser's growth potential and aims to maintain share across its brand portfolio [54][58] Question: Impact of hemp beverages and Hispanic consumers - Management noted that economic conditions and health concerns are significant factors affecting demand, with limited impact from hemp beverages [72][74]

Boston Beer(SAM) - 2025 Q3 - Earnings Call Transcript

2025-10-23 22:00

Financial Data and Key Metrics Changes - Revenue for Q3 decreased by 11.2% due to lower volumes, partially offset by increased pricing and favorable product mix [32] - Gross margin for Q3 was 50.8%, an increase of 450 basis points year-over-year, marking the highest level since 2018 [33] - Year-to-date EPS reached $11.82, with guidance for full-year EPS revised to $7.80 to $9.80, up from $6.72 to $9.54 [38] Business Line Data and Key Metrics Changes - Depletions decreased by 3% in Q3, with shipments down 13.7%, primarily driven by declines in Twisted Tea, Truly Hard Seltzer, and Samuel Adams [32] - Sun Cruiser and Angry Orchard brands showed growth, with Sun Cruiser becoming the leading RTD spirits brand in on-premise channels [22][32] - Twisted Tea experienced a decline of 5% in dollar sales year-to-date, attributed to macroeconomic factors and competition from RTD spirits [15][16] Market Data and Key Metrics Changes - The overall beer industry is estimated to be down over 4% in volume, while the company's depletions were down 3% [12][32] - The hard seltzer category declined by 4% in dollars, with Truly remaining a top brand but underperforming [25] - The Hispanic consumer segment continues to face challenges, impacting demand across the industry [16][97] Company Strategy and Development Direction - The company is focused on innovation, brand support through advertising, and margin improvement initiatives [7][11] - Plans to expand Sun Cruiser and introduce new innovation brands in 2026, while continuing to support Twisted Tea with advertising and promotional efforts [20][25] - The company aims to maintain share in its brand families and capitalize on growth opportunities in the beyond beer category [71][80] Management's Comments on Operating Environment and Future Outlook - The current macroeconomic environment remains challenging, with consumers managing budgets tightly and moderation trends impacting demand [8][9] - Management remains optimistic about long-term growth opportunities in the beyond beer category, which represents over 85% of the company's volume [9][10] - The company expects to see improvements in the macroeconomic environment and brand performance in the long term [21][72] Other Important Information - The company generated over $230 million in operating cash flow in the first nine months, allowing for brand investments and share repurchases [14] - The company has narrowed its volume guidance range and raised gross margin and EPS guidance for the full year [36][38] - The company ended the quarter with a cash balance of $250.5 million and an unused credit line of $150 million [40] Q&A Session Summary Question: Clarification on promotional spend and local marketing - Management indicated that promotional spending will support Twisted Tea and that local marketing efforts will continue into next year [44][46] Question: Gross margin performance and future targets - Management expressed confidence in maintaining high gross margins due to ongoing savings projects and operational efficiencies [56][59] Question: Top line growth outlook and brand contributions - Management remains optimistic about Sun Cruiser's growth potential and aims to maintain share for Twisted Tea and Truly [70][76] Question: Impact of hemp beverages and Hispanic consumers - Management noted that the Hispanic consumer segment represents about 20% of Twisted Tea drinkers and highlighted macroeconomic factors as significant drivers of industry declines [97][98] Question: Fourth quarter earnings outlook - Management reiterated that Q4 is typically the lowest revenue quarter and explained the changes in production and marketing spend that contribute to this trend [104][108]

AB InBev relaunches Bud in Germany

Yahoo Finance· 2025-10-23 13:48

Core Insights - Anheuser-Busch InBev is reintroducing the Bud beer brand to the German market to celebrate its 150th anniversary next year, coinciding with the growth of international lager beers in Germany [1][4] - The beer will initially be sold exclusively in Rewe stores, with plans to expand to other retail outlets and bars throughout Germany [2] - The brewing of Anheuser-Busch Bud will take place within the European Union, although specific breweries have not been disclosed [3] Market Context - Germany's beer sales declined last year, with approximately 8.3 billion liters sold, marking a 1.4% decrease from 2023, and domestic consumption fell by 2% to 6.8 billion liters [5] - AB InBev reported a slight decline of 0.1% in beer volumes in Europe for the first half of the year, which was considered an outperformance compared to the industry in five out of six key markets [6] - The company noted that industry volumes were estimated to be flat in the second quarter of 2025, indicating a potential stabilization in the market [6]

Heineken® 0.0 signs global partnership with Premier Padel, marking its debut in the world's fastest-growing sport

Globenewswire· 2025-10-23 10:36

Core Insights - Heineken® 0.0 has announced a global partnership with Premier Padel, becoming the Global Beer Partner for the leading professional padel tour, marking its entry into the rapidly growing sport of padel [1][6] Company Overview - Heineken® 0.0 aims to enhance quality socializing through its partnership with Premier Padel, aligning with the sport's vibrant social community and appeal to wellness seekers [2][6] - The brand is committed to creating engaging experiences that connect players and fans, emphasizing the importance of in-person interactions and balanced lifestyles [3][4] Industry Context - Premier Padel has seen significant growth, featuring 24 tournaments across 16 countries in 2025, including its first tournament in the US, and plans to expand into Asia in 2026 [3][7] - The sport has attracted over 600 players from 29 countries, highlighting its role as a platform for international growth and diversity [3][7]

Heineken® 0.0 signs global partnership with Premier Padel, marking its debut in the world’s fastest-growing sport

Globenewswire· 2025-10-23 10:36

Core Insights - Heineken 0.0 has announced a global partnership with Premier Padel, becoming the Global Beer Partner starting in 2026, aligning with the sport's growing popularity and social aspects [2][3][6] Company Overview - Heineken 0.0 aims to enhance quality socializing through its partnership with Premier Padel, which is recognized as the leading professional padel tour globally [2][9] - The brand's commitment to creating engaging social experiences is reflected in its strategy to connect with the padel community, which values social interaction [3][4] Industry Context - Padel is identified as the world's fastest-growing sport, with significant commercial and fan engagement opportunities, as evidenced by the 24 tournaments held across 16 countries in the 2025 season [6][9] - The sport's expansion includes plans to enter new markets, such as Asia, and has already attracted over 600 players from 29 countries in its competitions [6][9]