无线通信

Search documents

6Ghz频段,谁能用?

半导体芯闻· 2025-11-10 10:56

Core Viewpoint - The article discusses the ongoing debate in Europe regarding the allocation of the 6 GHz frequency band, with mobile network operators advocating for its exclusive use for 5G and 6G services, while the Wi-Fi Alliance and Dynamic Spectrum Alliance (DSA) argue for its continued availability for Wi-Fi applications, highlighting the potential impact on digital development in Europe [1][2]. Group 1: Stakeholder Positions - The Wi-Fi Alliance and DSA express concerns that restricting Wi-Fi access to the 6 GHz band would severely hinder digital development in Europe, emphasizing that Wi-Fi is a primary means for consumers to access the internet [2]. - A spokesperson from Germany's Federal Ministry of Digital and Transport indicates that the demand for the 6 GHz band from mobile network operators is considered higher than that for Wi-Fi applications, suggesting a shift in policy [2][3]. - The DSA claims that blocking Wi-Fi access to the 6 GHz band would have a devastating impact on the future of Wi-Fi technology in Europe, which is crucial for maintaining the Wi-Fi ecosystem and fostering digital innovation [2]. Group 2: Technical and Regulatory Context - Reports indicate that the spectrum available for Wi-Fi is significantly less than that for mobile networks, with demand for the 6 GHz band from Wi-Fi expected to exceed that of mobile networks [3]. - Vodafone has previously tested the 6 GHz band, achieving download speeds of up to 5 Gbps, and argues for opening the band to enhance cellular network capacity as existing bandwidth becomes exhausted [3][4]. - The International Telecommunication Union (ITU) has supported the mobile communications sector by designating the 6 GHz band for cellular services at the 2023 World Radiocommunication Conference [4]. - The European Commission plans to make a technical coordination decision regarding the 6 GHz band, with a report from the European Conference of Postal and Telecommunications Administrations (CEPT) due by July 2027 [4].

蓝牙和Wi-Fi之外,中国原生短距通信技术“星闪”加速商业化

Mei Ri Jing Ji Xin Wen· 2025-11-07 09:27

Core Viewpoint - The 2025 Consumer Electronics Innovation Conference (CEIC 2025) highlighted Huawei's advancements in the HarmonyOS and the introduction of the StarFlash technology, which aims to revolutionize short-range wireless communication, competing with existing technologies like Bluetooth and Wi-Fi [1]. Group 1: HarmonyOS and StarFlash Technology - Huawei's HarmonyOS has become a digital foundation for various industries transitioning into an intelligent society, with the latest version, HarmonyOS 6, introducing features like intelligent focus and smart capabilities [1]. - StarFlash is a new generation of short-range wireless communication technology developed in China, designed to integrate the advantages of Bluetooth and Wi-Fi, offering two communication interfaces: SLB for low latency and high reliability, and SLE for low power consumption [1]. - StarFlash technology boasts energy consumption at 60% of Bluetooth's, speeds over six times faster than Bluetooth, and supports ten times the number of terminal connections compared to Bluetooth [1]. Group 2: Applications and Market Potential - StarFlash technology is already being utilized in various devices, including keyboards, mice, smartwatches, and home appliances, with applications expanding rapidly [4]. - In high-reliability fields such as aerospace and industrial environments, StarFlash has replaced traditional cable connections, enhancing efficiency and reducing weight [4]. - The digital car key using StarFlash technology is expected to be a significant application in the next three years, offering improved accuracy and reduced costs compared to traditional solutions [4]. Group 3: Commercialization and Future Outlook - The expected shipment of StarFlash chips is projected to exceed 200 million units by the end of 2023, indicating a strong commercial push [4]. - Despite the promising technology, StarFlash currently has a low penetration rate compared to Bluetooth and Wi-Fi, with Bluetooth device shipments expected to reach 4.7 billion units in 2024 [5]. - The goal for StarFlash is to achieve what Bluetooth and Wi-Fi have accomplished over 20 years within the next decade, with aspirations for international expansion [5].

康希通信20251106

2025-11-07 01:28

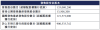

Summary of the Conference Call for 康希通信 Company Overview - **Company**: 康希通信 (Kangxi Communication) - **Industry**: Wireless Communication Technology Key Points Financial Performance - **Q3 Revenue Growth**: Revenue for Q3 increased by 3.21% year-on-year, reaching a record high for a single quarter, with total revenue of 526 million yuan for the first three quarters, a 39.32% increase year-on-year [2][3] - **Net Profit**: The company reported a net loss of 30.53 million yuan in Q3, although the loss narrowed compared to the previous year [2][3] - **Gross Margin**: Gross margin for the first three quarters was 23.13%, up 2.32 percentage points year-on-year, with Q3 gross margin at 24.43%, an increase of 5.63 percentage points year-on-year [2][3] Product Development and Market Position - **WiFi 7 Products**: WiFi 7 products have become the core growth engine, accounting for over 50% of revenue. The company has established deep partnerships with major SoC manufacturers like Broadcom, Qualcomm, and MediaTek, leading to continuous order and shipment growth [2][4] - **Future Technology**: The company is proactively developing WiFi 8 technology, with plans to launch related products in 2026 [2][5] - **UWB Technology**: The company is collaborating with invested enterprises to develop Ultra Wide Band (UWB) products, targeting applications in tracking, radar, and data transmission. The UWB market in China is expected to reach 20 billion yuan by 2028 [4][9] Diversification and Strategic Initiatives - **Business Diversification**: The company is expanding into low-altitude economy and industrial IoT sectors, with successful orders for high-efficiency drone RF front-end chips and smart control wireless communication chips [2][6] - **Strategic Focus**: The company is focusing on four strategic directions: building a moat around WiFi products, diversifying product offerings, protecting intellectual property, and enhancing market value management [2][8] Legal Challenges - **337 Investigation**: The company is involved in a 337 investigation initiated by Skyworks, with three patents withdrawn due to insufficient infringement evidence. The remaining two patents have completed court hearings. Legal expenses related to this investigation totaled approximately 50.6 million yuan for the first three quarters, significantly impacting net profit [2][7][22] - **Impact of Legal Costs**: Excluding these legal costs, the core business has returned to profitability. The company expects a significant decrease in related expenses in Q4 and anticipates a gradual reduction in the impact of these legal issues on overall performance in 2026 [7][8][10] Market Outlook and Competitive Landscape - **Market Expansion**: The company is targeting overseas markets, particularly Europe and South Asia, with expectations of overseas sales accounting for 6%-7% of total sales for the year [10] - **Competitive Position**: The merger between Skyworks and Qorvo may create a monopolistic giant, but it also presents opportunities for domestic manufacturers like 康希通信 to become key suppliers for major clients [11][19] Future Growth and Challenges - **Mobile WiFi Market**: The company is working to increase its market share in the mobile WiFi sector, which is crucial for future growth. Currently, WiFi 6 accounts for about 40% of revenue, while WiFi 7 contributes over 50% [12][16] - **Emerging Trends**: The company is observing a shift from Bluetooth to WiFi connections in certain applications, particularly in IoT and wearable devices, which may drive future product development [13][14][15] Shareholder Activity - **Shareholder Reduction**: Two major shareholders reduced their holdings, but this has not significantly impacted the company's operations or strategic direction [21] Conclusion - 康希通信 is positioned for growth with a strong focus on WiFi technology, diversification into new markets, and proactive management of legal challenges. The company remains optimistic about its future profitability and market expansion despite current challenges.

Comcast(CMCSA) - 2025 Q3 - Earnings Call Transcript

2025-10-30 13:30

Financial Data and Key Metrics Changes - Total company revenue declined about 3% year over year, primarily due to tough comparisons to last year's Paris Olympics, but excluding that impact, revenue increased nearly 3% driven by strong performance across six growth businesses [16][24] - EBITDA and adjusted EPS were consistent with last year, while free cash flow increased 45% to $4.9 billion [16][26] - Connectivity and platforms EBITDA declined by 3.7% this quarter, reflecting the costs associated with the strategic pivot [13][18] Business Line Data and Key Metrics Changes - Broadband subscribers declined by 104,000 in the quarter, with a deceleration in broadband ARPU growth resulting in 2.6% growth this quarter [19][20] - Wireless net additions hit a new record at 414,000, with nearly half of residential postpaid phone connects coming from customers taking a free line [21][88] - Business services revenue was up 6% and EBITDA grew by nearly 5% in the quarter, driven by advanced services like Cybersecurity Cloud Solutions [22] Market Data and Key Metrics Changes - The broadband environment remains intensely competitive, with a focus on simplifying pricing and improving customer experience [7][17] - The media segment, excluding the comparison to last year's Paris Olympics, saw revenue increase by 4%, with Peacock revenue growing at a mid-teens rate [24][102] Company Strategy and Development Direction - The company aims to be a winner in the multi-gig symmetrical broadband market, with a strategy focused on network, product, and customer experience [7][8] - A new pricing model has been introduced, simplifying offers and enhancing customer experience, which is expected to stabilize the broadband customer base [12][20] - The company is investing in sports content to enhance its media business, leveraging live sports to drive viewership and advertising revenue [14][102] Management's Comments on Operating Environment and Future Outlook - Management expressed confidence in the long-term growth potential despite near-term headwinds from the broadband repositioning and the onboarding of sports rights [28][52] - The leadership transition is seen as a positive step towards navigating the company's strategic pivot and achieving sustainable growth [31][33] Other Important Information - The company returned $2.8 billion to shareholders this quarter, including $1.5 billion in share repurchases and $1.2 billion in dividends [16][26] - The company maintains a healthy balance sheet, ending the quarter with net leverage at 2.3 times [27] Q&A Session Summary Question: Context around the evolution of ARPU and customer migration to new plans - Management indicated that due to investments, ARPU growth is unlikely in early 2026, but they are actively migrating customers to new pricing and packaging [42][46] Question: Anticipation of growth rate improvement in convergence - Management is optimistic about the growth rate improving as they continue to market new offers and promotions [44][50] Question: Trajectory of CMP EBITDA next year - Management acknowledged that investments in sales, marketing, and customer service are necessary to support the reset, which will impact EBITDA [60][68] Question: Speculation about Warner Brothers Discovery and implications for Verizon relationship - Management expressed confidence in the relationship with Verizon and emphasized that the bar is high for pursuing any M&A transactions [74][78] Question: Conversion of free wireless lines to pay next year - Management is focused on ensuring quality connections and has strategies in place to transition free lines to paid status effectively [84][88] Question: Advertising outlook and impact of programmatic - Management reported a strong advertising quarter, driven by sports, and noted the increasing use of programmatic and digital advertising [102][104]

广和通(300638) - 300638广和通投资者关系管理信息20251029

2025-10-29 15:50

Financial Performance - In the first three quarters of 2025, the company achieved a revenue of 5.366 billion CNY, with a net profit attributable to shareholders of 316 million CNY [3] - Revenue growth of 7.32% year-on-year, while net profit decreased by 2.19% year-on-year [3] - Improvement in gross margin and significant increase in operating cash flow both year-on-year and quarter-on-quarter [3] Product Performance - Revenue from wireless communication modules showed slight growth, while solution revenue experienced substantial growth, primarily from AI solutions, robotic solutions, and other solutions [3] - The company has a mature solution for AI toys, with products including communication modules and MagiCore chip box solutions, which have been successfully mass-produced [3] - The FWA business is growing rapidly due to low 5G penetration in target markets and increasing overseas demand [3] Collaborations and Market Expansion - Collaboration with Hesai Technology focuses on providing integrated solutions, particularly in robotics [3] - A formal partnership with XREAL has been established, with details available on the company's WeChat [3] - The company has developed close relationships with numerous downstream clients in the AI toy sector, maintaining a positive outlook for future revenue growth [3] Robotics and Product Development - The lawnmower robot business has achieved mass production, with expectations for significant growth next year [4] - The monocular solution is cost-effective, while the binocular solution is primarily used in large commercial scenarios [4] - The company has launched a new generation of the Fibot intelligent robot development platform, successfully applied in data collection for advanced visual-language-action models [4]

广和通(300638) - 300638广和通投资者关系管理信息20251029

2025-10-29 13:50

Group 1: Financial Performance - The company achieved a revenue of 5.366 billion CNY in the first three quarters of 2025, with a year-on-year growth of 7.32% [3] - The net profit attributable to shareholders decreased by 2.19% year-on-year [3] - Operating cash flow showed significant increases both year-on-year and quarter-on-quarter [3] Group 2: Product Performance - Revenue from wireless communication modules experienced slight growth, while solution revenue saw substantial increases, primarily from edge solutions, robotics solutions, and AI solutions [3] - The company has successfully mass-produced its lawn mowing robots, with expectations for significant growth in the following year [4] - The monocular solution is currently the mainstream in terms of shipment structure, while the binocular solution is mainly applied in large commercial scenarios [4] Group 3: Strategic Partnerships and Market Outlook - The company has established a formal partnership with XREAL, focusing on AI toy solutions and other applications [3] - The FWA business has seen rapid growth, driven by low penetration rates in target markets and increasing overseas demand [3] - Collaboration with Hesai Technology focuses on providing integrated solutions, particularly in robotics [3]

Rogers Communications(RCI) - 2025 Q3 - Earnings Call Transcript

2025-10-23 13:00

Financial Data and Key Metrics Changes - Consolidated service revenue increased by 4% to $4.7 billion, while adjusted EBITDA decreased by 1% to $2.5 billion, reflecting modest growth in wireless, cable, and media combined with the consolidation of MLSE results [24][25][28] - Free cash flow was reported at $829 million, down 9% year-over-year due to increasing taxable income and the timing of tax installment payments [24][26] - The debt leverage ratio stood at 3.9 times, reflecting a slight increase due to the acquisition of the additional stake in MLSE [25][26] Business Line Data and Key Metrics Changes - Wireless service revenue was flat year-over-year, with adjusted EBITDA up 1%, driven by cost efficiencies that improved wireless margins to 67%, up 60 basis points [18][19] - Cable service revenue grew by 1% year-over-year, with adjusted EBITDA up 2%, leading to cable margins of 58%, an increase of 70 basis points [21] - Media revenue surged by 26% to $753 million, driven by strong performance from the Toronto Blue Jays and the consolidation of MLSE [22] Market Data and Key Metrics Changes - The wireless market saw a total of 111,000 mobile phone net additions in Q3, with a year-to-date total of 206,000, primarily on the Rogers Postpaid brand [7][19] - Retail internet additions were 29,000 in the quarter, contributing to approximately 80,000 new internet subscribers year-to-date [9][21] - Blended mobile phone ARPU decreased by 3% to $56.7, reflecting competitive pressures and lower international roaming revenue [20] Company Strategy and Development Direction - The company is focused on maintaining strong execution across its three core businesses: wireless, cable, and media, while also exploring opportunities to unlock value from its sports and media assets [12][29] - The launch of satellite to mobile technology aims to enhance coverage in remote areas, reinforcing the company's commitment to innovation [8][9] - The company plans to acquire the remaining minority stake in MLSE, which is expected to enhance revenue and profitability growth [12][23] Management's Comments on Operating Environment and Future Outlook - Management expressed confidence in sustaining service revenue growth despite competitive pressures and a slower growth economy [18][51] - The company anticipates strong execution in Q4, with expectations for positive service revenue growth for wireless [51] - Management highlighted the importance of customer experience and operational efficiency, particularly through the deployment of AI technologies [42][44] Other Important Information - Capital expenditures for the year are expected to be approximately $3.7 billion, a reduction from previous targets, reflecting a focus on capital efficiency [14][28] - The company maintains a strong liquidity position with available liquidity of $6.4 billion [26] Q&A Session Summary Question: Discussion on wireless competitive environment and pricing sustainability - Management indicated that streamlined pricing and promotional strategies have resonated well with customers, leading to positive subscriber performance [32][35] Question: Insights on churn management - A holistic approach to base management has been implemented, focusing on proactive customer engagement to reduce churn [36] Question: Clarification on service revenue trends and roaming impacts - Management confirmed that lower roaming volumes and wholesale revenues contributed to the decline in service revenue [40] Question: Opportunities from AI technologies - Management outlined three main areas for AI deployment: customer experience, operational efficiency, and security enhancements [44][45] Question: Expectations for wireless revenue trends and subscriber growth - Management expects positive service revenue growth for wireless, despite current immigration levels impacting subscriber additions [51][68] Question: Competitive advantages of converged offerings - The company is leveraging its converged footprint to enhance customer offerings, leading to increased demand for bundled services [78] Question: Financing plans for upcoming acquisitions - Management confirmed that credit agencies are aware of the company's plans and that no equity will be needed to bridge gaps for upcoming deals [91][92]

硕贝德10月22日获融资买入3766.12万元,融资余额6.16亿元

Xin Lang Cai Jing· 2025-10-23 01:29

Core Insights - On October 22, ShuoBeide's stock fell by 3.07%, with a trading volume of 420 million yuan [1] - The company experienced a net financing outflow of 532.19 million yuan on the same day, with a total financing balance of 616 million yuan, representing 6.05% of its market capitalization [1] - ShuoBeide's main business includes the development, production, and sales of wireless communication terminal antennas, with revenue contributions from antennas at 50.50%, harnesses and connectors at 26.34%, smart sensor modules at 13.73%, and heat dissipation components at 8.86% [1] Financial Performance - As of June 30, ShuoBeide reported a revenue of 1.208 billion yuan for the first half of 2025, marking a year-on-year growth of 48.50% [2] - The net profit attributable to the parent company reached 33.53 million yuan, showing a significant increase of 981.11% compared to the previous period [2] - The company has distributed a total of 116 million yuan in dividends since its A-share listing, with no dividends paid in the last three years [2] Shareholder Information - As of June 30, 2025, the number of shareholders increased to 58,900, with an average of 7,485 circulating shares per person, a decrease of 2.45% from the previous period [2] - Hong Kong Central Clearing Limited is the second-largest circulating shareholder, holding 11.4313 million shares, an increase of 9.1216 million shares from the previous period [2]

AT&T Stock Rises. Why This Matters More Than So-So Earnings.

Barrons· 2025-10-22 11:11

Core Insights - More customers than expected switched to the wireless carrier's cellphone plans over the third quarter, which helped to boost shares [1] Group 1 - The increase in customer switch to the wireless carrier's plans exceeded expectations [1] - This customer growth contributed positively to the company's share performance [1]

广和通募29亿港元首日破发跌12% 广发基金管理等浮亏

Zhong Guo Jing Ji Wang· 2025-10-22 08:57

Core Viewpoint - Guanghetong Wireless Co., Ltd. (stock codes: 300638.SZ, 00638.HK) was listed on the Hong Kong Stock Exchange, closing at HKD 18.98, down 11.72% from its issue price, with an intraday low of HKD 18.89 [1] Summary by Sections Share Issuance and Capital Structure - The total number of shares issued under the global offering was 135,080,200 H-shares, with 13,508,200 shares for the Hong Kong public offering and 121,572,000 shares for international offering [2] - The number of shares issued at listing (before the exercise of the over-allotment option) was 900,533,742 [2] Key Investors - The cornerstone investors included Qindao Gantong, Pacific Asset Management, China Taiping (Hong Kong), GF Fund Management, GF International, Ruihua Investment, Zhidu Investment, Zhang Xiaolei, Guotai Junan Securities Investment, and Junyi Hong Kong Fund [5] Pricing and Proceeds - The final offer price was HKD 21.50, with total proceeds amounting to HKD 2,904.2 million, and net proceeds after estimated listing expenses of HKD 93.6 million were HKD 2,810.6 million [7] - Approximately 55% of the net proceeds are expected to be allocated for R&D, particularly in AI and robotics technology innovation and product development [7] Use of Proceeds - About 15% of the net proceeds is planned for building manufacturing facilities in Shenzhen, China, primarily for module products [7] - 10% of the net proceeds is expected to be used for repaying certain interest-bearing bank loans [7] - Another 10% is anticipated for strategic investments and/or acquisitions, focusing on companies in wireless communication, AI, robotics, and other complementary fields [7] - The remaining 10% is expected to be used for working capital and other general corporate purposes [7] Company Overview - Guanghetong is a provider of wireless communication modules, offering products such as data transmission modules, smart modules, and AI modules [8] - The company provides customized solutions based on its module products, including edge AI solutions, robotic solutions, and other applications [8]