高性能存储芯片

Search documents

韩国巨头,竞相扩产

半导体行业观察· 2026-02-19 02:46

SK 海力士正在龙仁半导体集群建设一期晶圆厂,原计划于明年 5 月竣工。目前一期厂房外部结构施 工已过半,规划中的 6 座洁净室已有 3 座同步建设。洁净室是对粉尘、微生物与颗粒物进行严格管 控的专用空间。SK 海力士龙仁一期厂房为三层建筑,规模相当于清州厂区的 6 座 M15X 晶圆厂。 据报道,SK 海力士正计划提前试产,最早可能在明年 2—3 月启动。公司将在龙仁一期率先完工的 洁净室内快速完成设备安装,实现提前投产,主要生产在 AI 时代需求激增的高性能 DRAM(如 DDR5)与高带宽内存 HBM。 三星电子也在平泽建设P4(第四座)晶圆厂,原计划明年第一季度竣工,如今工期有望提前至今年第 四季度,整体缩短约三个月。三星会根据市场行情调整存储与代工设备的配置,P4 厂大概率将生产 目前供不应求的高性能存储芯片。近期有消息称,三星已制定战略,在 P4 厂新建一条10 纳米级第 六代(1c)DRAM 生产线,专门用于 HBM 生产,新线月产能预计可达 10 万 —12 万片晶圆。一位 半导体行业人士表示:"韩国存储厂商正疯狂赶工,提前投产时间表。" 公众号记得加星标⭐️,第一时间看推送不会错过。 随着" ...

韩国芯片,不可或缺

半导体行业观察· 2026-02-09 01:18

Core Viewpoint - Taiwan's dominance in the semiconductor manufacturing sector is being challenged by South Korea, which is rapidly advancing, particularly in high-performance memory chips [2] Group 1: Market Dynamics - South Korea is one of only three countries capable of producing advanced high-bandwidth memory chips, alongside Taiwan and the USA, giving it a strategic advantage [2] - Samsung Electronics and SK Hynix together hold over 50% of the global memory market share, making it difficult for other suppliers like Micron and Western Digital to match their scale and technology [2] - There is a significant shortage of memory chips, with prices for certain types increasing by over 300% in the past three months due to panic buying [2] Group 2: Investment and Production Capacity - Samsung plans to invest approximately $310 billion over the next five years in semiconductor manufacturing and related fields [3] - The construction of Samsung's Pyeongtaek plant will utilize over 50,000 NVIDIA GPUs for AI workloads, with production expected to start in 2028 [3] - The South Korean government is supporting a massive chip industry cluster with a commitment of around $456 billion in private investment [3] Group 3: Value Chain and Diversification - South Korea is shifting from a memory-centric focus to a diversified product portfolio that includes AI accelerators, automotive chips, and defense semiconductors [4] - Samsung is the second-largest foundry globally, following TSMC, and is advancing into the 3nm chip space [4] - A proposed public-private partnership for a 12-inch 40nm "national foundry" aims to provide local manufacturing opportunities for semiconductor startups [4] Group 4: Challenges and Government Actions - The semiconductor industry in South Korea faces challenges such as water and electricity shortages, with the planned Yongin chip cluster requiring approximately 13 to 15 gigawatts of power [4] - There is a projected shortage of about 56,000 semiconductor engineers in South Korea by 2031 [4] - The South Korean government is taking steps to address these issues through the Semiconductor Special Act, which will provide legal frameworks for direct subsidies and infrastructure spending [5]

再次暴涨近7%!美光科技股价飙升创历史新高两日涨幅近18%引爆市场热情

美股IPO· 2025-12-20 01:11

Core Viewpoint - Micron Technology has experienced significant market interest, with its stock price rising 6.99% on December 19 and a cumulative increase of 17.91% over two days, reaching a historical high [1] Group 1: Market Performance - The strong performance of Micron Technology's stock is driven by several key factors, including the robust growth of the global technology industry, particularly in the semiconductor sector [3] - Micron's recent financial report exceeded market expectations, with Q1 revenue reaching $13.64 billion, a year-on-year increase of 56.7%, and adjusted earnings per share of $4.78 [3] - The surge in demand for high-performance storage chips in data centers has been a core driver of Micron's performance and stock price increase [3] Group 2: Future Outlook - Financial institutions have raised Micron Technology's target prices, with some analysts suggesting it may be one of the fastest-growing companies in terms of revenue and net profit in the U.S. semiconductor industry [3] - The ongoing development and application of AI technology are expected to usher in a new growth opportunity for the semiconductor storage industry, with sustained market demand anticipated in the coming years [4] - Investors are encouraged to focus on leading companies in the semiconductor storage sector while managing risks and staying informed about global economic and industry dynamics [3][4]

存储器板块走强 机构圈出这些机会

Di Yi Cai Jing· 2025-10-27 04:42

Group 1 - The storage sector is experiencing a strong performance, with companies such as Zhongdian Port and Dawi Co., Ltd. hitting the daily limit, while Purain Co., Ltd. and Jiangbolong have increased by over 8% [1] Group 2 - Guojin Securities highlights the continuous improvement in AI application effects, recommending a focus on the storage industry chain that is experiencing sustained growth [2] - Dongguan Securities notes that the recent price increases by overseas storage giants are primarily driven by the explosion of AI applications, leading to a surge in demand for high-performance storage chips used in AI servers and data centers, which in turn drives up prices across the storage market [2] - It is suggested to pay attention to segments benefiting from this trend, including storage modules, niche storage, and materials for storage supporting equipment [2]

揭秘涨停 | 芯片概念多股涨停

Zheng Quan Shi Bao Wang· 2025-10-21 10:52

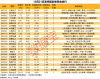

Market Overview - On October 21, the A-share market closed with a total of 93 stocks hitting the daily limit, with 79 stocks after excluding 14 ST stocks, resulting in a limit-up rate of 80.87% [1] Top Gainers - The stock with the highest limit-up order volume was Shihua Oil Service, with 465,700 hands, followed by ShenKai Co., Zhonghua Rock Soil, and Shihua Machinery with 348,300 hands, 344,900 hands, and 325,400 hands respectively [2] - In terms of consecutive limit-up days, Pioneer Electronics and ST Zhongdi achieved three consecutive limit-ups, while ShenKai Co., Shihua Machinery, and CITIC Heavy Industries had two consecutive limit-ups [2] Significant Stocks - Pioneer Electronics achieved a limit-up with a closing price of 25.03 yuan and a limit-up order amount of 4.61 billion yuan, focusing on smart gas metering and safety monitoring [3][4] - ShenKai Co. closed at 11.21 yuan with a limit-up order amount of 3.90 billion yuan, driven by deep-sea equipment and robot concepts [3][4] - Shihua Machinery closed at 7.72 yuan with a limit-up order amount of 2.51 billion yuan, benefiting from oil and gas equipment and state-owned enterprise status [3][4] Sector Highlights Chip Sector - Multiple stocks in the chip sector, including Dawi Co., Taiji Industry, and Wentai Technology, achieved limit-ups, with Dawi Co. focusing on high-performance storage chip products [4][5][6] Real Estate Sector - Stocks such as Shangshi Development and Hefei Urban Construction saw limit-ups, with Shangshi Development reporting a signed sales amount of approximately 290 million yuan [7] Energy Equipment Sector - Stocks like Shihua Oil Service and ShenKai Co. also achieved limit-ups, with Shihua Oil Service accelerating its overseas business development [8] Investment Trends - The net buying amount for stocks on the Dragon and Tiger list included significant purchases in Shanhe Intelligent and Hefei Urban Construction, with net buying amounts of 1.88 billion yuan and 1.18 billion yuan respectively [9][10]

16家A股半导体公司净利润增速超100%

21世纪经济报道· 2025-08-28 00:26

Core Viewpoint - The semiconductor sector in A-shares has shown strong upward momentum, driven by significant earnings growth, particularly from leading AI chip companies like Cambricon, which reported a revenue increase of 4347.82% year-on-year [1][3]. Group 1: Industry Performance - In the first half of the year, 86 semiconductor companies reported earnings, with 54 showing year-on-year profit growth, compared to 50 in the same period last year, indicating a mild recovery in the semiconductor industry [1][3]. - The overall net profit of 76 semiconductor companies totaled 88.7 billion yuan, down from 97.1 billion yuan in the same period last year, suggesting a more tempered recovery [5]. - The fastest net profit growth was observed in companies like Taiji Co., which reported a 3789.4% increase, and Silan Microelectronics and Jingrui Electric Materials, both exceeding 1000% growth [3][4]. Group 2: Structural Opportunities - The semiconductor industry is experiencing a cyclical upturn, but there are notable disparities within the sector, with some companies lagging behind due to competitive pressures in the consumer electronics market [7][8]. - Companies like Jucheng Co. and Zhongke Microelectronics reported significant profit declines, highlighting the challenges faced by firms in the consumer electronics segment [8]. - Conversely, sectors such as automotive electronics and high-performance storage chips are witnessing robust demand, driven by trends in AI, smart driving, and data centers [9][10]. Group 3: Emerging Trends - The demand for automotive electronics is growing rapidly, with companies like Jingfang Technology and OmniVision benefiting from this trend [9]. - New emerging fields, such as smart home technology and AI toys, are also showing promising growth, indicating a diversification of demand within the semiconductor industry [9][10]. - The overall semiconductor landscape is characterized by structural opportunities, particularly in network communication, storage, industrial chips, and automotive chips, aligning with the performance of various industry segments [10].

财报里的“芯”趋势:高性能存储与汽车芯片赛道迎来高光时刻

2 1 Shi Ji Jing Ji Bao Dao· 2025-08-27 12:07

Core Viewpoint - The A-share semiconductor sector has shown strong upward momentum, driven by significant earnings growth from key companies, particularly in AI chips, indicating a moderate recovery in the industry despite structural differences in performance among companies [1][2]. Group 1: Earnings Performance - Cambricon (688256.SH) reported a revenue of 2.881 billion yuan, a year-on-year increase of 4347.82%, and a net profit of 1.038 billion yuan, reversing a loss of 530 million yuan from the previous year [1]. - A total of 86 semiconductor companies have disclosed their half-year financial reports, with 54 companies achieving year-on-year net profit growth, compared to 50 companies in the same period last year [1]. - Sixteen companies reported net profit growth exceeding 100%, with some exceeding 1000%, highlighting a significant recovery in profitability for many firms [2]. Group 2: Industry Trends - The semiconductor industry is experiencing a recovery phase, driven by factors such as the proliferation of electric vehicles, the penetration of smart driving, and the growing demand for data centers and AI computing power [3]. - Companies like Kema Technology (301611.SZ) and Yangjie Technology (300373.SZ) reported strong growth in net profits, attributed to the ongoing demand in automotive electronics and artificial intelligence sectors [3]. - Despite the overall recovery, there are structural differences within the industry, with some companies lagging behind due to competitive pressures in the consumer electronics market [4][5]. Group 3: Market Dynamics - The total net profit of 76 semiconductor companies reached 8.87 billion yuan in the first half of the year, down from 9.71 billion yuan in the same period last year, indicating a moderate recovery trend [4]. - Nine companies reported a net profit decline exceeding 100%, with some experiencing losses over 500%, reflecting the challenges faced by certain segments within the industry [4]. - The demand for high-performance storage chips is being driven by the growth of data centers and computing power centers, with companies like Zhongdian Port (001287.SZ) reporting a 65% increase in net profit [6]. Group 4: Emerging Opportunities - New sectors such as smart home technology and industrial control are showing promising growth, with companies like Lexin Technology (688018.SH) benefiting from sustained demand [7]. - The semiconductor industry is witnessing structural opportunities, particularly in network communication, storage, industrial chips, and automotive chips, aligning with the performance of various segments within the supply chain [7]. - Analysts suggest that the demand for AI computing power is driving steady growth in the market for advanced semiconductor hardware, while traditional consumer electronics continue to show signs of weak recovery [7].

SK海力士预计高性能存储芯片销量有望翻一番

news flash· 2025-07-24 00:03

Core Insights - SK Hynix reported record quarterly profits driven by strong demand for advanced chips and preemptive stockpiling by clients ahead of potential tariffs in the U.S. [1] - The company anticipates intensified competition among major tech firms to enhance the reasoning capabilities of AI models, leading to increased demand for high-performance, high-capacity memory products [1] - SK Hynix expects its HBM chip sales to double compared to 2024, highlighting its leading position in the HBM chip sector [1] - In the first quarter of this year, SK Hynix surpassed Samsung Electronics to become the largest memory chip manufacturer globally, attributed to its dominance in the HBM chip market [1] - HBM chips are critical components in AI chipsets designed by companies like NVIDIA, facilitating the processing of large data volumes for training AI models [1]