Bank Of Chongqing(01963)

Search documents

重庆银行,被罚220万

Zhong Guo Ji Jin Bao· 2025-10-23 04:52

Group 1 - Chongqing Bank was fined 2.2 million yuan due to multiple violations in credit business, including negligence in the "three checks" process and imprudent investment practices [1][2] - The bank's related personnel, Liu Xiaona, received a warning for issues related to the "three checks" negligence [1][2] - Chongqing Bank was established in 1996 and became the first local state-owned commercial bank listed on the Hong Kong Stock Exchange in November 2013, later listing on the Shanghai Stock Exchange in February 2021 [2] Group 2 - As of the end of July, Chongqing Bank's total assets reached 1,008.7 billion yuan, an increase of 152.1 billion yuan, representing a growth rate of 17.76% compared to the previous year [2] - In the first half of 2025, Chongqing Bank reported operating income of 7.659 billion yuan, a year-on-year increase of 7.00%, and a net profit attributable to shareholders of 3.19 billion yuan, up 5.39% year-on-year [3] - The bank's net interest margin stood at 1.39%, while net income from fees and commissions decreased by 28.62% to 365 million yuan, accounting for only 4.76% of total operating income [3]

重庆银行 被罚220万

Zhong Guo Ji Jin Bao· 2025-10-23 04:46

值得一提的是,今年下半年,重庆银行还迈入了"万亿俱乐部"。8月29日,重庆银行发布关于经营情况 的自愿性公告称,截至7月末,该行资产总额达到10087亿元,较上年末增加1521亿元,增幅为 17.76%。 10月22日,国家金融监督管理总局重庆监管局开具一批行政处罚公告,其中,重庆银行因涉及多项信贷 业务违规被罚款220万元。 公告显示,重庆银行存在的违法违规行为包括贷款"三查"不尽职、投资业务不审慎,因此对该行共计罚 款220万元。同时,该行相关负责人刘某娜因存在贷款"三查"不尽职部分问题,对其给予警告处罚。 | ব | 重庆银行股份有限 | | 贷款"三查" | 罚款共计 | | | --- | --- | --- | --- | --- | --- | | | 公司 | 渝金管罚 | 不尽职、投资 | 220万元 | | | | | 决字 | 业务不审慎 | | 重庆金融 | | ਦੇ | 刘晓娜 | (2025) | 贷款"三查" | | 监管局 | | | | 23号 | 不尽职部分问 | 警告 | | | | | | 题 | | | 【导读】因贷款"三查"不尽职等问题,重庆银行被罚220万元 公开 ...

因贷款“三查”不尽职、投资业务不审慎,重庆银行被罚220万元

Sou Hu Cai Jing· 2025-10-22 11:52

文|王彦强 中报显示,2025年上半年,重庆银行实现营业收入76.59亿元,同比增长7.00%;实现归母净利润31.9亿元,同比增长5.39%。净息差为1.39%。 从资产质量来看,截至2025年上半年末,该行的不良贷款率为1.17%,较上年末下降0.08个百分点;拨备覆盖率为248.27%,较上年末提升3.19个百分 点。核心一级资本充足率降至8.80%,较上年末下降1.08个百分点,接近监管红线。 值得一提的是,2025年上半年,重庆银行的手续费及佣金净收入为3.65亿元,同比下降28.62%,占营业收入比重仅4.76%。 截至2025年上半年末,重庆银行的资产总额为9,833.65亿元,较上年末增长14.79%;贷款总额5,006.70亿元,较上年末增长13.63%;存款总额为5,441.36 亿元,较上年末增长14.77%。 10月22日,国家金融监督管理总局重庆监管局行政处罚信息公开表显示,重庆银行,因贷款"三查"不尽职、投资业务不审慎,被罚款220万元。同时, 相关责任人刘晓娜,被警告。 | 4 | 重庆银行股份有限 | | 贷款"三查"不 | 罚款共计 | | | --- | --- | --- ...

涉贷款“三查”不尽职!重庆银行被罚逾200万元

Bei Jing Shang Bao· 2025-10-22 11:13

北京商报讯(记者 孟凡霞 周义力)10月22日,国家金融监督管理总局重庆监管局行政处罚信息公开表 显示,重庆银行因贷款"三查"不尽职、投资业务不审慎等违规行为,被罚款220万元;相关负责人刘晓 娜被予以警告。 ...

港股异动丨内银股普涨,农业银行涨超1%再创新高,录得10连阳

Ge Long Hui· 2025-10-22 01:56

Group 1 - The core viewpoint is that Hong Kong bank stocks are experiencing a bullish trend, with Agricultural Bank of China reaching a new historical high and achieving a 10-day consecutive rise [1] - Morgan Stanley anticipates that after a seasonal adjustment in Q3, there will be good investment opportunities in Q4 and Q1 of the following year for domestic bank stocks [1] - Factors supporting the revaluation of Chinese banking stocks include upcoming dividend distributions, stabilized interest rates, a 500 billion RMB structural financial policy tool, and a more sustainable policy path [1] Group 2 - Agricultural Bank of China saw an increase of 1.04%, reaching a latest price of 5.820 [2] - Other banks also recorded gains, including Chongqing Bank (+0.91%), Zhengzhou Bank (+0.78%), and Zhejiang Bank (+0.77%) [2] - The overall trend indicates a positive performance across various banks, with notable increases in share prices for several institutions [2]

银行业周度追踪2025年第41周:如何展望银行股行情的持续性?-20251019

Changjiang Securities· 2025-10-19 13:45

Investment Rating - The investment rating for the banking sector is "Positive" and is maintained [11] Core Viewpoints - There is still divergence in the market regarding the sustainability of the banking stock market. However, it is believed that valuation recovery will continue. From a strategic perspective, it is essential to view the relationship between banking stocks and market sentiment dialectically. In the medium to long term, undervalued banking stocks align with the market's slow bull direction, as the index has been reaching new highs over the past year. In the short term, the performance of growth stocks benefiting from high-risk preferences may diverge from low-risk banking stocks, which indirectly help stabilize the index [6][38] - The fundamental logic supporting the valuation recovery of banking stocks remains solid. The trend of establishing a bottom line for significant risks in urban investment, real estate, and capital is clear, with policies still supporting urban investment debt and orderly capital replenishment for important banks. Mainstream banks continue to show stable growth in performance, with revenue growth points shifting from investment income to net interest income since 2025. It is expected that more banks will see a reversal in net interest income growth as deposit costs continue to decline in 2026 [6][39] Summary by Sections Market Performance - This week, the banking index rose by 5.0%, outperforming the CSI 300 and ChiNext indices by 7.3% and 10.7%, respectively. The market's risk appetite has decreased since the fourth quarter, but the banking sector has seen significant relative gains due to a valuation recovery [2][8] - Individual stocks such as Chongqing Bank and Yunnan Rural Commercial Bank led the gains, while the stock price of Shanghai Pudong Development Bank showed notable elasticity as its convertible bonds approach maturity [19][21] Trading Dynamics - Each round of adjustment presents opportunities for low-valuation configurations. The mid-term dividend has already started, and the demand for dividend assets from absolute return funds remains unchanged. The pressure from new funds and the maturity of existing non-standard assets will push the dividend yield of banking stocks to continue declining [7][39] - The trading volume and turnover rate of state-owned banks, city commercial banks, and rural commercial banks have decreased compared to last week, but the turnover rate of banking stocks has begun to rise again, indicating a change in market risk appetite [10][31] Convertible Bonds - Attention is drawn to the strong redemption trading opportunities for convertible bonds in the banking sector. As the banking sector rises, the stock prices of convertible bond banks are approaching their strong redemption prices. The recent rebound in the stock price of Shanghai Pudong Development Bank has been driven by active conversions by major shareholders [9][26] Future Outlook - The market remains optimistic about the effectiveness of anti-involution measures and the expected recovery of the PPI next year. If macroeconomic recovery resolves the asset shortage contradiction, the fundamentals of banking stocks will benefit accordingly. Additionally, local state-owned assets and industrial capital continue to have a positive outlook on banking stocks, with frequent increases in holdings by major shareholders and management since the third quarter [7][39]

重庆银行助力“重庆智造”走向世界

Hua Xia Shi Bao· 2025-10-17 02:33

Core Insights - Chongqing Bank has significantly increased its financial support for the construction of the Western Land-Sea New Corridor, with a financing balance reaching 47.1 billion yuan by June 2025, marking a 57% increase from the beginning of the year [1] - The bank has launched the "Yumao Loan" product to provide targeted financial assistance to small and micro enterprises, facilitating their expansion into overseas markets [4][6] Group 1: Financial Support and Initiatives - Chongqing Bank's financing for the Western Land-Sea New Corridor has reached 47.1 billion yuan, reflecting a 57% growth since the start of the year [1] - The "Yumao Loan" initiative has been recognized for its effectiveness in alleviating financing difficulties for small and micro enterprises, with over 1 billion yuan in cumulative credit support provided [4][6] - The bank has established a specialized service team to respond quickly to the financing needs of local enterprises, exemplified by the timely issuance of a 5 million yuan loan to a local technology company [3][4] Group 2: Financial Innovation and Risk Management - Chongqing Bank has upgraded its SWIFT ISO 20022 messaging standard, enhancing the efficiency and security of cross-border payment services for foreign trade enterprises [5] - The bank's forfaiting business reached 4.1 billion yuan, with a 15% increase since the beginning of the year, while its inclusive finance balance surged by 74% to 1.3 billion yuan [6] - The bank has introduced innovative foreign exchange risk management products, achieving a 67-fold increase in foreign exchange hedging business volume compared to the previous year [6] Group 3: Future Plans and Strategic Goals - Chongqing Bank plans to deepen its financial support for the Western Land-Sea New Corridor, focusing on enhancing financing for infrastructure and industrial cluster development [7] - The bank aims to continue refining its product system, including supply chain finance and cross-border investment, to create a comprehensive financial service ecosystem [7] - The ongoing digital transformation and collaborative efforts are expected to further strengthen the bank's role in supporting the national strategy and local economic development [7]

重庆银行股价连续5天上涨累计涨幅16.16%,招商基金旗下3只基金合计持342.14万股,浮盈赚取492.68万元

Xin Lang Cai Jing· 2025-10-16 12:52

Core Viewpoint - Chongqing Bank's stock has experienced a significant increase, rising 2.78% to 10.35 CNY per share, with a total market capitalization of 35.962 billion CNY and a cumulative increase of 16.16% over the past five days [1] Company Overview - Chongqing Bank was established on September 2, 1996, and listed on February 5, 2021. The bank primarily provides corporate and personal banking products and services, as well as money market operations [1] - The bank operates through three business segments: corporate banking, retail banking, and funding operations. The revenue composition is as follows: corporate banking 75.09%, retail banking 16.94%, funding operations 7.72%, and undistributed 0.25% [1] Fund Holdings - Three funds under China Merchants Fund have significant holdings in Chongqing Bank, totaling 342.14 thousand shares. The estimated floating profit today is approximately 95,800 CNY, with a total floating profit of 492,680 CNY over the past five days [2] - The specific funds and their holdings are as follows: - China Merchants Economic Selection Stock A (012835): 1.899 million shares, accounting for 3.11% of the fund's net value, with a floating profit of about 53,180 CNY today and 273,490 CNY over five days [2] - China Merchants Research Preferred Stock A (008261): 997,400 shares, accounting for 2.84% of the fund's net value, with a floating profit of about 27,930 CNY today and 143,630 CNY over five days [2] - China Merchants Trend Navigation Mixed A (017960): 524,700 shares, accounting for 3.14% of the fund's net value, with a floating profit of about 14,690 CNY today and 75,560 CNY over five days [3]

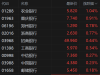

城商行板块10月16日涨0.81%,重庆银行领涨,主力资金净流出4059.77万元

Zheng Xing Xing Ye Ri Bao· 2025-10-16 08:27

Market Performance - The city commercial bank sector increased by 0.81% on October 16, with Chongqing Bank leading the gains [1] - The Shanghai Composite Index closed at 3916.23, up 0.1%, while the Shenzhen Component Index closed at 13086.41, down 0.25% [1] Individual Stock Performance - Chongqing Bank (601963) closed at 10.35, up 2.78% with a trading volume of 346,800 shares [1] - XD Shanghai Bank (601229) closed at 9.59, up 2.02% with a trading volume of 1,019,000 shares [1] - Suzhou Bank (002966) closed at 8.61, up 1.89% with a trading volume of 433,600 shares [1] - Other notable performances include Qingdao Bank (002948) up 1.84% and Chengdu Bank (601838) up 1.69% [1] Capital Flow Analysis - The city commercial bank sector experienced a net outflow of 40.6 million yuan from institutional investors and a net outflow of 188 million yuan from speculative funds, while retail investors saw a net inflow of 228 million yuan [1] - Jiangsu Bank (600919) had a significant net inflow of 1.4 billion yuan from institutional investors, despite a net outflow of 114 million yuan from speculative funds [2] - Ningbo Bank (002142) reported a net inflow of 58.6 million yuan from institutional investors, while experiencing a net outflow from both speculative and retail investors [2]

重庆银行股价连续5天上涨累计涨幅16.16%

Xin Lang Cai Jing· 2025-10-16 07:09

风险提示:市场有风险,投资需谨慎。本文为AI大模型自动发布,任何在本文出现的信息(包括但不 限于个股、评论、预测、图表、指标、理论、任何形式的表述等)均只作为参考,不构成个人投资建 议。 数据显示,中欧基金旗下2只基金重仓重庆银行股票,合计持有重庆银行212.57万股,按前一日收盘 10.07元,今日截止发稿股价10.35元计算,日浮盈59.52万元。连续5天上涨期间浮盈赚取306.1万元。 基金名称基金代码基金经理持股数量(股)占流通股比例(%)占基金净值比(%)持股数量变动(股)中欧瑾泉 灵活配置混合A001110刘勇19753190.10512.59新进中欧琪福混合A014759李泽南1504000.0080.28新进 其中,中欧瑾泉灵活配置混合A(001110)二季度持有股数197.53万股,占基金净值比例为2.59%,位居 第七大重仓股。根据测算,今日浮盈赚取约55.31万元。连续5天上涨期间浮盈赚取284.45万元。 中欧琪福混合A(014759)二季度持有股数15.04万股,占基金净值比例为0.28%,位居第四大重仓股。 根据测算,今日浮盈赚取约4.21万元。连续5天上涨期间浮盈赚取21.66万 ...