KCGJ(600097)

Search documents

股票行情快报:开创国际(600097)10月27日主力资金净卖出622.80万元

Sou Hu Cai Jing· 2025-10-27 11:32

Core Viewpoint - The stock of Kaichuang International (600097) has shown a decline in price and mixed capital flow, indicating potential volatility in investor sentiment and market performance [1][2]. Group 1: Stock Performance - As of October 27, 2025, Kaichuang International closed at 11.67 yuan, down 0.68% with a turnover rate of 1.73% and a trading volume of 41,600 shares, amounting to a transaction value of 48.68 million yuan [1]. - The net outflow of main funds was 6.228 million yuan, accounting for 12.79% of the total transaction value, while retail investors saw a net inflow of 6.198 million yuan, representing 12.73% of the total [1]. Group 2: Financial Metrics - Kaichuang International's total market value is 2.812 billion yuan, with a net asset of 2.326 billion yuan and a net profit of 27.6027 million yuan, ranking 64th, 42nd, and 43rd respectively in the agriculture, animal husbandry, and fishery industry [2]. - The company reported a year-on-year revenue increase of 17.92% to 1.25 billion yuan for the first half of 2025, with a net profit increase of 206.35% to 27.6027 million yuan [2]. - The gross profit margin stands at 31.49%, significantly higher than the industry average of 15.78% [2].

渔业板块10月27日跌0.74%,中水渔业领跌,主力资金净流出3628.24万元

Zheng Xing Xing Ye Ri Bao· 2025-10-27 08:25

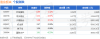

证券之星消息,10月27日渔业板块较上一交易日下跌0.74%,中水渔业领跌。当日上证指数报收于 3996.94,上涨1.18%。深证成指报收于13489.4,上涨1.51%。渔业板块个股涨跌见下表: | 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | --- | --- | --- | --- | --- | --- | | 600467 | 好当家 | 2.43 | -0.41% | 32.98万 | 8026.73万 | | 300094 | 国联水产 | 3.55 | -0.56% | 27.46万 | 9763.61万 | | 600097 | 开创国际 | 11.67 | -0.68% | 4.16万 | 4867.73万 | | 002069 | 獐子鸟 | 3.91 | -0.76% | 12.22万 | 4780.49万 | | 600257 | 大湖股份 | 5.55 | -1.07% | 16.19万 | 8969.03万 | | 000798 | 中水渔业 | 8.03 | -1.11% | 9.05万 | 7285.54万 | 从资金流向上来看,当日 ...

股市必读:开创国际(600097)10月24日主力资金净流出200.42万元,占总成交额2.88%

Sou Hu Cai Jing· 2025-10-26 21:48

Core Viewpoint - The stock of Kaichuang International (600097) closed at 11.75 yuan on October 24, 2025, reflecting a decline of 1.18% with a trading volume of 59,000 shares and a transaction amount of 69.6455 million yuan [1]. Trading Information Summary - On October 24, the net outflow of main funds was 200.42 thousand yuan, accounting for 2.88% of the total transaction amount; the net outflow of speculative funds was 764.45 thousand yuan, making up 10.98% of the total transaction amount; while retail investors saw a net inflow of 964.87 thousand yuan, representing 13.85% of the total transaction amount [2][4]. Company Announcement Summary - Kaichuang International will hold its second extraordinary general meeting of 2025 on November 3, 2025, combining on-site and online voting. The on-site meeting will take place at 1:30 PM at Building 3, No. 661 Anpu Road, Yangpu District, Shanghai. The main agenda is to review the proposal to supplement the independent director of the tenth board of directors. Due to the current independent director Wang Zhao's term nearing completion, Beijing Xiaojian Technology Development Co., Ltd. and its concerted parties have nominated Yang Lin as the new independent director. Yang Lin, born in June 1987, holds a master's degree and has been the deputy director of Beijing Balanced Game Environmental Science Research Institute since June 2019. He does not hold shares in the company and has no connections with the controlling shareholder, actual controller, or other shareholders holding more than 5%. He has not been subject to regulatory penalties and meets the qualifications for independent director positions. This nomination has been approved by the board of directors' nomination committee and the company's tenth board of directors' nineteenth (extraordinary) meeting [2][4].

每周股票复盘:开创国际(600097)将召开临时股东会增补独董

Sou Hu Cai Jing· 2025-10-25 20:35

Core Viewpoint - Kaichuang International (600097) has seen a stock price increase of 5.86% this week, closing at 11.75 yuan, with a market capitalization of 2.831 billion yuan as of October 24, 2025 [1]. Company Announcement Summary - Kaichuang International will hold its second extraordinary general meeting of 2025 on November 3, 2025, combining on-site and online voting [1][3]. - The meeting will review the proposal to appoint Yang Lin as an independent director, following the upcoming end of the current independent director Wang Zhao's six-year term [1][3]. - Yang Lin, born in June 1987, holds a master's degree and has been the deputy director of the Beijing Balanced Game Environmental Science Research Institute since June 2019. He does not hold any shares in the company and has no connections with the controlling shareholders or other major shareholders, meeting the qualifications for independent director [1][3].

股票行情快报:开创国际(600097)10月24日主力资金净卖出200.42万元

Sou Hu Cai Jing· 2025-10-24 11:16

Core Insights - The stock of Kaichuang International (600097) closed at 11.75 yuan on October 24, 2025, down by 1.18% with a trading volume of 59,000 hands and a transaction amount of 69.6455 million yuan [1] Group 1: Stock Performance and Trading Data - On October 24, 2025, the net outflow of main funds was 200.42 thousand yuan, accounting for 2.88% of the total transaction amount, while retail investors saw a net inflow of 964.87 thousand yuan, making up 13.85% of the total [1] - Over the past five days, the stock has experienced fluctuations in net fund flows, with notable changes in retail and main fund activities [2] Group 2: Financial Metrics and Industry Comparison - As of the latest report, Kaichuang International has a total market value of 2.831 billion yuan, with a net asset value of 2.326 billion yuan and a net profit of 27.6027 million yuan [3] - The company reported a year-on-year revenue increase of 17.92% to 1.25 billion yuan, with a significant rise in net profit by 206.35% [3] - The company's gross profit margin stands at 31.49%, significantly higher than the industry average of 15.77% [3]

渔业板块10月24日跌1.29%,中水渔业领跌,主力资金净流出1397.74万元

Zheng Xing Xing Ye Ri Bao· 2025-10-24 08:21

Core Insights - The fishing sector experienced a decline of 1.29% on October 24, with Zhongshui Fisheries leading the drop at 2.52% [1] - The Shanghai Composite Index closed at 3950.31, up 0.71%, while the Shenzhen Component Index closed at 13289.18, up 2.02% [1] Sector Performance - The following stocks in the fishing sector showed notable declines: - Zhanzi Island (002069) closed at 3.94, down 0.51% - Guolian Aquatic Products (300094) closed at 3.57, down 1.11% - Kaichuang International (600097) closed at 11.75, down 1.18% - Haodangjia (600467) closed at 2.44, down 1.21% - Dahuhua (600257) closed at 5.61, down 1.23% - Zhongshui Fisheries (000798) closed at 8.12, down 2.52% [1] Capital Flow Analysis - The fishing sector saw a net outflow of 13.98 million yuan from main funds and 10.57 million yuan from speculative funds, while retail investors had a net inflow of 24.54 million yuan [1] - Detailed capital flow for individual stocks includes: - Zhanzi Island: Main funds net inflow of 2.47 million yuan, speculative funds net inflow of 1.33 million yuan, retail net outflow of 3.80 million yuan - Zhongshui Fisheries: Main funds net inflow of 1.07 million yuan, speculative funds net inflow of 0.33 million yuan, retail net outflow of 1.40 million yuan - Kaichuang International: Main funds net outflow of 2.00 million yuan, speculative funds net outflow of 7.64 million yuan, retail net inflow of 9.65 million yuan - Dahuhua: Main funds net outflow of 2.68 million yuan, speculative funds net outflow of 2.61 million yuan, retail net inflow of 5.30 million yuan - Haodangjia: Main funds net outflow of 3.41 million yuan, speculative funds net outflow of 1.47 million yuan, retail net inflow of 4.88 million yuan - Guolian Aquatic Products: Main funds net outflow of 9.42 million yuan, speculative funds net outflow of 0.51 million yuan, retail net inflow of 9.92 million yuan [2]

开创国际(600097) - 开创国际2025年第二次临时股东会资料

2025-10-24 07:45

上海开创国际海洋资源股份有限公司 2025 年第二次临时股东会 会议资料 2025 年 11 月 3 日 目 录 一、会议召开形式:本次股东会采取现场投票与网络投票相结合的方式召 开 二、会议召开时间: 四、现场会议议程 (一) 主持人宣布会议开始并向大会报告出席现场会议的股东人数及其 代表的股份数 (二) 审议以下议案 1、关于增补第十届董事会独立董事的议案 (三) 针对大会审议的议案,对股东提问进行回答 (四) 推选计票人、监票人 (五) 投票表决 (六) 休会(统计投票表决的结果) (七) 宣布会议表决结果 (八) 律师宣读关于本次股东会的法律意见书 (九) 会议结束 议案一: 上海开创国际海洋资源股份有限公司 关于增补第十届董事会独立董事的议案 | 会议议程 . | | --- | | 议案一:关于增补第十届董事会独立董事的议案 ... | 1 会议议程 现场会议召开时间:2025 年 11 月 3 日下午 1:30 网络投票时间:采用上海证券交易所网络投票系统,通过交易系统投 票平台的投票时间为股东会召开当日的交易时间段,即 9:15-9:25,9:30- 11:30,13:00-15:00;通过互 ...

渔业板块10月23日涨0.46%,开创国际领涨,主力资金净流出3210.54万元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:14

Core Insights - The fishery sector experienced a 0.46% increase on October 23, with KaiChuang International leading the gains [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index also rose by 0.22% to 13025.45 [1] Stock Performance - KaiChuang International (600097) closed at 11.89, with a rise of 2.32% and a trading volume of 89,400 shares, amounting to a transaction value of 106 million yuan [1] - ZhongShui Fishery (000798) saw a 0.97% increase, closing at 8.33 with a trading volume of 62,700 shares and a transaction value of 51.95 million yuan [1] - DaHu Co. (600257) increased by 0.53%, closing at 5.68 with a trading volume of 122,000 shares and a transaction value of 68.95 million yuan [1] - HaoDangJia (600467) remained unchanged at 2.47, with a trading volume of 282,400 shares and a transaction value of 69.44 million yuan [1] - ZhangZiDao (002069) also remained unchanged at 3.96, with a trading volume of 89,500 shares and a transaction value of 35.24 million yuan [1] - YuanLian Aquatic Products (300094) decreased by 0.55%, closing at 3.61 with a trading volume of 248,500 shares and a transaction value of 89.31 million yuan [1] Capital Flow - The fishery sector saw a net outflow of 32.11 million yuan from main funds, while retail investors contributed a net inflow of 32.45 million yuan [1] - Detailed capital flow for key stocks indicates that KaiChuang International had a net inflow of 2.90 million yuan from main funds, while ZhongShui Fishery experienced a net outflow of 5.19 million yuan [2] - DaHu Co. and HaoDangJia also faced significant net outflows from main funds, amounting to 5.26 million yuan and 5.83 million yuan respectively [2]

股票行情快报:开创国际(600097)10月22日主力资金净卖出347.92万元

Sou Hu Cai Jing· 2025-10-22 12:03

Core Viewpoint - The stock of Kaichuang International (600097) has shown a slight increase in price, with significant fluctuations in capital flow, indicating mixed investor sentiment and potential opportunities for analysis [1][2]. Group 1: Stock Performance - As of October 22, 2025, Kaichuang International closed at 11.62 yuan, up 0.43%, with a turnover rate of 1.72% and a trading volume of 41,500 lots, amounting to a transaction value of 48.32 million yuan [1]. - The capital flow data on October 22 indicates a net outflow of 3.48 million yuan from institutional investors, accounting for 7.2% of the total transaction value, while retail investors saw a net inflow of 7.73 million yuan, representing 16.0% of the total [1]. Group 2: Financial Metrics - Kaichuang International's total market capitalization is 2.8 billion yuan, with a net asset value of 2.326 billion yuan and a net profit of 27.6 million yuan, ranking 65th, 42nd, and 42nd respectively within the agriculture, animal husbandry, and fishery industry [2]. - The company reported a year-on-year revenue increase of 17.92% to 1.25 billion yuan for the first half of 2025, with a significant rise in net profit by 206.35% to 27.6 million yuan [2]. - The gross profit margin stands at 31.49%, significantly higher than the industry average of 15.68%, indicating strong operational efficiency [2].

渔业板块10月22日跌0.09%,獐子岛领跌,主力资金净流出3794.35万元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:19

Market Overview - On October 22, the fishery sector declined by 0.09%, with Zhuangzi Island leading the drop [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Stock Performance - Key stocks in the fishery sector showed mixed performance, with the following closing prices and changes: - Zhongshui Fishery (000798): 8.25, +0.49% - Kaichuang International (600097): 11.62, +0.43% - Haodangjia (600467): 2.47, +0.41% - Guolian Aquatic Products (300094): 3.63, -0.27% - Dahuhua (600257): 5.65, -0.70% - Zhuangzi Island (002069): 3.96, -1.00% [1] Capital Flow - The fishery sector experienced a net outflow of 37.94 million yuan from main funds and 18.56 million yuan from speculative funds, while retail investors saw a net inflow of 56.51 million yuan [1] - Detailed capital flow for key stocks includes: - Guolian Aquatic Products: Main fund net inflow of 1.55 million yuan, retail net inflow of 2.11 million yuan - Zhongshui Fishery: Main fund net outflow of 2.70 million yuan, retail net inflow of 4.19 million yuan - Kaichuang International: Main fund net outflow of 3.48 million yuan, retail net inflow of 7.73 million yuan - Zhuangzi Island: Main fund net outflow of 4.08 million yuan, retail net inflow of 6.34 million yuan - Haodangjia: Main fund net outflow of 11.32 million yuan, retail net inflow of 15.19 million yuan - Dahuhua: Main fund net outflow of 17.90 million yuan, retail net inflow of 20.95 million yuan [2]