Agentic AI

Search documents

Rapid7 Celebrates 7th Year of Recognition in Gartner® Magic Quadrant™ for Security Information and Event Management (SIEM)

Globenewswire· 2025-10-15 16:30

Core Insights - Rapid7, Inc. has been recognized in the 2025 Gartner® Magic Quadrant™ for Security Information and Event Management (SIEM) for the seventh consecutive year, highlighting its leadership in threat detection and exposure management [1] Company Overview - Rapid7's SIEM solution, InsightIDR, provides an integrated detection and response ecosystem, designed with a security-role interface and an analyst-first experience, continuously validated by Rapid7's own Security Operations Center (SOC) [2] - The company has received recognition from various industry analysts, including Forrester, Frost Radar™, and IDC, indicating strong market validation for its solutions [2] Product Development - The launch of Incident Command, an AI-native SIEM powered by Agentic AI workflows, aims to enhance security teams' capabilities by providing speed, clarity, and actionable insights through integrated workflows [3] - InsightIDR's extensible architecture allows integration with advanced analytics, automation tools, and data sources across cloud and endpoint environments, contributing to its strong market adoption [3] Features and Benefits - Rapid7's SIEM offering focuses on faster threat detection, reducing alert fatigue, and centralizing investigation workflows, with the latest evolution, Incident Command, providing a unified solution for visibility, collaboration, and rapid response [4] - Key features of Incident Command include enhanced visibility, collaboration tools, and rapid response capabilities across the attack surface [4] Market Position - Rapid7 serves over 11,000 global customers, emphasizing its mission to simplify and make cybersecurity more accessible, while integrating cloud risk management with threat detection [7]

Madison Reed’s Agentic AI and Sticky Subscriptions Fuel IPO Buzz.”

Forbes· 2025-10-15 16:00

Core Insights - Madison Reed is launching an agentic-AI concierge to enhance bookings and product discovery, alongside a hair-color subscription model that shows high customer retention [2][8] - The company has raised over $250 million in funding and is on a potential IPO trajectory similar to Oddity Tech, indicating strong market positioning [2][34] Company Overview - Madison Reed disrupted the hair dye industry by introducing ammonia-free hair color at scale in 2013, setting a new standard for ingredient transparency and performance [3][4] - The company has expanded its product offerings to create a comprehensive hair-care ecosystem, enhancing customer lifetime value and diversifying revenue streams [14][15] AI and Technology Integration - The newly introduced AI assistant, Madi, automates consultations and appointment scheduling, significantly increasing the likelihood of bookings at Madison Reed's salons [5][6] - AI is also utilized for demand forecasting and inventory optimization, leading to improved operational efficiency and higher margins [7][19] Subscription Model and Market Dynamics - Madison Reed's subscription model is highly effective, with approximately 70% of revenue coming from memberships, capitalizing on predictable replenishment cycles [12][13] - The global hair-color market is valued at around $25 billion and is expected to exceed $40 billion by 2032, with the premium segment growing at more than twice the rate of mass hair color [10][11] Competitive Landscape - Madison Reed stands out in the beauty-tech sector, paralleling the success of Oddity Tech, which went public with a valuation of approximately $2.8 billion [18][21] - The company combines digital precision with retail reach, offering subscriptions, wholesale, and salon services under one platform, creating a vertically integrated ecosystem [20][28] Future Prospects - Madison Reed is positioned for a potential IPO in 2026 or 2027, supported by strong recurring revenue and positive EBITDA margins [32] - The company is exploring international expansion opportunities, particularly in Latin America, the U.K., and the Middle East, where at-home color and hybrid salon models are gaining traction [32]

ROCon Houston 2025: Qualys Expands Enterprise TruRisk Management (ETM) with Built-in Agentic AI Fabric to Include Identity Security, Industry-Specific Threat Prioritization, and Exploit Validation

Prnewswire· 2025-10-15 14:30

Core Insights - Qualys, Inc. has introduced enhancements to its Enterprise TruRisk Management (ETM) platform, focusing on proactive risk management to predict and prevent emerging cyber threats, particularly in the context of agentic AI [1][3][9] Group 1: New Capabilities - The enhancements to Qualys ETM include improved identity security for both human and non-human identities, predictive threat analysis, and validation of exposure exploitability, allowing security teams to anticipate cyber risks before breaches occur [1][3] - ETM Identity consolidates visibility and remediation across various identity and access management systems, correlating identity and asset risk into a single Identity TruRisk score, which helps security teams focus on the most exploitable attack paths [5][6] Group 2: Addressing AI-Driven Threats - The rise of AI has led to an increase in the volume and complexity of cyber attacks, necessitating a proactive, intelligence-driven approach to breach prevention tailored to organizations' unique risk profiles [3][4] - Qualys ETM aligns Identity Risk Posture Management with contextual threat intelligence and exposure exploitability validation, enabling measurable risk reduction at an enterprise scale [3][4] Group 3: Enhanced Risk Management Tools - TruLens provides real-time, tailored threat intelligence, allowing organizations to detect, prioritize, and remediate cyber risks more effectively by continuously applying live threat analysis and business impact context [6][7] - TruConfirm validates the exploitability of exposures by executing real-world attack scenarios, enabling security teams to prioritize and mitigate risks more efficiently [8][9] Group 4: Market Position and Availability - Qualys ETM is now generally available, with its new features, including ETM Identity, TruLens, and TruConfirm, available in preview [9][11] - Qualys serves over 10,000 subscription customers globally, including many from the Forbes Global 100 and Fortune 100, indicating a strong market presence [11][12]

Cellebrite Expands Market Reach with Innovations in Agentic AI, Cloud and Device Virtualization for the Company's Autumn 2025 Release

Globenewswire· 2025-10-15 12:30

Core Insights - Cellebrite announced its Autumn 2025 Release, enhancing its Digital Investigation Platform with new integrations and AI-powered analysis capabilities [1][3] - The addition of Corellium technology through a reseller agreement expands Cellebrite's mobile virtualization offerings, enhancing its digital intelligence solutions [2][3] Product Innovations - The Autumn 2025 Release includes the new Guardian Investigate solution, which utilizes agentic AI to analyze various evidence types and streamline investigative workflows [5] - The Guardian suite has been expanded to include SaaS offerings for digital forensics and investigations, with a focus on collaboration and data residency compliance for EU customers [5] - New deployment options for Pathfinder, Cellebrite's multi-device investigative data analytics solution, are now available in AWS GovCloud, offering cost-optimized configurations [5] Market Impact - Cellebrite's technology is utilized in over 1.5 million investigations annually, serving more than 7,000 customers globally across various sectors including law enforcement and intelligence [3][6] - The integration of Corellium solutions has attracted multiple customers in the defense and intelligence sectors, enhancing mobile vulnerability research and application security testing [5]

Okta CEO's 3 cybersecurity bets for 2026

Yahoo Finance· 2025-10-15 12:22

Core Insights - Okta's CEO Todd McKinnon is focusing on three strategic initiatives: consolidating identity, enhancing cybersecurity, and preparing the workforce for agentic AI [1][2]. Company Performance - Okta's stock has increased by 13% year to date, aligning with the S&P 500's performance [3]. - The company reported second-quarter revenue of $728 million, reflecting a 13% year-over-year growth and surpassing Wall Street's estimate of $711 million [3]. - Adjusted earnings per share rose by 26% to $0.91, exceeding expectations of $0.84 [3]. - Okta has raised its full-year revenue guidance to between $2.875 billion and $2.885 billion, indicating a growth of 10% to 11% [4]. Strategic Initiatives - The first initiative, identity consolidation, aims to address the challenges enterprises face with multiple identity vendors, promoting cost reduction and improved security [5]. - The second initiative focuses on closing security gaps, as identity-based breaches are a significant risk for enterprises [5]. - McKinnon emphasizes the need for comprehensive security coverage, advocating for a unified "identity security fabric" to enhance threat response capabilities [6].

Oracle Helps Organizations Optimize the Candidate and Hiring Experience with Agentic AI

Prnewswire· 2025-10-15 12:02

Core Insights - Oracle has introduced new AI-powered capabilities in Oracle Fusion Cloud Recruiting to enhance the candidate experience and improve job matching [1][2] - The Oracle Career Coach utilizes agentic AI to analyze candidates' backgrounds, skills, and interests, aiming to surface better job matches and boost applicant quality [1][2] Candidate Experience Enhancement - The new capabilities allow for hyper-personalization of the candidate experience, helping candidates find suitable job opportunities more efficiently [3][6] - Oracle Career Coach provides on-demand assistance, including real-time conversational AI support for various candidate needs [6] Recruitment Efficiency - The system enables quicker hiring of quality talent by streamlining the application process, allowing candidates to apply faster through automated data transfer and guided application steps [4][6] - Simplified interview scheduling is introduced, saving time for both recruiters and candidates by coordinating interviews based on availability [6] Brand Consistency and Multi-Channel Access - Organizations can reflect their brand across all channels, tailoring the candidate journey to align with specific hiring processes and brand guidelines [5][6] - The platform supports multi-channel access, facilitating seamless communication with candidates through various platforms, including mobile and messaging apps [6] AI Integration and Customization - Oracle Fusion Cloud HCM integrates AI capabilities to enhance the overall human resource process from hiring to retirement [6][7] - Customers can create and manage unique AI agents using AI Agent Studio, allowing for tailored AI experiences that meet specific business needs [8]

Omdia:到2029年 亚太生成式AI软件市场将增长至276亿美元

Zhi Tong Cai Jing· 2025-10-15 06:21

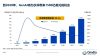

Core Insights - Independent Software Vendors (ISVs) are becoming key players in driving the commercialization of generative AI from experimentation to practical application [1][2] - The generative AI software market in the Asia-Pacific region is projected to grow to $27.6 billion by 2029, with a compound annual growth rate (CAGR) of 52.3% [1][5] - Collaboration between ISVs and cloud vendors will be crucial for the successful commercialization of generative AI [1][2] Market Opportunities - Omdia predicts that generative AI will create up to $158.6 billion in new opportunities for partners by 2028, with ISVs being among the most significant beneficiaries [2][13] - The global generative AI software market is expected to grow from $26.3 billion in 2025 to $101.3 billion by 2029, with a CAGR of 48.1% [5] Challenges Faced by ISVs - High computing and integration costs pose significant barriers for ISVs, who must invest heavily in model selection and data preparation before market validation [8] - Many ISVs lack brand recognition, making sales cycles unpredictable and complicating international market expansion due to compliance and local visibility issues [8] - The current pricing models are immature, with many projects remaining in pilot phases or highly customized deployments, hindering scalable and profitable growth [8] Cloud Vendor Strategies - Major cloud vendors are adjusting their strategies to assist ISVs in overcoming challenges, but their approaches vary [9][10] - AWS emphasizes modular combinations and a mature marketplace to help ISVs quickly build and promote AI solutions [10] - Microsoft Azure integrates AI deeply into enterprise suites but has higher entry barriers for partners [10] - Google Cloud focuses on engineering-driven paths, requiring higher self-expansion capabilities from ISVs [10] - Alibaba Cloud activates local ecosystems with low-code development tools but has a more fragmented marketplace [10] ISV Growth Stages - ISVs' growth in the generative AI space can be categorized into four stages: 1. AI Ready (Exploration Stage): Testing feasibility through APIs or demos [11] 2. AI Embedded (Deepening Stage): Integrating generative AI into existing products [11] 3. AI Native (Co-creation Stage): Embedding intelligent capabilities and enhancing market visibility [11] 4. AI Driven (Ecosystem Stage): Becoming ecosystem leaders with replicable solutions and international expansion [11] Future Outlook - Most ISVs are currently in the first two stages, focusing on reusable application scenarios and sustainable pricing models [12] - To unlock the potential of generative AI, ISVs and cloud vendors must collaborate to create scalable and practical solutions that businesses can adopt confidently [13]

角逐机器人“最后一厘米”丨创业邦发布《2025灵巧手行业研究报告》

创业邦· 2025-10-15 00:09

Core Insights - The article emphasizes the rapid development of the dexterous hand industry, highlighting its strategic importance as the "last centimeter" of embodied intelligent robots, and its role in transitioning robots from "execution tools" to "embodied intelligent carriers" [5][30] - The dexterous hand market in China is entering a critical phase of technological breakthroughs and accelerated industrialization, supported by government policies, industrial clusters, and capital investment [5][12] Market Development and Industry Ecosystem - The global dexterous hand market is projected to reach approximately $1.7 billion in 2024 and $3 billion by 2030, with the Asia-Pacific region holding the largest market share at 37.9% in 2024 [7][8] - China's dexterous hand industry is expected to produce 4,180 units in 2024, indicating significant growth potential [7] - The industry is characterized by a concentration of innovation and investment in regions such as the Yangtze River Delta, Pearl River Delta, and Beijing, with key cities including Shenzhen, Shanghai, and Beijing [12] Investment and Financing Overview - From 2022 to August 2025, there were 164 financing events in China's dexterous hand industry, with a total disclosed financing amount of 27.02 billion yuan, involving 56 companies [16][18] - The number of financing events has shown an upward trend, with 53 events in 2024, a year-on-year increase of 70.9% [16] - The majority of financing events occurred in the pre-A round stage, with 60 events, followed by angel rounds (36 events) and B rounds (29 events) [26] Industry Trends and Future Insights - The technology path for dexterous hands is evolving from "biomimetic imitation" to "intelligent emergence," with advancements in drive systems and sensing technologies [30] - The industry ecosystem is moving towards full-chain collaboration, with accelerated localization of core components and the rise of regional clusters [30] - Application scenarios are expanding across various fields, including service, medical, and industrial sectors, with dexterous hands enhancing human-robot interaction and precision in medical procedures [30]

Vista Equity CEO Robert Smith: Massive opportunity ahead in agentic AI enterprise software

CNBC Television· 2025-10-14 19:53

Let's welcome in another Robert Smith. He is the founder, chairman, and CEO of Vista Equity Partners. He is with me here at the Case Conference in Beverly Hills.And we're so happy to have you. Thanks for being here. >> Good to see you, Scott.Thanks for inviting me. >> All right. So, I mentioned all these people who are opining on this topic.Paul Tudtor Jones was on CNBC just last week said, "It feels exactly like 1999." Ken Griffin, quote, "There are obvious echoes of the dot era." And we even heard from Ja ...

Sidetrade: Revenue for the First Nine Months of 2025 up 13% at Constant Exchange Rates

Globenewswire· 2025-10-14 15:49

Core Insights - Sidetrade reported a 13% increase in revenue for the first nine months of 2025, driven by a 17% rise in SaaS subscription revenue, reaching €44.4 million [1][7][8] - The company experienced a rebound in bookings in Q3 2025, with a 27% increase, narrowing the year-to-date gap in Annual Contract Value (ACV) to €7.81 million compared to €8.94 million in the same period of 2024 [1][3] - Sidetrade has been recognized for its strong ESG performance, receiving a Gold Medal from EthiFinance and ranking among the top 15% of companies assessed by EcoVadis [11][12] Revenue and Growth - For the first nine months of 2025, SaaS subscription revenue reached €38.7 million, reflecting a 17% increase compared to €33.0 million in the same period of 2024 [5][8] - The company’s new Annual Recurring Revenue (ARR) rose by 20% in Q3 2025, while services bookings increased by 30% [4] - Subscriptions from enterprise accounts with annual revenue above €2.5 billion rose by 30%, now accounting for 54% of the customer base [9] Strategic Initiatives - The planned acquisition of ezyCollect, a leading Order-to-Cash player in the Asia-Pacific region, aims to enhance Sidetrade's global presence and access to a mid-market of several million companies [2] - The rollout of agentic AI and the development of a global partner network are expected to significantly impact bookings in 2026 [4][2] International Operations - 69% of Sidetrade's revenue in the first nine months of 2025 was generated outside France, indicating a strong international growth trajectory [10] ESG Recognition - Sidetrade achieved an ESG score of 77/100 from EthiFinance, highlighting its commitment to sustainability and governance [12][11] - The company’s initiatives in human rights, diversity, responsible procurement, and carbon management have been recognized as leading practices in the tech industry [12][13]