专用设备制造

Search documents

赢合科技:10月23日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-25 03:58

Group 1 - The core point of the article is that Yinghe Technology (SZ 300457) held its 23rd meeting of the 5th board of directors on October 23, 2025, via telecommunication voting, where it reviewed the proposal to amend the management system for shares held by directors and senior management [1] - For the first half of 2025, Yinghe Technology's revenue composition was 100% from specialized equipment manufacturing [1] - As of the time of reporting, Yinghe Technology's market capitalization was 20.8 billion yuan [1] Group 2 - A notable event reported is a well-known brand's acquisition of 2,000 shares for 170 million yuan, despite the target company's registered capital being only 10,000 Hong Kong dollars and it not yet being operational, raising questions about the necessity of the acquisition [1]

大宏立:2025年前三季度净利润约1042万元

Mei Ri Jing Ji Xin Wen· 2025-10-24 09:13

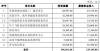

(记者 王晓波) 截至发稿,大宏立市值为32亿元。 每经头条(nbdtoutiao)——中国创新药,今年海外授权已卖出800亿美元!对话创东方投资合伙人卢 刚:生物医药二级市场火热,一级市场为何募资遇冷? 每经AI快讯,大宏立(SZ 300865,收盘价:33.1元)10月24日晚间发布三季度业绩公告称,2025年前 三季度营收约2.43亿元,同比减少19.5%;归属于上市公司股东的净利润约1042万元,同比减少 44.69%;基本每股收益0.1089元,同比减少44.69%。 ...

双良节能拟不超12.9亿定增 连亏1年连3季近3年募61亿

Zhong Guo Jing Ji Wang· 2025-10-24 02:46

Core Viewpoint - The company, Shuangliang Energy (600481.SH), has announced a plan to issue shares to specific investors in 2025, aiming to raise up to 1.29199 billion yuan for various projects, including the construction of a zero-carbon intelligent manufacturing plant and the production of green hydrogen equipment [1][2]. Summary by Sections Share Issuance Details - The share issuance will target no more than 35 specific investors, including various financial institutions and qualified foreign investors, with all subscriptions to be made in cash at a price not lower than 80% of the average trading price over the previous 20 trading days [1][2]. - The shares will be domestic listed ordinary shares (A-shares) with a par value of 1.00 yuan each, and the total number of shares issued will not exceed 30% of the company's total share capital prior to the issuance [2]. Fundraising and Project Allocation - The total amount expected to be raised is up to 1.29199 billion yuan, which will be allocated to several projects, including: - Zero-carbon intelligent manufacturing plant construction: 499.339 million yuan - Production of 700 sets of green hydrogen equipment: 200 million yuan - R&D projects: 213.6 million yuan - Working capital: 385 million yuan [2][3]. Shareholder Structure and Control - The controlling shareholder is Shuangliang Group, with the actual controller, Miao Shuangda, holding a total of 45.93% of the shares as of September 30, 2025. Post-issuance, the total share capital will increase to approximately 2.4359 billion shares, with the actual controller's stake reducing to 35.33% [4]. Previous Issuance Termination - The company has decided to terminate its 2023 plan for issuing A-shares due to various external and internal factors, with the previous plan aimed at raising up to 2.56 billion yuan for different projects [5]. Financial Performance - For the third quarter of 2025, the company reported a revenue of 1.688 billion yuan, a decrease of 49.86% year-on-year, while the net profit attributable to shareholders was 53.18 million yuan, an increase of 164.75% year-on-year [8][9].

天能重工:第三季度净利润1481.6万元,同比增长124.98%

Xin Lang Cai Jing· 2025-10-23 09:33

天能重工公告,第三季度营收为10.55亿元,同比增长59.33%;净利润为1481.6万元,同比增长 124.98%。前三季度营收为25.13亿元,同比增长37.54%;净利润为8405.86万元,同比增长1,359.03%。 ...

长龄液压:第三季度净利润为4471.25万元,同比增长72.70%

Xin Lang Cai Jing· 2025-10-23 09:23

长龄液压公告,第三季度营收为2.85亿元,同比增长37.08%;净利润为4471.25万元,同比增长 72.70%。前三季度营收为7.5亿元,同比增长10.50%;净利润为1.1亿元,同比增长20.51%。 ...

润邦股份:公司高度关注公司股票二级市场情况

Zheng Quan Ri Bao Wang· 2025-10-23 07:43

Core Viewpoint - Runbang Co., Ltd. (002483) is actively monitoring its stock performance in the secondary market and is committed to promoting healthy and stable development to enhance its fundamentals [1] Group 1 - The company is paying close attention to the situation of its stock in the secondary market [1] - The company aims to continuously advance its healthy and stable development [1] - The company is focused on improving its fundamental performance [1]

社保基金三季度重仓17股,锁定高增长潜力股

Huan Qiu Wang· 2025-10-23 03:45

Core Insights - The Social Security Fund actively adjusted its portfolio in Q3, entering 7 new stocks and increasing holdings in 10 stocks, focusing on high-growth potential companies with solid fundamentals [1][3] - By the end of Q3, the Social Security Fund appeared among the top ten shareholders of 33 stocks, with a total holding value of 13.07 billion yuan [1] - The fund maintained its position in 6 stocks, while reducing holdings in 10 stocks, indicating a strategy to optimize its portfolio amid market fluctuations [1] New Investments - The Social Security Fund made its first investments in 7 stocks, including Jinling Mining, Lanke High-tech, and Electric Connection Technology, with Jinling Mining receiving the largest allocation of 8.81 million shares [1] - Most of the newly invested companies showed strong performance, with 6 out of 7 reporting year-on-year profit growth in the first three quarters, and Lanke High-tech successfully turning a profit [1] - The average increase in the stock prices of the newly invested companies since October was 0.28%, with Jinling Mining seeing a cumulative increase of over 10% [1] Increased Holdings - The Social Security Fund increased its holdings in 10 stocks, with Poly Development receiving the largest increase of 19.86 million shares [3] - The fund's stake in Sankeshu and Xinqianglian grew by over 1.3 percentage points, reflecting strong confidence in their future development [3] - Among the 10 companies that received increased investments, 9 reported year-on-year profit growth in the first three quarters, with Xinqianglian turning a profit and achieving over 600 million yuan in net profit, benefiting from industry demand recovery and cost control [3] Investment Strategy - The investment trends of the Social Security Fund in Q3 signal a strong focus on quality growth stocks that represent China's economic transformation and upgrading [3] - The fund adheres to a value investment philosophy, prioritizing companies' profitability and growth potential as key decision-making criteria [3] - As a stabilizing force in the market, the Social Security Fund's holdings provide significant reference value for investors [3]

A股前三季度分红增长显著

Jin Rong Shi Bao· 2025-10-23 01:21

Core Viewpoint - The A-share market has seen a significant increase in dividend distribution in the first three quarters of 2025, with a total cash distribution of 662.03 billion yuan, representing an 18.93% year-on-year growth [1] Group 1: Dividend Distribution Overview - A total of 843 listed companies in the A-share market announced profit distribution plans for the first three quarters of 2025, a 22.71% increase from 687 companies in the same period of 2024 [1] - Among these, 588 companies have completed dividend payments totaling 309.69 billion yuan, while 255 companies with a total of 352.33 billion yuan in proposed dividends are expected to complete their distributions in the fourth quarter [1] Group 2: High Dividends from State-Owned Enterprises and Industry Leaders - The six major state-owned banks plan to distribute over 204.7 billion yuan, accounting for nearly 31% of the total dividend amount [2] - Industrial Fulian plans to distribute 6.55 billion yuan, which is 52.3% of its net profit for the first half of 2025, with a dividend yield of 5.8% [2] - China Shenhua intends to distribute 19.47 billion yuan, equivalent to 78.4% of its net profit for the same period, supported by high coal prices and improved operational efficiency [2] Group 3: Financial Sector and Agricultural Industry Dividends - CITIC Bank plans to distribute 10.46 billion yuan, a 15% increase year-on-year, with a distribution ratio exceeding 30% [3] - Wens Foodstuff Group and Shennong Development are also distributing high dividends, with Wens proposing 1.99 billion yuan, representing 35.2% of its net profit [3] Group 4: Increased Dividend Activity Among Small and Medium Enterprises - Small and medium-sized enterprises are showing increased enthusiasm for dividend distribution, with Huayan Precision Machinery proposing a high dividend of 60 million yuan, yielding 4.2% [4] - Companies like Meihua Medical and Zhejiang Huayuan have increased their dividend frequency, indicating a shift towards a more stable shareholder return mechanism [4] Group 5: Policy Support and Strategic Adjustments - The growth in dividend distribution is closely linked to policy support, including guidelines from the State-owned Assets Supervision and Administration Commission aimed at enhancing investor returns [5][6] - Companies are adjusting their strategies and governance structures, with mature companies focusing on profit distribution while growth-stage companies use dividends to signal improved profitability and cash flow [6] Group 6: Market Trends and Investor Sentiment - The A-share market is experiencing a shift from technology growth to value dividend styles, with high-dividend stocks benefiting from net inflows from institutional investors [7]

上海琅凇乾科技有限公司成立 注册资本5万人民币

Sou Hu Cai Jing· 2025-10-22 21:46

天眼查App显示,近日,上海琅凇乾科技有限公司成立,法定代表人为管丹丹,注册资本5万人民币, 经营范围为一般项目:技术服务、技术开发、技术咨询、技术交流、技术转让、技术推广;专用设备制 造(不含许可类专业设备制造);液压动力机械及元件制造;轴承、齿轮和传动部件制造;机械设备销 售;机械零件、零部件销售;电气设备销售;液压动力机械及元件销售;轴承、齿轮和传动部件销售; 金属工具销售;电气设备修理;通用设备修理;专用设备修理;电子元器件与机电组件设备制造。(除 依法须经批准的项目外,凭营业执照依法自主开展经营活动)。 ...

合锻智能10月22日龙虎榜数据

Zheng Quan Shi Bao Wang· 2025-10-22 14:41

Group 1 - The stock of Hezhuan Intelligent (603011) increased by 2.55% today, with a turnover rate of 27.33% and a trading volume of 3.179 billion yuan, showing a fluctuation of 9.91% [1] - Institutional investors net sold 68.442 million yuan, while the total net selling by brokerage seats amounted to 49.810 million yuan [1][2] - The stock has appeared on the "Dragon and Tiger List" 18 times in the past six months, with an average price increase of 1.42% the day after being listed and an average increase of 6.19% over the following five days [2] Group 2 - In the latest half-year report, the company reported a revenue of 982 million yuan, representing a year-on-year growth of 8.23%, while net profit decreased by 11.39% to 9.5131 million yuan [2] - The main capital outflow today was 129 million yuan, with large orders contributing to a net outflow of 112 million yuan [2] - The top five brokerage seats accounted for a total transaction volume of 472 million yuan, with buying amounting to 177 million yuan and selling amounting to 295 million yuan, resulting in a net selling of 118 million yuan [1][2]