化肥助剂

Search documents

2月5日丰倍生物(603334)涨停分析:SAF原料、绿色政策、专精特新驱动

Sou Hu Cai Jing· 2026-02-05 07:45

Core Viewpoint - The stock of Fengbei Bio (603334) reached its daily limit on February 5, closing at 59.08 yuan, driven by its unique position in the sustainable aviation fuel (SAF) market and alignment with national green policies [1] Group 1: Company Overview - Fengbei Bio is one of the few companies qualified to supply industrial-grade SAF blended oil and has established partnerships with leading SAF manufacturers such as HXN Energy, Jiaao Environmental Protection, and Phillips66 [1] - The company’s main business aligns with national green environmental policies, focusing on the comprehensive utilization of waste oils, which is a key area supported by resource recycling initiatives [1] - As a newly listed company on the main board under the registration system as of November 5, 2025, and recognized as a national-level "specialized and innovative" small giant, Fengbei Bio is experiencing increased policy and market attention [1] Group 2: Market Performance - On February 5, the stock saw a net inflow of 60.18 million yuan from main funds, accounting for 12.87% of the total trading volume, while retail investors experienced a net outflow of 27.86 million yuan, representing 5.96% of the total [2] - The stock's price increased by 10% on February 5, following a 9.99% rise on February 4, indicating strong upward momentum in recent trading days [2] - The company has established a complete industrial chain from waste oils to biodiesel and bio-based materials, with a market share of 6.46% in fertilizer additives, showcasing significant downstream collaboration advantages with leading agricultural chemical companies [1]

富邦科技涨2.12%,成交额2698.00万元,主力资金净流入45.46万元

Xin Lang Cai Jing· 2025-12-19 06:50

Group 1 - The core viewpoint of the news is that Fubon Technology's stock has shown a positive trend with a 9.21% increase year-to-date and a recent 2.12% rise in intraday trading, indicating investor interest and market activity [1] - As of September 30, Fubon Technology reported a revenue of 1.016 billion yuan, reflecting a year-on-year growth of 9.19%, while the net profit attributable to shareholders decreased by 12.29% to 80.6494 million yuan [2] - The company has a market capitalization of 2.503 billion yuan and a trading volume of 26.98 million yuan, with a turnover rate of 1.09% [1] Group 2 - Fubon Technology's main business segments include fertilizer additives (72.51%), biological products (17.87%), and fertilizer products (6.28%), indicating a strong focus on agricultural chemicals [1] - The number of shareholders decreased by 9.51% to 16,500, while the average circulating shares per person increased by 10.51% to 17,461 shares [2] - The company has distributed a total of 164 million yuan in dividends since its A-share listing, with 52.03 million yuan distributed in the last three years [3]

惨!新股上市9天跌7天,从76跌到47,散户:这是来卖公司的吧!

Sou Hu Cai Jing· 2025-12-07 08:43

Company Overview - The company in focus is Fengbei Biological (603334), which specializes in the comprehensive utilization of waste resources, particularly known for its "waste oil refining" business model, converting waste oils into biodiesel and bio-based materials [3][5] - Fengbei Biological holds EU ISCC certification and has established partnerships with leading agricultural companies and international firms like Shell and BP, positioning itself as a top player in the domestic biodiesel industry [3] Financial Performance - From 2022 to 2024, the company's revenue is projected to increase from 1.709 billion to 1.949 billion yuan, while the net profit attributable to shareholders is expected to decline from 133 million to 124 million yuan, indicating a "revenue growth without profit growth" scenario [5] - The Q3 2025 report shows revenue of 2.251 billion yuan and a net profit of 117 million yuan, reflecting year-on-year growth of 62.32% and 35.32% respectively, but the net profit margin has decreased from 6.97% in the first half of 2024 to 5.21% [5] Market Reaction - After its debut on November 5, the stock experienced a significant drop, with seven out of nine trading days closing lower, plummeting from a peak of 76 yuan to around 47 yuan, highlighting a volatile market response [11][13] - The stock initially surged by 172% on the first day but faced a sharp decline of 14.4% the following day, leading to substantial losses for investors who bought in at higher prices [11][13] Investor Sentiment - Investors expressed frustration over the perceived manipulation of the stock, with claims that the actual controller had already profited through related transactions and cash dividends prior to the IPO, totaling over 65 million yuan [9] - The situation has raised concerns about the role of the underwriting institution, which is seen as prioritizing profit over the quality of the offering, leading to a sentiment of betrayal among retail investors [9][13]

富邦科技:公司磷化工相关产品主要为化肥助剂

Mei Ri Jing Ji Xin Wen· 2025-12-01 01:12

Core Viewpoint - The company, Fubon Technology, specializes in phosphate chemical products primarily used as fertilizer additives, serving modern agriculture with new materials and high-tech products [1] Summary by Categories Business Overview - The company's phosphate chemical products include anti-caking agents, multifunctional coating agents, granulation modifiers, flotation agents for phosphate ore, slow-release materials, and other energy-saving additives such as defoamers, settling agents, flocculants, evaporation aids, scale inhibitors, and phosphoric acid purification agents [1] - The agricultural chemical additives business is applied in nitrogen, phosphorus, potassium, and compound fertilizer enterprises, as well as related mining companies [1] Partnerships and Collaborations - The company has established stable and ongoing partnerships with over 400 large and medium-sized fertilizer enterprises globally, including notable names such as Yuntianhua, Guizhou Phosphate, Hubei Yihua, Stanley, Xinlianxin, and others [1] Market Position and Global Reach - Fubon Technology has formed three major business centers in China, Europe, and Africa, enhancing its group procurement of raw materials both domestically and internationally [1] - The company holds a significant market share in East Asia, Southeast Asia, Europe, and North Africa, positioning itself as a leading enterprise in the global fertilizer additive industry with strong R&D capabilities, a comprehensive product range, and an efficient sales service system [1]

富邦科技的前世今生:2025年三季度营收10.16亿排行业第9,净利润8320.38万排第6

Xin Lang Cai Jing· 2025-10-30 09:45

Core Viewpoint - Fubon Technology is a leading company in the fertilizer additive industry, with strong R&D capabilities and a solid market position, despite facing challenges in revenue and profit rankings within the industry [1][2]. Group 1: Company Overview - Fubon Technology was established on January 22, 2007, and listed on the Shenzhen Stock Exchange on July 2, 2014, with its registered and operational offices located in Hubei Province [1]. - The company specializes in the R&D, production, sales, and service of fertilizer additive products, holding a significant market share in the compound fertilizer sector [1]. Group 2: Financial Performance - For Q3 2025, Fubon Technology reported a revenue of 1.016 billion yuan, ranking 9th in the industry, with the industry leader, Yuntu Holdings, generating 15.87 billion yuan [2]. - The main business segments include fertilizer additives (496 million yuan, 72.51%), biological products (122 million yuan, 17.87%), and other segments [2]. - The net profit for the same period was 83.2 million yuan, ranking 6th in the industry, with the top performer, Xinyangfeng, achieving 1.396 billion yuan [2]. Group 3: Financial Ratios - As of Q3 2025, Fubon Technology's debt-to-asset ratio was 24.69%, lower than the industry average of 46.56%, indicating strong solvency [3]. - The gross profit margin was 25.40%, which, although lower than the previous year's 29.60%, remains above the industry average of 17.09%, reflecting a competitive profitability position [3]. Group 4: Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 9.51% to 16,500, while the average number of shares held per shareholder increased by 10.51% to 17,500 [5]. - Notably, the eighth largest shareholder is the Nuoan Multi-Strategy Mixed Fund, which holds 1.5898 million shares [5]. Group 5: Future Outlook - Longcheng Securities projects that Fubon Technology will achieve revenues of 1.417 billion, 1.705 billion, and 2.171 billion yuan for 2025 to 2027, with corresponding net profits of 123 million, 172 million, and 244 million yuan [5]. - The company is expected to maintain a "buy" rating, supported by its global strategic expansion and growth in the agricultural chemical market, with a 5.62% year-on-year increase in additive business revenue in the first half of 2025 [5].

掘金“地沟油”!废弃资源综合利用“小巨人”今天申购

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-26 23:14

Core Viewpoint - Fengbei Bio (603334.SH) is set to be listed on the Shanghai Stock Exchange, focusing on the comprehensive utilization of waste oil resources and oil chemical products [1][2]. Company Overview - Established in 2014, Fengbei Bio primarily engages in waste oil resource utilization, with oil chemical products as a supplementary business [1]. - The company has developed a range of products including bio-based materials and biofuels, with a focus on agricultural additives and biodiesel [3]. Financial Performance - Fengbei Bio's projected revenues for 2022, 2023, and 2024 are 17.09 billion, 17.28 billion, and 19.48 billion CNY, respectively, with year-on-year growth rates of 31.89%, 1.12%, and 12.75% [4]. - The net profit attributable to the parent company for the same years is expected to be 1.33 billion, 1.30 billion, and 1.24 billion CNY, with growth rates of 30.85%, -2.73%, and -4.54% [4]. Market Position - Fengbei Bio holds a market share of approximately 4.68% in China's biodiesel industry, ranking sixth in production capacity [3]. - In the agricultural chemical sector, the company has a market share of about 6.72% for pesticide additives and 6.46% for fertilizer additives [4]. Research and Development - The company has obtained 135 patents, including 33 domestic invention patents and 3 international invention patents, and has been recognized as a national-level "little giant" enterprise [3]. Client Base - Fengbei Bio's clientele includes major global commodity traders such as TRAFIGURA and GLENCORE, as well as renowned end-users like CARGILL and BP [3].

A股申购 | 丰倍生物(603334.SH)开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:45

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times [1] Group 1: Company Overview - Fengbei Bio is a high-tech enterprise in the field of waste resource utilization, primarily producing resource products from waste oils, forming a recycling industry chain of "waste oils - biofuels (biodiesel) - bio-based materials" [1] - The main business of the company focuses on the comprehensive utilization of waste oil resources, with auxiliary operations in oil chemical products [1] - The primary products from waste oil resource utilization include bio-based materials and biofuels, with bio-based materials mainly consisting of pesticide and fertilizer additives, and biofuels primarily being biodiesel [1] Group 2: Market Position and Partnerships - Fengbei Bio has established long-term collaborations with leading companies in the agricultural chemical sector, including Fengle Seed Industry, Jiuyue Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1] - As of the end of 2024, the company has a biodiesel production capacity of 105,000 tons, ranking sixth in China's biodiesel industry [2] Group 3: Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.948 billion CNY for the years 2022, 2023, and 2024, respectively [2] - Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2] - The company indicated that its operating cash flow was good from 2022 to 2023, but a decline in 2024 was noted due to an increase in operating receivables [2]

丰倍生物开启申购 现有生物柴油产能10.5万吨

Zhi Tong Cai Jing· 2025-10-26 22:39

Core Viewpoint - Fengbei Bio (603334.SH) has initiated its subscription with an issue price of 24.49 CNY per share and a maximum subscription limit of 11,000 shares, reflecting a price-to-earnings ratio of 30.47 times. The company operates in the waste resource utilization sector, focusing on converting waste oils into biofuels and biobased materials, establishing a comprehensive recycling industry chain [1]. Company Overview - Fengbei Bio is a high-tech enterprise specializing in the comprehensive utilization of waste resources, primarily focusing on waste oils to produce biobased products and biofuels. The main products include biobased materials such as pesticide and fertilizer additives, and biofuels like biodiesel [1]. - The company has established long-term partnerships with leading agricultural chemical firms, including Fengle Seed Industry, Jiuyi Co., Lutianhua, Sichuan Meifeng, and Batian Co. [1]. Production Capacity - As of the end of 2024, Fengbei Bio's biodiesel production capacity is 105,000 tons, ranking sixth in China's biodiesel industry. Compared to peers like Zhuoyue New Energy and Jiaao Environmental Protection, Fengbei's net profit after deducting non-recurring gains is lower than Zhuoyue but higher than Jiaao and Longhai Bio [2][3]. Financial Performance - The company reported revenues of approximately 1.709 billion CNY, 1.728 billion CNY, and 1.949 billion CNY for the years 2022, 2023, and 2024, respectively. Net profits for the same years were approximately 133 million CNY, 130 million CNY, and 124 million CNY [2][4]. - Total assets as of December 31, 2024, are 12.368 billion CNY, with equity attributable to shareholders at 7.558 billion CNY. The asset-liability ratio has improved from 49.12% in 2022 to 43.13% in 2024 [4]. Profitability Metrics - For the fiscal year 2024, the company expects a net profit of approximately 1.238 billion CNY, with a basic earnings per share of 1.15 CNY. The return on equity is projected at 17.91%, down from 30.57% in 2022 [5].

富邦科技跌2.09%,成交额6220.46万元,主力资金净流出246.67万元

Xin Lang Cai Jing· 2025-09-22 06:24

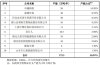

Company Overview - Fubon Technology, established on January 22, 2007, and listed on July 2, 2014, is located in Wuhan, Hubei Province. The company specializes in the research, production, sales, and services of fertilizer additives [1] - The main business revenue composition includes fertilizer additives (72.51%), biological products (17.87%), fertilizer products (6.28%), other businesses (2.52%), intelligent equipment (0.72%), and technical services (0.08%) [1] Financial Performance - As of June 30, the number of shareholders for Fubon Technology was 18,300, a decrease of 13.35% compared to the previous period. The average circulating shares per person increased by 15.41% to 15,801 shares [2] - For the first half of 2025, Fubon Technology achieved operating revenue of 685 million yuan, a year-on-year increase of 6.50%. However, the net profit attributable to the parent company was 61.217 million yuan, a year-on-year decrease of 12.47% [2] Stock Performance - On September 22, Fubon Technology's stock price fell by 2.09%, trading at 8.91 yuan per share, with a total market capitalization of 2.575 billion yuan. The trading volume was 62.2046 million yuan, with a turnover rate of 2.38% [1] - Year-to-date, the stock price has increased by 12.36%, but it has decreased by 2.09% over the last five trading days, 9.08% over the last 20 days, and 1.55% over the last 60 days [1] Dividend Information - Since its A-share listing, Fubon Technology has distributed a total of 164 million yuan in dividends, with 52.0303 million yuan distributed over the past three years [3] Industry Classification - Fubon Technology is classified under the Shenwan industry as basic chemicals - agricultural chemical products - compound fertilizers. It is associated with concepts such as drones, small-cap stocks, smart agriculture (digital countryside), micro-cap stocks, and the Xiong'an New Area [1]

富邦科技涨2.29%,成交额4454.50万元,主力资金净流入109.78万元

Xin Lang Zheng Quan· 2025-09-18 03:06

Company Overview - Fubon Technology, established on January 22, 2007, and listed on July 2, 2014, is located in Wuhan, Hubei Province. The company specializes in the research, production, sales, and services of fertilizer additives [1][2]. - The main business revenue composition includes fertilizer additives (72.51%), biological products (17.87%), fertilizer products (6.28%), other businesses (2.52%), intelligent equipment (0.72%), and technical services (0.08%) [1]. Stock Performance - As of September 18, Fubon Technology's stock price increased by 2.29%, reaching 9.40 CNY per share, with a total market capitalization of 2.717 billion CNY [1]. - Year-to-date, the stock price has risen by 18.54%, with a 1.40% increase over the last five trading days, a 5.05% decrease over the last 20 days, and a 7.80% increase over the last 60 days [1]. Financial Performance - For the first half of 2025, Fubon Technology reported a revenue of 685 million CNY, reflecting a year-on-year growth of 6.50%. However, the net profit attributable to shareholders decreased by 12.47% to 61.217 million CNY [2]. - The company has distributed a total of 164 million CNY in dividends since its A-share listing, with 52.03 million CNY distributed over the past three years [3]. Shareholder Information - As of June 30, the number of shareholders for Fubon Technology was 18,300, a decrease of 13.35% from the previous period. The average number of circulating shares per shareholder increased by 15.41% to 15,801 shares [2].